Sentiment is driving shares of this telehealth leader lower in the near term. However, the long-term story is still very much intact as the growth rate and growth opportunity remain high and large, respectively. Specifically, investors are turned off in the near-term by the company’s signal of little membership growth for 2021, as well as the loss of a Fortune 500 company contract. However, the company remains on track to deliver 30%-40% revenue growth in the medium-term. In our view, the market’s negativity is overblown, and an attractive buying opportunity exists. In this report, we review the health of the business, growth opportunities, valuation, risks, and conclude with our opinion on investing.

Teladoc Share Price

Overview: Teladoc (TDOC)

Teladoc Health Inc. (TDOC) is the largest provider of virtual healthcare services. The company works with many board-certified physicians and behavioral healthcare specialists to provide telehealth services to its member base of over 70 million individuals. This includes 51 million unique U.S. paid Members and 22 million visit fee only individuals. Its portfolio of services and solutions covers hundreds of medical subspecialties from non-urgent, episodic needs like flu and upper respiratory infections, to chronic, complicated medical conditions including diabetes, hypertension, cancer and congestive heart failure.

source: Company data

Teladoc delivers virtual healthcare services on a business-to-business (B2B) basis to thousands of clients including employers, health plans, hospitals and health systems, and insurance and financial services companies. Over 40% of Fortune 500 companies currently use Teladoc. Over 50 healthcare plans in the US also cover its service.

The company noted that nearly 10.6 million telehealth visits were delivered by Teladoc clinicians and therapists in 2020. TDOC’s revenue model is highly recurring in nature (a good thing); and as of FY20, nearly 79% of revenue was recurring. It primarily consists of subscription fees, typically on either a per-Member-per-month (PMPM) or per-enrollee-per-month basis (PEPM).

Last year the company added chronic disease treatment to its platform with its $18.5 billion acquisition of Livongo Health (this was a big deal). It continues to keep its growth investments high, with ~35% of revenue spent on sales, advertising, and marketing initiatives in 2020. So, there are lots of reasons to believe that Teladoc will continue its fundamental growth momentum.

High Growth, High Margin Business

Teladoc delivered $454 million in the first quarter revenue, an increase of 151% over the prior year, including organic revenue growth of 69% for legacy Teladoc. Teladoc remains on track to grow its revenues at a 30% to 40% increase per year through 2023, which should be comforting to investors concerned about a potential post-COVID-19 deceleration in telehealth adoption and utilization. The company even raised its FY21 revenue guidance by $20 million to $1.97 billion to $2.02 billion for the year, noting the following in the Q121 earnings call:

“Our network of clinicians provided 3.2 million visits during the first quarter, representing more than 50% growth over the prior year's quarter despite a historically weak flu season. We continue to see significant strength in noninfectious disease and specialty visits with mental health volumes, in particular, driving growth in both B2B and DTC channels.”

Given its market-leading position that includes approximately 73 million members and 14 million visits enabled, we believe that Teladoc has a long runway for growth with its existing base via increased member penetration and per member per month (PMPM) fee expansion driven by multi-product sales. The average PMPM was $2.24 in Q121, up from $0.87 in the prior year's first quarter and $1.76 in Q420.

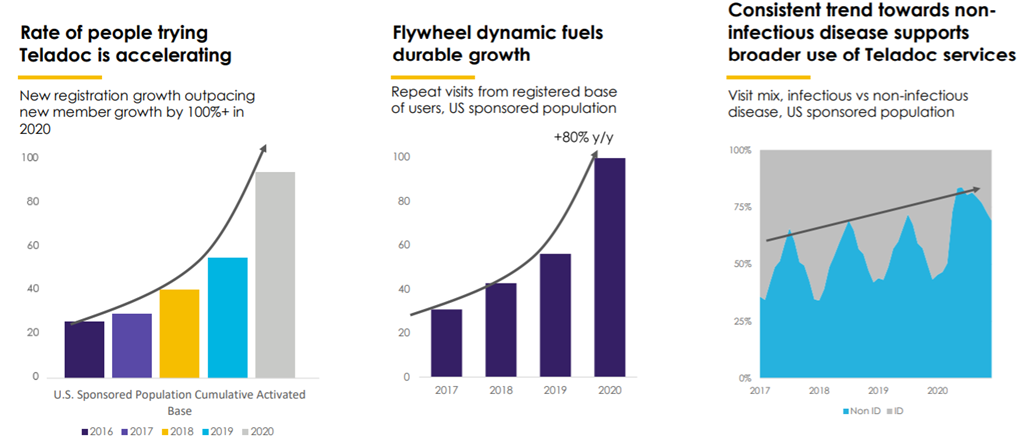

The rising consumer adoption and trust on the platform is a positive as well. The rate of people trying Teladoc is accelerating as shown in the figures below. For example, new registration growth outpaced new member growth by 100%+ in 2020. Further, an increase in repeat visits from the user base and a shift in the visit mix to non-infectious diseases supports broader use of Teladoc services.

source: Company data

The strength across its channels, products and geographies, combined with a robust pipeline of new opportunities, gives us confidence in the near-term and the long-term outlook for the business.

Meanwhile, high gross margins and inherent operating leverage in the model should continue to drive profitability. Adjusted gross margin improved by 780 bps YOY to 67.8% in Q121 (this is really good!) and adjusted EBITDA rose 429% YOY to $56.6 million in Q1. TDOC expects adjusted EBITDA in 2021 in the range of $255 million to $275 million, implying a growth rate of 101% to 117% YOY.

source: Company data

Large addressable market

The company estimates its total addressable market opportunity to be ~$250 billion. This means it has a lot of room to grow; and COVID-19 has caused a massive acceleration in the use of telehealth. Before COVID-19 hit, only 11% of Americans wanted to seek care over the internet. But that has now risen to 76%, according to McKinsey & Company. Health care providers are seeing 50x to 175x the number of patients via telehealth than they did before the pandemic.

The penetration level remains low and the company has significant room to grow within existing Teladoc client relationships across both telehealth and chronic condition products (as shown in figure below).

source: Company data

Most US telemedicine users remain satisfied with the remote care. According to eMarketer, nearly 62% of US telemedicine users were satisfied with telemedicine care as of the end of 2020. This year, 48.1 million adults in the US are expected to use telemedicine, representing 15.4% growth from a year prior, according to eMarketer.

We expect this behavior to continue even post the pandemic and the number of users are predicted to reach 64 million by 2023 (more than 3x the number in 2019).

source: eMarketer

Valuation:

Teladoc’s valuation has come down in recent months, despite the fact that the business fundamentals and opportunities remain strong. For example, the company continues to expect a very high sales growth rate (~30%-40% in the medium-term) yet the shares trade at just under 12 times sales (and that number falls to only 8.7 as compared to 1 year forward sales estimates). This is an attractive valuation considering the high sales growth rate can continue many years into the future. Further, gross margins are attractively high at 66%. Some investors are turned off by the low operation margin, but this is actually expected and preferred for a company in high growth mode, such as Teladoc (i.e. the company is spending heavily on growth not in order to maximize long-term profits).

To add a little more color, Teladoc shares are down roughly 50% since their highs in February, amid concerns regarding the post-COVID-19 deceleration in the adoption of telehealth services. The stock has also suffered due to a misinterpreted article from the Wall Street Journal which reported that PepsiCo had migrated its telehealth contract from Teladoc to Amwell (AMWL) (in reality, this was an old news story that had no bearing on the current fundamentals of the company). In our view, the stock price correction offers an attractive entry point for investors.

Risks:

Regulatory risk: Telehealth services are subject to regulations which in the past have changed frequently. This is a concern given that any unfavorable regulations around telehealth may limit the ability of the company to conduct its operations.

Lack of profitability: The company has a history of cumulative losses since inception. Even for the recently concluded Q1, it reported net loss of ~$200 million. This has resulted in accumulated deficit of ~$1.2 billion. However, growth investors understand that these types of losses are normal (and actually preferred) as the company focuses on growing its recurring revenue customer base which leads to longer-term valuation maximization. Contrary to the views of some short-term investors, we like the way Teladoc is operating its business.

Competition: While the virtual care market is in the early stages of development, it is still highly competitive. Teladoc faces competition from publicly listed firms such as Amwell (AMWL) and GoodRx (GDRX). Additionally, it faces competition from private players such as Doctors on Demand, MDLive, LiveHealth Online, and others. If the competitive intensity increases and TDOC is unable to maintain its leadership position, then the growth rate could be adversely impacted. Nonethess, Teladoc’s current leadership position is an advantage.

Conclusion:

Teladoc is a leader in the US telehealth market which has witnessed rapid growth amid the pandemic. The outlook for the industry is bright regardless of the pandemic. TDOC delivered solid Q1 results and raised its outlook for the full year as well. We are impressed by the expansive company-specific growth drivers (including new product offerings, recent acquisitions, and continued penetration into the existing client base) which should further augment existing high growth. Very important to note, TDOC expects medium-term revenue growth of 30% to 40% (this is a lot—very attractive). In our view, the sell-off in recent months creates an extraordinarily attractive entry point. If you are a long-term investor—buy and hold. We are currently long shares of Teladoc.