The Blue Harbinger Income Equity portfolio was up 0.76% in May (outpacing the S&P 500), and it is now up 14.77% for the year (also outpacing the S&P 500). And it finished the month with a highly compelling 6.0% yield. In this report, we review the performance and positioning of the portfolio, plus 4 top high-income opportunities, all of which we currently own.

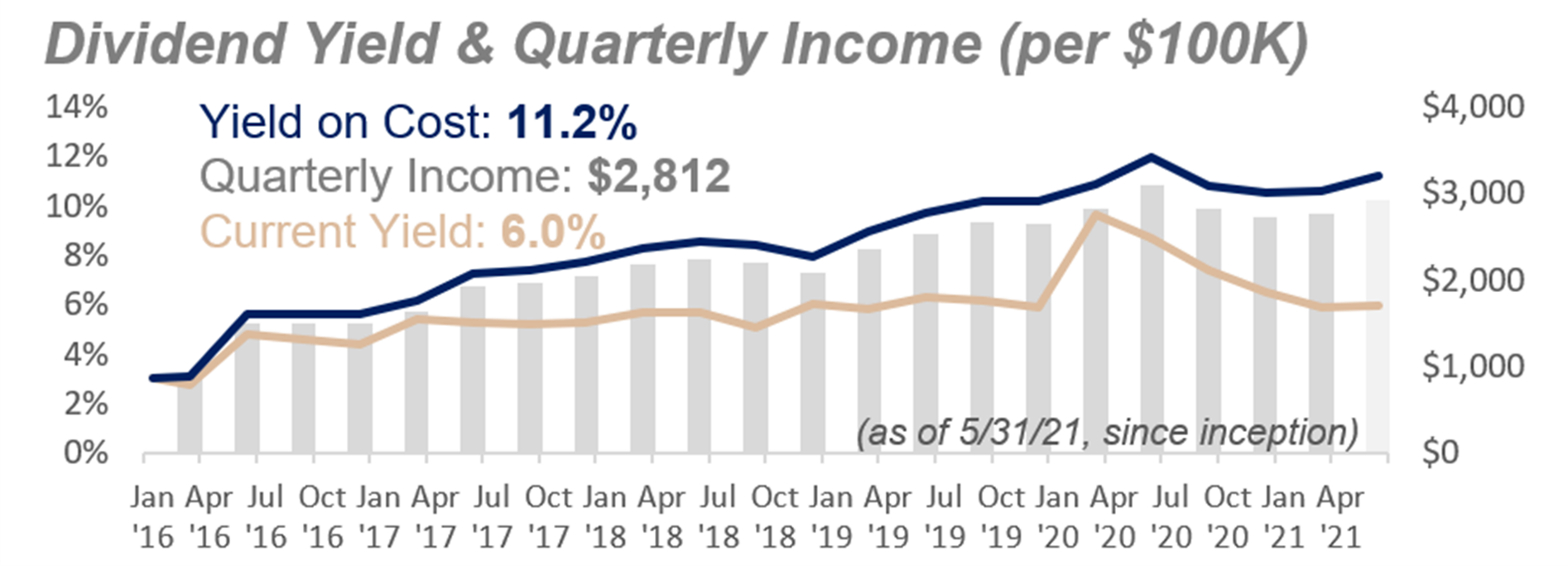

For starters, here is a look at the long-term performance of the Income Equity portfolio. As you can see, the strategy is focused on delivering high income, and has been consistently been delivering high income that continues to grow over time.

For example, the strategy currently yields 6.0%, but it you had invested in January of 2016 (when the strategy first started), you’re “yield on cost” would now be a whopping 11.2%. This is a big number, but not surprising, because as the value of the portfolio increases, so does the amount of income it pays. An initial $100,000 investment would now be paying $2,812 per quarter (i.e. every three months), and if you are an income-focused investor, this is compelling.

Regarding the positioning of the strategy, it holds stocks in many of the sectors that were most challenged during the pandemic, but are now rebounding hard, with more room to run, especially with market wide inflation fears kicking up. For example, real estate (REITs) and financials (including business development companies) make up a healthy portion of the allocations. These are both sectors that historically do well as inflation rises. Obviously, interest rates remain relatively low by historical standards, but have been on the rise, and there are concerns regarding the recent sharp uptick in inflation as measured by Consumer Price Index, for example. As another example of inflation, the housing market has been on fire in most regions as demand is high.

We continue to like the current positioning and holdings within the Income Equity portfolio, as we believe the income-paying value sectors are positioned very well for the quarters and years ahead.

Worth noting, we believe it is often more important to be a bit of a contrarian investor instead of chasing what’s hot, and this strategy is paying off in recent months as the pandemic trade continues to unwind (i.e. social distancing stocks continue to sell off very hard, and value and income sectors have continuing legs, in our view).

4 Top High-Income Opportunities

To share some top ideas, below we review 4 top high-income investments (all currently holdings in our Income Equity portfolio) that we believe are particularly attractive and worth considering if you don’t own them already.

Ares Capital (ARCC), Yield: 8.1%

Ares Capital is a blue chip Business Development Company (“BDC”) which means they provide financing to smaller “middle market” businesses. The company is essentially a financial stock, and financials do well during periods on inflation. For example, as interest rates rise, financial companies can earn higher rates of return (and high net interest margins) as they can raise the rates at which they make new loans. Ares is one of the most well-managed BDCs and you can read our recent full report here.

Enterprise Product Partners (EPD), Yield: 7.4%

EPD operates one of the largest integrated networks of midstream infrastructure for natural gas, natural gas liquids, crude oil, petrochemical and refined products in the US. And with the recent increase in energy prices this entire sector gains strength and attractiveness. And will inflation on the rise and energy prices strong, EPD is positioned well for continuing success. You can read our recent report on EPD here.

Adams Natural Resources Fund (PEO), Yield: 7.3%

Another potential contrarian big winner is the Adams Natural Resources Fund, a closed-end fund that pays a minimum of 6.0% annual yield, and it’s currently trading at a wide attractive discount to it’s NAV. If you are looking for a good way to play the inflation trade, this one is worth considering. Here is our recent report with more information.

Reaves Utility Fund (UTG), Yield: 6.2%

If you are an income-focused investor, boring can be very attractive. And this utility-sector closed-end fund (UTG) has many boring and many attractive qualities. And considering our ongoing low interest rate environment combined with the increasing trajectory of inflation, this monthly high-income producer is worth considering. You can access our full report here.

The Bottom Line:

At the end of the day, it’s your nest egg and you need to decide what investments make the most sense for you. And in our current market environment, growth stocks (i.e. “the pandemic trade”) continues to sell off (and it can continue to fall further) and value and income sectors have been on the rise with more room to run. We like select utilities, REITs, BDCs and natural resources because they are sectors that can continue to perform well as inflation concerns continue to rise. From a contrarian standpoint, value and income stocks are attractive, and we like the positioning of our Income Equity portfolio going forward.