The portfolio tracker tool has been updated for August, and our holdings and performance remain on track for continuing long-term success. We’ve made one position change to our target weights for both the Disciplined Growth and the Income Equity portfolios.

Holdings

Regarding the Disciplined Growth portfolio, we added a small target position in Pinterest (PINS). PINS is a very attractive social media image-sharing service that allows people to save and discover information. And the company is growing rapidly thanks to its large/growing user base and the extremely high success rate of targeted ads revenue versus other social media platforms.

Shares of PINS sold off significantly after last week’s earnings announcement, which we believe the market has incorrectly interpreted with a short-term lens. We’ll have more to say about this extremely powerful long-term opportunity soon, but simply wanted to share this new idea information right away.

Regarding the Income Equity portfolio, we reduced our target weight to 0% for the preferred shares of Altera Infrastructure (ALIN.B). Unfortunately, management decided to halt the dividend payment on these shares, and the price declined dramatically. And even though these are cumulative dividends (meaning the company must pay them in arrears before they ever call them or pay dividends on common shares) there is no requirement for them to ever reinstate the dividend in the future, especially considering the company was taken private (there are no publicly traded common shares). This is an unfortunate situation, but it happens from time to time, and it is why we have a diversified portfolio.

Performance

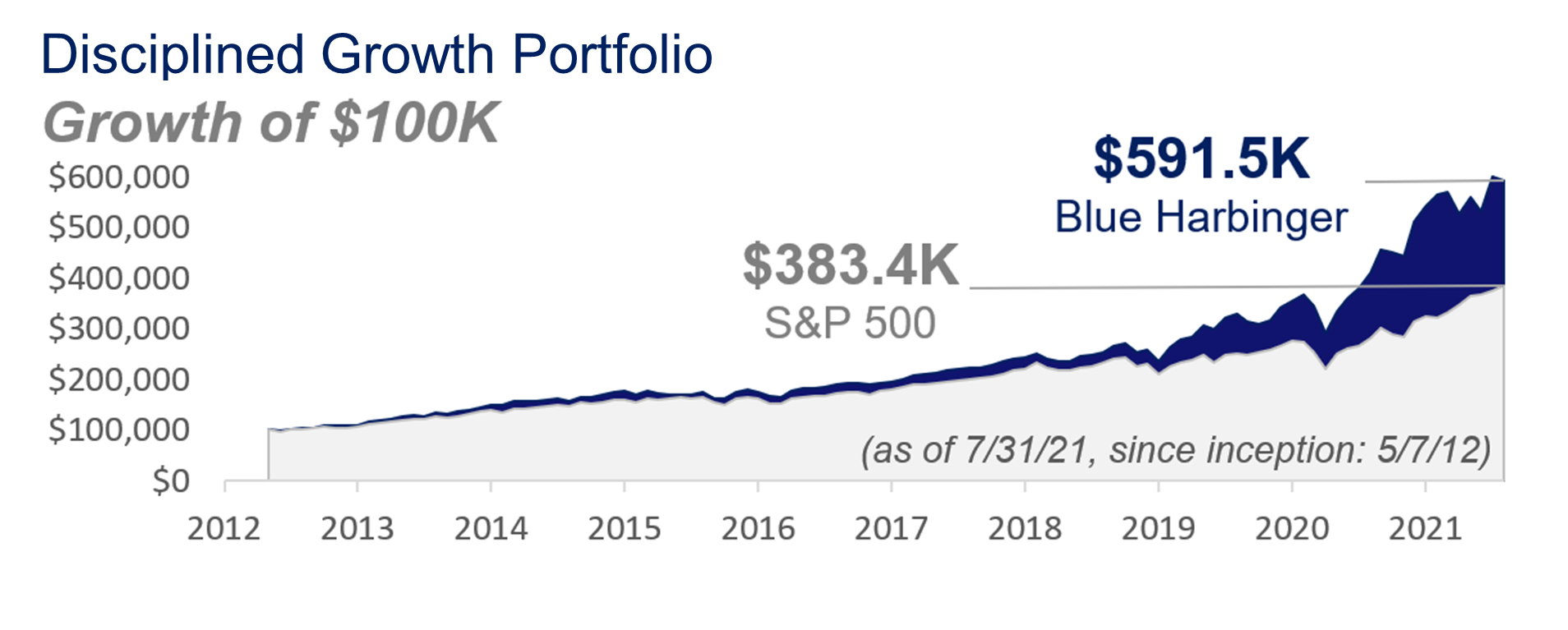

Regarding performance, both strategies continue to post strong gains for the year, and remain on track in achieving their long-term goals. Since inception, the Disciplined Growth portfolio continues to dramatically outperform the S&P 500, and we believe the portfolio continues to be positioned for ongoing outperformance in the years ahead (thanks to the attractive businesses it holds, currently just over 30 positions).

And the Income Equity portfolio continues to deliver high income and a portfolio value that grows. Specifically, the Income Equity portfolio currently yields just over 5.8% (and the “yield on cost” is over 11.1%). Importantly, even if you have spent 100% of the income that this strategy kicks off, the value of your account has continued to growth significantly faster than the rate of inflation (something a lot of other income strategies cannot say).

The Bottom Line

The key to successful long-term investing is to know your goals, and then to assemble a portfolio of attractive opportunities that will help you achieve those goals. Not all investors have the same goals (for example high income versus long-term growth). But what all investors do have in common is simply that disciplined, long-term, goal-focused investing will continue to be a winning strategy.

Don’t let the media, fearmongers or get-rich-quick crowd fool you into taking your eyes off your specific goals. Be smart. Use discipline. Stay focused.

You can view all of our current holdings here.