Luckily for the planet, the widespread use of fossil fuel is likely to end. Just not anytime soon. And as a true fiduciary should, Exxon Mobil remains committed to growing long-term shareholder value—despite relentless pressures from the climate-change woke mob. In this report, we review Exxon Mobil’s business strategy, climate change pressures, dividend safety, valuation and risks. We conclude with our opinion on investing.

Business Overview

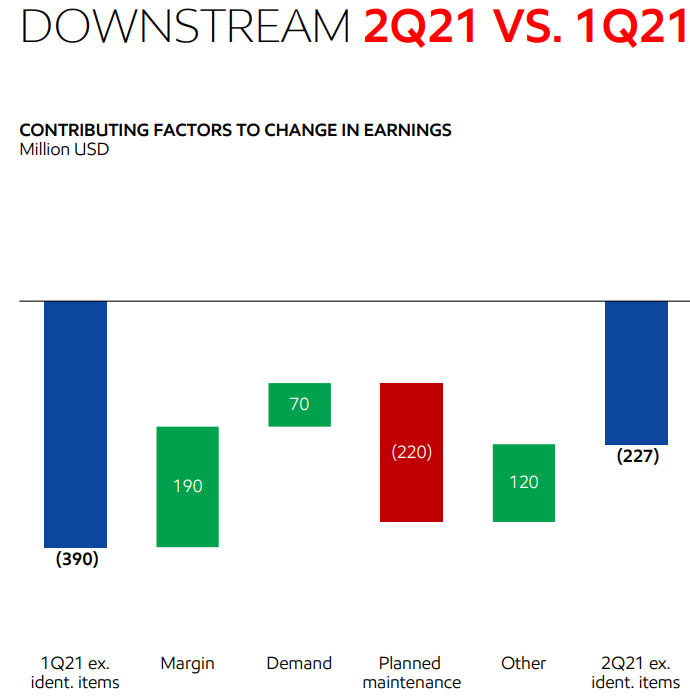

Exxon Mobil is an integrated oil and gas company. Specifically, it explores for and produces crude oil and natural gas. It operates through three segments: Upstream, Downstream and Chemical. Here is a look at the relative size of each segment through the lens of its most recent quarterly earnings numbers.

As you can see in the graphics above, Upstream (i.e. exploration and production) is the largest segment, followed by Chemicals (for example, polymers for rubber plus packaging), and then followed by Downstream (distribution of refined products).

Worth noting, Chemicals just had its best quarter ever, and the company should continue to be helped by higher commodity prices and pandemic re-opening demand. Exxon Mobil is in significantly better financial shape now than it was last year (when it was basically borrowing money to support its dividend—more on this later). Before diving into more financial details, it’s worth first considering some of the pressures Exxon Mobil has faced (and continues to face) with regards to addressing climate change risks.

Climate Change Pressures

Exxon Mobil faces a wide range of pressure related to climate change because of the industry it operates in (fossil fuels), as well as its massive size (over $200 billion market cap). For a little background, according to one source:

“When fossil fuels are burned, they release large amounts of carbon dioxide, a greenhouse gas, into the air. Greenhouse gases trap heat in our [the] atmosphere, causing global warming.”

For a little perspective, Exxon Mobil recently lost two board seats to an activist hedge fund (Engine No. 1) basically over climate change concerns (the hedge fund wants to drive Exxon towards a greener strategy).

Exxon Mobil has also faced highly-public divestment campaigns and shareholder resolutions (some of them more serious than others) aimed at reducing its carbon footprint. For example, here and here. And then, of course, there are the pressures of more sophisticated advocates (such as CalPERS) who choose not to divest, but rather remain major shareholders so they can engage/pressure Exxon Mobil with their views.

Exxon Mobil’s Climate Change Response

The first page (after the title page and disclosures) of Exxon Mobil’s most recent investor presentation does a good job summing up their response to climate change pressures. Specifically, the company remains focused on growing long-term shareholder value (as a good corporate fiduciary should be).

More specifically, Exxon acknowledges the “lower-carbon future” environment, but then lists low carbon solutions last, behind other critical priorities in their efforts aimed at “growing long-term shareholder value.”

Morningstar analyst, Allen Good, sums up his good perspective on Exxon’s business strategy (with regards to climate change) as follows:

“While many peers have announced intentions to divert investment to renewables to achieve long-term carbon intensity reduction targets, ExxonMobil remains committed to oil and gas. It has responded to calls to bring in more outside voices to its board and announced emission reduction targets. It is also investing in low-carbon technologies, but these efforts are measured and keep oil and gas production at the core. While its strategy is unlikely to win praise from environmentally oriented investors, we think it’s likely to prove more successful and likely holds less risk.”

Exxon Mobil is not ignoring climate change concerns altogether, as they ae progressing towards lower-emission initiatives.

However, the company is prioritizing other initiates, such as delivering cost reductions, advancing high-return projects, and executing value-accretive divestments (more on these in a moment).

Dividend Safety (Dividend Yield: 5.9%)

Exxon Mobil’s high dividend yield attracts many income-focused investors, however there are significant questions about its safety. For example, the dividend payout has not been increased since 2019, and the company was basically using borrowed money to maintain the dividend in 2020 as cash flows struggled mightily from pandemic-related reduced demand and lower commodity prices.

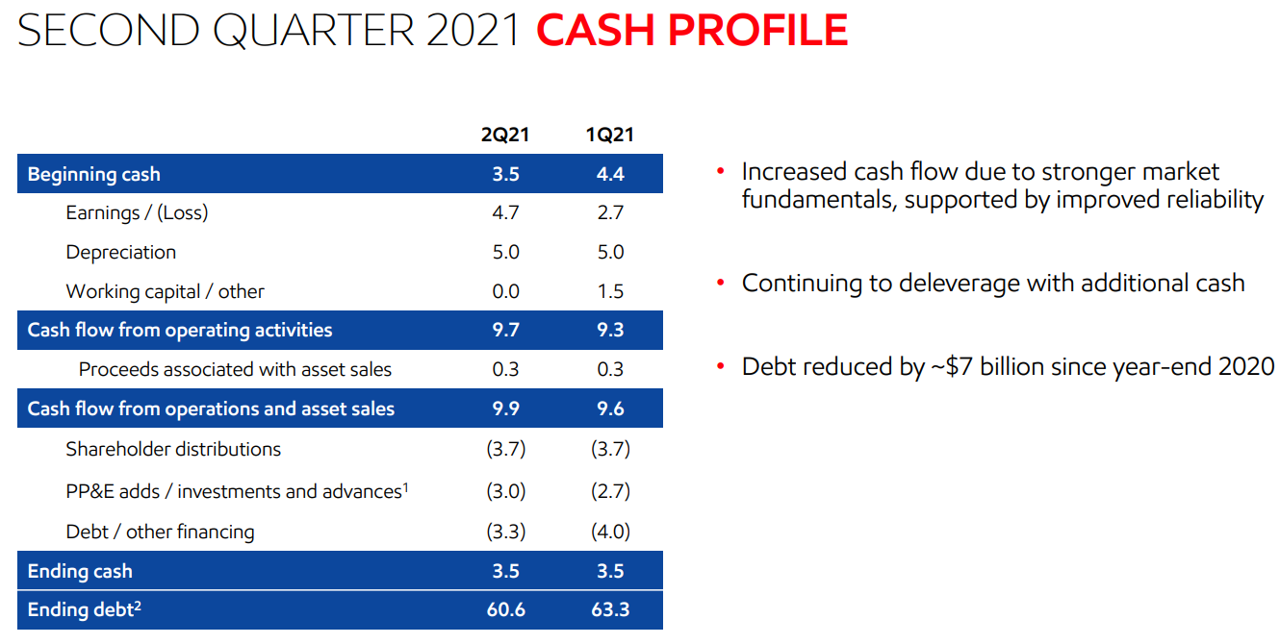

Fortunately for investors, conditions have improved as commodity prices, demand and cash flows have all increased. However, Exxon Mobil isn’t entirely out of the woods just yet. Specifically, Exxon Mobil is using excess cash flow to reduce debt. And the conservative no-dividend-increase cash flow approach has also resulted in no new share repurchase plans either.

In our view, the lack of increasing cash paid to shareholders (through dividends and share repurchases) is a good thing, as the company remains financially conservative. Exxon Mobil got itself into trouble by being too aggressive in the past (for example, acquiring companies such as XTO Energy when commodity prices were higher, only for those companies to turn out to be losers as commodity prices fell). Exxon Mobil is being smart by strengthening its balance sheet now (i.e. paying down debt).

And it shouldn’t be too hard for investors to wait for a future dividend increase, considering the current yield is high and the current stock valuation is too low (i.e. there is some share price appreciation potential here).

Valuation

From a valuation standpoint, Exxon Mobil currently trades at approximately 6.5x forward EBITDA, which is significantly lower versus last year (a good thing).

As you can see in the chart above, EBITDA estimates have improved significantly versus 2020, yet EV (and the share price in particular) do not fully reflect these improvements. As the company continues to grow EBITDA, pay down debt and strengthen the balance sheet, the share price has lagged. In our view, these shares should trade around 9x forward EBITDA, implying significant share price appreciation potential, particularly as market conditions remain strong.

Risks

Exxon Mobil faces a variety of risks that investors should consider. For example, the company is at the mercy of commodity prices and the long-term supply and demand dynamics in the energy markets. For example, Exxon has historically taken on projects when energy prices were high, only to have the projects become unprofitable when energy prices subsequently fell.

Another risk factor for Exxon is environmental risks. Aside from the potential liabilities of environmental incidents, the company also faces the risks of regulatory changes with regards to the environment as well as the pressures from activist investors with an agenda that places environmental factors (such as climate change) ahead of financial sustainability.

Debt levels pose another risk for the company. Exxon is a capital intensive business, and large levels of debt can become particularly challenging when cash generation is lower (such as 2020). The company has been paying down debt and strengthening its balance sheet, but meeting capital demands of operating the business poses a risk to investors.

Conclusion

Exxon Mobil is in dramatically better financial condition than it was last year (during the onset of covid) as improved demand and higher energy prices have led to strengthening EBITDA. And despite intense pressure from climate change advocates, the company has been measured in its environmental and clean energy initiatives in order to work towards growing long-term shareholder value. In our view, the dividend safety has increased dramatically this year (as the company pays down debt and grows EBITDA), and the shares continue to be undervalued by the market. If you are looking for an outsized dividend with some share price appreciation potential, Exxon Mobil is worth considering for a spot in your portfolio.

We are currently long shares of Exxon Mobil.