Headquartered in Canada, this midstream company operates the world’s largest oil and natural gas pipeline network (transporting about 25% of overall crude oil produced in North America). Approximately 98% of the revenue is derived from long term cost-of-service or take-or-pay contracts with automatic escalators leading to predictable cash flows across business cycles which in turn allows for consistent dividends. The company has been actively investing in upgrading and expanding its pipeline networks while also taking small steps towards greener alternatives to reduce its carbon footprint. The company has also increased its dividend for the last 26 consecutive years and is on track to continue this trend in the coming years. In this report, we analyze the business model, market opportunity, financials, valuations, risks, and finally, conclude whether an investment in the company’s stock offers an attractive balance between risks and rewards.

Overview: Enbridge (ENB), Yield: 8.5%

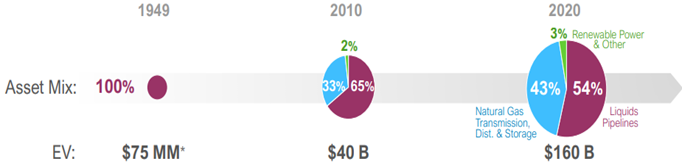

Incorporated in 1949, Enbridge has grown to become one of the largest midstream companies operating a diversified asset base including a wide network of oil and natural gas pipelines, gas utilities, as well as an expanding renewable business. With its 17,127 miles of crude pipeline, the company transports about 25% of the overall crude oil produced in North America and about 65% of US-bound Canadian production which accounts for 40% of total U.S. crude oil imports. The company also operates an extensive network of natural gas pipelines that stretches for about 23,850 miles and transports about 20% of all natural gas consumed in the US. Enbridge is Canada’s largest natural gas utility service provider with 3.8M metered connections in Ontario and Quebec serving over 15M people. Additionally, although still a small part of the overall business, the company is also investing in cleaner alternatives. Oil pipeline business continues to remain the primary segment for the company contributing 54% of overall EBITDA, followed by natural gas transmission and utility businesses contributing 29% and 14%, respectively. Currently, only 3% of company’s EBITDA comes from renewable energy sources.

Source: Investor presentation

Enbridge benefits from a resilient business model where 98% of company’s revenue is generated from long-term take-or-pay and cost-of-service contracts leading to a stable and predictable cash flow stream. Crude price volatility as well as demand–supply volume challeges have relatively minimal impact on its operations in the near to medium term. This allows the company to reward shareholders with consistent dividend payout across market cycles as well as fund large portions of expansion initiatives from internal accruals.

Source: Investor presentation

Oil and gas industry has been through challenging times, however the outlook has become brighter

The oil and gas industry has faced significant headwinds in 2020 stemming from the coronavirus pandemic. While the midstream companies didn’t face major disruptions due to their stable contractual agreements, the upstream and downstream entities had to book substantial losses due to a slump in crude prices and volumes resulting from a collapse in global economic activities. However, operating environment has substantially improved so far this year. Global rollout of covid vaccines has helped economic activities to resume leading to a recovery in energy demand. Besides, controlled production cuts by OPEC+ nations have led crude prices to recover, providing much needed support to the oil and gas industry.

Source: macrotrends.net

While there have been considerable efforts to reduce carbon footprint and shift to cleaner fuel alternatives, the transition has a long way to go. Therefore, although renewables will continue to outgrow coal, crude oil and natural gas, both traditional and new age energy sources will be required to meet increasing global demand. As per IEA, after unprecedented decline in 2020, global energy demand is expected to rebound sharply in 2021 and return to pre-pandemic levels by the end of the year. In the long run, global oil demand will rise to 104.1 mb/d by 2026, representing an increase of 4.5% from pre-pandemic levels, whereas, natural gas demand will increase by 7% to 4277 bcm/d by 2024.

Actively investing to expand its current business footprint as well as taking small steps towards greener alternatives

To capture long term energy demand, Enbridge has been consistently investing capital to expand its network of pipelines while also replacing existing assets to improve efficiency. Currently, the company is going through a strategic plan to invest C$17B of capital until 2023 which will bring in C$2B of incremental EBITDA each year from 2023. Out of this, C$8B has already been spent and C$9B of investments are scheduled to be made by the end of 2021 itself. The most important project out of its current investment plan is the Line 3 replacement project running from Alberta, Canada to Wisconsin, USA. Initially planned in 2014, the project’s Canada, North Dakota and Wisconsin leg has already been completed, however, it is facing major push back from environmentalists and residents in Minnesota. While the construction has been approved by a lower judge and later by Minnesota court of appeals, it is pending review in the State’s Supreme Court. Till then, project is allowed to progress. In fact, after beginning in December 2020, around 80% of the project is already complete and the replaced line is expected to come into service by the end of this year. Although legal hurdles may delay the project and increase costs, Line 3 is a critical oil transport highway between Canada and US and we believe it will get completed.

A portion of capital spending program has also been allocated towards renewable energy segment. Enbridge has 3 offshore wind farms under construction around the coast of France at a cost of C$2B, whereas in the US, it has already received approvals to construct 4 solar power projects which will increase its energy generation capacity from 15MW to 40MW by 2022.

Resilient cash flow generation across business cycles

Enbridge boasts strong financials backed by long-term contracts along with built-in automatic revenue escalators. In Q2 2021, company reported an adjusted EBITDA of C$3.3B which represents flat YoY growth. Improvement in volume levels and higher tolls as compared to last year were offset by losses in energy services segment as there were limited arbitrage opportunities due to market backwardation. Efficiencies achieved as the company streamlined its operations during the pandemic also strengthened EBITDA performance. Distributable Cash Flows (DCF) stood at C$2.5B which represents a 3% growth on a yearly basis as the company benefitted from lower interest rate environment as well as higher cash tax savings during the quarter. Enbridge has provided a DCF guidance of C$10B for 2021 which implies a YoY growth of almost 6%. Besides it expects to continue expanding its DCF at a CAGR of 5-7% through 2023 driven by improvement in operational efficiency, toll escalators as well as its ongoing capital expenditure program.

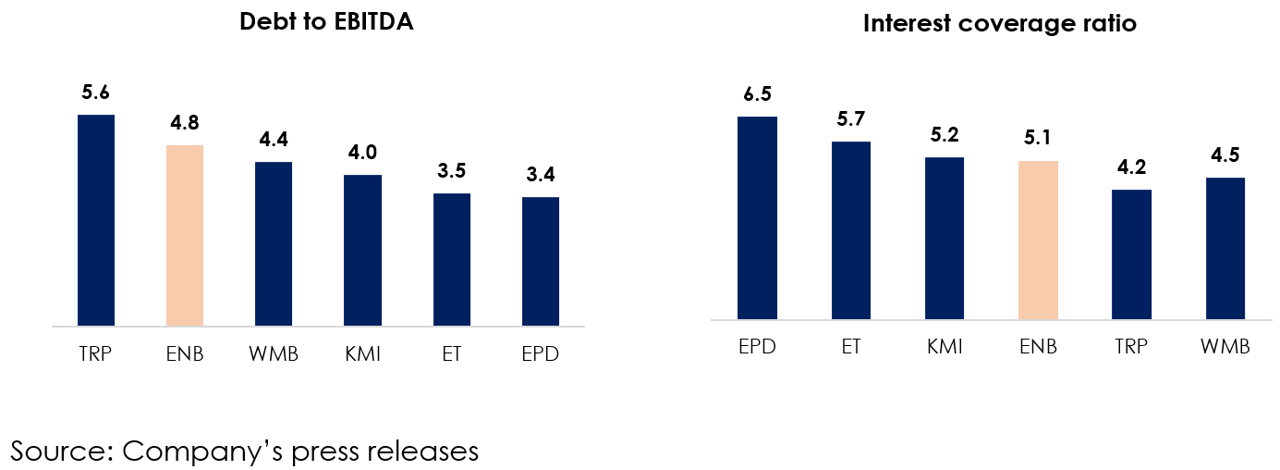

Strong financial position with improving leverage

Although Enbridge operates a capital-intensive business, a predictable cash flow stream has always helped Enbridge to consistently maintain a stable and comfortable leverage position. Its current Debt to EBITDA and interest coverage ratio stand at 4.8x and 5.1x respectively, which are in line with the midstream industry averages. Going forward, we can expect company’s financial leverage to improve further as EBITDA grows through implementation of its extensive investment program. Enbridge has a long-term target of maintaining a Debt-to-EBITDA ratio of less than 5x which we believe is comfortably achievable given its robust business model.

Trading at an attractive dividend yield

Enbridge has a history of consistently growing its dividends for the last 26 years. In fact, company has increased its dividends per share at an impressive CAGR of 10% during the same period. For Q2 2021, it declared a dividend of C$0.835 per share which is 3% higher than the same quarter last year. Besides with a payout ratio of just 67%, dividend levels are poised to grow in the next few years as Enbridge expands its distributable cash flows.

Enbridge’s dividend yield shot up to 14% during the broader market collapse in March last year. While the stock price has recovered considerably since then, it is still trading at a forward dividend yield of 6.8% which is significantly higher than its pr-pandemic levels of just 4%. With a highly predictable and low volatility business model, the risk-rewards look attractive at current valuation.

Risks

Line 3 pipeline oppositions: Pipeline industry, especially new pipeline construction has been facing increasing scrutiny and push back from environmentalists, local tribes and other residents. This may severely impact Enbridge’s current and future construction projects and operations. While the company has received green light from Minnesota court of appeals for its Line 3 replacement project and the construction is over 60% complete, the matter is still pending in the State’s Supreme Court. Any adverse decision regarding this may impact Enbridge’s operations and lead to heavy losses however we believe the probability is low as investment in the industry will dry up if investors face an uncertain regulatory regime, an outcome not favorable for economic growth.

Conclusion

Operating a low-risk business model with steady predictable cash flows, Enbridge has consistently increased its dividends for the past 26 years. Besides, it has been actively investing to upgrade and expand its pipeline networks which will lead to further growth in the company’s distributable cash flows and thereby dividends in the coming quarters. Trading at an attractive valuation which is below its pre-pandemic levels, Enbridge provides an attractive opportunity for long-term income focused investors to lock-in high dividend yields while also generating capital gains as the company pursues growth opportunities.