The net lease REIT we review in this report has come through the pandemic largely unscathed thanks to the mission-critical nature of it properties for its tenants. It also has an impressive dividend history, with consecutive annual increases since going public in 1998. Looking ahead, this REIT has multiple growth catalysts that should help it continue its impressive track record. In this report, we review the health of the business, valuation, risks, dividend safety, and then conclude with our opinion on investing—particularly if you are a long-term income-focused investor that also likes growth.

Overview: WP Carey (WPC)

WP Carey Inc. (WPC) is a real estate investment trust (REIT) that specializes in a diversified range of “operationally-critical, single-tenant” commercial real estate properties, including industrial, warehouse, office, retail, self-storage and others. Through its sale and leaseback model, WPC leases out its properties on a long-term triple-net lease basis (under triple-net leases the tenant pays for all real estate taxes, insurance and maintenance expenses) to tenants operating in a number of different types of businesses, primarily in the US and Northern and Western Europe. As of 30 June, 2021, WPC had a well-diversified net lease portfolio, that consists of 1,266 properties (with ~150 million of square footage) in 25 countries, with a weighted average lease term (WALR) of 10.8 years and generated ~$1.2 billion in annualized base rent (ABR). The following charts show the level of diversification of WPC’s ABR by property type, tenant type and geography.

Source: 2Q21 Investor Presentation

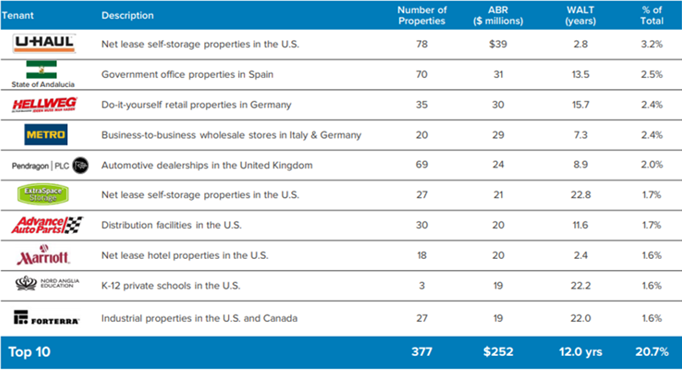

Worth noting, none of its 356 net-lease tenants account for more than 3.2% of its ABR, and the top 10 tenants represent just about 21% of the total ABR, and have a higher WALR (12.0 years) compared to the overall portfolio.

Source: 2Q21 Investor Presentation

WPC was founded back in 1973, and had previously operated primarily as an investment management company, while also directly owning a variety of net lease corporate real estate assets on its balance sheet. Over the past decade, it gradually changed its focus, first through a reorganization as a REIT in 2012, and then through a merger with one of its funds in 2013, and transitioned its core business activities to net lease investing and the active management of its portfolio. This allowed WPC to significantly increase its size and scale, resulting in improved access to capital, which is highly critical to its investment activities and growth.

The company is still an advisor to $2.9 billion of AUM (including $1.6 billion of net lease AUM), which it manages through two non-traded managed investment programs - Corporate Property Associates 18 (CPA:18) and Carey European Student Housing (CESH) Fund. It intends to manage these programs through the end of their respective life cycles, but has ceased raising capital for any new fund, indicating a clear strategic focus toward becoming a pure play net-lease REIT.

Resilient Performance Across Economic Cycles

Apart from diversification, WPC’s deep expertise in sale and leaseback transactions on “mission critical” properties has been one of the key factors that has helped it stay resilient to economic cycles. WPC generally sources its deals through individual networking, and is open to working with companies/tenants that have below investment grade balance sheets,

In fact, about 70% of WPC’s tenants have balance sheets that are below investment grade. As such, WPC gets the opportunity to cherry pick some of the strongest companies as tenants by doing an in-depth review of their business profile and financial position, and then drafting stronger lease contracts with built-in rent escalators. These sellers readily agree to such contracts as they can monetize their assets without having to forego the all-important access to their vital properties. Since these properties are critical to their operations, they continue to occupy them and pay rents even during the worst of times, and this is one of the primary reasons that WPC was able to maintain steady occupancy levels and stable rent collections of over 96%, while its peers were struggling throughout the COVID-19 pandemic.

Source: 2Q21 Investor Presentation

Well Positioned for Robust Growth Ahead

Guaranteed Internal Growth from Embedded Rent Escalations, Rising Inflation Provides Upside: The embedded rental escalations in WPC’s leasing contracts provide a guaranteed internal growth of rental revenues, allowing the company to maintain a steady, albeit slow, annual ABR growth trajectory, as we can see from the chart below.

Source: 2Q21 Investor Presentation

WPC currently has 99.5% of its ABR coming from leases with built-in rent growth, including 60% from leases tied to inflation. Of this, a large majority (representing 37% of the total ABR) comes from leases tied to uncapped CPI.

Source: 2Q21 Investor Presentation

This means that a sustained higher level of inflation will be beneficial to WPC and will provide additional upside to the rental growth over the longer term. The company currently expects its contractual same-store rent growth to increase about 100 basis points to ~2.5% over the next 12 months, assuming that inflation for the remainder of 2021 remains at about 3.5% in the US and averages ~2.75% across Europe, after which it stabilizes to around 2% in 2022 in both the regions.

External Growth from Acquisitions and Opportunistic Investments: While WPC remained resilient and came out relatively unscathed from the pandemic in 2020, it has been actively setting itself up for future growth through aggressive investment/acquisition of high-quality assets, focused mostly on high demand industrial and warehouse properties. It has also been expanding into attractive subsectors within industrials, such as in the R&D, lab space and industries like food processing and production, which are all well suited for sale leasebacks.

During the recently concluded second quarter of 2021, WPC’s total investment volume was $780 million, with a WALT of 21 years, demonstrating WPC’s ability to originate leases that are among the longest in the net lease sector. Also, the investments were at a going-in weighted average cap rate of 5.6%, which is quite impressive given the persistent compression in cap rates, particularly for the industrial and warehouse assets for which prices have been rising owing to their increased demand. For that matter, industrial and warehouse assets continue to remain WPC’s key focus areas, along with retail assets in Europe, where it generated ~40% of the second quarter’s total deal volume. In fact, despite the lower cap rates, Europe provides WPC with better pricing dynamics, helping it to generate wider spreads. For example, WPC can issue euro-denominated debt at over 100 bps cheaper than it can for US bonds, and thus generate wider spreads even at a lower cap rates.

Overall, investments during the second quarter took the first half deal volumes in 2021 to just under $1 billion. The company expects to maintain high deal volumes, going forward, resulting from a combination of factors, including its singular focus on investing for the balance sheet; as sale-leasebacks continue to gain popularity with companies as part of an overall trend of leasing rather than owning real estate; and as the pick-up in M&A activity drives net lease deal flow with companies seeking to optimize their balance sheets and private equity firms seeking to monetize their assets in order to drive returns. WPC already has $122 million of capital investment projects scheduled to complete in the second half of the year, and with several hundred million dollars of deals in the pipeline, it is well positioned to achieve a record year in terms of deal volume and meet its upwardly revised investment guidance of $1.5 billion to $2.0 billion in 2021. We believe these aggressive investments put WPC on track to substantial rental growth in the coming years.

Moreover, these investments put to rest concerns about near-term expirations of certain leases, particularly on a couple of its largest tenants, U-Haul and Marriot in 2024, which jointly account for 4.8% of the company’s ABR.

Source: 2Q21 Investor Presentation

Strong Liquidity, Capital Market Flexibility and Favorable Cost of Capital

With the increase in size and scale over the the past decade, and as a result of its strong Investment grade balance sheet (with Baa2/positive rating from Moody’s and BBB/stable rating from S&P) WPC has managed to significantly improve its ability to access capital across geographies and at highly favorable cost of capital. And the company has been prudently taking advantage of this ability by being highly active in the equity and the debt capital markets in 2020 and 2021 so far.

For example, WPC recently issued $455 million of equity through a forward offering, which provides it with significant flexibility to match the funding of deals in its pipeline with equity issued at a predetermined price. In February 2021, it had issued $425 million of senior unsecured notes maturing in 2033 at the lowest ever coupon of 2.250%, and another €525 million of euro denominated bonds maturing in 2030 at a paltry 0.950% interest rate, exemplifying its strength in tapping the capital markets at the most beneficial rates. The company had used the proceeds from these issuances to refinance higher priced debts, and as a result, its weighted average interest rate has decreased significantly, and at the end of the second quarter stood at 2.6% vs. 3.2% a year ago, reflecting the continued improvement in its overall cost of capital. Also, after the refinancing of certain debts at attractive terms, WPC has been able to structure its debt maturity very favorably, and it has no major debt maturing before 2024.

Source: 2Q21 Investor Presentation

On the leverage front, the WPC’s debt-to-gross assets ratio at the end of the second quarter was 41.1%, which remains at the low end of its target range. Net debt to adjusted EBITDA was 6x at the end of the quarter and 5.8x when factoring in the remaining shares available under the latest equity forward issuance.

WPC’s liquidity has also remained strong, and as the end of 2Q21, it had ~$2 billion available from cash and the available capacity on its $1.8 billion credit facility. Additionally, it has an outstanding settlement of about 4 million shares remaining under forward agreements by the end of 2022, which will bring in net proceeds of ~$300 million, thus further enhancing its liquidity profile. Overall, the company’s strong liquidity profile, and its ability to access the capital markets opportunistically positions it well to fund its new acquisitions.

Strong, Growing Dividend

WPC has demonstrated its commitment to the dividend by increasing it every quarter in 2020, when others were cutting or suspending their dividends amid pandemic-related headwinds. This year so far, WPC has increased the dividend in both the quarters, paying out $1.048 and $1.050 in 1Q21 and 2Q21 respectively, and has kept its track record intact of increasing dividends every year since it went public in 1998.

Source: 2Q21 Investor Presentation

While the dividend has grown consistently over the years, the rate of growth has been modest over the past few years as the growth in its adjusted funds from operations (AFFO) has been rather modest, considering the conservative nature of its investments, which, on the other hand has allowed it to remain resilient to market conditions. Nevertheless, its pays out a large portion of its AFFO in dividends to shareholders. In 2Q21, based on the AFFO of $1.27 and quarterly dividend of $1.05, the company’s dividend payout ratio was ~83%. For 2021, based upon the mid-point of the increased AFFO guidance of $4.94-$5.02, the payout ratio works out to ~84%. Going forward, we believe that the company’s aggressive acquisitions in the past few quarters and the expectation of robust investment volumes ahead will meaningfully drive AFFO growth in the years to come, which in turn will help it to continue to raise its dividend quarter after quarter.

Also, at the current annualized dividend per share of $4.20, WPC delivers a dividend yield of 5.3% which we think is fairly attractive, considering the safety WPC provides in terms of dividend payouts and the low yields on fixed-rate securities.

Valuation

While WPC has seen reasonable share price gains over the past year, it has significantly lagged its competitor Broadstone Net Lease (BNL), whose portfolio exhibits highly comparable characteristics to that of WPC. It has also lagged behind the NETLease Corporate Real Estate ETF (NETL) which consists of net-lease REITs in the US and tracks the Fundamental Income Net Lease Real Estate Index.

Source: Yahoo Finance

Also, the shares are trading at a TTM Price-to-AFFO multiple of 16.4x, which is below the TTM Price-to-AFFO multiple of 18.5x seen prior to the pandemic.

We think the price movement gap of WPC’s shares compared to its peers is unwarranted given the fundamental strength of its business model that stems from its high level of diversification and also its focus on investing in mission critical properties. We also believe the stock’s trading multiple has the potential to expand at least to the pre-pandemic levels, considering its largely visible growth that is expected to come from the aggressive acquisitions and from the built-in rent escalators in its contractual leases.

Risks

Tenant Bankruptcies: WPC is exposed to the risk of tenants not being able to meet their rental obligations owing to company-specific as well as macro factors. However, WPC’s diversification, across property types, geographies and tenants, and focus on operationally critical properties are key mitigants of this risk. Nonetheless, should some of these tenants face financial trouble, it could lead to future fund flow interruption.

Interest rate risk: Even though interest rates are expected to remain relatively tame in the near to mid-term, dramatically rising rates could create challenges for RETS as they are often seen as an alternative to bonds. Higher interest rates could mean decreased demand for REITs, thereby causing a decline in their share price.

Conclusion

WPC has a very strong business that is characterized by a well-diversified portfolio of properties that are mission critical to its tenants. The portfolio displayed strong resiliency to the pandemic in 2020 and helped WPC come out of pandemic challenges relatively unscathed.

Looking ahead, WPC has a highly visible growth trajectory coming from built-in rent escalators, and from the aggressive investments it is making in the acquisition of properties, which is well supported by its ability access capital markets across geographies at beneficial pricing. However, its valuation, both relative to its peers and to its pre-pandemic trading multiple, does not adequately reflect these strong underlying fundamentals. We believe the visible growth catalysts should help WPC expand its multiples at least to the pre-pandemic trading levels and close the gap with its peers, while also allowing it to continue to raise its dividend. If you are a long-term income investor that likes rising dividends and rising share prices, WP Carey is worth considering for investment. We currently own shares.