Stalwart, blue-chip, US stock market juggernaut, and Google parent, Alphabet (GOOGL), made a new 52-week low this week. This is a company that has over 10% revenue growth, a seemingly insurmountable ecosystem and moat, and now trades at only 10 times forward EV to EBITDA. In this report, we review Google’s business model, revenue growth, capital allocation, current valuation and big risks. We conclude with our strong opinion on investing.

Overview: Google’s Business

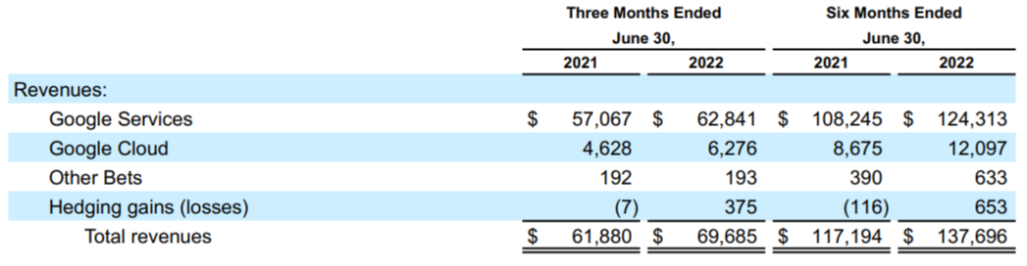

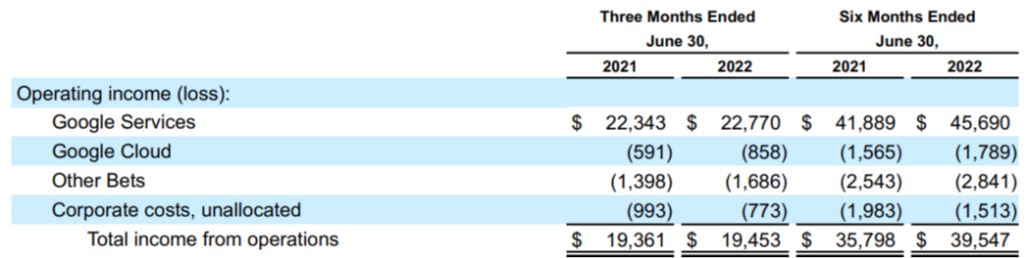

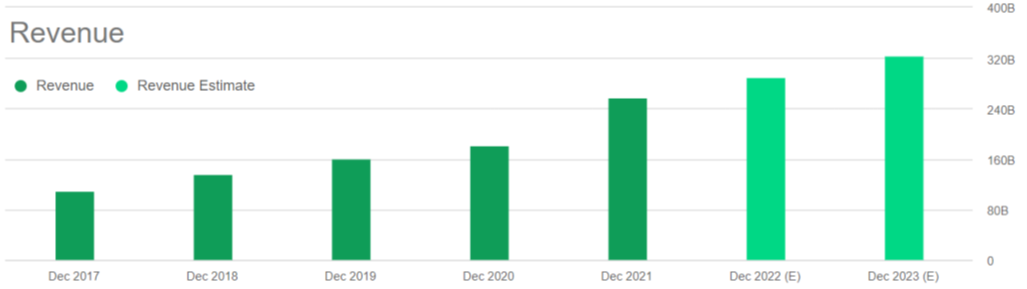

Google breaks its business down into three operating segments, and if you don’t know “Google Service” (which is basically advertising) generates the lion’s share of the revenue and basically all of the profits, as you can see in the following 10-Q excerpts.

For your information, and to be specific, Google defines its three operating segments as follows:

Google Services: includes products and services such as ads, Android, Chrome, hardware, Google Maps, Google Play, Search, and YouTube. Google Services generates revenues primarily from advertising; sales of apps and in-app purchases, digital content products, and hardware; and fees received for subscription-based products such as YouTube Premium and YouTube TV.

Google Cloud: includes Google’s infrastructure and platform services, collaboration tools, and other services for enterprise customers. Google Cloud generates revenues from fees received for Google Cloud Platform services, Google Workspace collaboration tools, and other enterprise services.

Other Bets: is a combination of multiple operating segments that are not individually material. Revenues from Other Bets are generated primarily from the sale of health technology and internet services.

And to be clear, advertising has been the main source of revenue for years.

Revenue Growth and Competitive Advantages

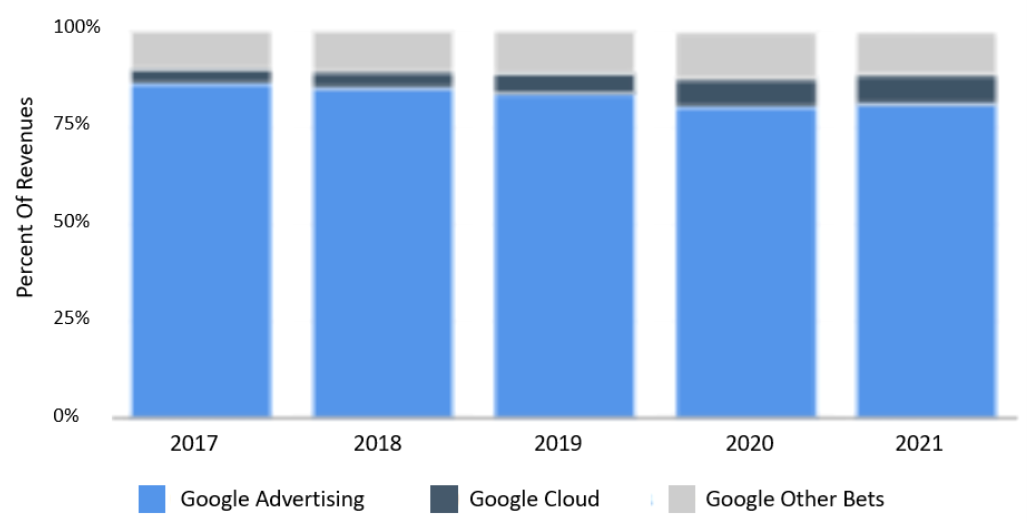

Google’s massive revenues (see above) are expected to keep growing rapidly, as you can see in the following chart.

More specifically, forward revenue estimates project a double-digit growth rate and a double-digit EBITDA growth rate. These are powerful growth rates (especially for a massive $1+ trillion company) and they are driven by the massive secular trends of digitization, cloud migration and smart device usage (which are believed to still be in the early innings of growth).

And to give you some perspective on Google’s massive ecosystem (which is basically the driver of its competitive “moat” versus competitors) here are a few key points to consider, by operating segment:

Google Services (Advertising) Segment: According to IDC, Google’s Android operating system is behind more than 70% of smartphones in the world, as compared to Apple iOS at ~27%. This is so important because (according to Wikipedia: “Most Android devices ship with additional proprietary software pre-installed most notably Google Mobile Services which includes core apps such as Google Chrome, the digital distribution platform Google Play, and associated Google Play Services development platform.” This gives Google a massive competitive advantage in gathering information about users that is extremely valuable to advertisers (i.e. Google’s biggest operating segment). Further, more than 90% of global searches are conducted through Google, thereby giving the company access to enormous data valuable to advertisers (Google's Chrome browser remains the market leader withroughly two-thirds of total market share (per StatCounter) as compared to 19% for Apple’s Safari and 4% for Microsoft's Edge). And further still, YouTube’s success (and contributions to top and bottom lines) continue to improve.

Google Cloud Services has been growing (even faster than Google Services), and is expected to keep growing as the globally digital revolution and cloud migration are still just getting started. Google has some strong advantages in this area (stemming from its many years of internal cloud development), however Google Cloud is still the number three player behind Amazon Web Services and Microsoft Azure.

We expect Google Cloud to keep growing rapidly (which is a good thing) but not enough to overtake AWS or Azure (which are also growing rapidly).

The Other Bets Segment is constantly innovating with technology. And despite the fact that this segment is a loss leader (it makes no money) it could open massive opportunities down the road. For example, Google’s autonomous vehicle technologies (i.e. Waymo) is a huge expense, but could open huge revenue opportunities many years down the road. Google’s research efforts into smart homes (i.e. Nest) is another example of an expense now that could turn to profit many years down the road. Further still, the company’s applications of machine learning may also expand and prove increasingly valuable.

Capital Allocation and Investments

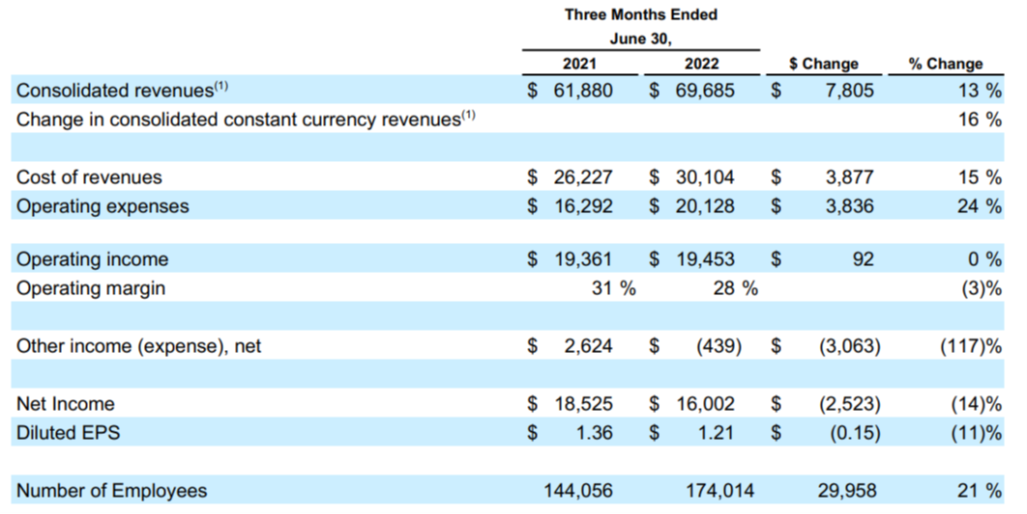

Google is a high-margin and high-cash-flow business, and this allows it to do a lot of things right. For starters, the company’s operating margin was recently 28% and its operating cash flow was $19.4 billion for the three months ended June 30, 2022 (also nearly 28%).

With regards to long-term debt, Google has relatively very little at around $12.8 billion versus $125 billion in cash (and equivalents) on its balance sheet. The leverage ratio is very low, and to a significant extent, this isolates Google from the increasing costs of financing growth that other companies (with high debt and less cash flow) face.

Google’s strong balance sheet position allows it to invest heavily in research (its R&D margin as a percent of revenue is ~12.7%, truly incredible considering the size of Google’s revenue). The company is also well positioned to continue its history of successful acquisitions (especially now that the market is down) such as its previous acquisitions of YouTube, DoubleClick, Android and Fitbit.

Further still, Google has continued to return cash to shareholders through buybacks ($18 billion in 2019, $31 billion in 2020, and $50 billion in 2021). And in April 2022, it authorized another $70 billion for share buybacks. And you can even make the case that Google has been setting itself up to start paying a dividend to shareholders in the future. For example, here is what Morningstar Senior Equity Analyst, Ali Mogharabi, had to say about it in a July 2022 research note:

“In late 2015, Alphabet became a holding company, with Google one of its wholly owned subsidiaries. Alphabet is also the parent company of other businesses, mostly moonshots, which are grouped into the other bets segment that includes Waymo. This structure has provided slightly more transparency to shareholders, as the company’s mature cash-generating business, Google, is managed separately. In our opinion, such a move may indicate that management is considering some form of redistribution of cash generated by Google to shareholders a few years down the road.”

Overall, Google has been a prudent allocator of capital and remains in an extremely strong cash position.

Valuation:

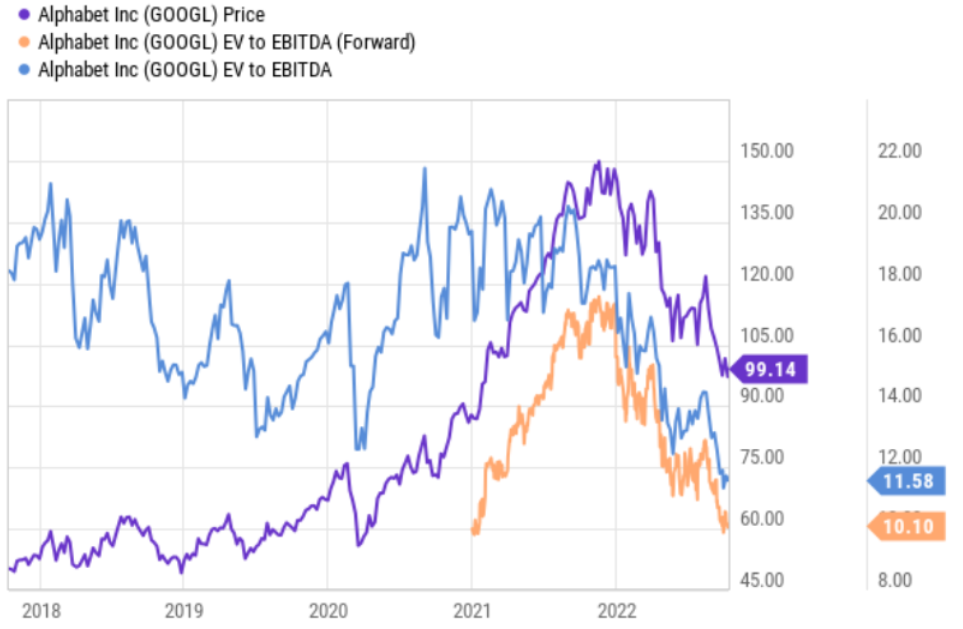

Google trades at around 10x forward EV to EBITDA, and this multiple could easily double given the company’s strong growth.

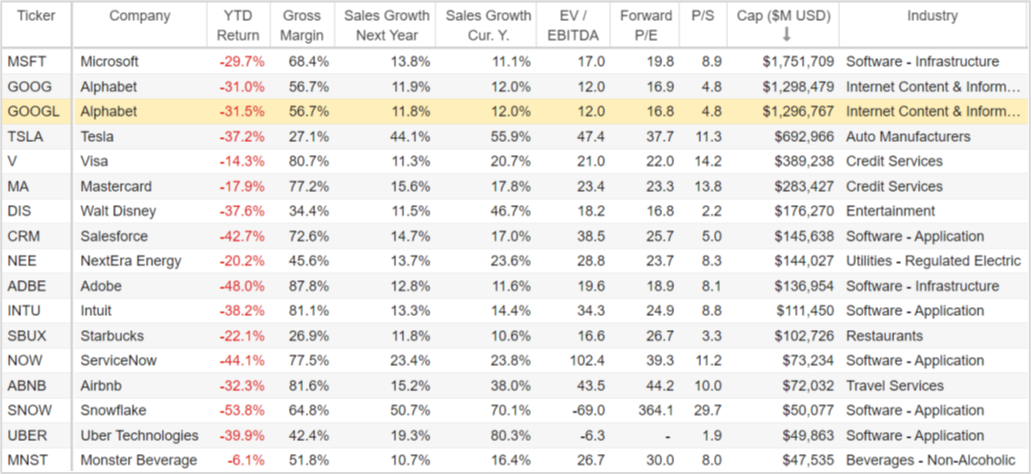

For perspective, here is the EV to EBITDA ratios for other companies with similarly high growth rates and strong margins.

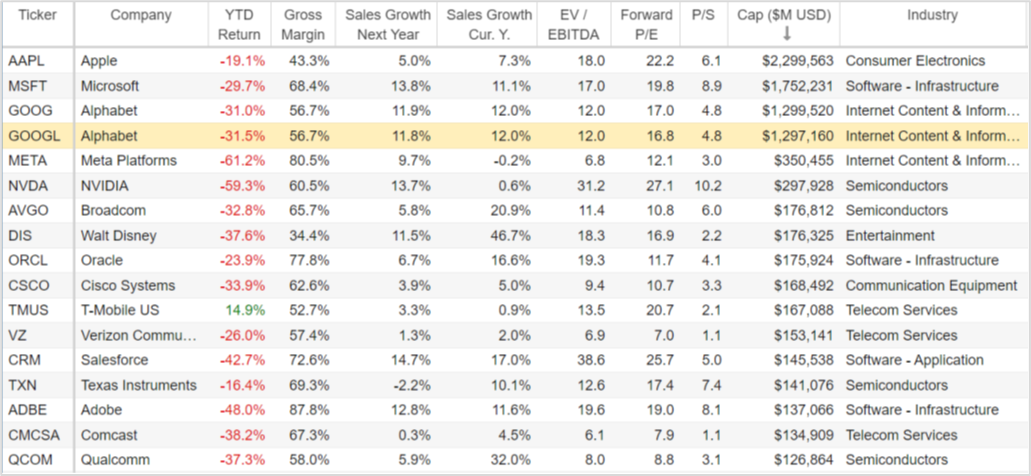

And here are other large cap companies in the technology and communication services sectors, for comparison purposes.

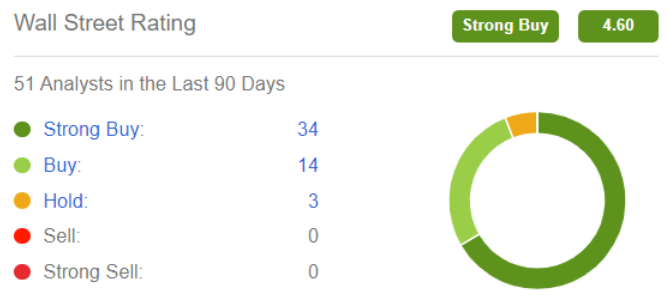

On these metrics, Google stands out as attractive, in our view. It also has one of the highest (most bullish) analyst ratings on the street, as you can see below.

The Big Risks:

Of course the shares of Google can still fall further, considering the macroeconomic backdrop. For example, the Federal Reserve has essentially zero regard for the damage it is doing to the stock market this year by raising rates dramatically (after all, its dual mandate is focused on employment and inflation, not stocks). And as the Fed fights inflation, rates can still go much higher, and stocks can still fall much further.

Another risk is the unfriendly dual share class structure of Google that gives 51% of the voting rights to Larry Page (co-founder) and Sergey Brin (co-founder). These two can collectively make decisions that may or may not be in the best interest of shareholders.

Data privacy and censorship are a big risk to Google. On one hand, users have concerns over how their data is used and how little control they have over it. Further, concerns over censorship (including government-sanctioned censorship around the world) gives rise to additional complaints and lawsuits.

Antitrust concerns are also a risk factor. For example, companies, regulatory agencies and governments have challenged Google’s biases as well as dominance (90% of global searches are conducted via Google) and this is an ongoing legal and brand risk for the company. Antitrust concerns could also limit Google’s future acquisition aspirations that may arise.

Conclusion:

Forward-looking investors recognized the macroeconomic risks months before the fed started taking inflation seriously. For example, many high-growth stocks started selling off particularly hard well before the Fed actually started rapidly increasing interest rates. And while many of these high-growth stocks deserved to sell off hard (as their valuations soared during the pandemic bubble, while their earnings remained totally non-existent), Google is not one of them.

Rather, Google is a good example of a high-quality growth stock that has been caught up in the significantly indiscriminate growth-stock sell-off. In fact, it is one of the four highly compelling opportunities we highlight in our new report: “When the Market Pukes: Buy These 4 Stocks in Buckets.” Things can still get much worse before they get better, but in the long term we expect Google shares are going dramatically higher. We are currently long Google.