AGNC preannounced a significant decline to its book value for the third quarter, and is now a very tempting 17% yield. Especially considering some uncertainty has been removed and higher interest rates will benefit the net interest income going forward. However, there are massive market cycle risks (and opportunities) that AGNC investors need to navigate. In this report, we review AGNC’s business model, its new book value, price appreciation potential, dividend safety and long-term fundamentals. We conclude with our strong opinion about investing.

About AGNC

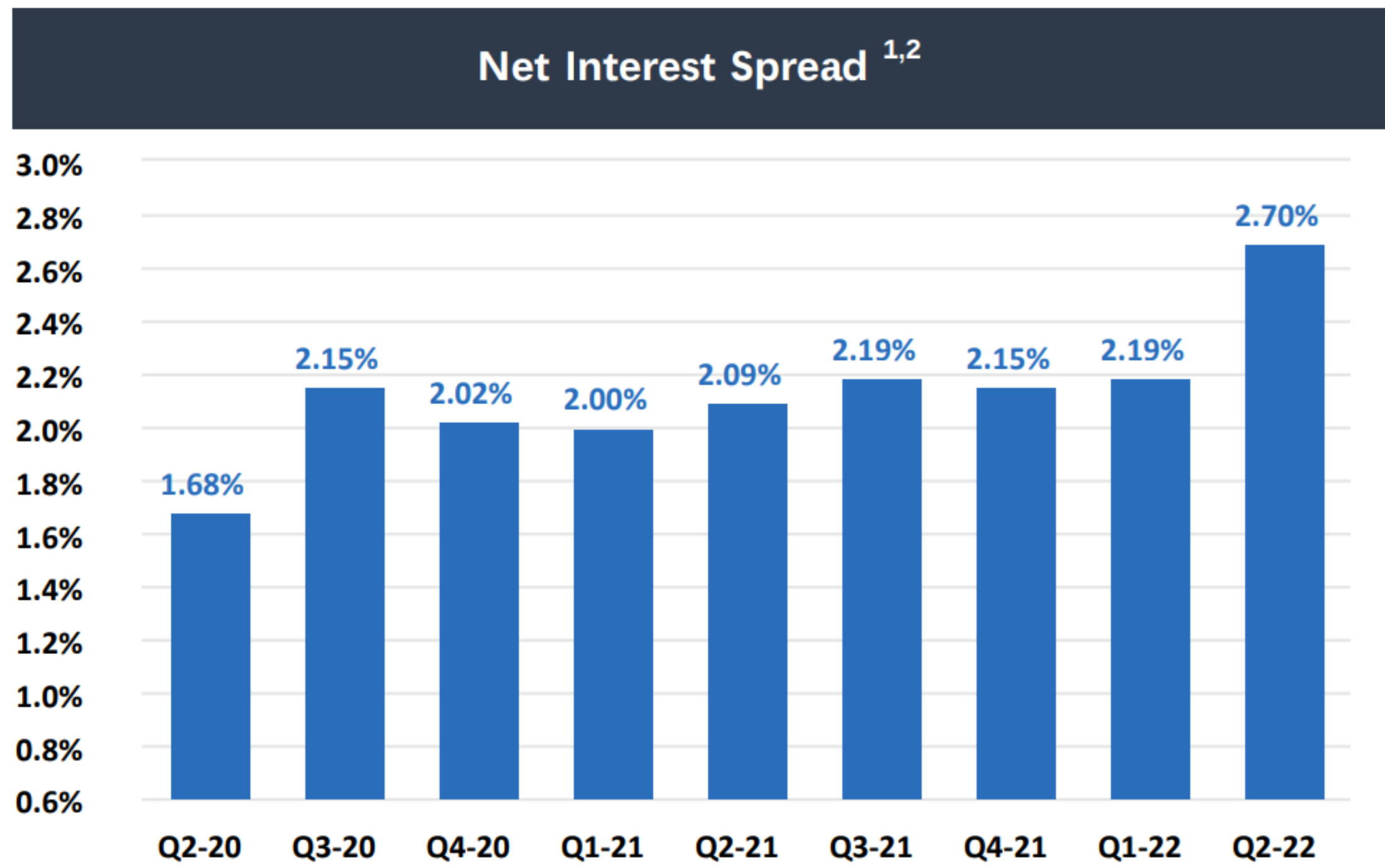

AGNC’s business model is fairly straightforward. It basically borrows money to invest in agency mortgage-backed securities. And AGNC generates income from the net interest spread it earns on those securities minus the cost of borrowing and hedging (and net of realized gains and loses on those securities and hedges). For example, here is a look at AGNC’s unlevered net interest spread (note: AGNC typically levers these returns 7-8x, thereby generating yields sufficient to cover the dividend).

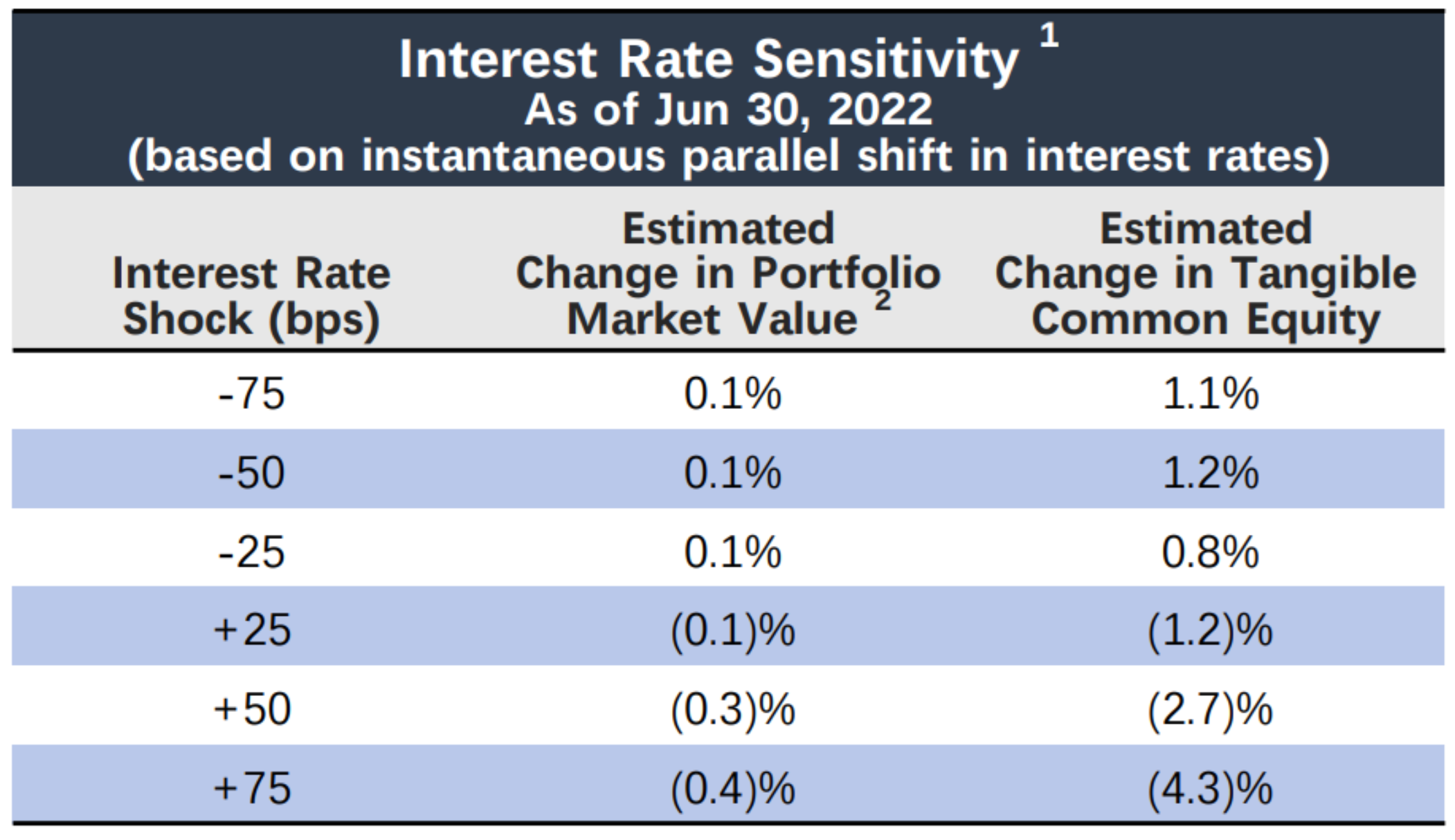

When interest rates go up (like they have been this year), the value of AGNC’s assets (i.e. agency mortgage-backed securities) go down (i.e. as rates rise, bond prices fall); but when interest rates go up, AGNC’s future earnings power also increases because the net interest spread between borrowing and investing increases—this is a good thing for AGNC.

When interest rates rise quickly (like they have this year), AGNC gets hit multiple times: first by falling asset prices (i.e. realized and unrealized losses on the investment securities it holds) and second by broken and inadequate hedges (as they have to be adjusted, which can be expensive).

Furthermore, when agency MBS credit spreads widen, AGNC’s book value falls. This is why AGNC’s book value has fallen so sharply this year, as the company preannounced this week. INSERT LINK

Looking Ahead

In theory, AGNC’s assets now have increased earnings power going forward (because interest rates are higher, thereby improving the company’s net interest margin). However, earnings power has also decreased because the company’s book value has declined (this means they have less equity to borrow against when buying agency MBS). Further, uncertainty remains high about the ongoing rate of interest rate hikes by the fed, which could cause further deterioration to AGNC’s balance sheet assets (i.e. agency residential MBS) and could cause more book value declines in the quarters ahead. Especially as the level of agency mortgage loan origination may be increasingly disrupted by challenging housing market conditions (as rates rise, it becomes more expensive for people to get a mortgage).

The Market Cycle

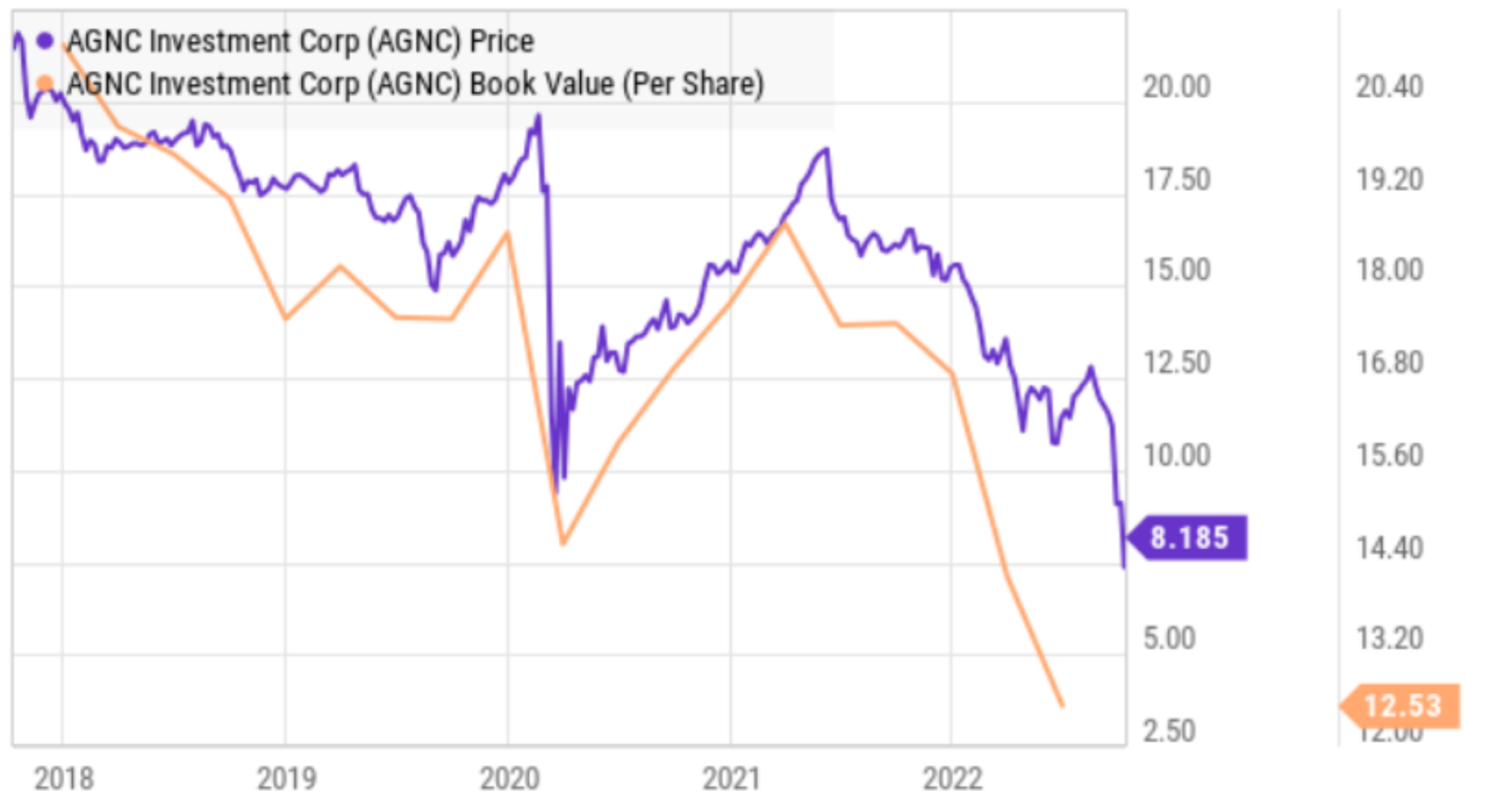

Plenty of investors have done extremely well by purchasing shares of AGNC when the market cycle provides beneficial tailwinds (and then selling when conditions worsen). For example, buying in late March of 2020 when the pandemic hit and the fed was aggressively buying bonds (including agency MBS) and lowering interest rates (which helped prop up AGNC’s plummeted book value) proved extremely lucrative for many investors.

Fast forward to mid-2021 - early-2022, when the fed interest rate expectations started increasing, many investors were wise to get out of AGNC before its book value and share price plummeted.

Current Valuation:

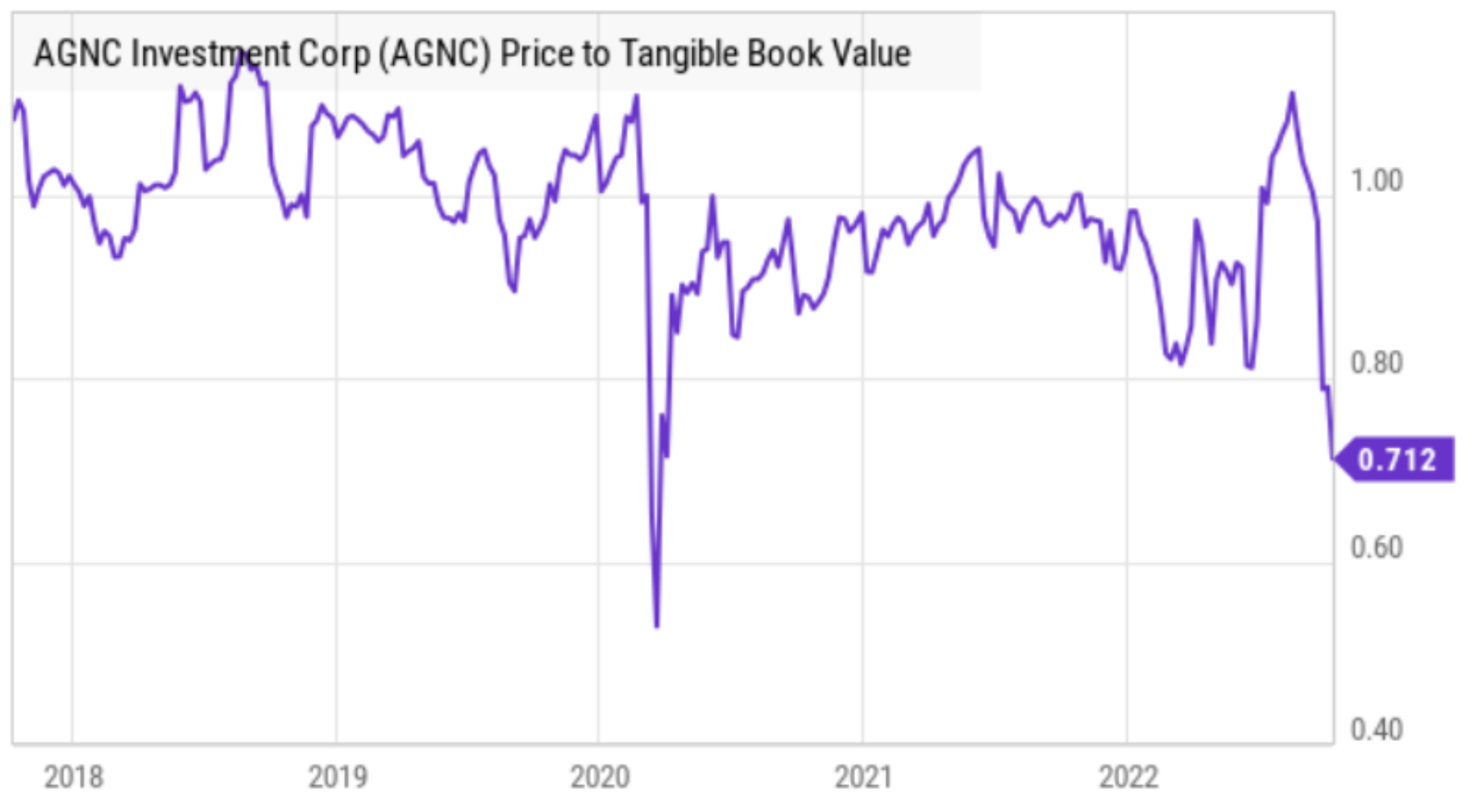

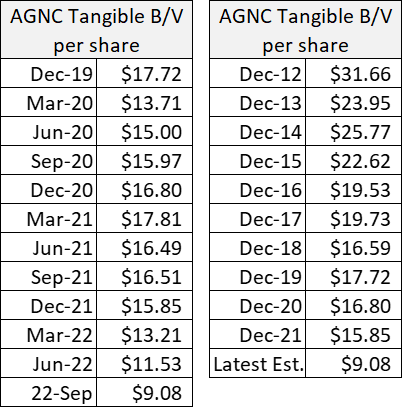

One of the most basic valuation metrics for mortgage-focused REITs like AGNC is price-to-book value. Book value is an indication of how much earnings power a mortgage REIT has because it is against their book value that they are able to borrow money to buy assets and generate returns. When a mortgage REIT trades at a premium to book value, it can be an indication that it is overvalued. And when it trades at a discount—that can be an indication that it is undervalued. For your reference, here is a look at AGNC’s historical price-to-book value per share.

And based on this week’s preannounced book value ($9.06 - $9.10), it currently trades at less than 0.9x book value—an attractive discount in the minds of many investors. Especially if you believe the fed’s sharp interest rates hikes are slowing and/or becoming less volatile/uncertain (this will help AGNC place better hedges), agency MBS credit spreads will shrink (thereby increasing AGNC’s book value) and our current point in the market cycle is attractive.

Dividend Safety

One of the main reasons investors are attracted to AGNC is its big dividend (paid monthly). And the dividend is well covered by the company’s non-GAAP earnings number (net spread and dollar roll, estimated to be ~$0.84) versus the $0.36 in monthly dividends paid each quarter (even after paying the smaller quarterly preferred share dividends).

AGNC has reduced its dividend many times in the past (and even increased it a couple times), and another reduction may be coming in the near future. Even if the dividend is reduced, we don’t expect it to be overly dramatic, but rather more of a right-sizing, as the company has done in the past.

Long-Term Returns

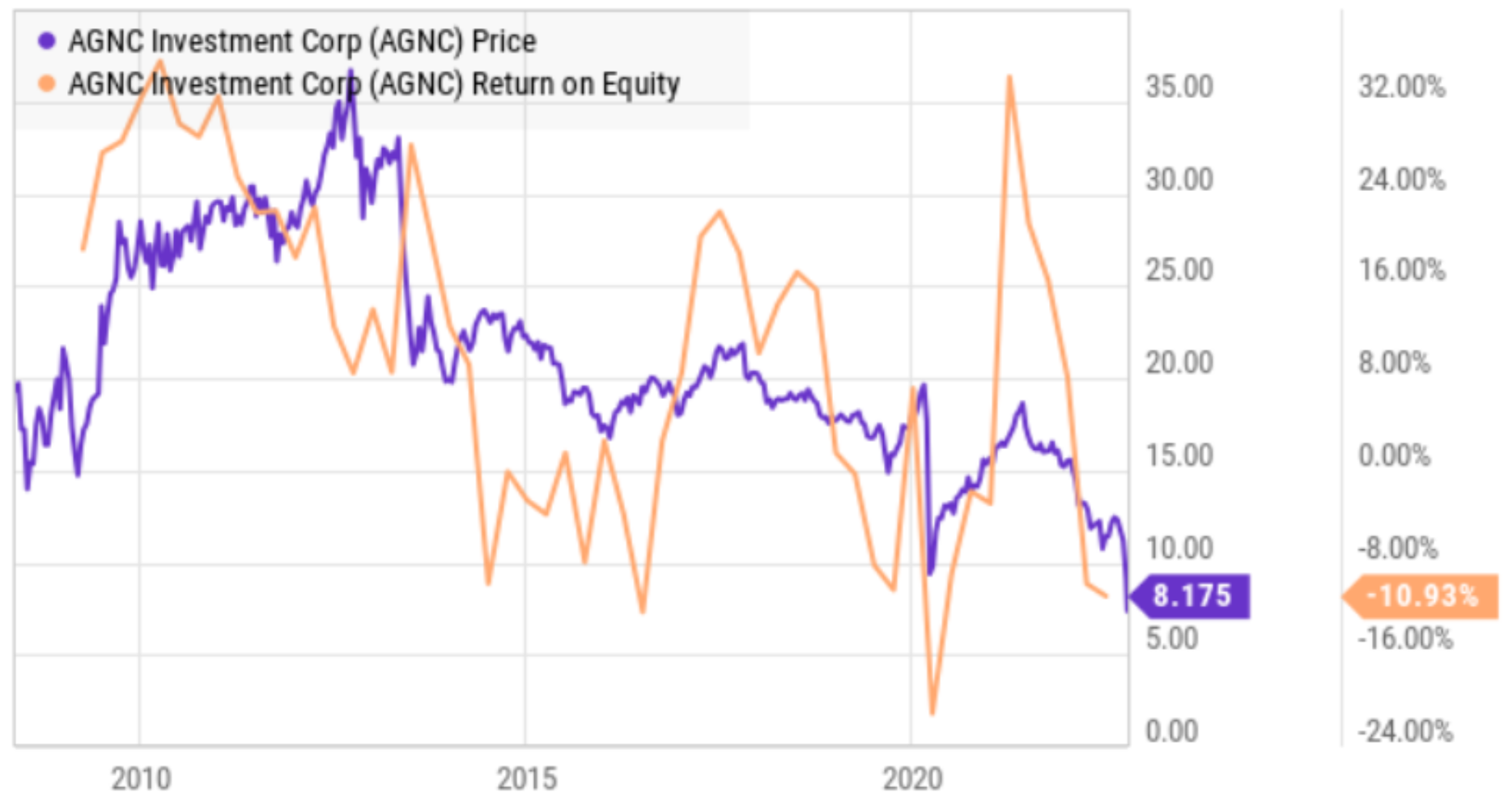

To provide some perspective on AGNC’s long-term return potential, here is a look at its long-term return on equity.

Return on equity is basically net income divided by book value (or equity value), and it has been declining over the years for AGNC. That’s not to say ROE can’t turn positive going forward, but it does suggest management decisions have not been the best. Book value is increased or decreased by return on equity (or return on book value), and share price generally follows book value in the long-term, even though in the short-term share prices can deviate widely as compared to book value.

And while AGNC may improve its book value and ROE going forward (especially based on higher interest rates and the current market cycle) long-term declines in these metrics are simply not a good thing for investors.

The Bottom Line

AGNC is tempting, especially for a shorter-term trade. The price is well below book value, and the return potential is improved considering interest rates (and net interest margins) are higher, especially now that the lion’s share of the cyclical book value declines may be over. And even if the dividend is rightsized, it won’t be the first time, and it will very likely still be a very large dividend (paid monthly).

As a long-term investor, AGNC has red flags. A constantly declining book value and negative return on equity are a turn off. For these reasons, we remain on the sidelines (we have owned AGNC in the past, but we currently do not own any mortgage REITs). However, we do acknowledge that AGNC may currently be set up attractively for some impressive shorter-term trading gains—if you are inclined to take advantage.