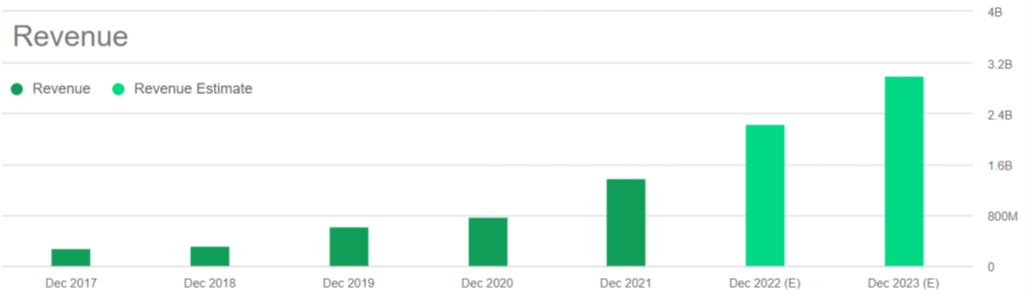

What started out as a microinverter technology (to help efficiently transform sunlight into energy) is rapidly growing into a one-stop-shop home-energy-solutions and technology company. Specifically, as the company’s microinverter business continues to grow rapidly (and gain market share from the other main industry competitor’s inferior technology), the product line continues to expand (now including batteries, EV charging, and impressive industry-leading smart software) into a massive secular trend (cleaner energy) opportunity (the SAM, or “serviceable addressable market,” is estimated to be $23 billion by 2025, versus the company’s $1.7 billion in total revenue over the last 12 months).

Overview: Enphase Energy (ENPH)

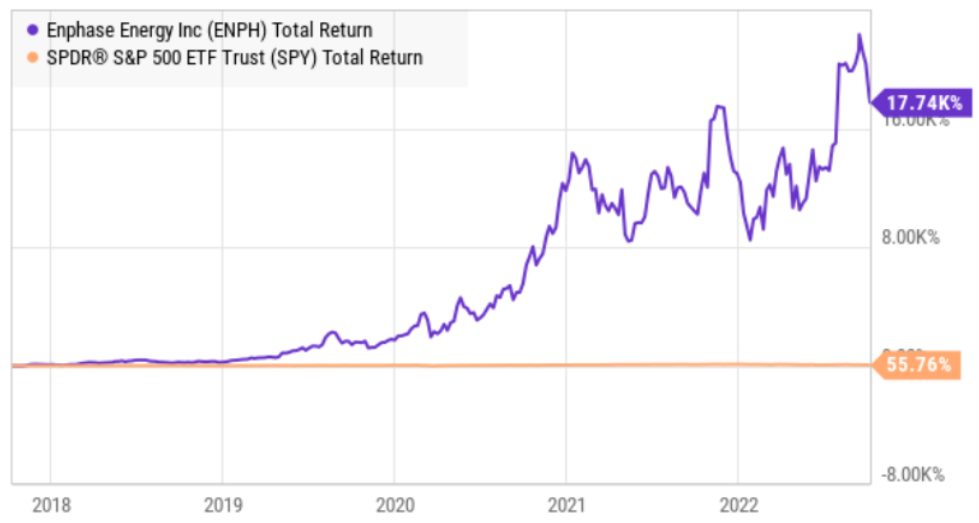

We currently own shares of Enphase in our Blue Harbinger Disciplined Growth Portfolio (we have since early 2021, view our earlier report here). The business has continued to grow rapidly since that previous report, and the share price is now dramatically higher. However, a recent short seller report from Muddy Waters about other solar industry companies (not Enphase) drove the entire industry group sharply lower, thereby creating an attractive “buy the dip” opportunity (if you can call it that, considering the share price is still up dramatically in recent years--we’ll have more to say about valuation later in this report).

About:

Enphase eloquently describes its own home energy solutions business on its website, as follows:

Advancing a sustainable future for all.

Founded in 2006, Enphase transformed the solar industry with our revolutionary microinverter technology which turns sunlight into a safe, reliable, resilient, and scalable source of energy to power our lives. Today, our intelligent microinverters work with virtually every solar panel made, and when paired with our award-winning smart battery technology, we engineer one of the industry's best-performing clean energy systems.

The Enphase Energy system enables people to make, use, save, sell, and own their power. This includes our industry-leading app, which provides unprecedented data and control in the palm of your hand. For the first time in the evolution of our centuries-old grid, people can get paid for the clean energy they produce and share with their communities, helping to build a new energy future that harnesses the sun. This clean, free, abundant source of energy can power our lives and ultimately help replace fossil fuels altogether.

Today, if you see a home with solar panels on it, there's a good chance it's an Enphase home. We have installed more than 48 million microinverters on over 2.5 million homes in over 140 countries, helping millions of people gain access to clean, affordable, and reliable energy while creating good jobs and a more carbon-free future for everyone. Enphase is putting people and their power at the center of our shared energy future.

Enphase home energy solutions are targeted towards homeowners, business owners and installers, and the Enphase Store gives a good overview of the expanding product line (such as EV chargers, microinverters, storage, communication, services and more) which is enabling the company to capture a large “share of wallet” per home.

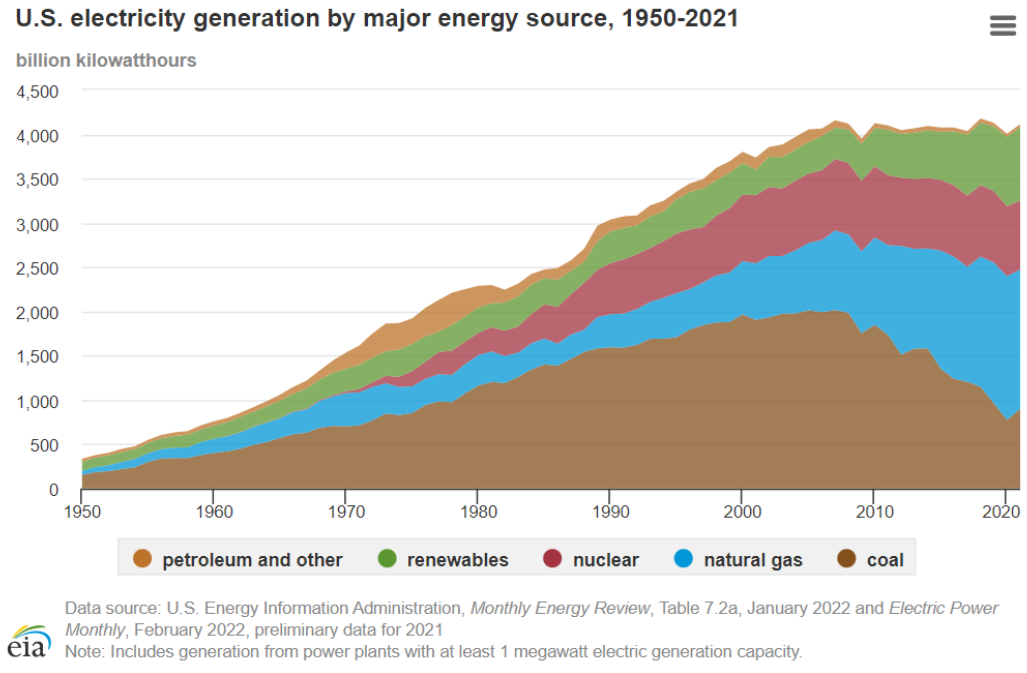

Secular Trend: Large SAM

Enphase is part of a massive secular trend to reduce the use of fossil fuel and increase the use of cleaner energies (such as solar). For some perspective, fossil fuels still comprised 60% of the energy supplied to the US grid in 2021, whereas renewables (such as solar) are small but growing.

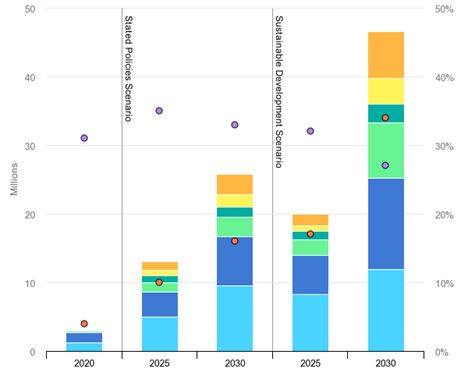

For more perspective, electric vehicle (EV) sales are expected to grow significantly in the years ahead (according to the International Energy Agency, as you can see in their chart below) which will also increase the demand for cleaner energy solutions (including Enphase’s EV charging products).

Also important, the US government backs alternative energy solutions in a variety of ways. For example, the US Senate’s recent climate bill passage should benefit Enphase based on higher government spending and more solar adoption.

Market Leader: Sustainable Moat

Enphase is a market leader in the microinverter space, as you can see in the following graphic comparing it to competitor SolarEdge Technologies (SEDG) in select markets.

This graphic shows that Enphase and SolarEdge are the two leaders, and that Enphase appears to be gaining share; this makes sense considering Enphase’s product is superior (versus traditional string inverters) and because of its expanding product line (as discussed earlier).

Worth noting, Enphase microinverters have improved upon the shortcomings of traditional string inverters (which are more prone to downtime if one circuit in the string goes down, and generally limited to the max power output of the weakest solar panel). And Enphase continues to strengthen its moat by building out its product line thereby creating a more captive audience and a more desirable total solution.

Further, Enphase is supported by a strong leadership team with extensive expertise in both semiconductors and solar. This is not a case of people from other industries piling into a nascent secular trend, rather Enphase leadership has deep industry experience. For example, CEO Badri Kothandaraman brings to Enphase more than 21 years of product development and general management experience in the semiconductor industry, and Dave Ranhoff, Chief Commercial Officer, brings extensive solar industry experience.

Also noteworthy, the company has over 484 patents and pending patent applications, thereby adding to its strengths.

The Financials

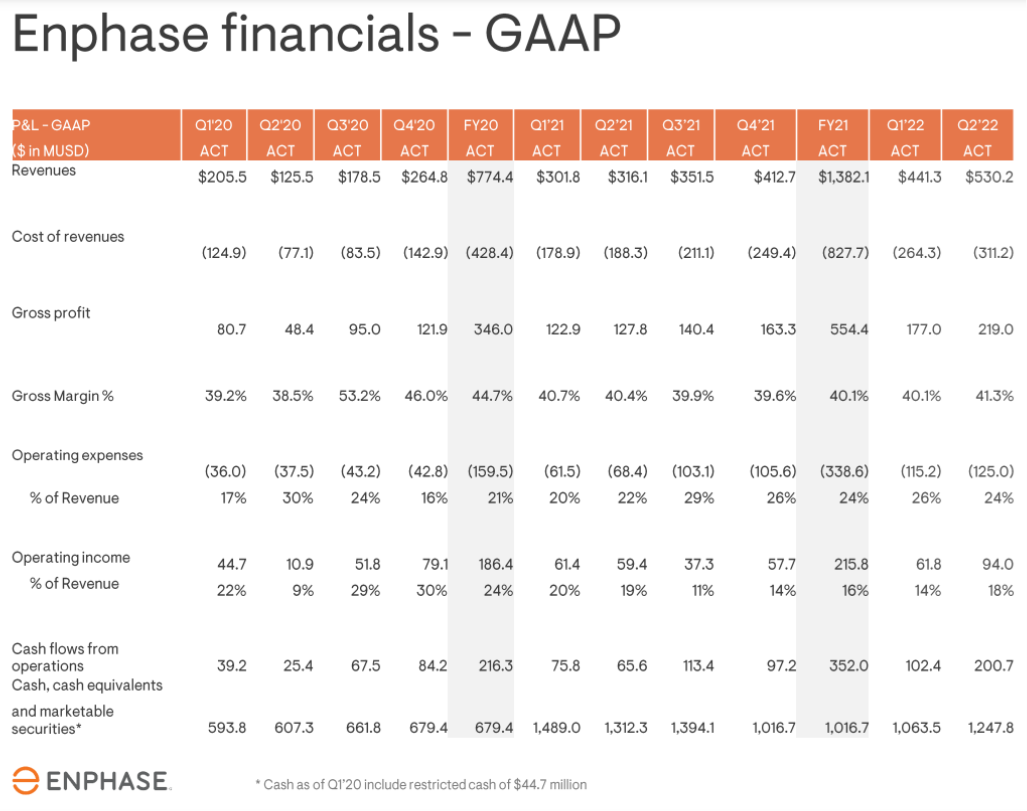

Enphase has been experiencing extremely strong revenue growth both organically (as the microinverter space expands rapidly) and through inorganic acquisitions to expand its product line and capabilities (such as its recent acquisitions of GreenCom Networks and Solar Lead Factory). And the shares are expected to continue growing rapidly thanks to the large secular trend and massive addressable market.

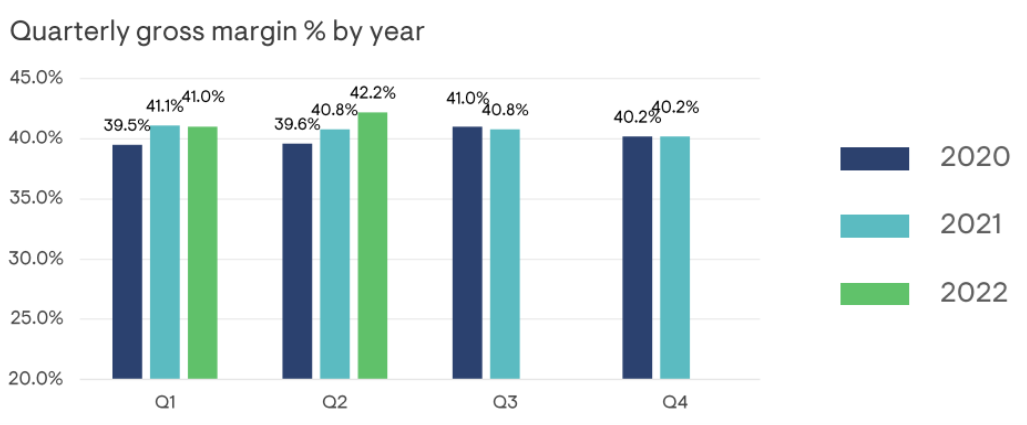

And the company is in a strong financial position to support continuing growth. For example, the company is GAAP profitable, with strengthening margins and a strong cash position.

Unlike unprofitable high-growth companies (both in clean-energy and other industries), we don’t foresee any financing challenges impeding Enphase’s continuing growth, especially considering it’s already profitable and demand is very strong and growing for this secular disrupting leader.

Valuation:

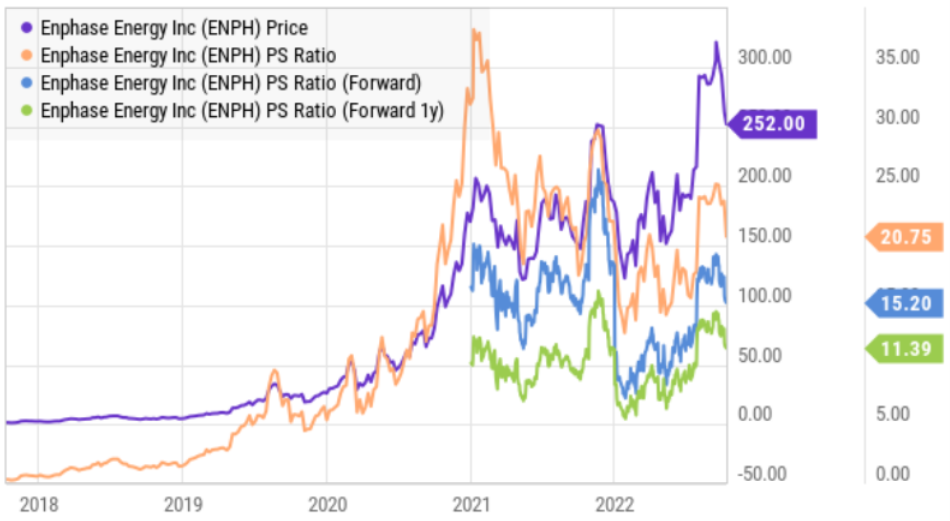

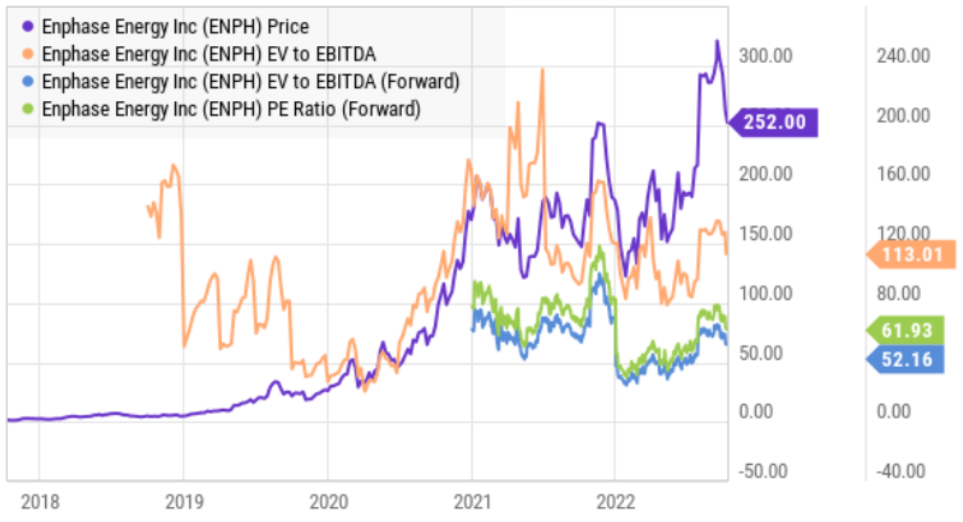

From a valuation standpoint, Enphase is not cheap, but it’s worth it. Some investors are calling for a correction in Enphase’s share price just because it is one of the few high-growth stocks that hasn’t crashed following the pandemic bubble (shares are up significantly so far this year). However, as mentioned, unlike other high-growth stocks, Enphase is already strongly GAAP profitable and in a better cash position (i.e. Enphase won’t be paralyzed by higher interest rates and a lower share price for share issuances like other high-growth stocks). Not to mention revenue continues to grow rapidly.

Enphase currently trades at ~11.4 one-year forward revenue, which may seem expensive, but it’s not as compared to the company’s ~60% revenue growth rate (and EBITDA Revenue growth rate).

And as mentioned, the company is already strongly profitable.

Interestingly, noted short-seller Muddy Waters recently released a negative report on solar industry companies Sunrun and Hannon Armstrong, which dragged solar share prices down indiscriminately. In our view, this creates a little extra margin of safety to add shares of Enphase, despite the fact that the longer-term trajectory remains sharply higher.

Risks:

The main risks for Enphase are a deep market wide recession (which would negatively impact almost all businesses, including Enphase), a highly volatile share price (if you’re not used to short-term price volatility, think twice before buying Enphase), valuation multiple contraction (if investors get increasingly fickle in the short term) new and existing competition (although Enphase is expanding its leadership position) and government regulation (although that remains firmly in Enphase’s favor, as previously mentioned). However, we believe Enphase remains on a sharp trajectory higher over the long-term, despite these near-term risks.

The Bottom Line:

Any company with high growth and a relatively high valuation multiple makes the market extremely nervous right now (with inflation and interest rate fears intensifying). However, Enphase deserves a higher valuation multiple because the business is so well positioned to continue executing on its strategy to capitalize from the growing clean energy secular trend and the company’s increasing leadership position.

We have owned Enphase for a relatively short period of time (more than 18 months), but expect to continue owning it for a longer period as long as the strong growth trajectory remains intact (which we believe it is). We are happy to ride out any near-term volatility (especially with an earnings announcement in two weeks) by continuing to own Enphase in our prudently concentrated long-term Disciplined Growth Portfolio. If you are looking for a high-growth opportunity, Enphase shares are worth considering.