If you are an income-focused investor, the BDC we review in this report may be interesting to you. It has a unique business strategy and a compelling 12.0% distribution yield. We dig into the details (including the nuances of the strategy, valuation, the current market environment, dividend safety and risks), and then conclude with our strong opinion on investing.

TriplePoint Venture Growth (TPVG), Yield: 12.0%

Triple Point Venture Growth (TPVG) is an externally managed Business Development Company (“BDC”) focused primarily on providing customized debt financing (typically with warrants and often some direct equity investments) to venture growth stage companies in technology and other high grow industries.

TPVG serves as the primary vehicle for the venture growth stage business segment of TriplePoint Capital’s global investment platform. For perspective, here is a small sample of some of the companies TPVG has historically provided capital to (you’ve likely heard of at least a few of them).

And TVPG’s differentiated strategy gives it unique advantages (that we will discuss later in this report). Here are some highlights from TPVG’s investment strategy.

For your information, TPVG’s book of investments currently consists of 56 debt obligors (129 loans) with a weighted average yield of 14.5% (currently valued at $768.8 million), plus $52.7 million of warrants (i.e. rights to buy mainly equity) and $55.3 million of equity positions (i.e. ownerships in companies they have provided financing to). TPVG’s book of investments typically yield 10% to 18% on an unlevered basis (including interest and fees on loans) which helps it support the well covered distribution yield to investors.

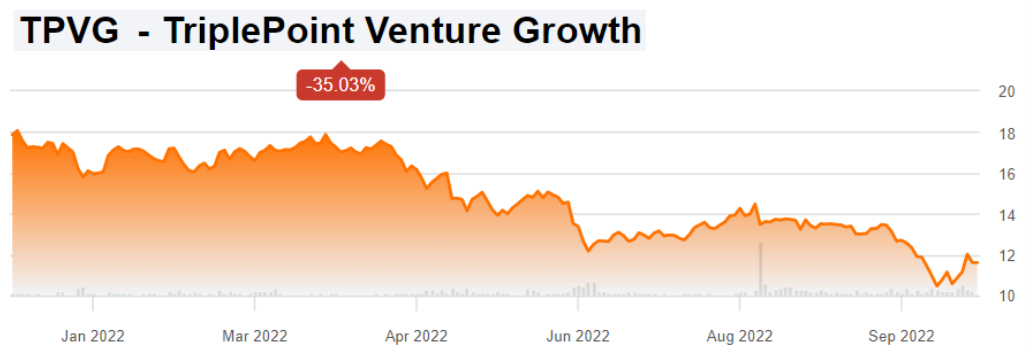

Recent Share Price Action

TPVG shares have recently sold off sharply, which is expected considering growth and technology stocks have sold off hard this year as the Fed continues to raise rates to fight inflation with the side effect of slowing the economy—particularly high growth companies (as valuations are now lower and capital raising is now more expensive). Here is a look at TPVG's year-to-date share price performance:

In our view, this is the right time to consider investing in high-growth and technology companies (i.e. when the market is down) if you are a long-term investor. And TPVG is particularly attractive because it pays a healthy double digit distribution yield (which can help investors cope with the broader market volatility).

Current Valuation:

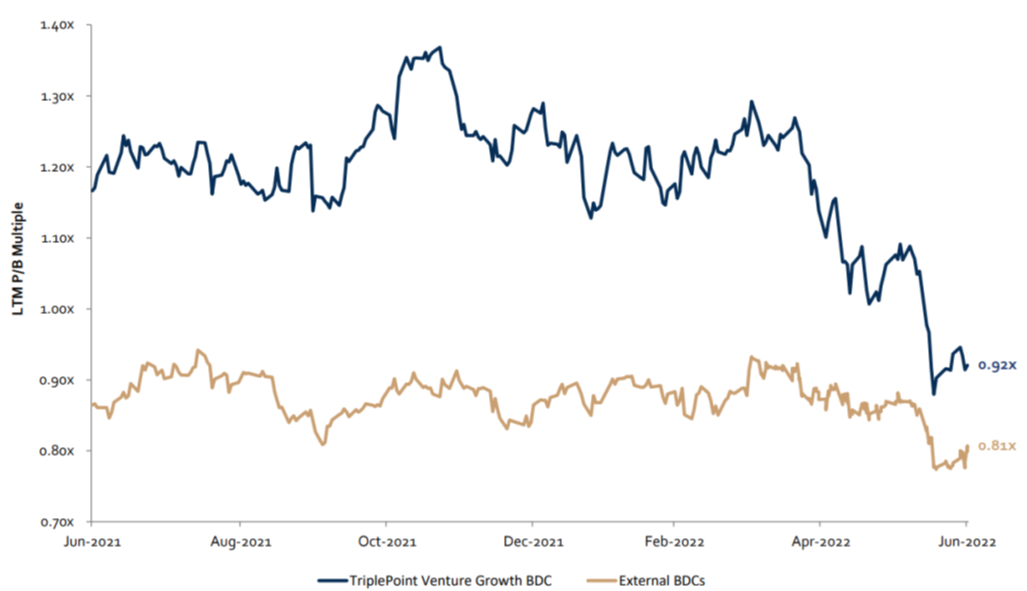

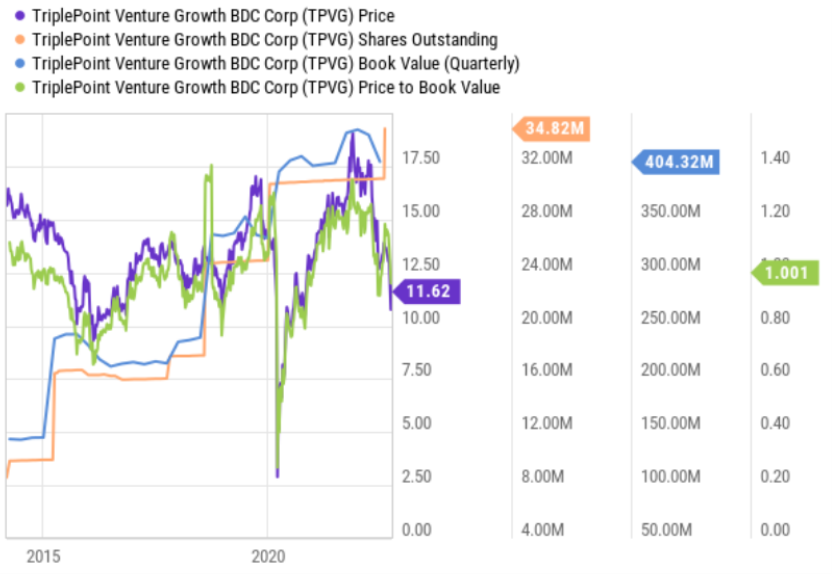

In fact, TPVG’s book value has declined lately (as its underlying holdings—primarily debt investments to venture growth stage companies—have been marked down due to realized and unrealized losses). In particular, TPVG’s shares currently trade at roughly book value (not a premium or a discount), and this is compelling considering they often trade at a premium. Here is a look at the historical price to book value multiple for TPVG versus other BDCs as of the end of the second quarter.

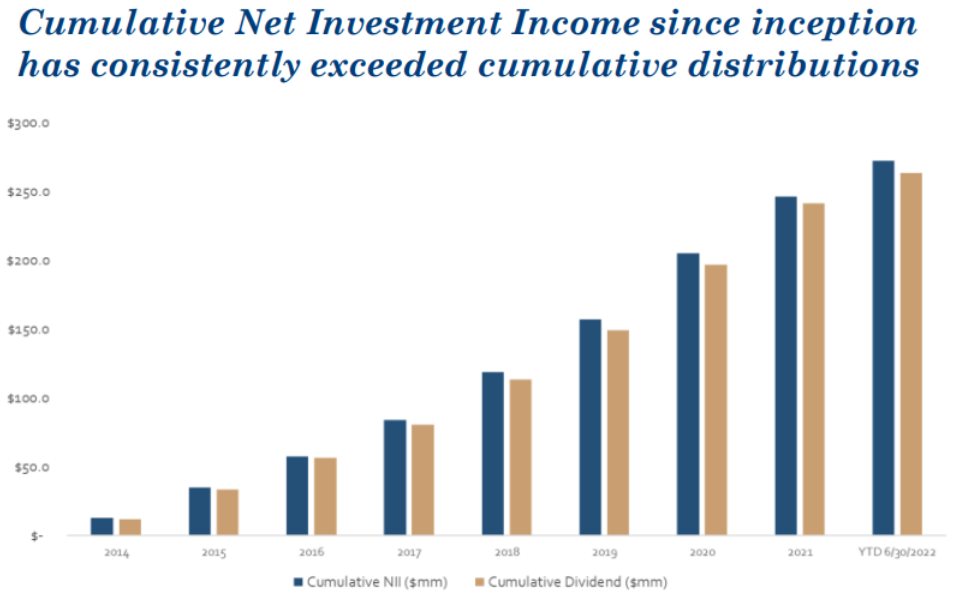

However, despite the book value multiple decline, TPVG’s net investment income continues to exceed its dividend payout (a very good thing).

In the most recent quarter, Net Investment Income (“NII”) was $0.41 per share—exceeding the quarterly dividend of $0.36 per share.

In our view, the lower price-to-book value multiple makes for an increasingly attractive time to consider adding shares of TPVG, especially considering the well-covered yield has mathematically risen so high (12.0%) as the share price has fallen. We view the share price and book value declines as mostly temporary (until the market recovers) and believe TPVG has the financial wherewithal and management team to navigate the current dynamic market conditions.

Management Team:

The TPVG management team is skilled and prepared to navigate the current market slowdown successfully. In particular, TPVG is in the uniquely attractive position to help venture growth stage companies (at a time when it is more challenging for them to raise equity capital—publicly or privately—because valuations are down) by providing them debt capital. According to Chairman and CEO James Labe during the latest quarterly call:

“Following a record year for venture capital activity, many of the companies have raised equity recently at attractive valuations are now looking to add debt in this valuation sensitive market. Companies are increasingly evaluating debt financing solutions as a result of the longer timelines for public listings. Other companies out there are seeking additional runway in the form of debt because they plan out their timetable and future equity rounds and augment their financing strategy and capitalization plans. We've seen each of these scenarios in the second quarter and we expect the trend to continue in 2022 and beyond. These trends have helped create a sustained demand for venture lending and provides continuing advantages for us with our deal structures and opportunistic pricing.”

The TPVG management team has worked together for over 23 years, and is supported by a team of more than 60 professionals with an average of 14 years of experience and 6 years with the TriplePoint Platform.

Risk Factors:

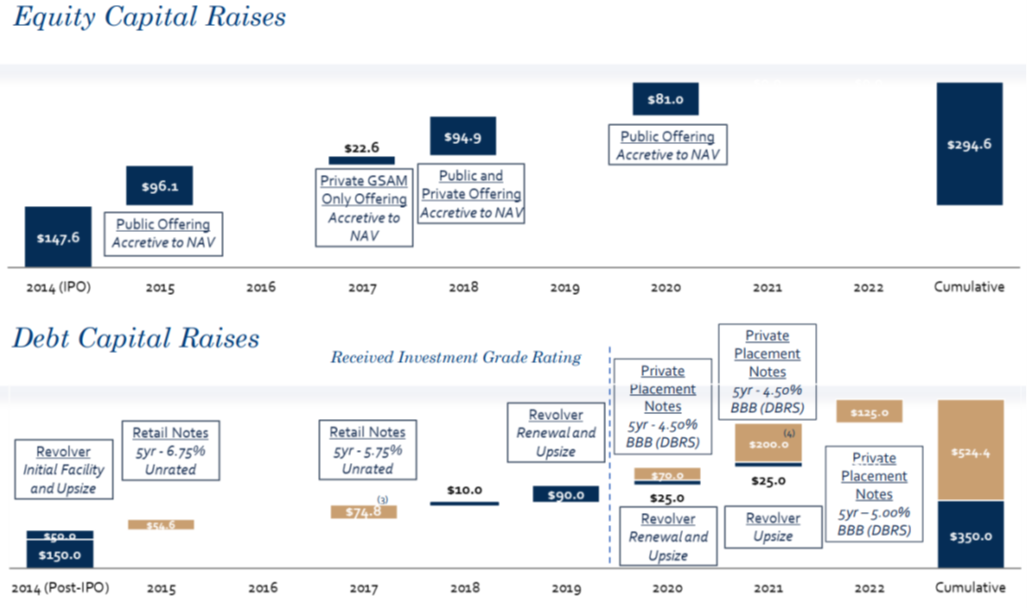

Important to note, TPVG does face a variety of risk factors that should be considered. For example, the company does have a history of issuing new shares (which can be dilutive to existing shareholders) and issuing new debt (which can increase risks). However, here is a look at TPVG’s historical equity and debt capital raises (below), and as you can see the equity raises were all accretive to NAV (meaning the new shares were issued when NAV was above book value) and the debt issuances were at attractive rates, especially considering rates have now been rising (worth noting, TPVG has a BBB “investment grade” credit rating from DBRS).

And since the end of the second quarter, TPVG again issued shares (at an accretive price) as you can see in the following chart (which also shows the price to book value is again compelling at roughly par).

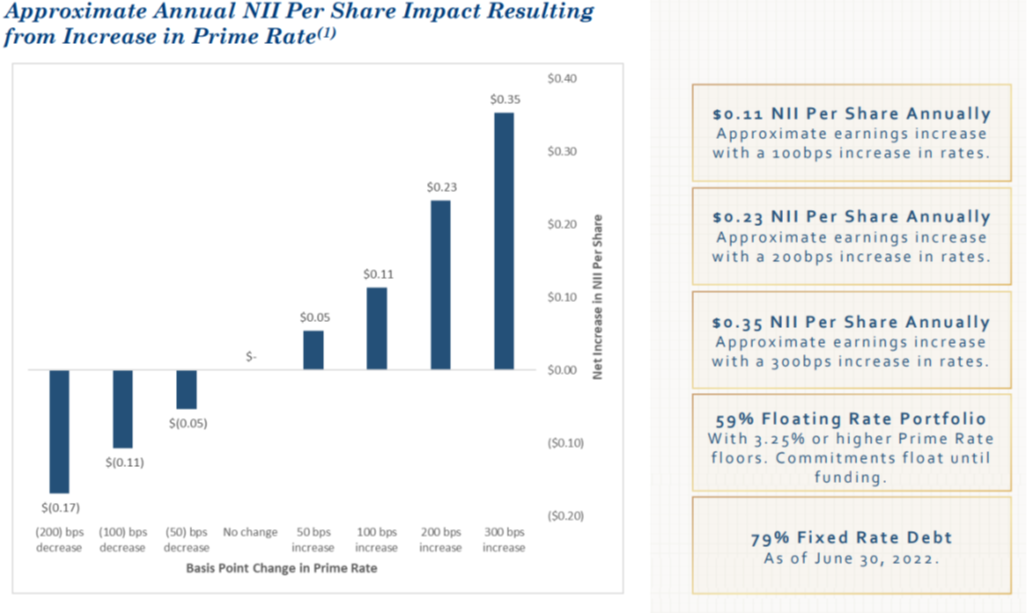

As mentioned, interest rate volatility also poses a risk for TPVG. However, rising rates are actually helpful as you can see in the chart below.

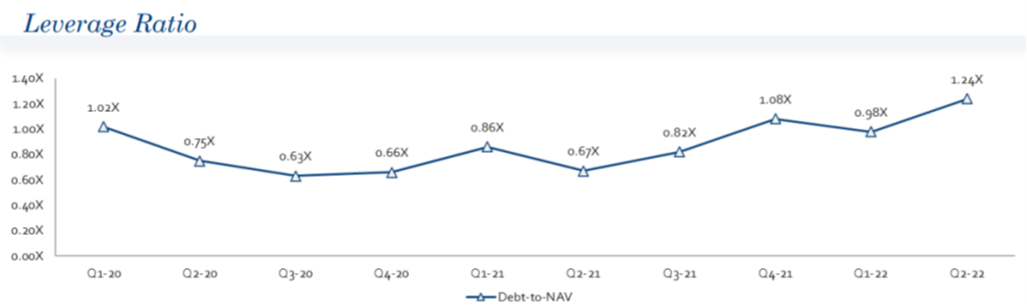

Increasing leverage (or borrowed money) is another risk factor. According to CEO James Labe during the most recent quarterly call:

“During the past few quarters, we have gradually been bringing up our portfolio leverage and in the second quarter, we are pleased to have hit our target leverage range.”

Even though leverage is at target, it will mathematically increase if book value continues to fall, which can create increased challenges for the business

A prolonged recession is another risk factor. As mentioned, the economy is currently struggling. And even though the management team is ready to take advantage of dynamic market condition (as described earlier) any type of prolonged recession will hurt the underlying portfolio companies and ultimately hurt TPVG.

Conclusion:

In our view, now is an attractive time to consider investing in TPVG. We have entered a lower point in the market cycle—particularly for growth companies (such as those TPVG provides capital to)—and that can be a good time to buy low. Especially considering TPVG remains financially healthy, and the shares no longer trade at a large premium to book value. Not to mention the dividend has mathematically risen to 12.0% (as the share price has fallen) and the dividend remains well covered by net investment income. Further, TPVG is poised to benefit from portfolio companies’ shift from equity to debt financing, and from rising interest rates (better net interest margins) so long as a dramatically prolonged recession does not occur. If you are an income-focused investor, TriplePoint Venture Growth is absolutely worth considering for a spot in your prudently diversified long-term investment portfolio. We do not currently own shares, but it is high on our watchlist.