Better. Faster. Smarter. The Software-as-a-Service (SaaS) company that we review in this article helps organizations digitize and unify their workflows. That may sound like a lot of hot air, but it’s not. This is a real deal profitable business that is growing rapidly, has an extremely high customer retention rate and a massive long-term total addressable market opportunity (so it can keep growing rapidly). The company does not pay a dividend, but the shares have gotten relatively inexpensive during the recent “tech wreck,” and 5 years from now many people will wish they bought shares. We are long this stock, and it currently presents a compelling buying opportunity.

Overview: ServiceNow (NOW)

The problem that the ServiceNow platform solves is that most organizations have a lot of outdated manual workflow processes (ranging from finance, to IT, to sales and marketing) that are segregated, inefficient, and make work miserable for employees. ServiceNow helps digitize and unify these workflows to capture valuable data and make life better for employees.

And for a little perspective on the size and growth of the company overall, ServiceNow had over $5.5 billion in revenues in 2021, and that number was growing at 28%. Further, it generated nearly $2 billion in free cash flow, and this demonstrates that ServiceNow isn’t just some pandemic bubble stock—ServiceNow is the real deal. It’s generates real cash flow, and lots of it.

Also very important, digitizing legacy workflow processes (like ServiceNow does) is one of the biggest secular megatrends among organizations across the world today. Ask just about any CEO and they’ll tell you that the “digital revolution” is front-and-center for their organizations, and it is a very big deal.

Land and Expand

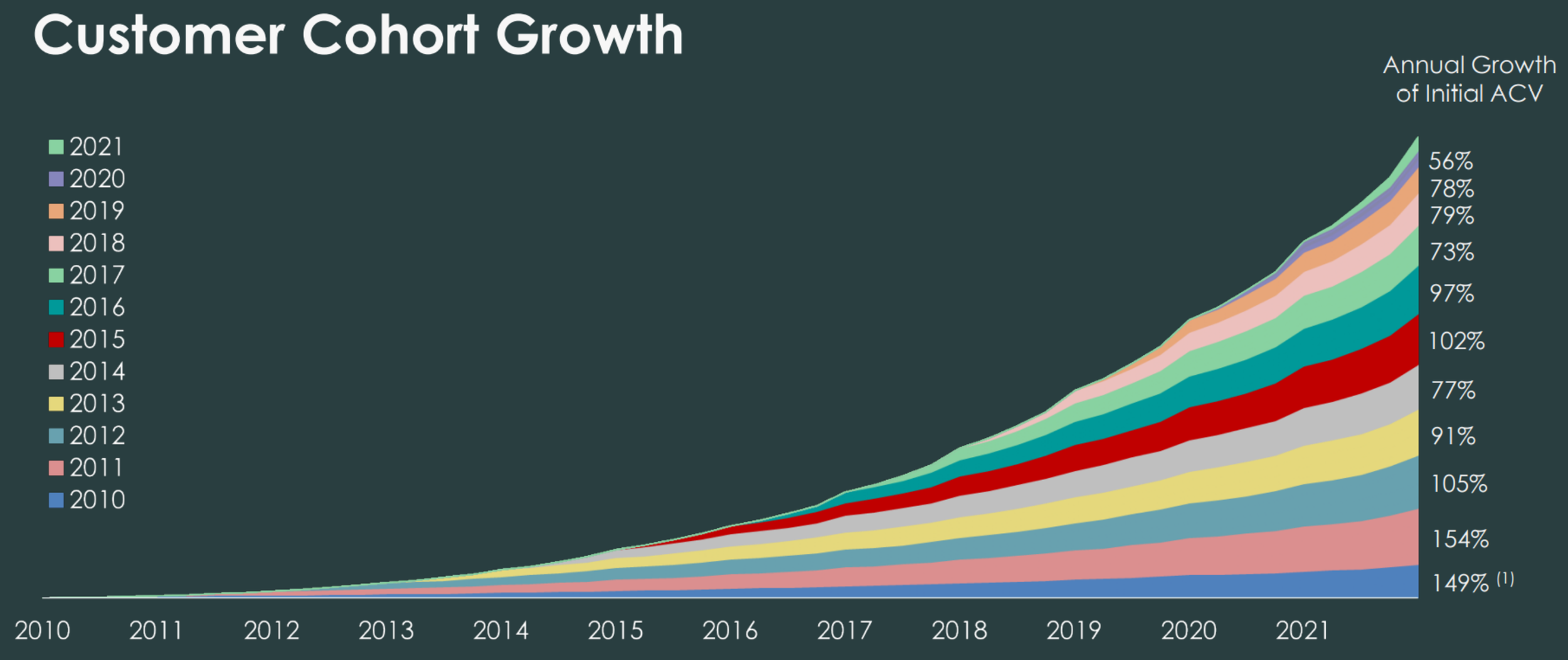

And one of the best parts of the ServiceNow platform is that it is a software as a service (SaaS) subscription which means once a customer signs up—they automatically renew their subscriptions—and this makes the customer retention rate very high (typically in the high 90’s, close to 100%). Furthermore, customers tend to like the platform so much that they continually expand their relationship with ServiceNow over time (see chart below) and this means massive sticky revenue growth (somewhat of a “holy grail” in the business world).

Industry Leader:

Also important to note, ServiceNow continues to be a top ranked (and highly regarded) solution among industry reviews. This is an important reason and indication for the company’s strong growth.

High Growth Trajectory and Profitability:

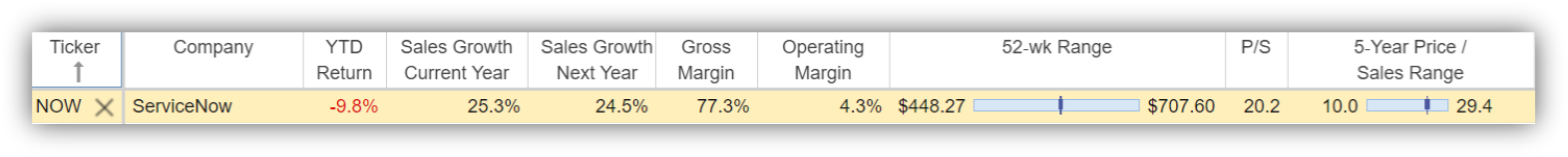

ServiceNow continues to grow its revenues at around 25% per year, which is dramatically higher than the typical large cap stock (its market cap is $116 billion) and very impressive.

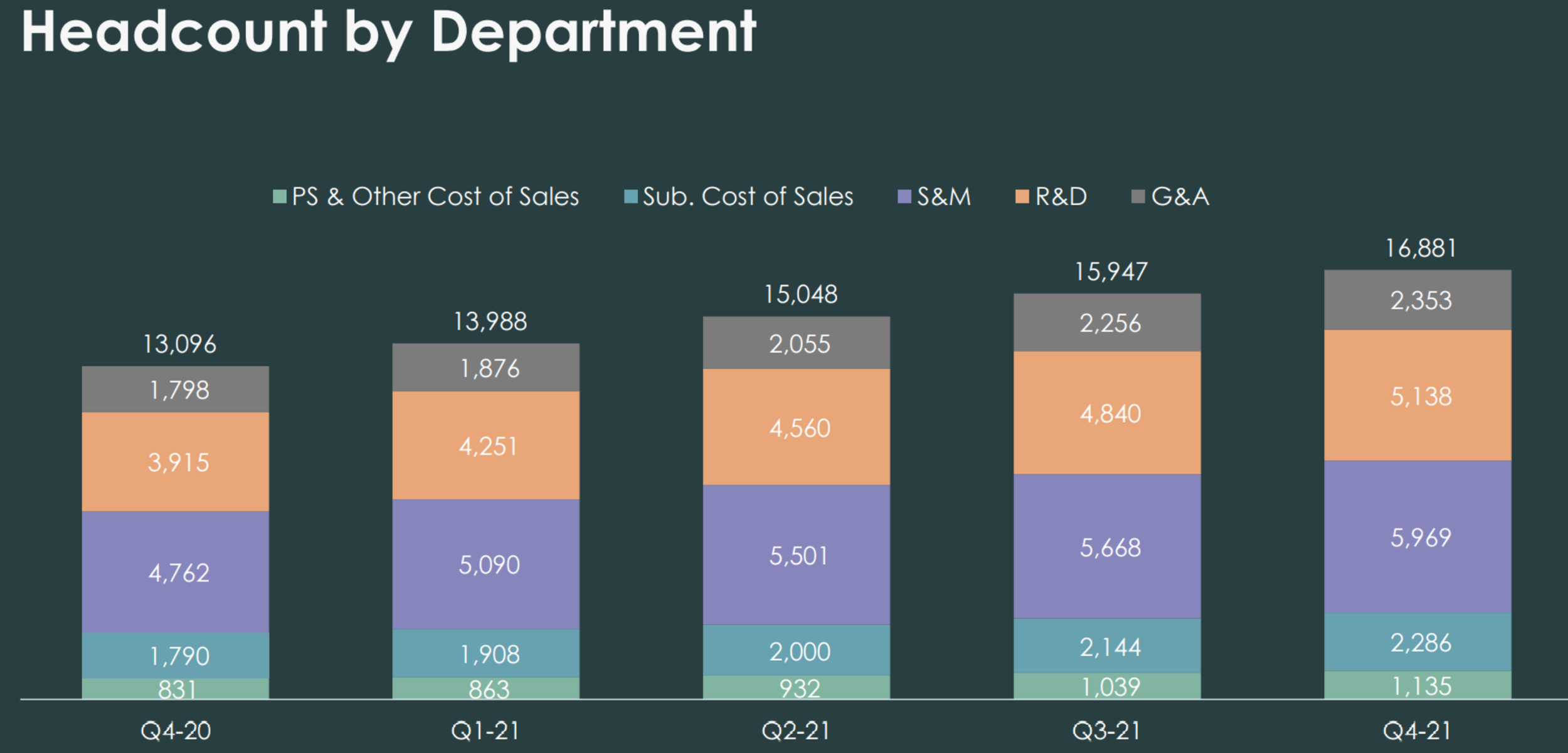

Further, the company continues to lean into future growth opportunities, as evidenced by its growing workforce (an indication that management believes powerful growth will continue).

Notably, ServiceNow’s operating costs are low, as evidenced by its 77.3% gross margins (see earlier) and such high margins are possible because of the efficiency of the software platform. Further, cash flows are enormous (see earlier), and the company is already very profitable—an impressive feat for a company growing this fast, and also critically important in our current interest rate environment as interest rates are set to rise. And operating margins would be even higher (see earlier table) if the company were not prudently spending heavily to keep growing rapidly (this is exactly what they should be doing). It’s also an indication that this company can (and likely will) eventually become and even more massive “cash cow” business.

Profitability and Valuation

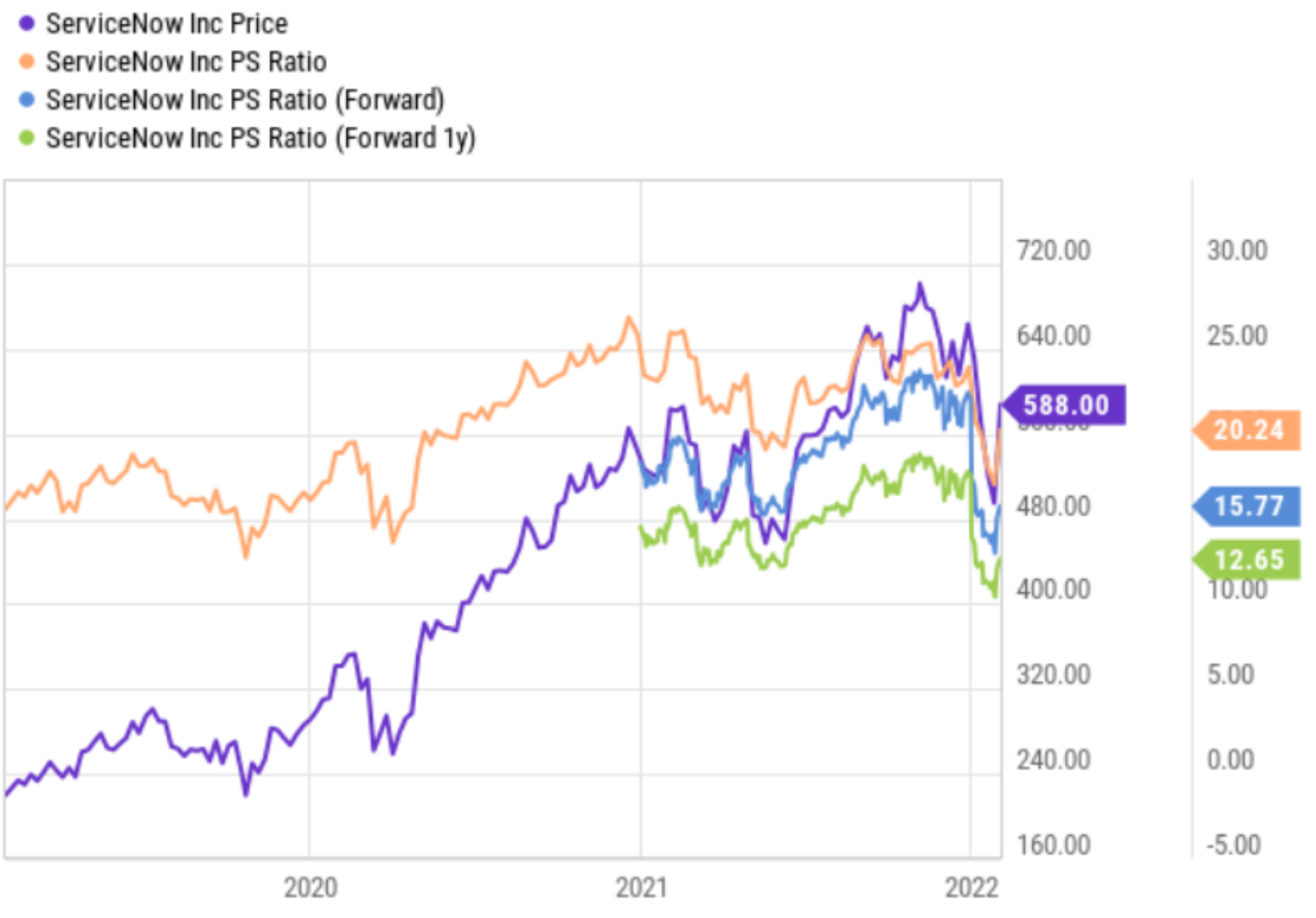

As tech stocks in general have sold off hard recently, shares of ServiceNow sit sharply below their 52-week high—despite the fact that the business remains very healthy and growing rapidly. And from a price-to-sales valuation metric basis, NOW is attractive at 12.65x 1-year forward sales.

Many companies with growth rates as high as ServiceNow tend to trade at much higher valuation multiples, and this is especially impressive because NOW is so much larger, proven and more profitable than most of these smaller peers with higher valuations. It’s also important to keep in mind that the true value of NOW is not based on the revenues or income in the next 12-months, but rather the ongoing revenue and income many, many years into the future.

More Evidence of Value

ServiceNow announced earnings last week, and basically confirmed that the recent price sell off is largely unwarranted considering the business remains so strong and the outlook remains bright. Here is how the CEO, Bill McDermott, started off his part during the earnings call: “ServiceNow has once again delivered results that significantly beat the high end of expectations.” He went on to explain that:

Subscription revenue growth was 30%.

Free cash flow growth was 32%.

Adjusted subscription billings growth was an exceptional 33%.

Operating margin was 23%, one point over guidance.

NOW had a record 135 deals over $1 million, which was up 50% year-over-year.

Some analysts fear that these strong numbers are just a “pull forward” of future results that cannot be sustained, however the strong headcount/hiring numbers are an indication to the contrary. NOW management believes the strong growth will continue.

The Bottom Line

We own shares of ServiceNow because we expect the shares to go dramatically higher in the years ahead. The recent share price pullback has created an increasingly compelling entry point if you want to own shares. Even if you are an income-focused investor, it can make sense to sprinkle a few growth stocks into your portfolio—especially if they are profitable, growing rapidly, have a massive market opportunity and just sold off (attractive valuation). Long ServiceNow.