So far this year, REITs have been the worst performing sector of the market. And that has created some attractive opportunities for income-focused investors. In this report, we review year-to-date market performance (what has been working and what hasn’t), we then dive into big-dividend REIT performance, and finally we highlight two big-dividend REITs that we believe are particularly attractive and worth considering for investment.

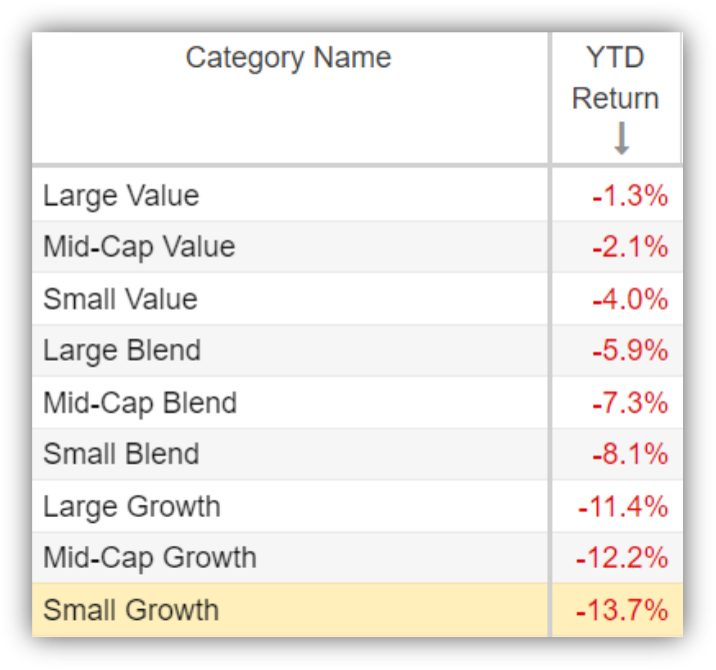

You can see in the table above what has been working this year (e.g. energy and financials), and you can see a few more market style and industry breakdowns below.

Particularly interesting, commodities have been performing very well as they often do when inflation fears grip the market.

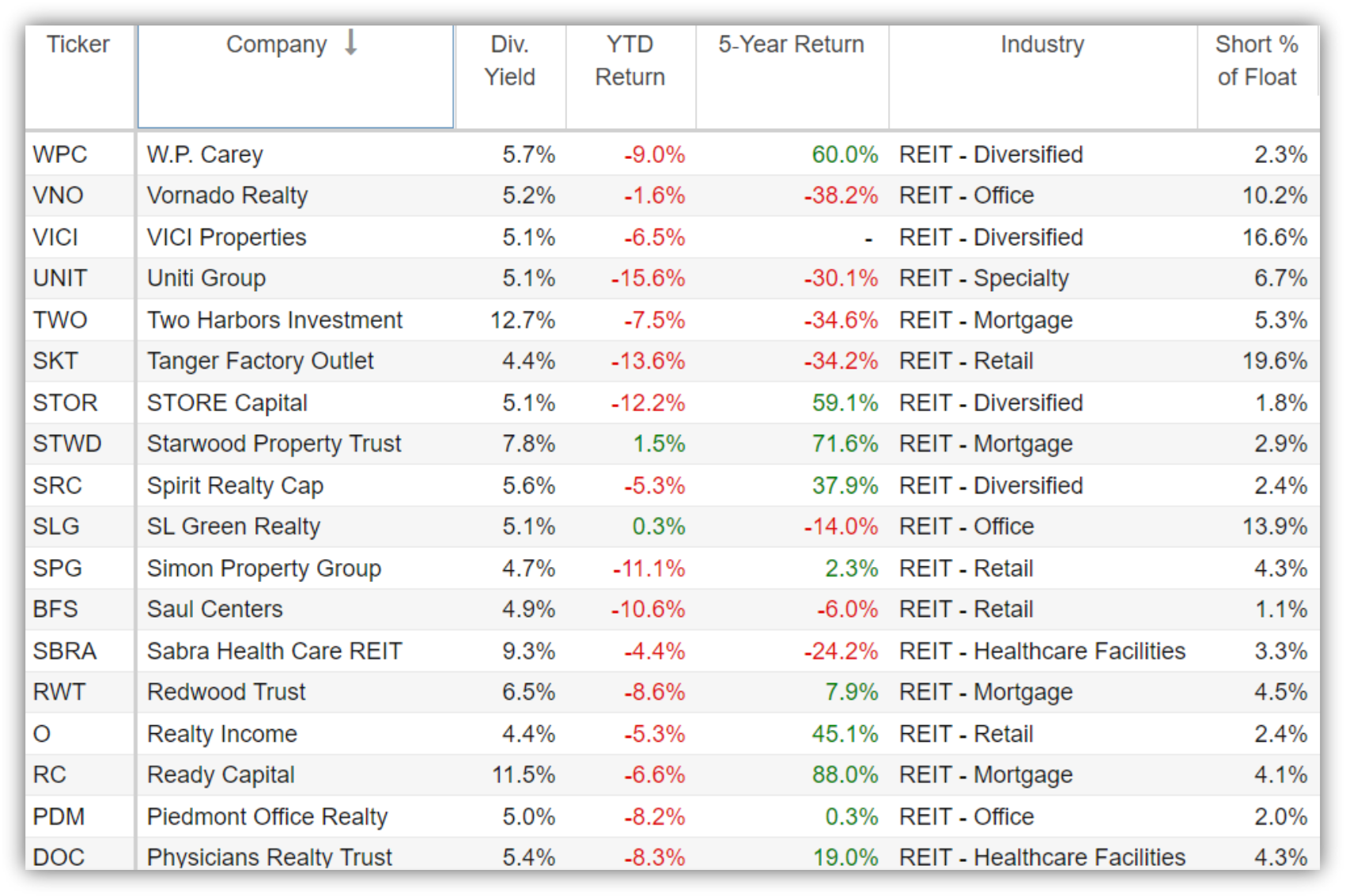

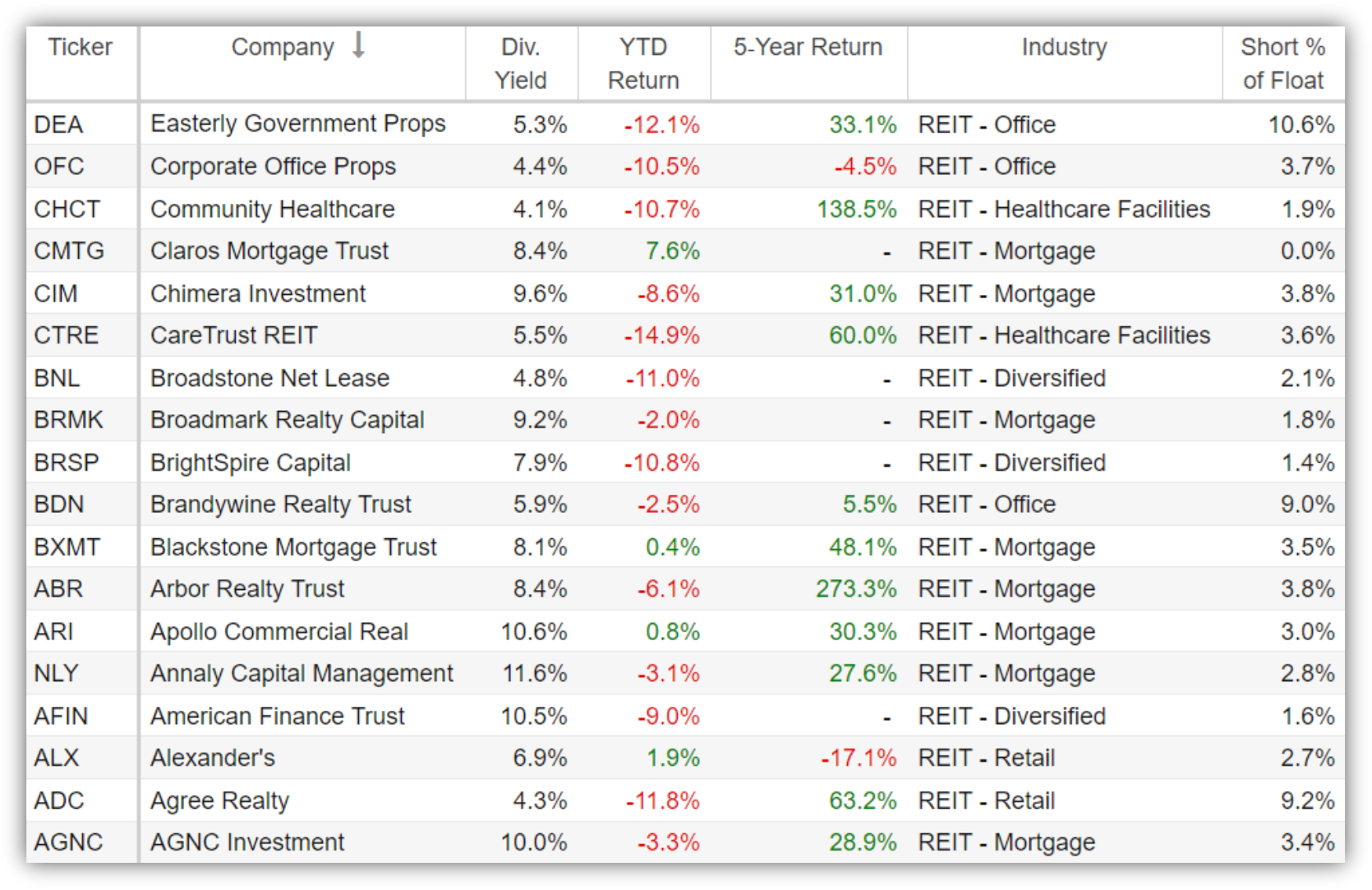

However, it is big-dividend REITs that have caught our eye. Here is a look at year-to-date performance for this group (in reverse alphabetical order).

Two names from the list that are particularly attractive are Simon Property Group (SPG) and W.P. Carey (WPC), not just because they are down this year, but because they are attractive over the long-term and they offer steady quarterly dividend payments that are compelling.

Simon Property Group (SPG), Yield: 4.9%

Simon Property Group announced earnings on Monday. They beat expectations for Funds From Operations (“FFO”) and earnings, but provided forward guidance lower than expected and the shares sold off. However, SPG remains one of the healthiest REITs (certainly in the retail space), and the management team has proven over and over to be extremely shrewd with the ability to get things done. And according to CEO David Simon (with regards to earnings):

We had a very busy and productive quarter to end a very successful year. We recorded occupancy gains, record retail sales, and demand for our space from a broad spectrum of tenants is robust, and our other platform investments had strong results.

If you are looking for a steady blue chip dividend REIT, SPG is worth considering. We currently own shares.

W.P. Carey (WPC), Yield: 5.6%

W.P. Carey is another attractive blue-chip REIT with an even higher dividend yield. The shares are down this year (as are most REITs), but the business remains healthy—and is expected to announce quarterly earnings numbers this week on 2/11 (Friday) before the market opens.

WPC owns operationally-critical commercial real estate, including over 1,200 net lease properties with high quality single-tenants across industrial, warehouse, office, retail and self-storage industries. Further, WPC’s built-in rent escalators help offset some of the risks of inflation. We are currently long shares of WPC and expect years of continuing success ahead.

The Bottom Line

We’d never advocate investing in any sector or style simply because prices are down. However, we do like attractive business when the prices are down—such as SPG and WPC. These two blue-chip REITs offer attractive dividends and attractive long-term value. We are currently long both and expect continuing strong performance in the years ahead.