The marine shipping industry can be volatile. However many of the companies in this group offer steadier big-dividend preferred shares (that can appeal to income-focused investors). In this report, we review a company that offers seaborne crude oil and petroleum product transportation services worldwide, including its attractive qualities and current risks, and with a special focus on its 9.6% yield preferred shares. We conclude with our strong opinion on investing.

Overview

Tsakos Energy Navigation (often referred to as “TEN,” although its NYSE ticker is “TNP”) offers marine transportation services for national, major, and other independent oil companies and refiners (such as Exxon Mobil (XOM), British Petroleum (BP), ConocoPhillips (COP) and others) under long, medium, and short-term charters. As of April 21, 2022, its fleet consists of 66 double-hull vessels (comprising of 60 conventional tankers, three LNG carriers, and three suezmax DP2 shuttle tankers). Tsakos was incorporated in 1993, is based in Athens, Greece and trades on the New York Stock Exchange. And with a market cap of only around $437 million, Tsakos is still one of the 10 largest oil tanker companies in the world.

Current Market Conditions: Improving

As mentioned, the marine shipping industry can be volatile. However, market conditions are currently improving for a variety of reasons.

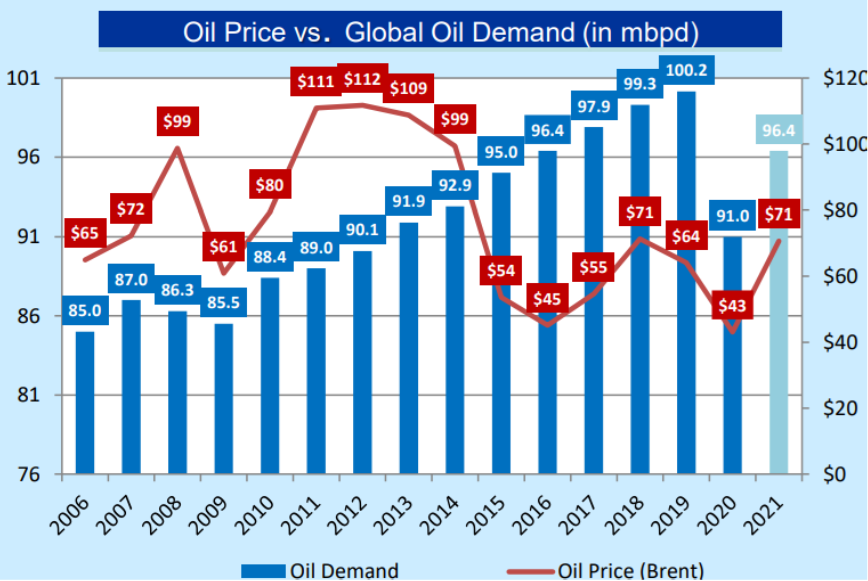

For starters, oil demand continues to increase as the world adjusts and recovers from the pandemic, as you can see in the following chart.

This chart from Tsakos (above) only goes through 2021, but oil prices and demand have continued to increase in 2022 (brent currently trades over $100)—a good thing for business. Furthermore, as global GDP continues to increase over time, so too is the demand for the shipping industry (including Tsakos) expected to grow.

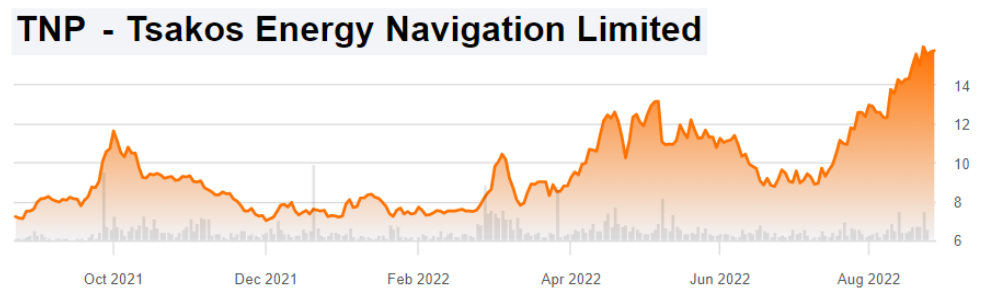

Furthermore, day rates (see chart above) have continued to climb dramatically in recent months, and this has had a very positive effect on the common shares of Tsakos (and other maritime shippers).

Furthermore, the Russia-Ukraine conflict has created a global redrawing of trade routes, thereby leading to an increase in oil tanker voyages—a positive for ton-mile demand.

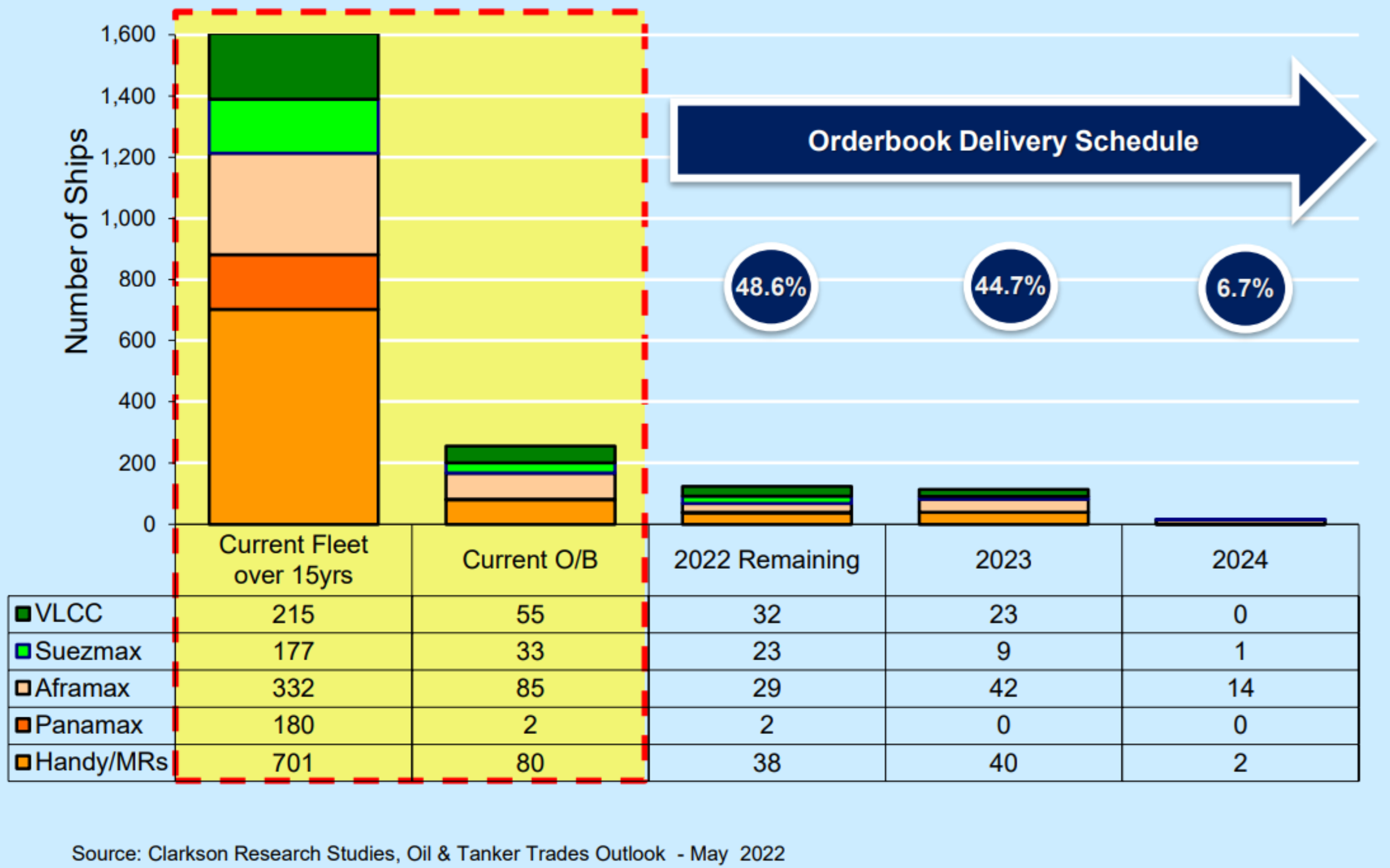

Further still, competition for Tsakos may be decreasing to some extent as demand increases (as explained earlier), newbuilds industrywide are down and competitor fleets continue to age (whereas Tsakos fleet remains relatively young). According to Tsakos, the industrywide new order book is historically low versus fleets over 15 years old (see chart below), although there have been some signs of shift more recently.

Additionally, upcoming regulations and discussions for alternative propulsion fuels should further propel scrapping activity for the industry (a good think for Tsakos). High scrapping prices should also contribute to an increase in scrapping (also good for Tsakos’ younger fleet).

Financial Position is Strengthening

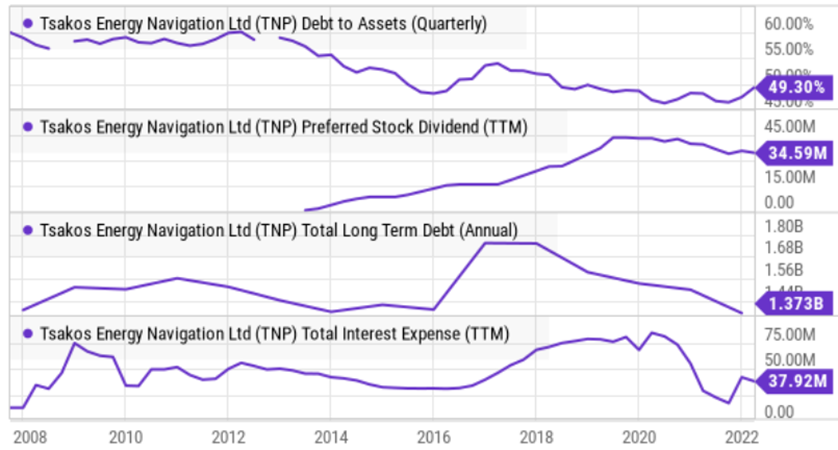

And while market conditions continue to improve, Tsakos’ financial position also continues to strengthen. For example, the company has been paying down debt over time, which lowers risk and creates more financial flexibility.

Additionally, the company’s recent earnings release showed improvement. Specifically, Tsakos beat both revenue and earnings expectations, and these numbers were for the quarter ended March 31 (i.e. day rates and demand have both been improving significantly since then). According to Tsakos, every $1,000pd increase in spot rates has a positive $0.39 impact on annual EPS (based on current vessels in spot contracts only and current common shares outstanding, which are subject to change).

In its latest earnings release, Tsakos reported GAAP EPS of -$0.12 and revenue of $149.7M (both exceeding expectations). Notably, EPS is negative (not great for the common shares, however preferred shares are ahead of common, and these net income and EPS numbers are after the preferred dividends have already been paid).

Dividends: Common and Preferred Shares

As you can see in the graphic below, Tsakos has paid a very large amount of dividends to investors over the years, but the dividend payments have fluctuated over time. On the other hand, Tsakos preferred share dividends have been steady (and they are ahead of common in the capital structure).

Three series of Tsakos preferred shares are currently traded in the market (and two series, B and C, have been redeemed by the company). You can see more information about the D, E and F series below, including recent prices, yields, when they can be redeemed (and at what price) by Tsakos, as well as the floating interest rate on two of the series, E and F, if they still trade after the redemption date.

Quantum online is a good resource for information on specific preferred shares (including Tsakos preferred shares).

Risks

If you haven’t already figured it out by the historical price volatility and negative EPS numbers, Tsakos common shares (and to a lessor extent, the preferred shares) are risky. For example, oil demand and oil prices are volatile, and these can impact Tsakos’ business (and common share price) dramatically.

Further, political risks are real, such as the Russia-Ukraine conflict. For example, protesters recently blocked a Greek tanker with Russian cargo from entering a U.K. port. And even though Tsakos and other shipping companies believe sanctions imposed on Russia are futile, political disruption creates risks. So far the disruption has benefited Tsakos (because the redrawing of trade routes has lead to an increase in oil tanker voyages), but politics always creates risks.

Rising interest rates are another risk factor because as rates rise, preferred share prices can fall (the market drives the price lower to make the yield commensurate based on the security-specific risks and the market rates of interest). Fortunately for investors, interest rates have ticked up again in recent weeks and Tsakos’ preferred shares now trade below their $25 redemption price.

Another risk factor is the issuance of more shares. For example, during the first quarter of 2022, Tsakos issued (through its ATM program) 3,603,697 common shares and 8,292 preferred shares generating $28.8 million of capital for the company. This can be dilutive and add risk to existing shareholders (especially as preferred shares are lower than bonds in the capital structure) and especially considering the common shares trade at a very large discount to book value (price-to-book) is around 0.341. Relatively speaking, this also makes the preferred shares more attractive relative to the common shares (because as the common shares get diluted, preferred shares are higher in the capital structure).

Conclusion

Even though market and company-specific financial conditions have been improving recently, Tsakos remains a risky and volatile business. However, the preferred shares are less risky and less volatile, and they benefit from improving market conditions and the company’s improving financial position (plus they trade at a discount). Preferred stock can be a valuable allocation to an income-focused investment portfolio, and the preferred shares of Tsakos are absolutely worth considering for investment.