Some investors are happy to know that interest rates on top savings accounts have risen from approximately 0% in 2020 to over 1% (in some cases) in 2022. However, when you factor in inflation of over 8% (CPI is 8.5%) you’re still losing money (or at least losing buying power). For those willing to move further out on the income-investment spectrum, preferred stocks can offer a compelling combination of higher income and lower price volatility (as compared to common stocks). In this report, we rank our top 10 big-dividend preferred stocks, counting down from #10 and finishing with our #1 top idea.

Market Environment

Before getting into the specific preferred stocks, it’s worth briefly considering the current market environment, including interest rates, inflation, monetary policy, risks factors and a few high level comments on the mechanics of preferred stocks in general.

Regarding interest rates, yes they are still very low. For example, the 10-year US treasury rate is up but still only around 3% (versus over 15% in the early 1980’s). And when you factor in inflation (which is still near a 40-year) high, current interest rates are absurd (i.e. your bank may pay you 1% per year on your savings, but you can still buy ~7.5% less stuff after a year after factoring in high inflation).

Current high inflation was caused mainly by the government response to the pandemic, including lowering interest rates, mailing out stimulus checks (and other easy money) and the supply chain challenges that were cause by lockdowns.

Arguably, the good news is that inflation is somewhat transitory, meaning the rate of year-over-year consumer price increases will likely slow (as supply chain issues are increasingly resolved, and as the delayed effects of the Fed’s latest interest rate hikes eventually slow the rate of inflation). The bad news is that prices aren’t likely to go back down to the levels they were before the pandemic (to a large extent, higher prices are here to stay). Nonetheless, as the rate of inflation slows, the buying power of your money will deteriorate at a slower rate.

There are many ways to deal with inflation through investments, but one strategy that can help is adding an allocation to preferred stocks to your investment portfolio. This can help boost your income and reduce the amount of price volatility (as compared to high-yield common stocks—which unfortunately are often just slowly dying companies that haven’t yet cut their dividend payments).

Briefly, preferred stocks are a stock-bond hybrid, in that they have characteristics of both stocks and of bonds, often including a par value (technically a redemption price, usually at $25) like a bond, which can help keep share prices less volatile (but also expose them to bond-like interest rate risks) and they represent ownership in a company (similar to a common stock, but with priority over common stock in the capital structure). We’ll explain more with specific examples when we get into the top 10 rankings.

In a nutshell, preferred stocks can offer attractive big-dividend payments and often with less share price volatility than a common stock. And depending on your goals, preferred stocks can be an worthwhile addition to a prudently diversified portfolio.

200 Big-Dividend Preferred Stocks

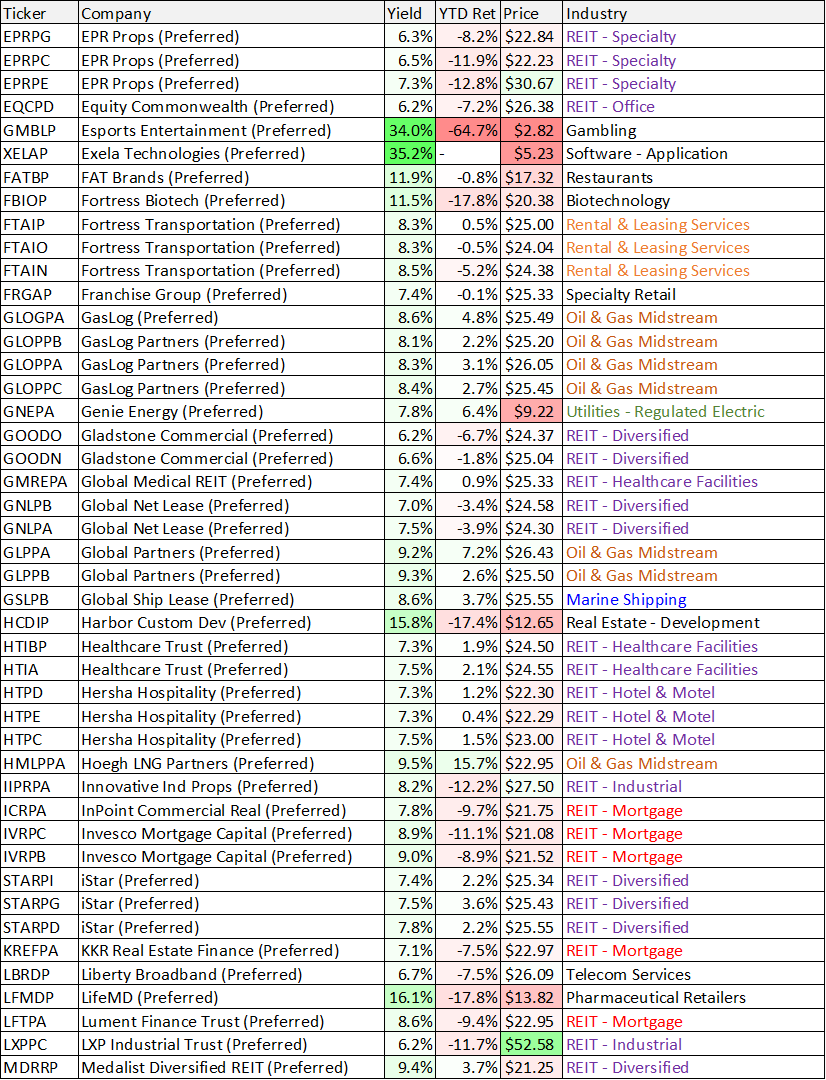

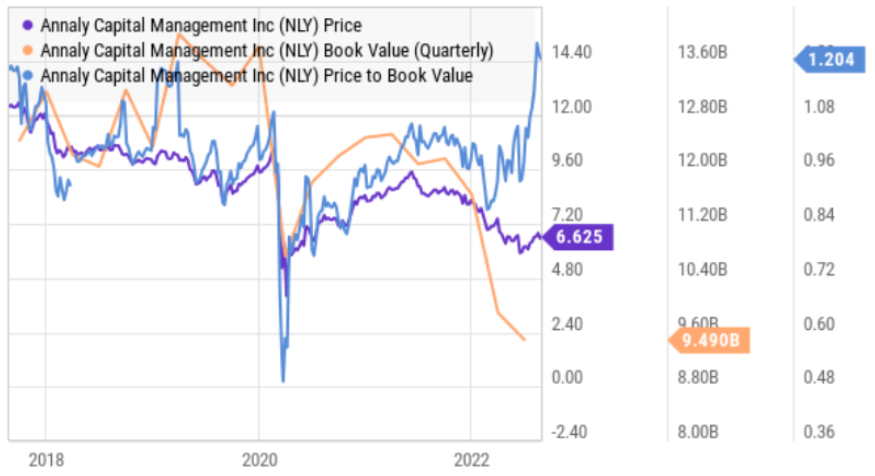

For your reference, and to provide a little more color on preferred stocks currently, here is a list of metrics (including yields, prices, industries and more) for 200 big-dividend preferred stocks (i.e. those with yields over 6%) sorted alphabetically.

Source: StockRover (data as of 25-Aug-22). Note: Yield is calculated as the percentage of price per share a company pays out to its shareholders as dividends annually, calculated by dividing the forecasted 12 month dividend payout by the current price.

Dishonorable Mention*

Before getting into the actual top 10 countdown and ranking, we are starting with a DIS-honorable mention. Specifically, it is an example of a popular big-dividend preferred stock we do NOT like.

*Rithm Capital (RITM.B), Yield: 8.3%

Formerly known as New Residential Investment Corp (NRZ), Rithm Capital is a big-dividend mortgage REIT (that also offers preferred shares) and it should be avoided, in our opinion. Its balance sheet consists of a hodgepodge of difficult-to-manage legacy mortgage-related assets that are of little importance to the financial system, its CEO has a history of questionable behavior, the business just lost its credible external management team (Fortress), and its opportunities are limited going forward. It’s basically dead money walking, as we explain in detail in this full report.

Top 10 Big-Dividend Preferred Stocks

With that backdrop in mind, let’s get into the ranking, starting with #10 and counting down to our top ideas.

10. Annaly Capital (NLY.F), Yield: 7.2%

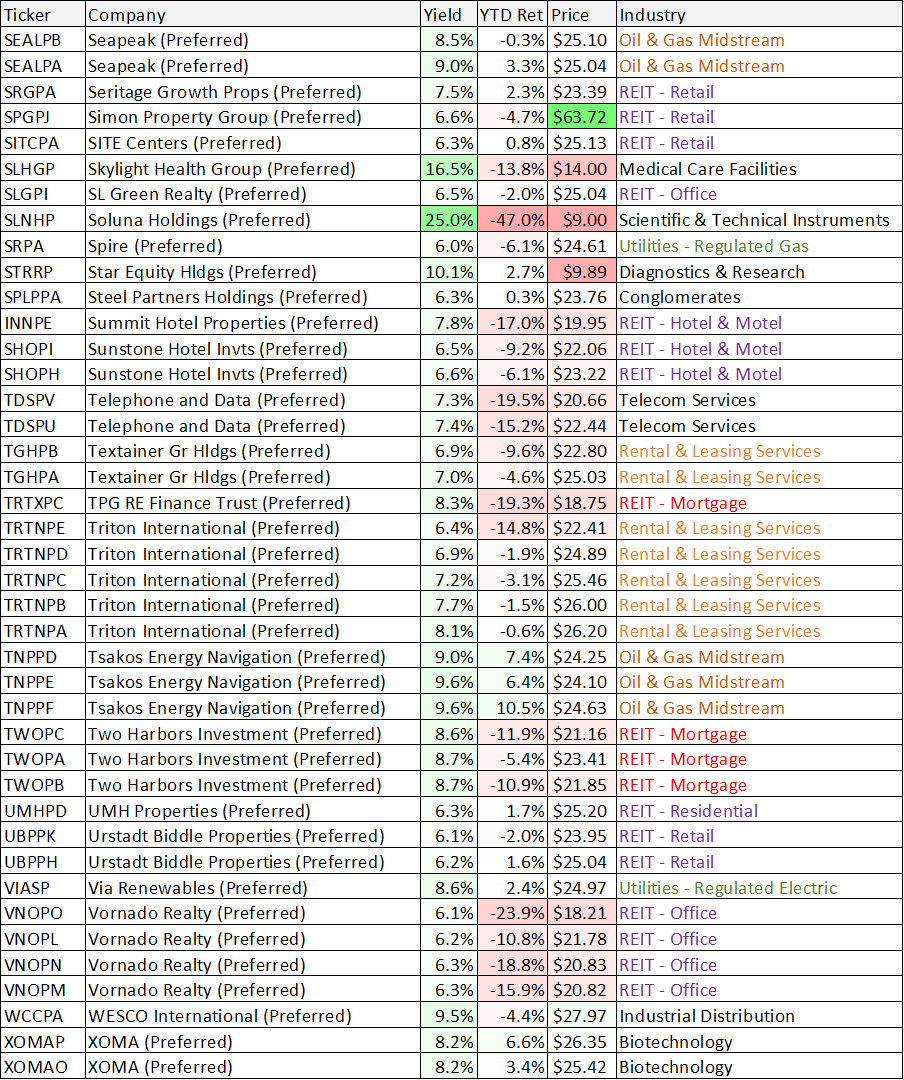

Annaly Capital is a mortgage REIT. Its balance sheet assets consist mostly of Agency Mortgage Backed Securities (Agency MBS) at around 71%, followed by Mortgage Servicing Rights (“MSRs”) at around 15%. And while those MSRs provide some natural hedging against the massive interest rate risk of the Agency MBS holdings (which tend to have long durations, considering they’re basically backed by 30-year mortgages), Annaly’s balance sheet is still highly sensitive to rising interest rates. Specifically, the reason Annaly’s balance sheet book value has been falling so sharply in recent quarters (see chart below) is because as rates rise, Agency MBS values fall.

Annaly currently trades at a premium to its book value (see chart above) which is a good thing and a bad thing, depending on your position. For example, the company just raised capital by issuing more common shares at a premium (a good thing), but also diluted existing common shareholders in the process (arguably a bad thing). And while the book value has taken a hit in recent quarters (a bad thing), Annaly can now make new investments at higher rates considering net interest margins have widened (a good thing). It’s dramatically more complicated than this with varying durations, default rates, originations, prepayments speeds, hedges and asset types, but in a nutshell, as rates have risen, Annaly’s book value has fallen as securities held for investment have been marked to market and ugly other comprehensive income numbers have resulted.

Despite the asset write-downs, Annaly still boasts that income available for distribution exceeded the dividend payment in the most recent quarter (a good thing). However, the common shares dividend yield and the price-to-book value are both still precipitously high (concerning).

On the other hand, Annaly preferred shares (see our earlier table for details) are higher in the capital structure, have less price volatility and may actually benefit if the common share dividend eventually gets cut (because it will free up more cash to support the preferred shares—which again are higher in the capital structure). Furthermore, if the market gets religion and the price-to-book-value premium on the common shares dissipates, that won’t necessarily hurt the preferred shares which actually do currently trade at a discount to their $25 redemption price.

Annaly has multiple series of preferred shares outstanding, with yield above 7% and prices below their $25 future redemption prices. They also convert to attractive floating rate dividends if they are not redeemed when eligible. Quantum Online is a good source for more information on each series of preferred shares. However, if you are an income-focused investor that prefers lower volatility, we believe Annaly’s preferred shares are worth considering for a spot in you portfolio.

9. Energy Transfer (ET.D), Yield: 8.4%

Energy Transfer is one of the largest and most diversified midstream energy companies in North America. It has approximately 120,000 miles of pipelines and associated energy infrastructure across 41 states (it transports the essential oil and gas products that basically make our lifestyles possible).

And while many investor prefer the 6.2% yield currently offered by the common units, other are attracted to the higher yielding preferred units, which also tend to have significantly less price volatility than the common.

Energy Transfer announced very strong earnings earlier this month, and the business remains very attractive for a variety of reasons, including its high quality earnings (it has strong cash flows and predominantly fee-based earnings that provide stability and limit its sensitivity to commodity prices), Diversified portfolio (it has complementary natural gas, crude oil and natural gas liquids franchises that offer a wide range of services), Nationwide footprint: (it has assets located in every major supply basin in the U.S. with access to all major demand markets in the U.S., as well as exports), and Significant inside ownership (management and insiders own ~13% of Energy Transfer’s total common units outstanding).

One big caveat (for some investors) with the preferred (and common) units of Energy Transfer (and one of the reasons why we’re not assigning it an even better ranking) is that it operates as a master limited partnership and issues a K-1 statement at tax time. For some investors, this is no problem at all, but for others it creates challenges because some brokers won’t allow you to own the units in a tax-exempt retirement account, and it may also generate unexpected tax and reporting requirements related to unrelated business taxable income.

If you can handle the K-1, then Energy Transfer is a no-brainer for income-focused investors considering its high income and healthy financials. And if you prefer higher income and less price volatility, the preferred shares may be an even better option for you.

8. Digital Realty (DLR.PK) (DLR.PJ), Yield: 5.8%

The preferred stock of Digital Realty does not offer the highest yield on our list, but it does offer one of the safest. Backed by a very financially strong and healthy data center business, DLR preferred shares currently yield just under 6% and they trade at an attractively discounted price (i.e. below $25).

As a data center REIT, Digital Realty has recently been shifting more towards connection and co-location services, thereby giving it access to attractive cloud-services growth. It also has an advantage over competitors that are more narrowly-focused geographically. Further, demand for data centers will continue to growth as the digital revolution and massive cloud migration will continue for many years.

One of the reasons we like the preferred shares (over the common) is because the preferreds are less impacted by potential risks (because they’re higher in the capital structure) such as the risk of competition (such as Equifax) and the risk that technology is enabling tenants to do more with less space (thereby reducing their data center needs).

Overall, data center needs will continue to grow. And while the common shares have sold off a bit (thereby making them more attractive as compared to their long-term value), the preferred shares are even more compelling for income-focused investors that prefer less volatility.

7. Tsakos Energy Navigation (TNP.E), Yield: 9.6%

Tsakos Energy Navigation offers seaborne crude oil and petroleum product transportation services worldwide. It also offers some highly-attractive big-dividend preferred shares too. In particular, market conditions have been improving, Tsakos’ financial position has been strengthening and the preferred shares are steadier and higher in the capital structure than the common. We recently wrote up a detailed report on Tsakos, and you can read that full report here.

6. NuStar Energy (NSS), Yield 9.3%

NuStar is an oil and gas storage and transportation company. It currently has approximately 10,000 miles of pipeline and 63 terminal and storage facilities that store and distribute crude oil, refined products, renewable fuels, ammonia and specialty liquids. Its combined system in the United States and Mexico has over 49 million barrels of storage capacity at its facilities.

NuStar’s common units (NS) offer a big yield (9.7%), but have been challenged by high debt and low growth. And while some investors believe the business is resilient (it’s recently been paying down debt by selling assets and experiencing strong volumes in its Permian crude system), other investors prefer the preferred shares which sit higher in the capital structure, offer less volatility and yield 8.8%, 9.1% and 9.3% (NS.C) (NS.B) (NS.A), respectively.

However, we like the publicly traded 2043 bonds (NSS), which currently offer a floating rate yield of ~9.7%. In particular, the bonds are higher than both common and preferred units in the capital structure, which could prove extremely important if NuStar eventually enters a bankruptcy or restructuring situation (i.e. the common and preferred units could go to essentially zero while the bonds may retain their value).

And particularly compelling for some, the bonds don’t issue a K-1 statement whereas the common and preferred shares do. Because NuStar is an Master Limited Partnership (“MLP”), it issues an annual K-1 statement that makes filing taxes more complicated for some (others don’t mind the K-1 at all). Further, some brokerages simply won’t allow you to own an MLP in an non-taxable retirement account (because it could actually generate taxes).

There are other important stipulations to these bonds. For example, the interest rate switched from fixed to floating after January 2018 (it now yields three-month LIBOR rate plus 673.4 basis points, which currently equates to around 9.7%). Also, there is a stipulation whereby the NuStar has the right, at any time, to defer NSS payments for up to 5 consecutive years (but not beyond the maturity date).

And while the bonds currently trade at a small discount to par (a good thing), the discount could get wider as market wide interest rates keep rising. Also important to note, NSS units are expected to trade flat, which means accrued interest will be reflected in the trading price and the purchasers will not pay and the sellers will not receive any accrued and unpaid interest. You can read more here.

Although technically a bond (not a preferred stock), we prefer the NuStar bonds over the common and preferred units. And if you are an income-focused investor, NuStar bonds are worth considering for a spot in your portfolio.

5. AGNC Investment Corp (AGNC.M), Yield: 7.8%

If you like big dividend payments, mortgage REIT AGNC Investment Corp is worth considering. The company invests in predominantly Agency mortgage backed securities (which are essentially backed by the US government) and the shares (both common and preferred) trade at attractively discounted prices.

AGNC announced quarterly earnings a few weeks ago, and not surprisingly—book value took a hit (amongst all the interest rate and agency-spread movements). However, it’s now positioned for stronger returns going forward (because it has more dry powder (less leverage) and because yields are higher on a go-forward basis).

The preferred shares offer slightly lower (but still attractively high) yields as compared to the common. And importantly, the preferred shares offer more safety and less price volatility (exactly what a lot of investors are looking for). We recently wrote up AGNC in detail and you can access that full report here.

4. New York Mortgage Trust (NYMT.N), Yield: 9.3%

New York Mortgage Trust is another mortgage REIT, although its assets are different. Specifically, NYMT holds a lot of mortgage-related assets that are not backed by government agencies. For example, NYMT holds a lot BPL Bridge Loans which are short-term business purpose loans collateralized by residential properties made to investors who intend to rehabilitate and sell the residential property for a profit.

Although not backed by government agencies, NYMT’s BPL Bridge Loans have the distinct advantage of being shorter duration (i.e. less interest rate risk). This frees up more capital to invest sooner and at higher rates (something Annaly Capital, for example, cannot easily do because of the long-term duration of the 30-year mortgages underlying the assets on their balance sheet). The current problem for NYMT is that as interest rates have risen, the housing market has slowed. Once interest rate and market volatility slow down, NYMT will be in a significantly better position. However, currently the common shares of NYMT trade at a wide discount to book value of 0.72x (some investors see this as great risk—others as great opportunity—its actually both, but we believe the potential rewards outweigh the risks).

In the meantime, the big-dividend preferred shares offered by NYMT are interesting and worth considering. For example, the dividend payout ratio on common shares is precipitous, but if it gets cut—that will free up more capital to support the preferred shares because they are higher in the capital structure (a good thing). The multiple series of preferred shares offer yields in excess of 8% and trade at discounted prices relative to their redemption prices (see our earlier table for details). You can also review more details on NYMT preferred shares here.

However, if you are an income-focused investor, both the common and preferred shares are interesting. And if you prefer high income with lower volatility risks then the preferred shares may be particularly attractive and worth considering for a spot in your income-focused investment portfolio.

3. Pyxis Tankers (PXSAP), Yield: 9.3%

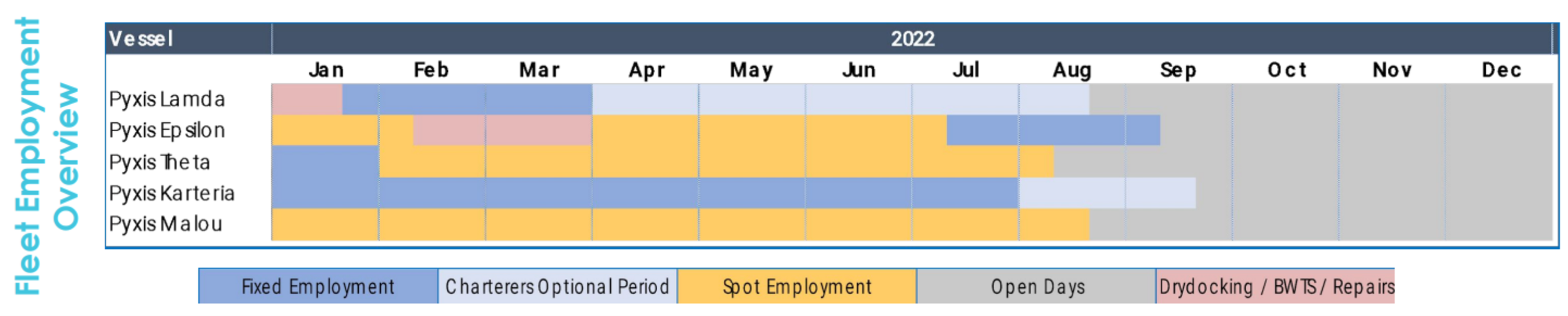

Pyxis Tankers is a maritime transportation company. It operates a modern fleet of five tankers. It transports refined petroleum products (such as naphtha, gasoline, jet fuel, kerosene, diesel, and fuel oil) as well as other liquid bulk items (including vegetable oils and organic chemicals). Incorporated in 2015 and based out of Maroussi, Greece, Pyxis is a microcap stock ($35 million market cap) traded on the Nasdaq.

Pyxis is attractive for a variety of reasons, including its growth-oriented strategy and modern eco-efficient fleet. At a time when many industry ships will be essentially taken out of the shipping rotation (due to aging and a sub-par amount of environmental friendliness) Pyxis young fleet is ahead of the curve.

Pyxis also has a compelling mixed-chartering strategy. Its fleet has been largely employed thus far in 2022, and the company has strong relationships with reputable customers to keep ships employed.

Further, Pyxis has a competitive cost structure and a balance capitalization, consisting of $73.8 million in total debt, $3.6 million in cash, a market cap of $25 million and a total enterprise value of 105.22 million. Noteworthy within that enterprise value, Pyxis has some compelling 9.3% yield preferred shares (PXSAP)).

And very importantly, Pyxis is currently benefiting from favorable long-term industry fundamentals as post-pandemic economic activity opens back up and charter rates remain high. The company achieved profitability in Q2 of this year and is forecast to post strong profitability in Q3 and Q4.

2. Hercules Capital (HCXY): Yield: 6.2%

Hercules is a highly-attractive and differentiated big-dividend Business Development Company (“BDC”) thanks to its unique strategy and financial strength, among others. Unlike most BDCs (that tend to focus on more-traditionally-value sectors of the market), Hercules is focused on financing for high-growth ventures—and its internal management team is uniquely qualified to purse this attractive strategy.

We also like Hercules because it can get many income-focused investors access to market sectors they don’t normally invest in (prudent diversification can be a very good thing). Further, growth and venture have sold off this year (including Hercules) thereby making for a lower entry point to purchase shares. Further still, if rates keep rising—Hercules is in good shape (double good if the market recovers).

Although technically not preferred shares, Hercules does offer some compelling high-income baby bonds (which in a lot of ways are better than preferred shares because they are higher in the capital structure, for example). And if you are an income-focused investor, these baby bonds are worth considering. You can read all the details in our recent full report here.

1. Triton International (TRTN.B), Yield: 7.7%

Triton International engages in the acquisition, leasing, re-leasing, and sale of various types of intermodal containers (those large 40-foot steel boxes you see on ships and trucks) and chassis to shipping lines, and freight forwarding companies and manufacturers. And while the company’s common shares offer a healthy 4.4% dividend yield, the preferred shares offer higher yields (over 7%) and less price volatility. We like the business, and we recently wrote it up in great detail (you can view the full report here).

Conclusion:

The bottom line when it comes to income-focused investing is that you need to set up an attractive strategy that meets your own individual needs for income and tolerance for volatility and risks. The preferred stock (and baby bond) ideas shared in this report offer highly compelling opportunities and may be a good fit for a spot in your prudently-diversified, long-term, income-focused portfolio.

For more top income-investment ideas, be sure to check out the 30+ holdings in our carefully constructed long-term Income Equity Portfolio here.