In theory, Mortgage REITs (or mREITs) do well when interest rates rise, but so far this year they have done poorly because MBS spreads have risen sharply (an indication of risk). Here is a look at 40 big-dividend mREITs, plus some insights on what is happening to their share prices (mainly courtesy of the Fed’s balance sheet), and then a few mREIT investment ideas worth considering.

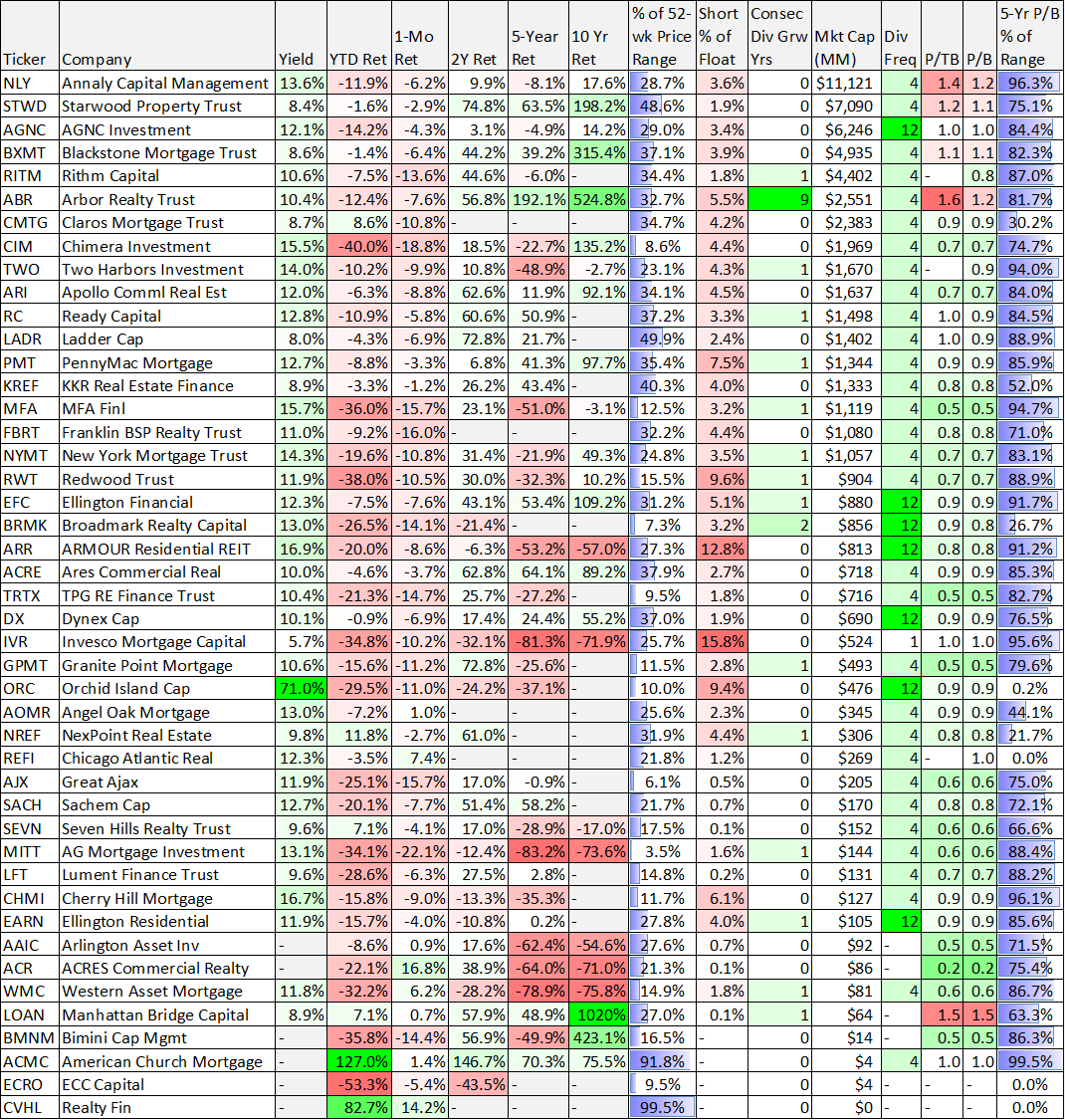

For starter, here is a look at 40 big-dividend mREITs, and as you can see—year-to-date performance has been ugly.

Interest Rates and MBS Spreads

The ugly year-to-date performance may seem counterintuitive because as interest rates rise, mREITs are supposed to make more money because net interest margins are supposed to increase (net interest margin is the rate between what they borrow money at and what they earn on their investments).

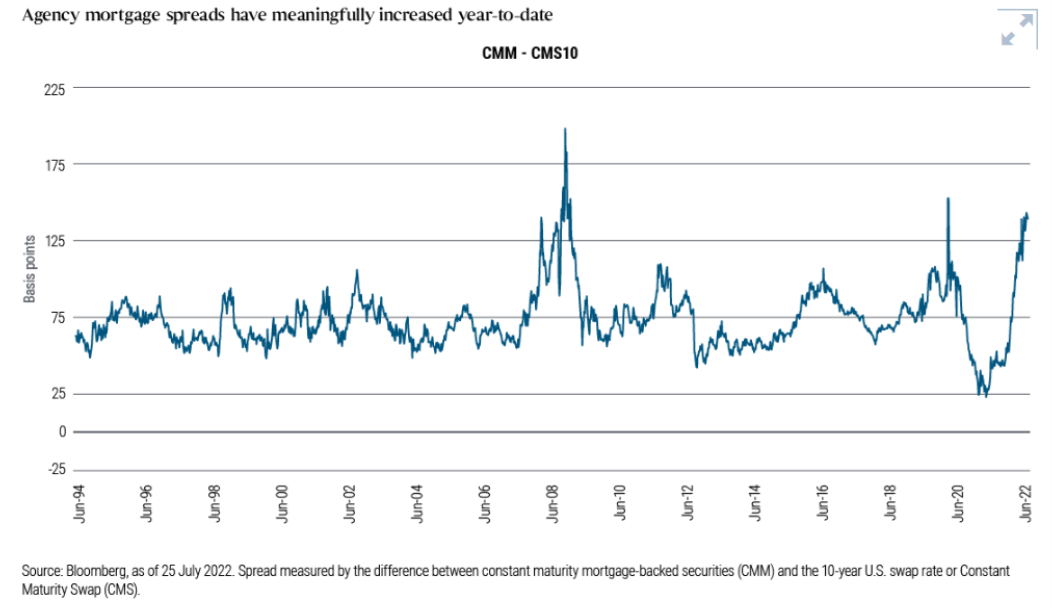

However, the big problem for mREITs this year has been widening MBS spreads, as you can see in the next chart (note: MBS spread is the difference in yield on Mortgage Backed Securities and a low risk treasury bond).

MBS spreads are rising for a couple reasons. Inflation has caused home prices to rise significantly and some argue this has created a housing bubble. And if housing price “bubble” bursts then mortgage defaults increase thereby decreasing the value of MBS securities (which are basically a pool of mortgages). Further, if the housing bubble bursts then there will be less new mortgage originations which could mean less business for mREITs to grow.

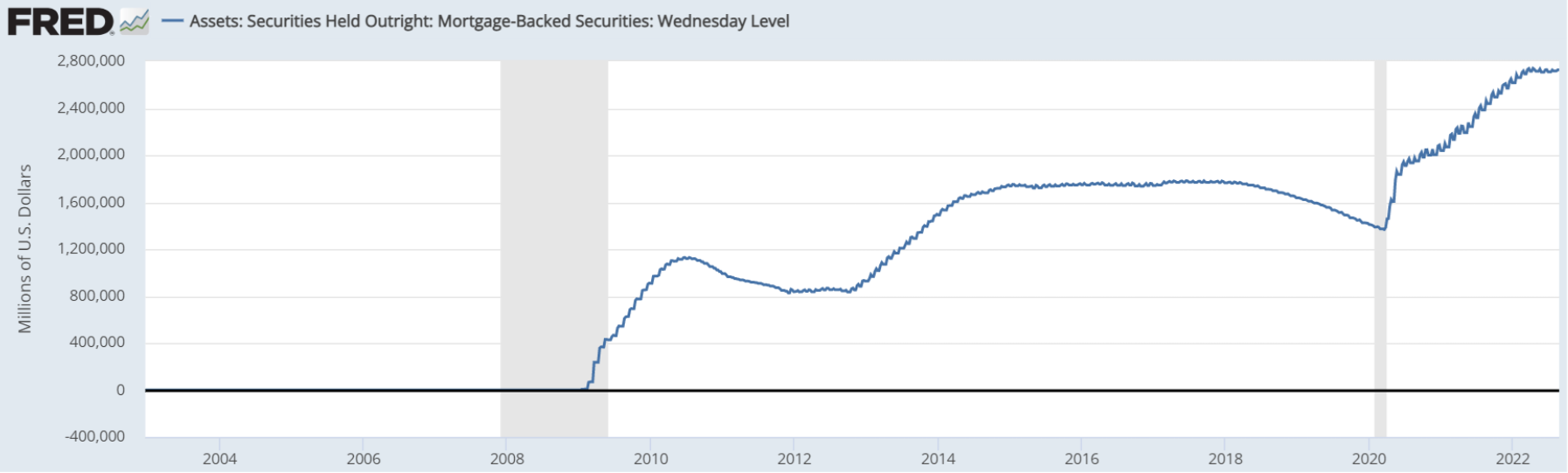

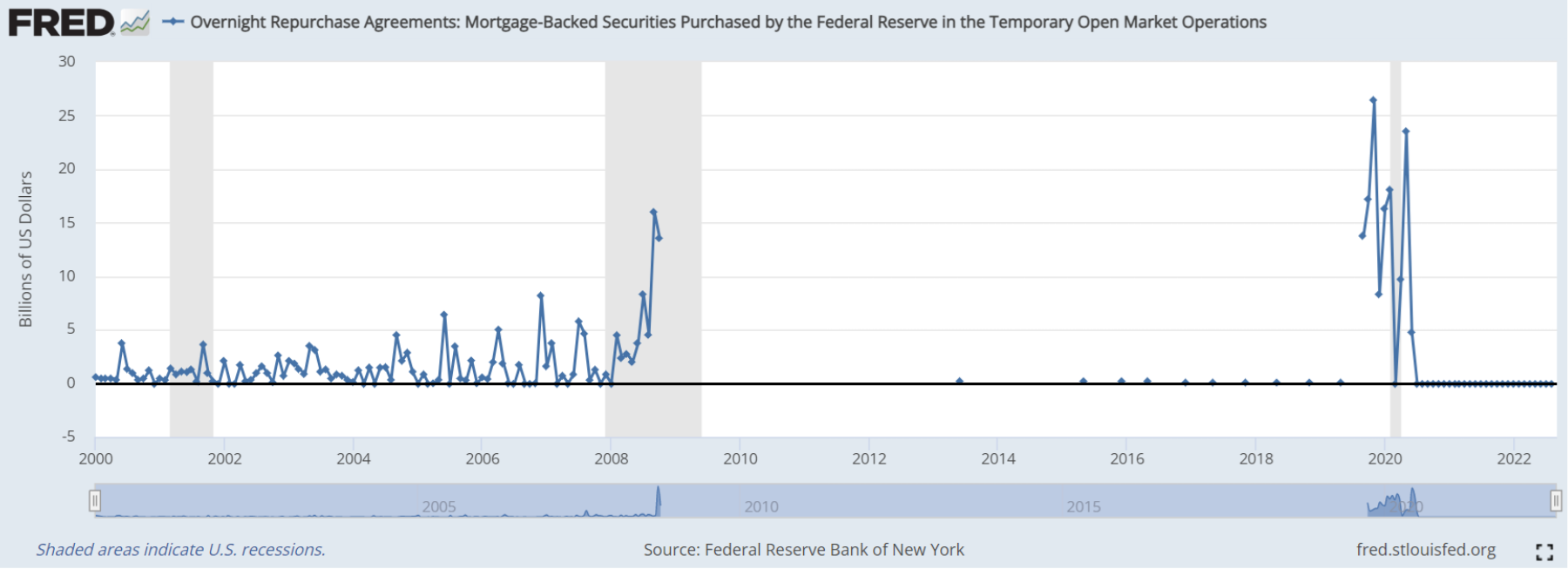

Second, the US fed has a lot of Agency MBS on its balance sheet (it bought them after the Great Financial Crisis in 2008-2009 and then again at the start of 2020 around the time the pandemic hit. You can see two fed balance sheet graphics below with information on their MBS purchases.

The theory here is that the fed has been supporting the mortgage market, and now that that support is going away—the value of mortgage backed securities are at risk. This is the other big reason why MBS spreads have widened and mREITs have fallen.

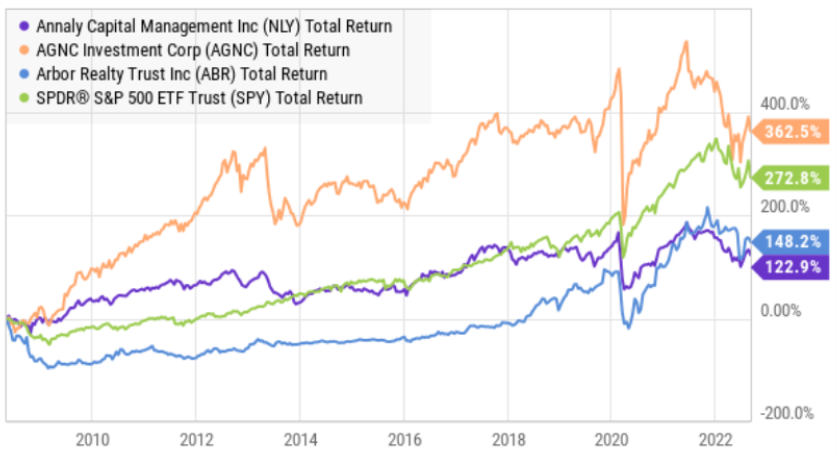

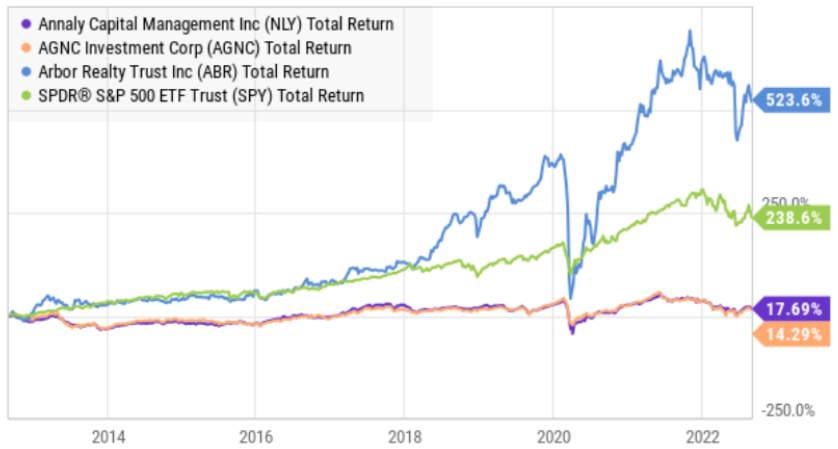

For a little more color, here is a look at how some large popular mREITs have performed historically on a total returns basis (price returns, plus dividends reinvested) from two different historical starting points.

As you can see, mREITs are cyclical and can be volatile. The main reason mREITs have historically gotten themselves into trouble is because they use a lot of leverage (or borrowed money) and when MBS prices fall quickly mREIT balance sheets become overlevered (they have too much borrowed money relative to the value of their assets) and they are required to sell at low firesale prices. This is bad and this is what happened in 2020 and again this year. It’s also why so many of them are forced to reduce their dividends from time-to-time throughout each market cycle.

The Bottom Line

Mortgage REITs are risky. Of course all mREITs are different (some better, some worse), but if they weren’t risky then their prices would rise more and their dividend yields wouldn’t be so high (the high yields are your compensation for taking on a lot of risk). Some investors are tempted to purchase mREITs heavily because their prices are down so much this year (an attempt to “buy low”), but just know that the risks are elevated as MBS spreads have widened, the supposed housing bubble may just be starting to burst and the Fed will further pressure the MBS market if it follows through and sells the mortgage-backed securities on its balance sheet. For these reasons, we currently prefer the preferred shares of mREITs and only in moderation within the constructs of a prudently diversified portfolio. We recently wrote about several attractive mREIT preferred shares, and you can read about them in this report: Top 10 Big-Dividend Preferred Stocks., including the preferred shares of AGNC, NYMT and NLY.