After the initial pandemic shock in 2020, certain high-growth stocks performed well. Extremely well. Bolstered by extraordinarily low interest rates and a new crowd of “work-from-homers” (with newfound time to “invest”) it seemed the sky was the limit. Until it wasn’t. Flash forward to now, the market has fallen sharply this year (especially high-growth stocks), and there is no short supply of reasons to stay bearish. Very bearish. In this report, we share data on 50 high-growth stocks that have crashed, run through a list of compelling reasons (data points) to stay bearish, and then discuss the merits of three interesting high-growth stocks from the list that have crashed particularly hard, with a special focus on pandemic darling, Palantir (PLTR). We conclude with some important takeaways and our very strong opinion about investing in Palantir and investing in this market in general.

50 High-Growth Pandemic Darlings That Crashed

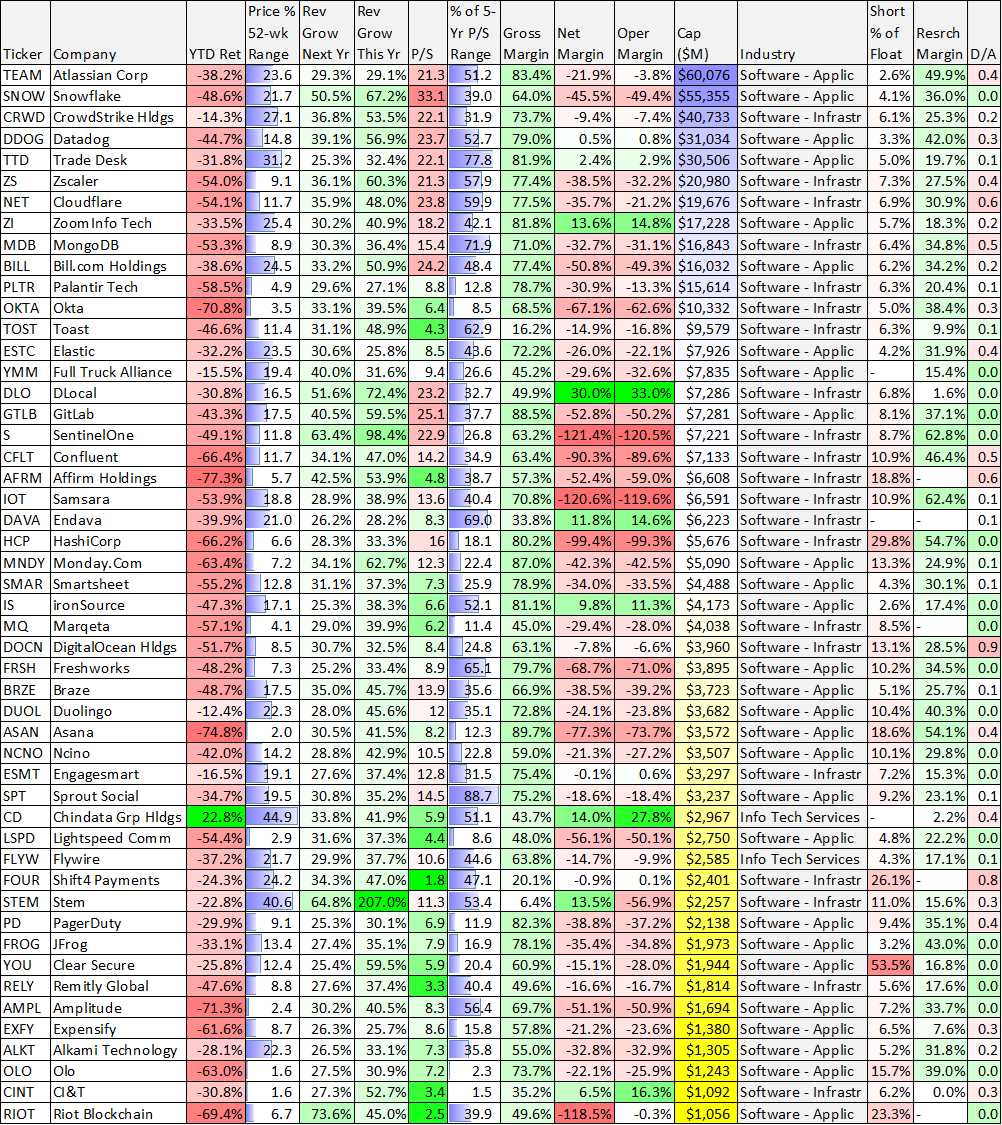

For starters, here is a look at 50 high-growth “pandemic darling” stocks (concentrated in software industries) that have crashed hard this year. The table is sorted by market cap, and you likely see at least a few you are very familiar with.

A lot of conservative value-oriented investors take a lot of satisfaction seeing the sharp declines this year. They warned (often loudly) that valuations were absurdly high considering many of these pandemic darlings that have never even generated a profit. What’s more, there are a lot of very compelling reasons to stay bearish on these stocks (such as high inflation, rising interest rates, lingering pandemic supply chain issues, a war in Europe and indications that corporate profit estimates are still too high based on the federal budget deficit) as we will cover in more detail in a later section of this report. But first, let’s take a look at one of the most hyped stocks in recent history, that rose dramatically during the pandemic, and has now fallen very hard, Palantir.

Palantir: Pandemic Stock Poster Child

Palantir is basically a data-mining software company that strangely generates a cult internet following since its September 2020 IPO, despite the fact that it has existed since 2003. Perhaps it’s the company’s secret government contracts that had so many investors mystified, or its expansion into the non-government Software-as-Service business at exactly the time when those stocks were being most hyped (because artificially low interest rates by the Fed dramatically magnified the present value of “possible” future earnings for those types of stocks) or maybe even its unusual name (it’s named after a mystical, all-powerful seeing stone in "Lord of the Rings"). Whatever the case may be, Palantir shares soared to very high valuations (for example, see how its current price-to-sales multiple compares to its 5-year (technically 2-year) range in our earlier table above).

Palantir Positives:

Before getting into the very negative things working against Palantir in the next sections of this report (both company-specific and macroeconomic) let’s first consider a few of the good things the company has going for it.

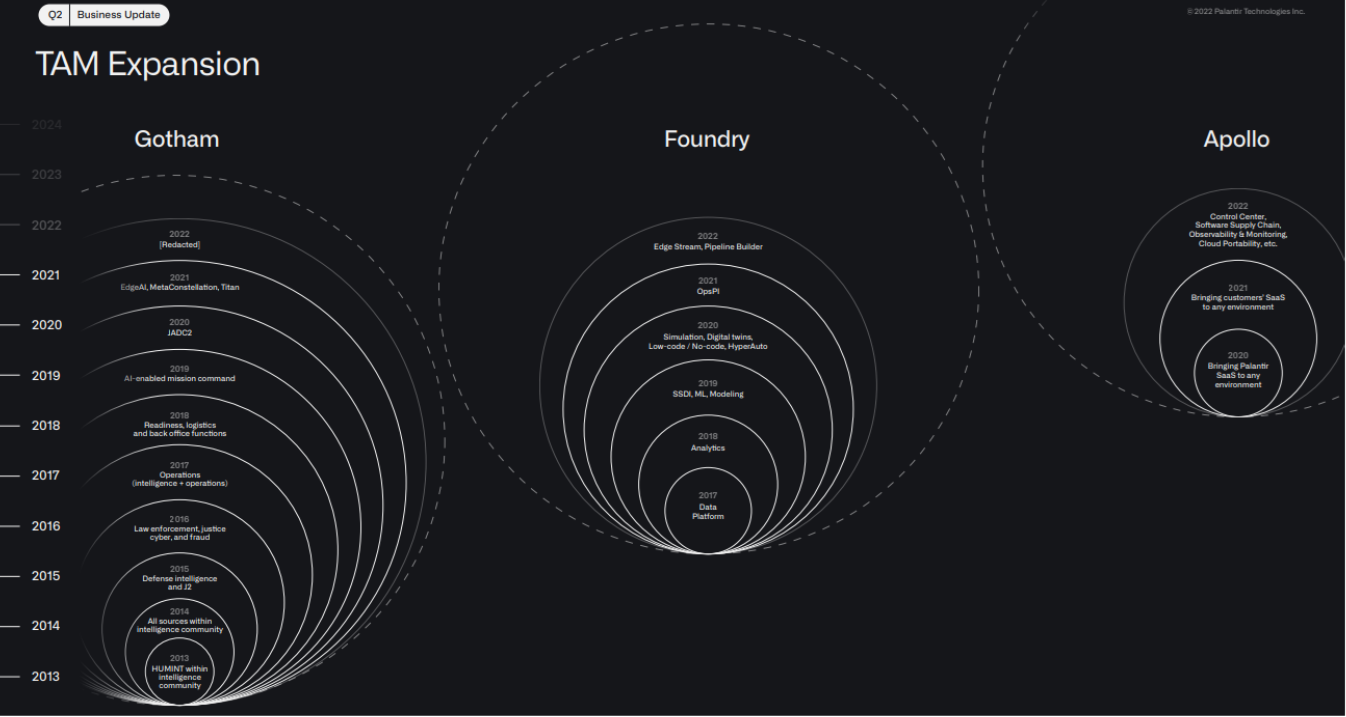

For starters, three big things many long-term growth investors look for in a stock are are a founder CEO (check: CEO Alex Karp cofounded Palantir), a very high revenue growth rate (check: Palantir revenue has been growing rapidly and is expected to keep growing rapidly, per our earlier table) and a very large Total Addressable Market (check: see the “TAM” graphic below from Palantir’s latest investor presentation).

Specifically, as you can see in the chart above, each of Palantir’s major businesses have continued to grow rapidly over time and continue to have large growth potential (dotted line). For reference:

Palantir Gotham is a software platform that enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, as well as facilitates the handoff between analysts and operational users, helping operators plan and execute real-world responses to threats that have been identified within the platform.

Palantir Foundry is a platform that transforms the ways organizations operate by creating a central operating system for their data; and allows individual users to integrate and analyze the data they need in one place.

Apollo is a software that enables customers to deploy their own software virtually in any environment.

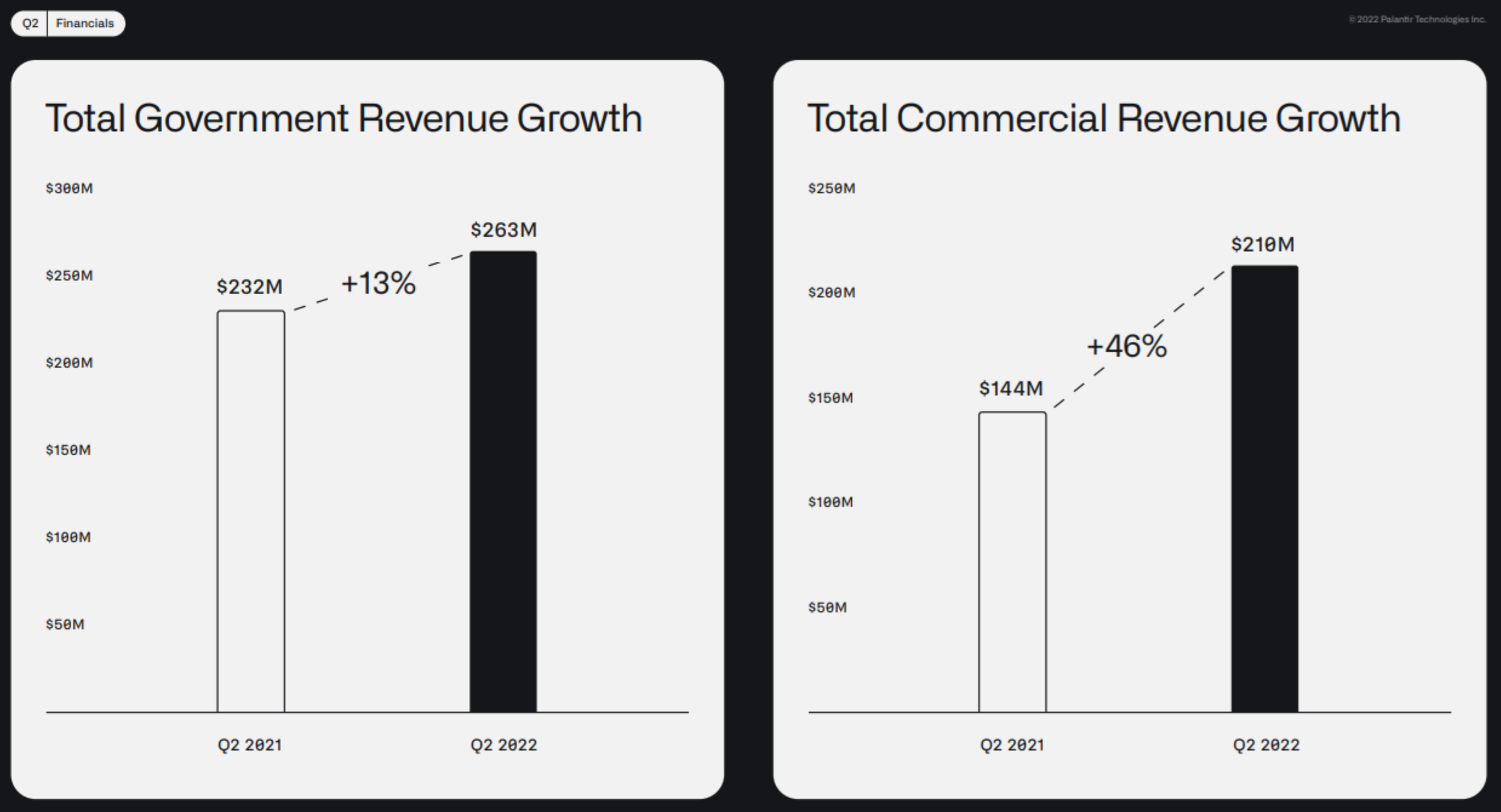

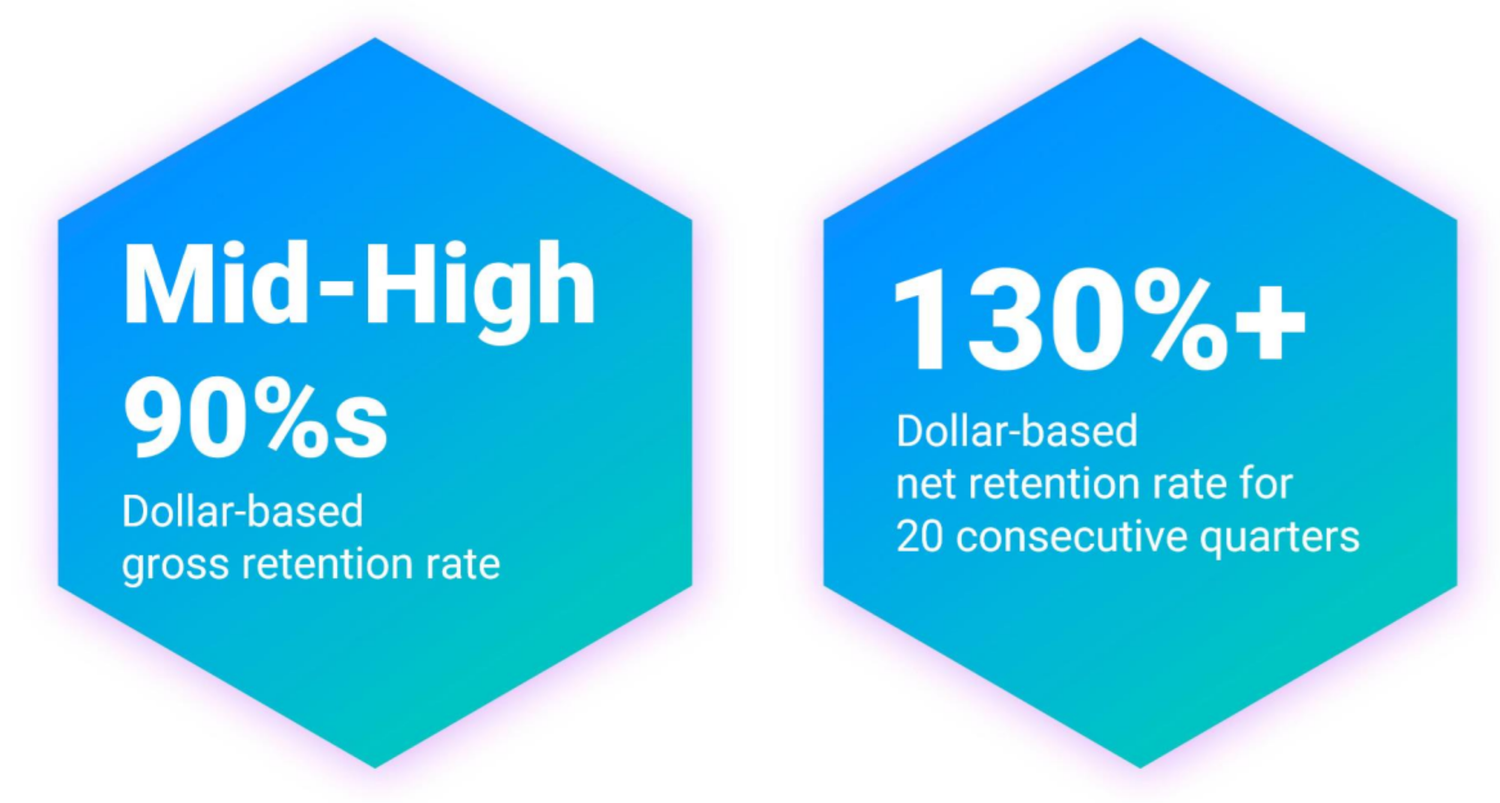

To add to these positives, Palantir continues to grow its clients (which have a very high retention rate—Palantir ended Q2 2022 with net dollar retention rate of 119%—high retention is often typical for the very attractive Software-as-a Service (SaaS) business), very high gross margins (see our earlier table), strong innovation (as per its high research margin and strong expansion into non-government clients) and its losses are shrinking (it’s moving towards profitability). And of course, its valuation multiples are dramatically lower than they were and relatively attractive as compared to peers and as compared to its high revenue growth and large TAM.

Palantir Negatives:

Of course there are a lot of negative things (challenges) Palantir currently faces, including the negative company-specific things we will cover in this section, plus the massively daunting macroeconomic challenges we will cover in the next section.

For example, Palantir’s government revenue (supposedly its “bread and butter”) is slowing.

According to a research note from Brad Zelnick at Deutsche Bank (Zelnick rates Palantir a “sell”):

"While we've always been more skeptical of Palantir's commercial opportunity, our thesis was rooted in what we saw as a uniquely strong position in Public Sector… Now with the Gov't business further decelerating off of easier compares and with diminished confidence/visibility ahead, we are left with very little to support our thesis."

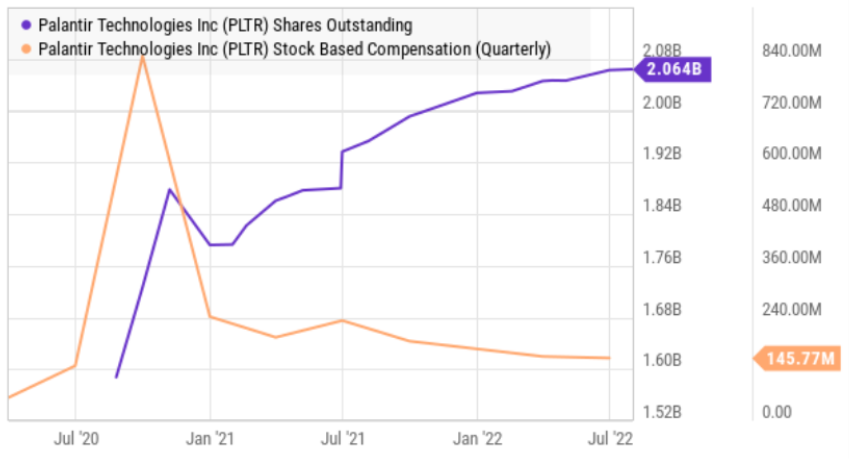

Another chronic qualm with Palantir has been its heavy stock based compensation and shareholder dilution.

And another huge negative for Palantir is the current extreme challenges the overall economy is facing (as we will cover in detail in the next section of this report). We’ll also share our strong opinion about investing in Palantir in the conclusion of this report.

More Big (Macroeconomic) Reasons to Stay Bearish on Palantir (and the Market in General):

Like other companies, Palantir currently faces a variety of massive macroeconomic challenges that give a lot of investors reason to stay extremely bearish on the market. For example, inflation is sky high (very bad for the economy), the fed keeps raising rates to fight inflation (but this has the side affect of slowing the economy), there are lingering pandemic supply chain issues, a terrible war in Europe and economists remain very pessimistic (as you can see in the following chart).

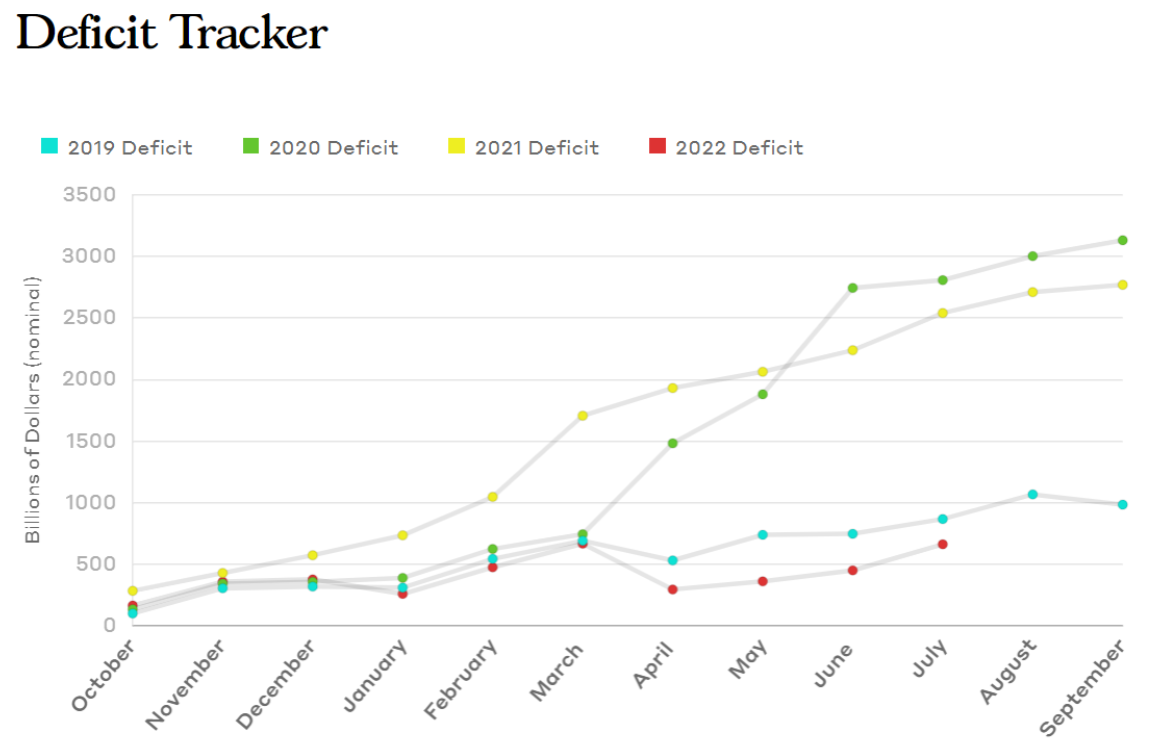

Further the federal budge deficit is about to create another big drag on the economy. If you don’t know, the federal budget deficit is the difference between government revenues (i.e. taxes) and government spending. And while years of government deficit spending can create enormous long-term economic problems, the short-term deficit fluctuations can exacerbate near-term challenges.

Counterintuitive to some, when the economy is strong, the government should reduce spending (build a rainy-day fund), and when the economy is struggling, extra government spending can actually help end the funk. Unfortunately, the economy is struggling big time this year, yet the government has dramatically reduced deficit spending, as you can see in the following chart.

And according to GMO Capital’s Jeremy Grantham, this reduced government deficit may be about to cause corporate profit margins and earnings take a hit, due to the Kalecki equation (basically, reduced government deficity spending will be a hit to corporate earnings, and this is not yet reflected in stock prices).

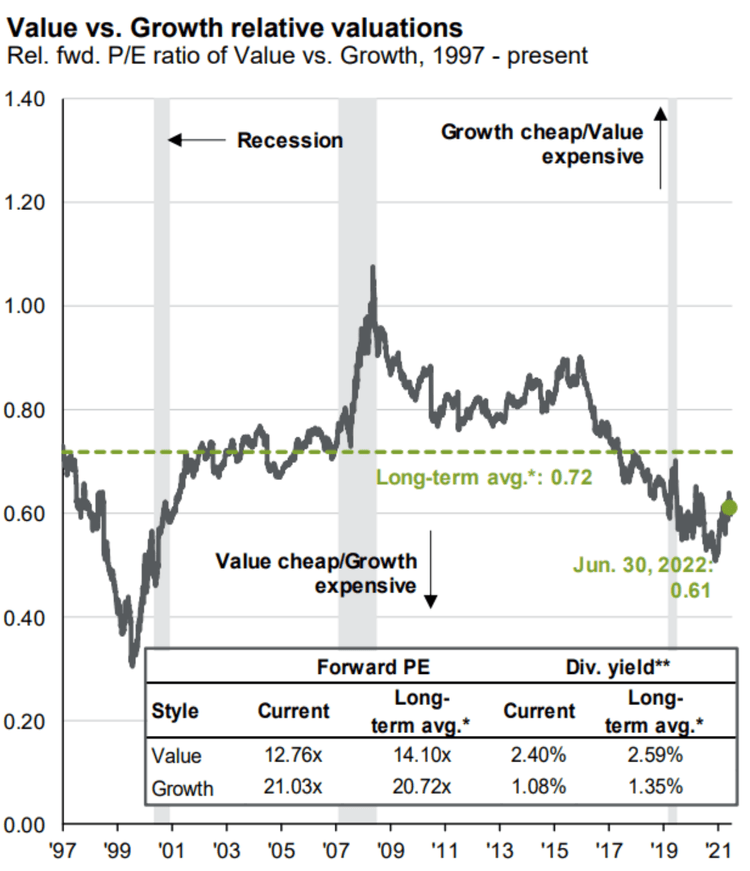

And of course we can make a strong case the growth stocks in particular (such as Palantir and the other names in our earlier chart) are still greatly overvalued (versus value stocks) based on historical levels, such as this chart (below).

Notice the divergence (in the chart above) becomes most pronounced around the time the US implemented and accelerated quantitative easing following the Great Financial Crisis (2008-2009) and the pandemic bubble (2020-2021), and right before the tech bubble bust (2000). Here is another chart on growth versus value, for your consideration.

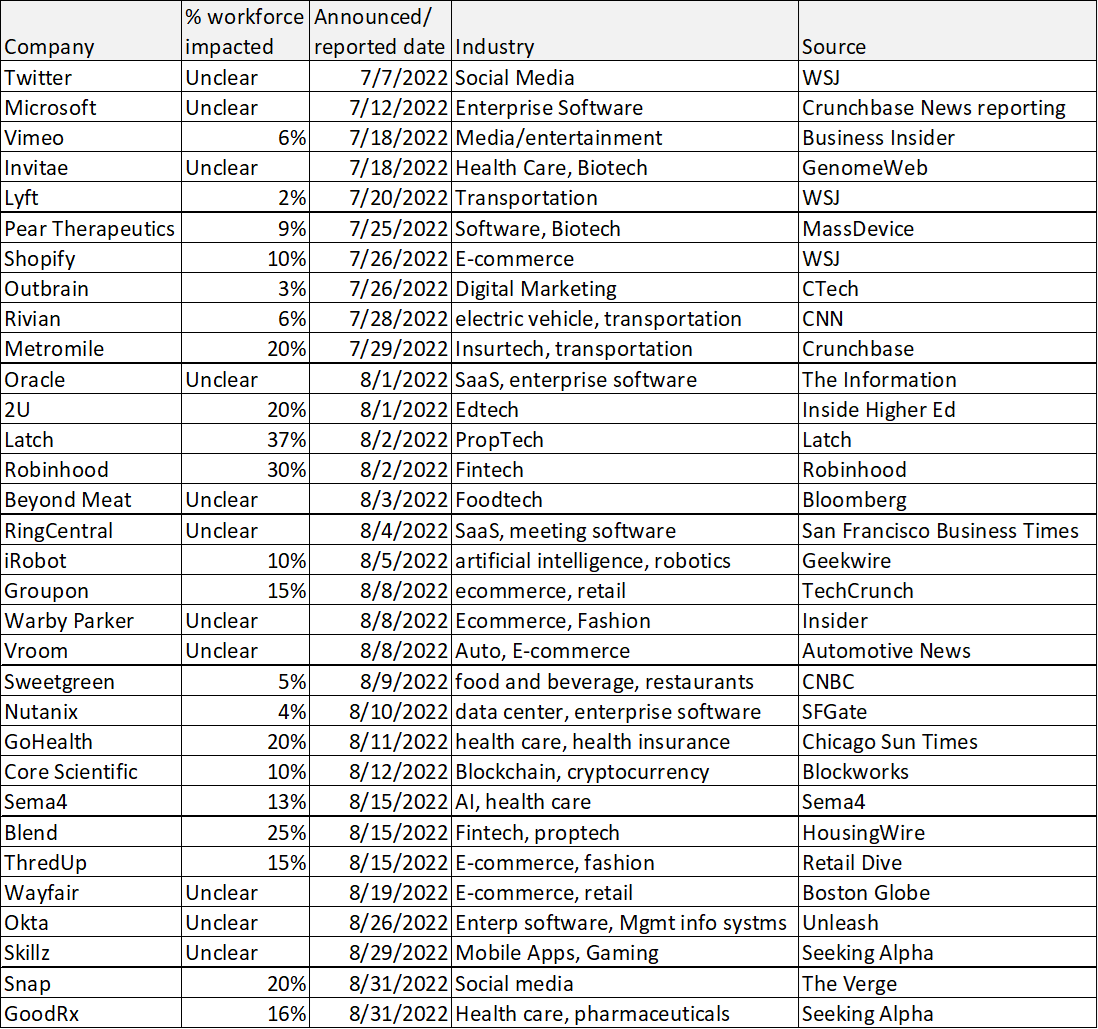

Further, a slew of recent layoff announcements by technology companies (see table below) suggest growth stocks in particular are just now finally bracing for the challenging markets ahead.

More Pandemic Darlings Worth Considering

With all of the negative things going on in the market, the thought of investing in growth stocks right now makes a lot of people want to puke. Even though Jeremy Grantham’s latest report (linked earlier) suggests we are just now entering the final stage of the market’s latest “super bubble,” the market has already been puking (particularly growth stocks) this year, and from a contrarian long-term investment standpoint—some investors believe that’s the best time to be buying in buckets. Let’s take a closer look at a few high growth stocks in particular,

Datadog (DDOG)

Datadog is a performance monitoring and cloud security platform, and the shares are more than 50% below their 52-week high as the valuation has taken an extreme hit as the pandemic bubble bursts.

However, Datadog continues to benefit from the three important growth stock characteristics we described earlier, including very high revenue growth (see our above), a large TAM (so it can keep growing, see below) and the company is led by its founder (CEO Olivier Pomel cofounded the company along with CTO Alexis Lê-Quôc, in 2010).

Also Datadog was named a leader in the 2022 Gartner Magic Quadrant for Application Performance Monitoring and Observability (see below). This is a very good thing for its continuing industry leadership.

Also, Datadog has has high customer retention rates (also very good for continuing growth, see below).

And again, it’s valuation has come way down over the last year (for example, both its price and price-to-sales ratios are significantly below their 52-week highs, as you can see in our earlier table), but its high revenue growth remains intact as it moves closer to GAAP profitability (good things). We’ll have more to say about Datadog in the conclusion of this report.

The Trade Desk (TTD)

The Trade Desk is another high-growth stock that has recently sold off very hard (it’s down more than 30% this year).

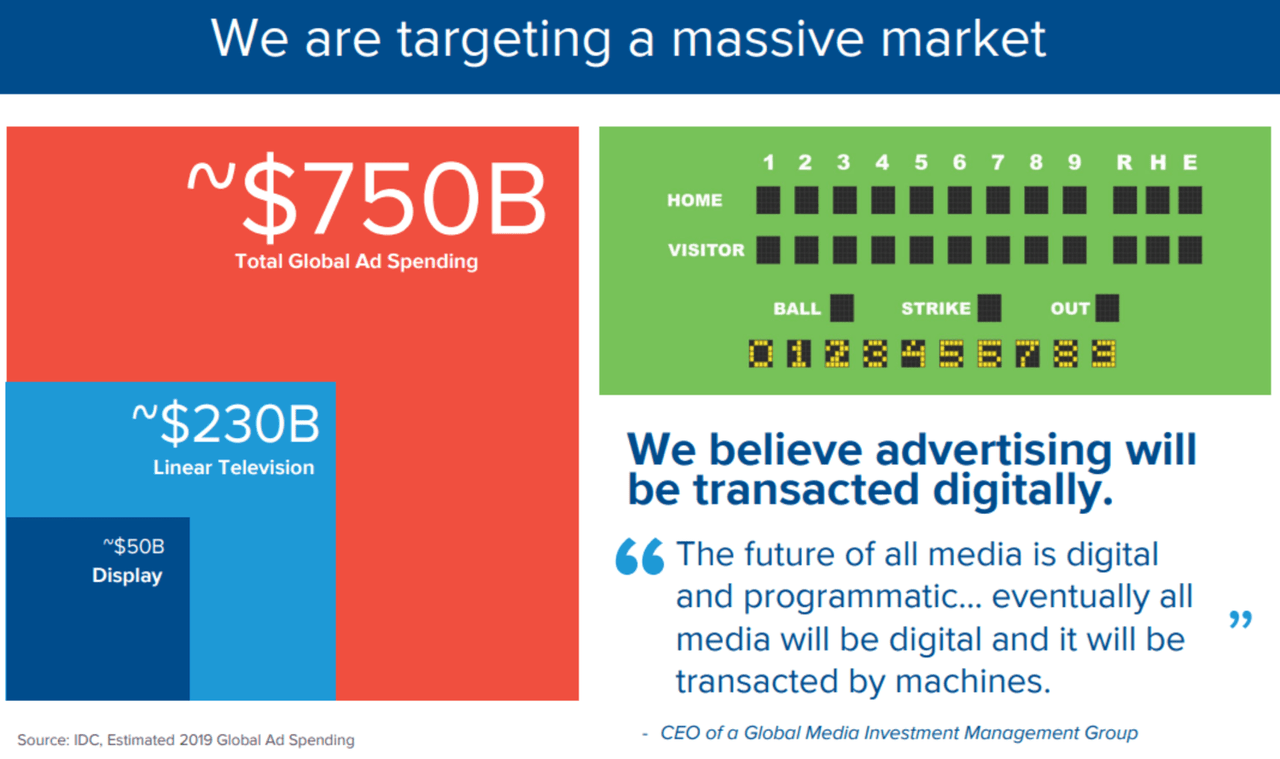

And like the other growth stocks we have highlighted in this report, it is attractively a founder-led business (Jeff Green is co-founder and current CEO), with very high revenue growth (see graphic above), and a very large TAM (see the graphic below).

If you don’t know, The Trade Desk is basically a self-service omni-channel advertising platform that allows ad buyers to pick from over 500 billion digital ad opportunities a day (including targeted ads across connected TV, mobile, video, audio, display, social, and native). We recently wrote about The Trade Desk in detail last month (where we correctly predicted that it would resume its steep share price declines in the short term), and we’ll have more to say about The Trade Desk in the conclusion of this report.

Conclusion:

The market is ugly. Very ugly. Aside from the sky high valuation levels many top growth stocks achieved last year (a bubble that continues to burst), macroeconomic conditions are bad (as described in this report). And unless you are in a position to buy-and-hold for the next decade, it would probably be a terrible idea to dump 100% of your nest egg into high growth stocks as described in this report (you might instead want to consider our recent report: Top 10 Big-Dividend Preferred Stocks).

On the other hand, if you are a long-term investor, you have a distinct advantage. That is to say, long-term compound growth is one of the most powerful wealth-creating exercises in the history of the world, but only if you have the ability to hang on (to high-growth secular leaders like Palantir, The Trade Desk and Datadog) through years of very high volatility (like we are experiencing now). In fact, this year’s steep price declines may get even worse (for reasons described in this report), but if you truly are a long-term investor you might also want to consider our expanded list of 150 top growth stocks down big (which also includes a few more top ideas) especially because we strongly believe this year’s ugly market environment will eventually get better.

No one knows where the market will be next week, next month or even next year. But over the long-term, it’s likely eventually going much higher (especially top growth stocks, like Palantir). And over the long term, top quality dividends stocks are also likely to keep paying big, steady, growing dividends. Choose a strategy that is right for you. We believe disciplined, long-term, goal-focused investing will continue to be a winner.