Celsius: Energizing the Beverage Market through Innovation and Market Expansion

Celsius (CELH) is involved in the creation, promotion and distribution of functional beverages and liquid supplements. The company also provides a powdered version of its energy drink and protein bars. In this report, we analyze Celsius’ business model, its market opportunity, financials, valuation and risks. We conclude with our strong opinion on investing.

Key Takeaways:

Diverse product portfolio with proven scientific support.

Multifaceted marketing & distribution strategy fueling growth.

Expanding market share in growing market.

Remarkable revenue growth. coupled with continued profitability

Healthy balance sheet supporting business expansion.

You can access a PDF version of this report here.

Overview:

Celsius was founded in 2004 in Delray Beach, Florida by the husband-wife duo of Steve and Janice Haley. The company marketed its beverage as an innovative "calorie-burning drink" that boosts metabolism. In just three years after its inception, Celsius gained significant attention by securing a major investment from South Florida entrepreneur Carl DeSantis and the drink received significant exposure through media coverage.

However, despite initial success, Celsius faced massive challenges. In 2010, the company initiated an IPO, raising $15M and rapidly expanding its product presence to over 20,000 retailers using an aggressive approach. Unfortunately, within the first 12 months, it exhausted its funds and was delisted. This is when Gerry David was roped in as the new CEO and the current CEO, John Fieldly was hired as the interim CFO to assist the new management team in revitalizing the company.

After a turbulent start, Celsius is now back on the NASDAQ and experiencing robust revenue and distribution growth. CEO John Fieldly credits this to a shift in messaging strategy, emphasizing energy and fitness over fat burning. Headquartered in Boca Raton, Florida, the company now offers a diverse range of products including carbonated and non-carbonated energy drinks, a powdered version of its energy drink and protein bars.

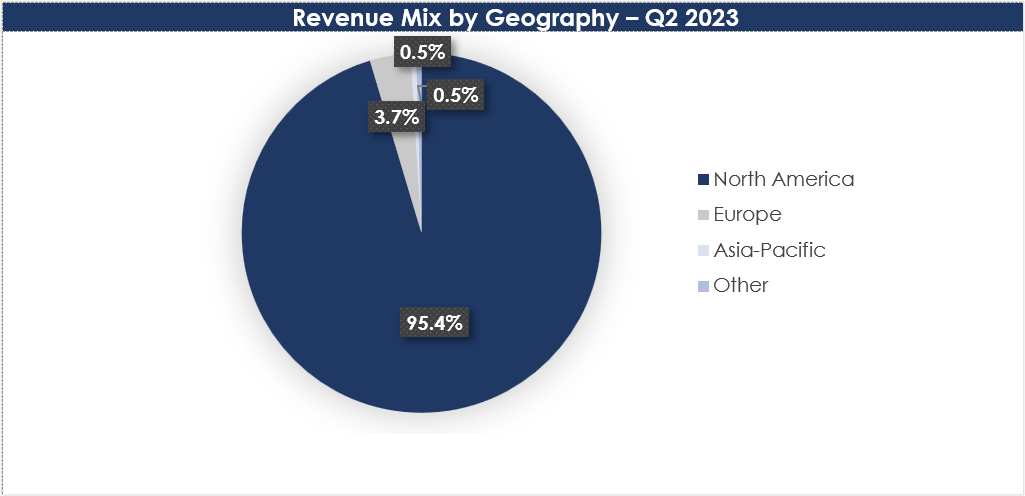

In Q2 2023, a significant share of Celsius' revenue was generated within the US, where it holds the position of third-largest energy drink brand, boasting an 8.6% market share. Additionally, Sweden contributed the largest portion of foreign revenue, accounting for ~$8M in the three months ending June 30, 2023.

Source: Company 10-Q

Diverse Product Portfolio with Proven Scientific Support

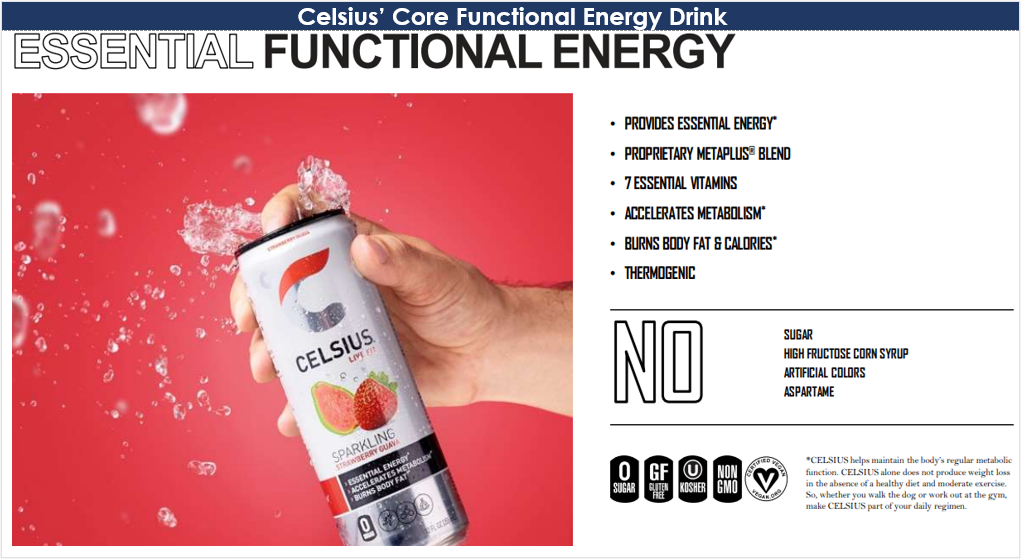

Celsius offers a wide range of products including carbonated and non-carbonated “essential” energy drinks under the CELSIUS Originals brand, carbonated “performance” energy drinks under CELSIUS HEAT, and branched-chain amino acids energy drinks for muscle recovery called CELSIUS BCCA+ENERGY. It also provides CELSIUS On-the-Go, a powdered version of its energy drink ingredients in individual packets and canisters. Additionally, it offers non-carbonated functional energy drinks under the CELSIUS Sweetened with Stevia name. Following the acquisition of Finland's Func Food Group Oyj in 2019, Celsius expanded its footprint in Finland, Sweden, and Norway. This expansion included brands such as FAST, FitFarm, and Coco Vi, offering a range of products like beverages, protein bars, supplements, and superfoods.

Featuring unique flavors like strawberry guava and peach among others, the company’s primary functional energy drink and liquid supplement brands are grounded in scientific research. Celsius’ drink has been supported by six self-funded studies published in reputable journals like the Journal of the International Society of Sports Nutrition, the Journal of the American College of Nutrition, and the Journal of Strength and Conditioning Research. These studies have consistently shown that a single serving of CELSIUS enhances metabolism, leading to the burning of 100 - 140 calories, while also providing sustained energy for up to three hours.

In an interview with NutraIngredients USA, CEO Fieldly highlighted – “A lot of companies make their structure function claims based on a single ingredient, not on a finished product. All Celsius science is based actually on finished products.” This means that in clinical trials, the focus is on evaluating the impact of consuming Celsius itself, rather than examining the effects of the individual ingredients used in Celsius.

Source: Investor Presentation

Multifaceted Marketing & Distribution Strategy Fueling Growth

Celsius has employed a comprehensive marketing and distribution strategy encompassing geographic targeting, diverse marketing channels, retail partnerships, and a focus on broader consumer demographics while staying attuned to emerging trends and consumer preferences. Some of the pivotal strategies that have contributed to the company's success are as follows:

Celsius strategically expanded its distribution by focusing on specific regions, initially targeting Miami and Tampa, and later adding cities with a high concentration of health clubs, such as Dallas, Los Angeles, and San Diego.

The company has secured distribution in over 150,000 retailers, including key accounts with major chains like Publix, Target, CVS, Walmart, 7-Eleven and Kroger.

The brand reaches its health-conscious consumer base (ages 24 to 44) through a multi-channel marketing approach. This includes digital TV for consumers at home, digital radio for commuters, and on-site marketing at running races and near beaches.

Celsius differentiates itself by appealing to both men and women, which sets it apart from many other energy drink brands that primarily target a male audience.

In 2014, the company made a strategic decision to cease D2C sales and shut down its ordering website. This move allowed the company to concentrate on serving retailers, both online and traditional, and align with the digital transformation in the grocery store industry.

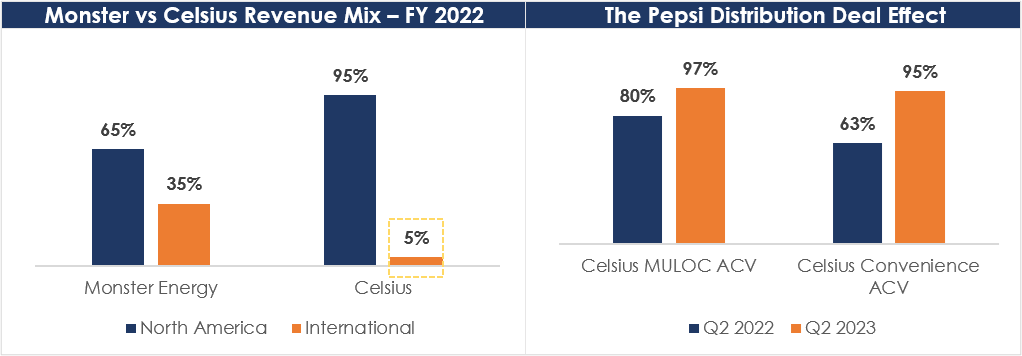

On August 1, 2022, a pivotal moment for Celsius occurred when Pepsi (PEP) became the official distributor in both the US and international markets. This granted it access to Pepsi’s wide distribution fleet, bottling network, and retail shelf space. This partnership also offers Celsius the opportunity to achieve expansion in global markets, resulting in substantial growth.

Source: Investor Presentation

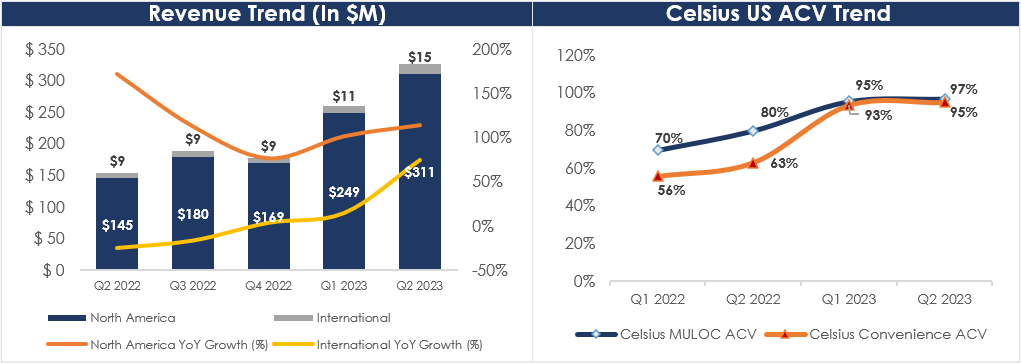

Source: Company Filings , Investor Presentation

Note - % All Commodity Volume is a critical metric for consumer-packaged goods brands like Celsius. It offers valuable insights into the rate at which their products are selling in specific stores, serving as a strong indicator of the potential sales success that their products could achieve in those retail locations. MULOC stands for Multi Outlet with Convenience Stores segment.

Expanding Market Share in Large and Fast-Growing Market

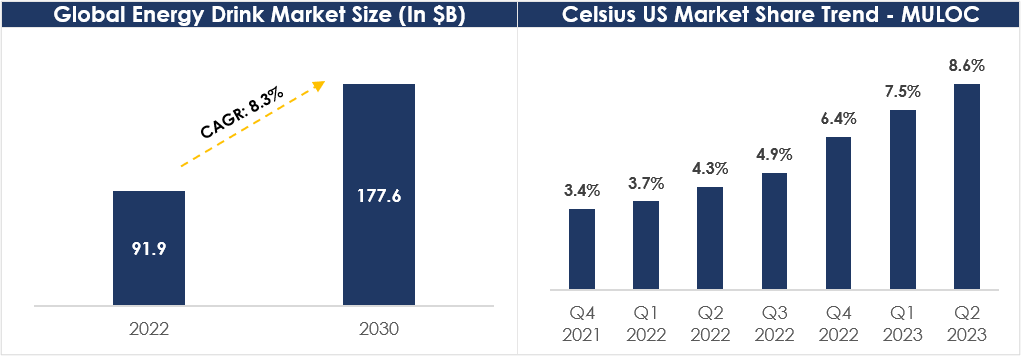

The growing demand for energy drinks to boost physical and mental performance is driving market growth. Industry players are actively marketing these drinks as functional beverages that improve energy and alertness. According to Grand View Research, the global energy drinks market size was valued at ~$92B in 2022 and is expected to grow at a CAGR of 8.3% to reach ~$178B in 2030. The company's TTM revenue, standing at $952M, indicates that it is merely beginning to tap into the market's potential.

Despite significant growth, the US energy drink industry remains highly concentrated, with Red Bull and Monster each claiming over 30% of market share. That said, Celsius is fast gaining traction and emerged as the #3 energy drink in the US in Multi Outlet with Convenience Store (MULOC) segment, doubling its market share from 4.3% in Q2 2022 to 8.6% in Q2 2023, as per IRI Energy Category 4W data ending 06/18/23. On Amazon, the company secured its position as the second-largest energy drink, commanding an 18.6% share of the Energy Drink Category, with Monster leading at 20.8%.

Source: Grand View Research & Company Earnings Transcripts

Remarkable Revenue Growth Coupled with Continued Profitability

In Q2 2023, total revenue increased 112% YoY to $326M. This growth was driven by the company’s primary North American business which recorded revenues of $311M, marking a remarkable 114% YoY increase. International revenue also displayed strong growth, surging by 76% to reach $15M, reflecting a recovery from the previous year's challenging business environment.

The management team attributed the accelerated growth in North American sales volume during Q2 to the successful integration into the Pepsi distribution system, driving continued expansion. There has also been consistent and robust growth in traditional distribution and club channels, with substantial contributions from SKU increases and placements. Moreover, the company's products have made inroads into new channels within C&G and foodservice, further boosting sales.

“We believe there is a significant opportunity for incremental growth going forward with PepsiCo over the next three to five years. Although earlier in the process, we are mapping out and rollout plans and continue to have discussions with our partners and opportunities for 2024 and beyond.” – CEO John Fieldly, Q2 2023 Earnings Call

The advantages of the Pepsi partnership are evident in Celsius' swift expansion of ACV, both in Multi Outlet with Convenience Store (MULOC) and Convenience Store segments, presenting a significant opportunity for increased availability throughout the US.

Source: Company 10-Qs

On the profitability front, Celsius reported a gross profit margin of 48.8% in Q2 2023, up 1,030 basis points as compared to last year. The boost in gross profit margin can be credited to lower unit costs for packaging and raw materials, decreased product waste and scrap, and enhanced efficiency in inbound and outbound freight operations. Non-GAAP Adjusted EBITDA rose by 357% in Q2 2023 to reach ~$78M. This increase was driven by substantial revenue growth, significantly improved gross margins, and continued efficiency in managing SG&A costs.

Source: Company Earnings Press Releases

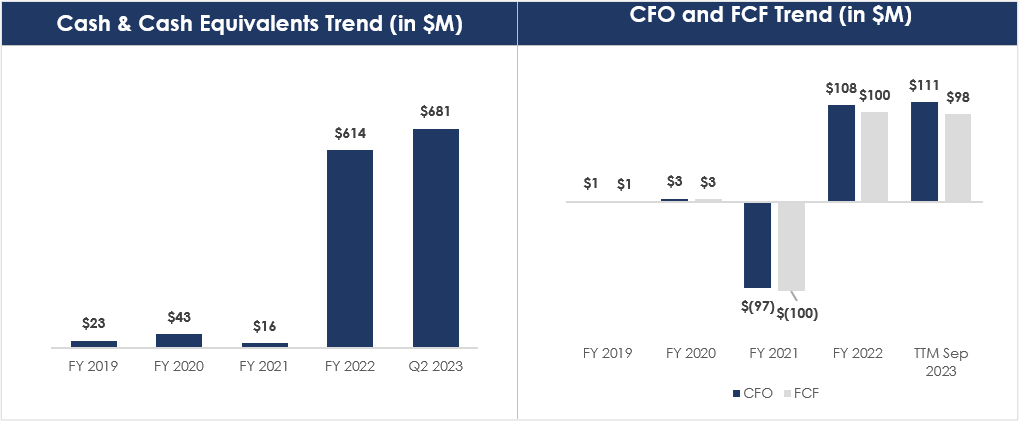

Healthy Balance Sheet supporting Business Expansion

Celsius ended Q2 2023 with $681M in cash and cash equivalents and zero long-term debt. The company generated $98M in Free Cash Flow (FCF) in the last twelve months ended Sep 2023, driven by improved operating performance and payments linked to the Pepsi transition. Ample liquidity and no debt lend Celsius the financial flexibility to support future growth initiatives.

Source: Company Filings

Valuation

Celsius' stock experienced significant growth in the past two years, and this positive trend has continued in 2023, with the stock up ~50% YTD. However, despite the recent rally in stock price, the company trades at 9.5x its forward sales, which is at a modest discount to its 5Y historical average. Also, it is worth noting that the company trades at only a slight premium to its closest publicly traded peer, Monster, despite experiencing revenue growth that is more than 5x Monster’s. Given Celsius’ robust financials and strong growth potential, we believe the current valuation offers a favorable risk-reward.

Source: Seeking Alpha

Risks

High competition: A significant risk lies in the highly competitive landscape, which could hinder Celsius from attaining the kind of brand image enjoyed by industry giants like Monster and Red Bull. However, it's worth noting that consumers perceive Celsius as a healthier option compared to its direct competitors. To maintain and strengthen this positive brand image, it's crucial for Celsius to maintain its marketing investments and secure a growing number of high-quality events and sponsorships.

Regulatory changes: The energy drinks industry is susceptible to risks stemming from government actions related to taxation. Celsius, despite offering sugar-free products supported by clinical studies, could still be susceptible to potential tax increases.

Conclusion

Celsius has demonstrated exceptional execution in the energy drink market, setting itself apart with a functional brand image and a robust distribution partnership with Pepsi. The company has ample liquidity and no long-term debt, providing strong financial flexibility to pursue growth opportunities. Overall, we believe Celsius can sustain its strong momentum, driven by continued growth in the US, global expansion, stable margins and healthy cash flows. Considering the current risk and reward dynamics, we view this as an attractive opportunity for patient, long-term investors.