The SaaS (Software-as-a-Service) business we review in this report was already benefiting dramatically from its leadership position in the massive digital revolution megatrend (which, by the way, is still in its early innings). However, by the very nature of the business (the company has immense well-organized data), Artificial Intelligence (“AI”) technologies will supercharge the value it brings to clients and the growth rate of its profits. In this report, we briefly review the business, its growth and valuation, and then conclude with our strong opinion on investing.

ServiceNow (NOW)

ServiceNow’s SaaS platform digitizes and automates previously siloed data and processes from across various departments within an organization to make life easier for employees and customers. ServiceNow is the industry leader (as evidenced by its growing customer base and the very high renewal rates on its subscription offerings—recently 99%). Further, the company’s “land-and-expand strategy (whereby once a customer is gained, ServiceNow expands the relationship through additional value-add offerings) makes this company a powerful revenue growth business.

Artificial Intelligence:

“ServiceNow's long-term trajectory is being supercharged by Generative AI.” That’s how CEO Bill McDermott put it on the latest earnings call, and we agree. For perspective, there are now more than 1 trillion workflows running through ServiceNow each year (and growing at 40% annually), and the data from these workflows makes the company an absolute gold mine for implementing value-add AI technologies.

For example, according to Bill McDermott, the company has introduced “Now Assist” for virtual agent (which maximizes productivity by eliminating time spent searching for information), “ServiceNow Generative AI controller” (which allows organizations to connect ServiceNow instances to Bolt, Microsoft Azure OpenAI service, and OpenAI API large language models), case summarization (a big time saver and pain-point eliminator for employees), text-to-code, text-to-flow and text-to-new-application-development, to name a few.

Growth:

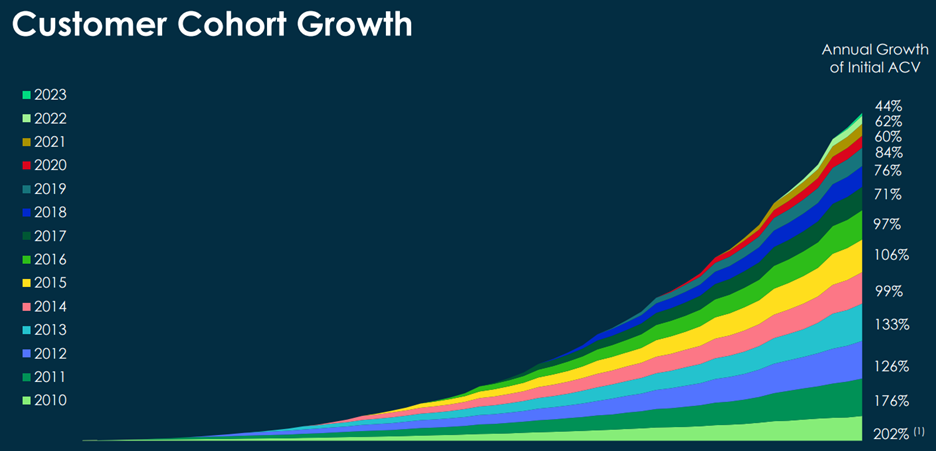

We’ve already gotten a flavor for the power of ServiceNow’s land-and-expand strategy (though the Customer Cohort Growth chart earlier), but to put that into perspective, the company’s revenues are expected to grow at over 20% this year and next (this is quite impressive for a large $115B market cap company, but not surprising considering the business).

Further, the massive digital revolution megatrend that underlies the business is still only just getting started as companies continue to migrate data to the cloud. Further still, the benefits of having enterprise-level data is one place are enormous as it allows companies and customers to draw valuable insights (that were previously not apparent) and they can do so with great speed (considering the data is now at their fingertips). And of course the value extracted from this data is being magnified and accelerated thanks to AI (and ServiceNow is in a better place than most companies to benefit from AI, as demonstrated through the examples provided earlier).

Valuation:

One of the most impressive characteristics about ServiceNow is that it is profitable. This may not sound impressive, but compared to other software companies (many of which are still not yet profitable), ServiceNow is better positioned to survive any market downturns, yet still benefit from economic upturns (which will only further accelerate its growth). ServiceNow’s net profit margin was recently 17.8%. Very impressive.

Further, as evidence of financial strength, the company initiated a share repurchase program in May of this year. And while the main goal of the program is to manage “the impact of dilution from future employee equity grants and employee stock purchase programs,” it’s still much better than a lot of other high-growth SaaS stocks that continue to heavily dilute shares with seemingly no concern for existing shareholders.

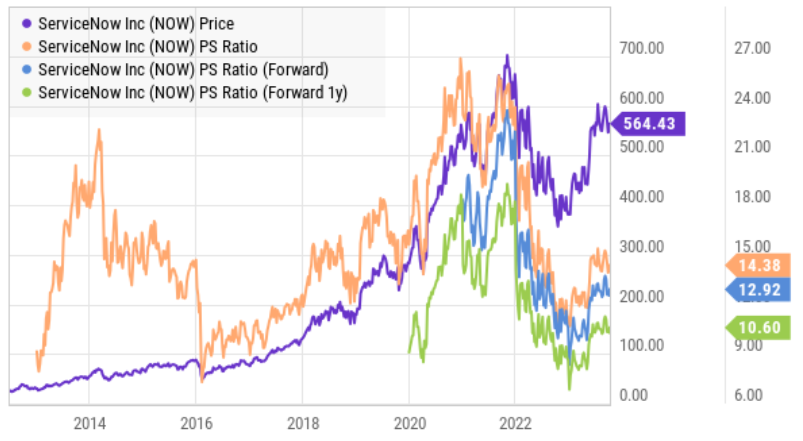

And from a price-to-sales multiple, ServiceNow trades at only 14.4x sales, low compared to its own history and the number gets even lower when you compare the price to forward sales expectations (as you can see in the chart below).

Granted, a double-digit price-to-sales ratio is rich compared to the universe of all stocks, yet it’s still quite compelling in light of the fact that sales are growing at over 20% (few companies can say this), the company is extremely profitable (profit margins are impressive) and it has strong competitive advantages (customers tend not to switch once they start using the ServiceNow platform, as evidenced by the 99% customer renewal rate).

The Bottom Line:

ServiceNow is attractive. It’s now benefiting from two big secular trends, including the digital revolution and now artificial intelligence. The company mentioned AI more than 30 times in its prepared remarks on its last earnings call on July 26th (and many more times in the Q&A) whereby it beat earnings and revenue expectations and raised forward guidance. We expect more positive news at the upcoming quarterly earnings announcement on October 25th, and we continue to be a long-term shareholder (we own ServiceNow in our Disciplined Growth Portfolio and have no intention of selling).