Meta (META) makes money through advertising on its four main assets, Facebook, Instagram, WhatsApp and Threads (they’re all basically communications aps). But how will the business be disrupted by newly emerging (and rapidly accelerating) Artificial Intelligence (“AI”) technologies? We answer that question in this report, as well as review Meta’s growth, valuation and competitive advantages. We conclude with our strong opinion on investing.

Meta: The Money-Printing Machine

As mentioned, Meta generates revenue through advertising on its four main communications technologies, and the company’s gross margins are truly impressive. Specifically, Meta’s recent gross margin (revenue - cost of goods sold) is 79.45%. This is extraordinarily high compared to other companies. From a gross profit margin standpoint, Meta is an absolute money-printing machine.

Meta’s Net Margins (i.e. Bottom Line Profits)

Meta’s recent bottom-line net margin was 18.7%. This is very profitable, and extremely important at a time when interest rates are rising and economic growth is slowing because it means Meta still has the ability to fund future growth organically (instead of going to the capital markets to borrow at high interest rates, for example).

Liberal Research Spending:

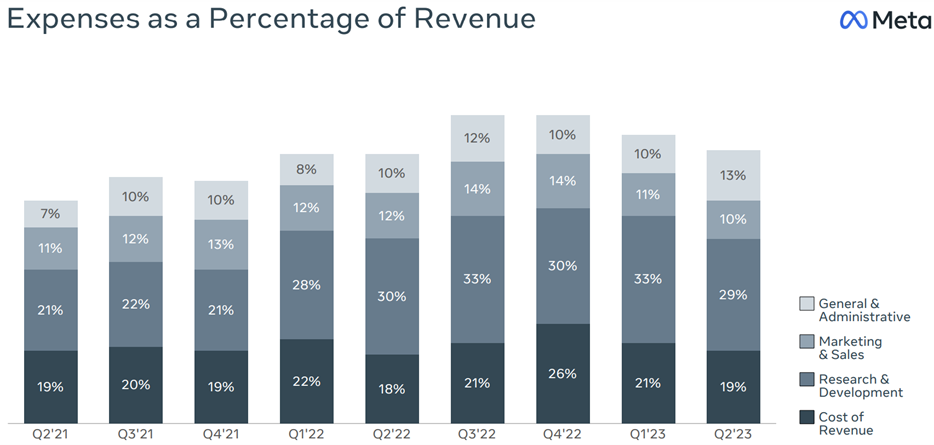

However, the big issue for Meta over the last two years has been very high spending on research & development (research margin was recently 31.3%). On one hand, this is good because it allows the company to experiment and discover new growth opportunities (such as the metaverse, AI and its new twitter competitor—Threads). On the other hand, it immediately reduces bottom-line net profits and the market can view this very negatively at times.

For example, the market hated Meta’s high spending in 2022 and the shares paid a big price (i.e. the share price fell sharply, as you can see below). More specifically, the market was unsure about Meta’s big pivot towards (and big spending on) the metaverse, especially at a time when economic growth was slowing and uncertainty was high.

However, in 2023 the company has focused on restraining costs and reducing employee headcount, and the shares have rebounded hard (i.e. Meta shares are up over 150% in 2023!).

Enter Meta AI Disruption

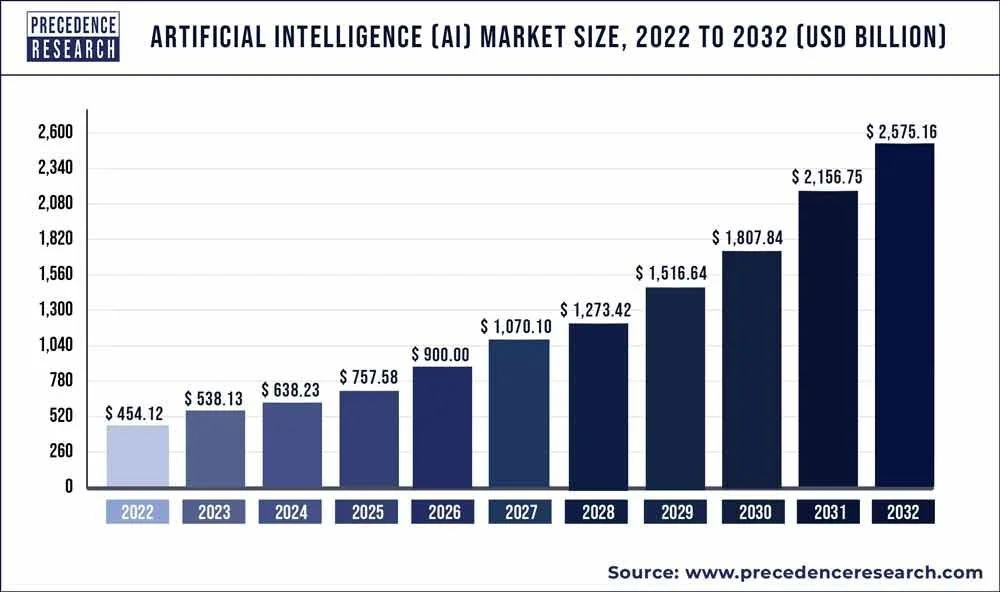

Unless you’ve been living under a rock, you’ve head about the massive opportunities and disruption that is only just beginning as a result of new AI technologies, such as large language models. Some experts predict the disruption caused by AI will be greater than the disruption caused by the internet itself (which has undoubtedly changed all of our lives significantly). And Meta is not getting left behind, as it focuses efforts on its own AI technologies through Llama2.

For example, Meta just recently debuted new new generative AI features for advertisers (remember, advertising is how Meta makes money). The features allow advertisers to “use AI to create backgrounds, expand images and generate multiple versions of ad text based on their original copy.”

We don’t necessarily view Meta’s new AI technologies as massively disruptive (yet), but rather as a way to improve an existing product and keep existing customers happy. In fact, we view it as a way to ward off competitors and to continue growing the business at a healthy clip. Said differently, AI is a way to help sustain Meta’s incredible money-printing machine. This is a good thing.

Meta’s Growth and Valuation

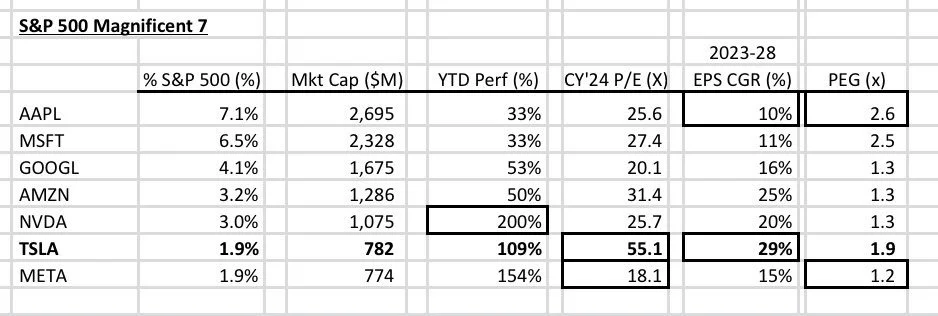

Meta is expected to grow revenues at a low double-digit rate this year and next year. This is truly impressive for a large company of Meta’s size (the market cap was recently over ~$800 billion—that’s larger than the total economy of many nations around the world!). And we believe Meta’s latest AI initiative will help maintain that growth rate.

From a valuation standpoint, Meta recently traded at a PEG ratio of 1.2x (see below). PEG ratio stands for price-earnings ratio, divided by growth, and you can see how Meta compares to other mega cap stocks in the table below (a lower PEG ratio is generally considered better).

Meta’s Competitive Advantages

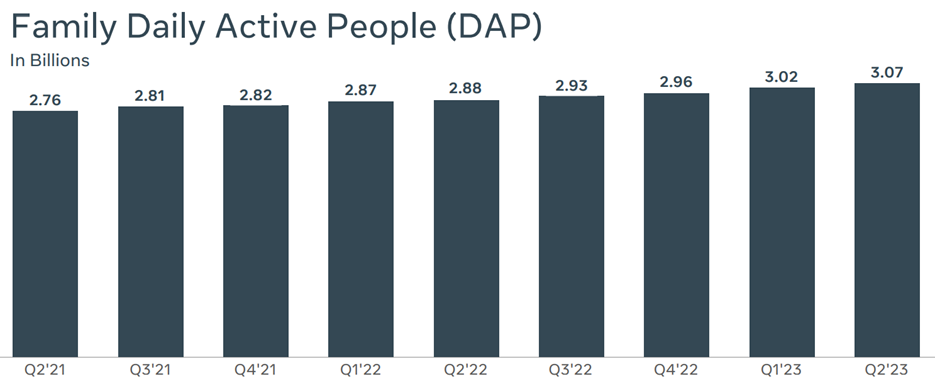

Meta faces constant threats from other big tech companies and other advertisers, including also the likes of TikTok. However, Meta’s big competitive advantage is its massive user base on its massive platforms.

The company constantly reports on (and works to defend and grow) its user base, as you can see reported in the following table

In a lot of ways, Big Tech owns the internet, and everyone else must pass through them (and play according to their rules). Meta is certainly a part of this, considering so many businesses around the globe rely on Facebook and Instagram for advertising (and so many people rely on them for communication). Similarly, many people rely on WhatsApp to communication for free (free, aside from the data the ap takes and uses (anonymously) for advertising purposes).

Our Bottom Line on Meta AI

AI is going to change the world, and those changes are only just getting started. In Meta’s case, the AI use cases rolled out thus far aren’t inherently disruptive, but they do help Meta defend itself from being disrupted by others now and in the future (i.e. AI helps keep users on Meta’s platforms). We’re excited to see how AI evolves at Meta in the years ahead, and we’re excited to see the company being aggressive in using AI (so they don’t get left behind).

And considering Meta’s high growth, strong competitive advantages and impressive PEG ratio, we like the company going forward. We are long shares of Meta within our Disciplined Growth Portfolio, and we look forward to many more years of strong gains ahead, especially as AI continues to unfold.