When market conditions get ugly, contrarian investors salivate. Not because they’re buying everything in buckets, but because they’re selectively adding compelling contrarian opportunities to their income-focused investment portfolios. And that is exactly what we focus on in this report. Specifically, we review current market conditions, share data on 50+ big-yield closed-end funds (“CEFs”) and then countdown our top 10 big-yield CEF opportunities.

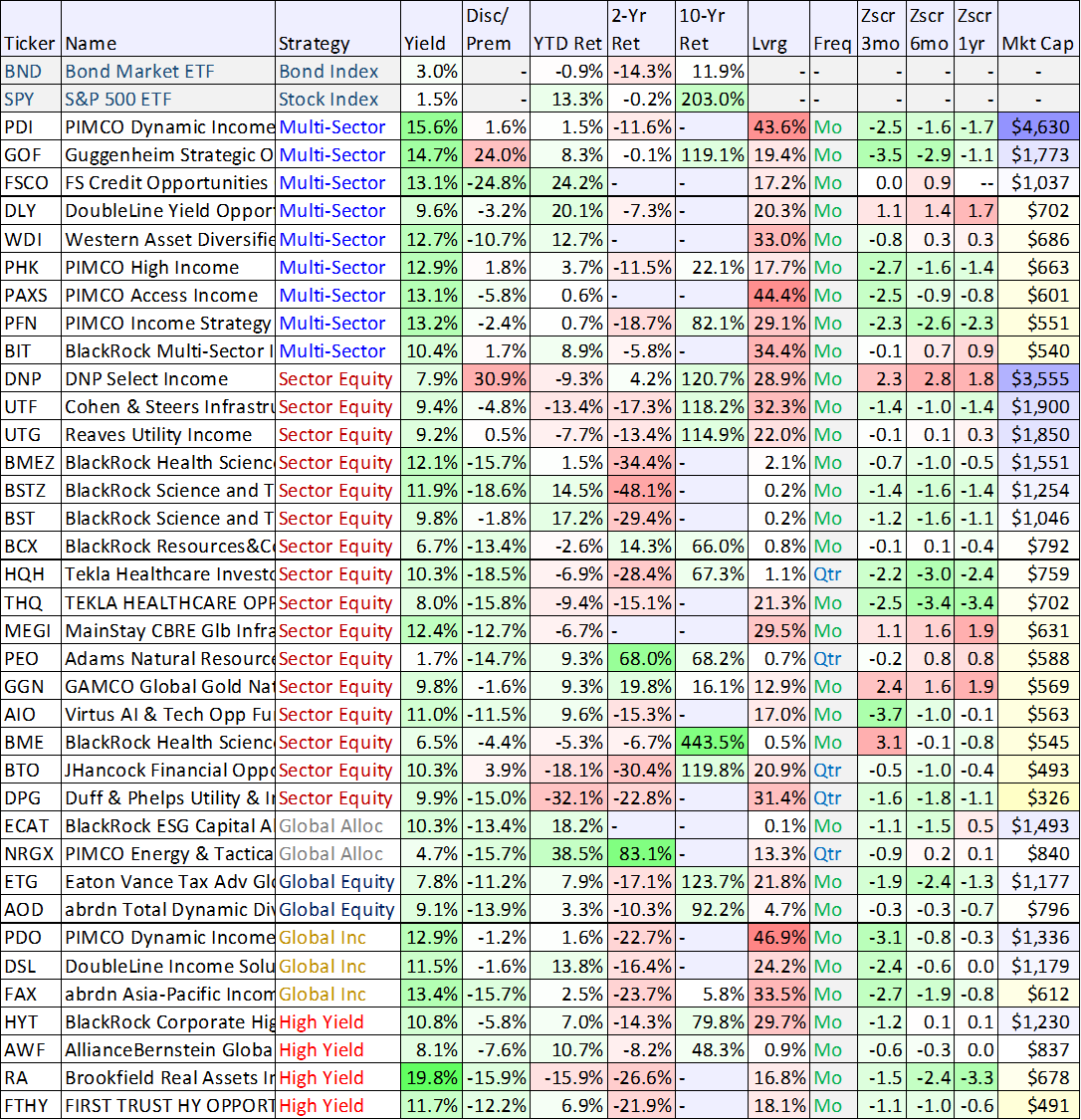

50+ Big-Yield CEFs

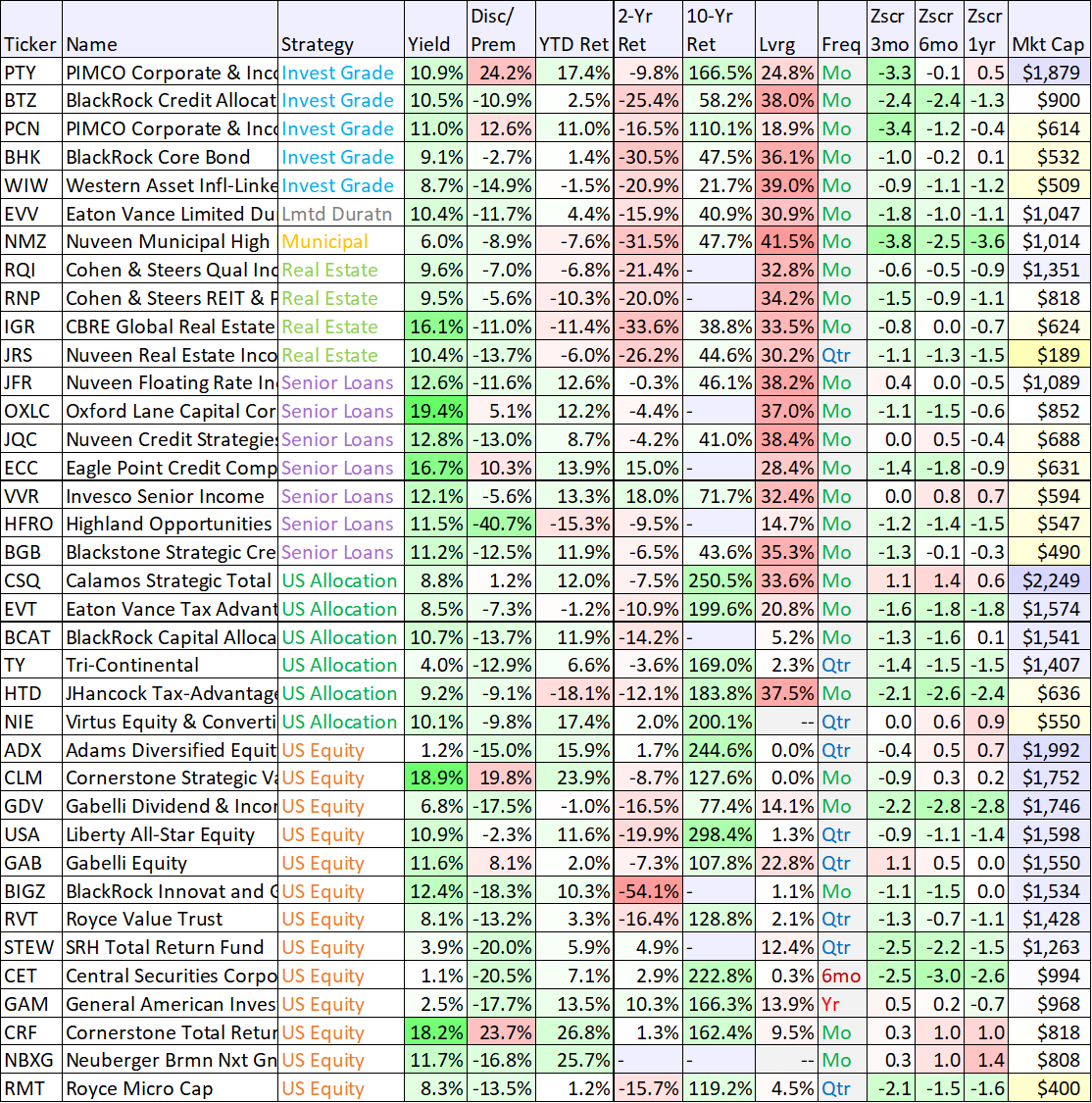

Before getting into our top CEF rankings, it’s worth first reviewing current market conditions to add some context. Specifically, here is a table with performance data on over 50 popular CEFs (sorted by strategy then market cap). You likely recognize at least a few of the largest CEFs across the categories. Other important characteristics include current discounts/premiums, leverage (or borrowed money) and z-score (a measure of how the magnitude of the current price discount/premium compares to history—negative is often considered better).

Data as of 9/28, source: CEF Connect, StockRover

Current Market Conditions

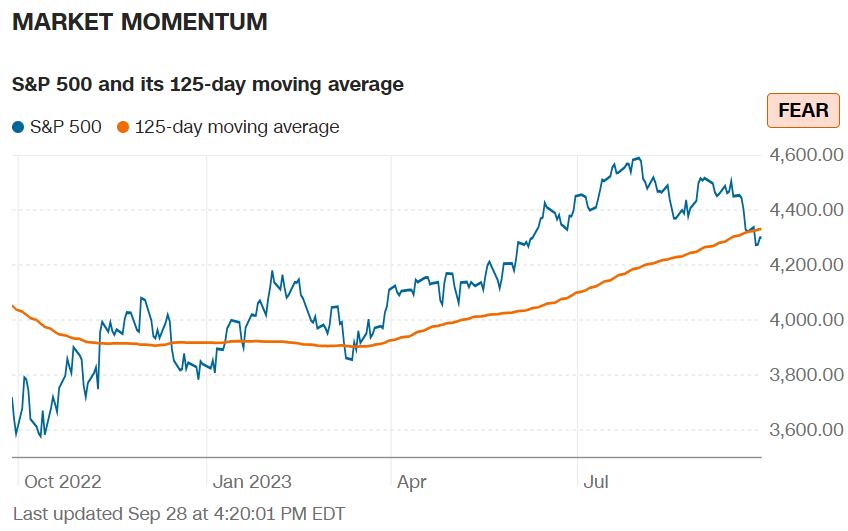

You may also notice a lot of negative 3-month z-scores in the table above—which can be an indication of recent selling pressure, or fear. The overall market (as measured by the S&P 500) is also down over the last month (as you can see in the next chart) and it has fallen below its 125-day moving average (another indication of selling pressure and fear).

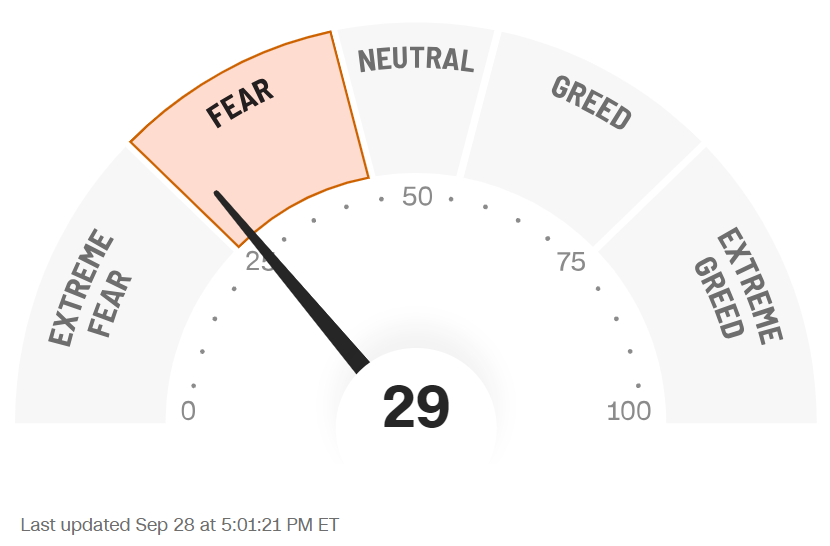

And more specifically, CNN’s “Fear and Greed” index (based on a variety of market barometers) suggest the market has moved into heavy fear recently, as you can see in the chart below.

Heavy fear can sometimes be a good contrarian indicator (and a time to “buy low”) as we will describe with specific examples later in this report.

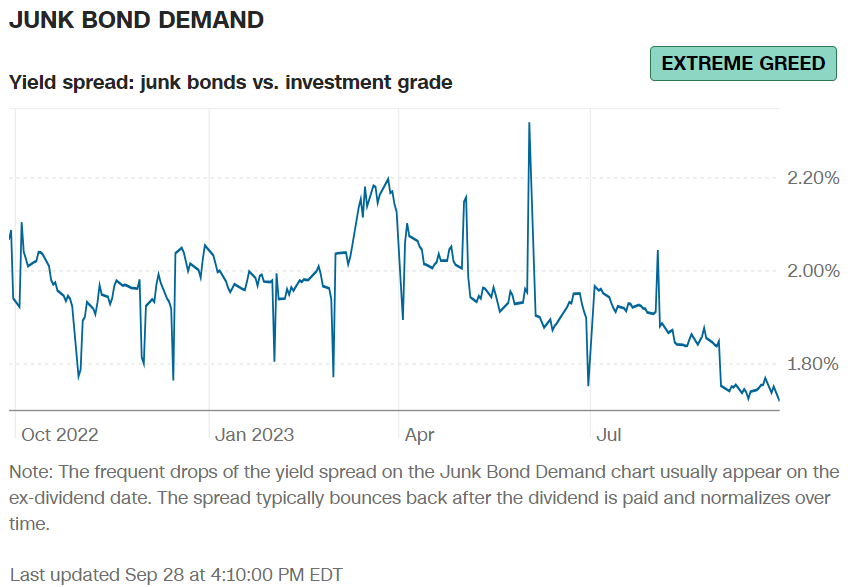

Also worth mentioning, credit spreads (for example the difference in yield between high-yield junk bonds and investment grade bonds) is strangely low right now. Usually an indication of market confidence, but also and indication that things can get a lot worse (when credit spreads widen, junk bonds have fallen in price). Yield spreads impact the bond CEFs that own riskier bonds in particular.

Interest Rates

A lot of the CEFs in our earlier table (and later in this report) invest in bonds, which are interest rate sensitive. Specifically, when rates go up, bond prices go down. And this has been a big part of the reason many bond funds have posted negative total returns over the last two years (as you can see in our earlier table).

Further, rising rates have put selling pressure on a lot of big-yield equity securities too. For example utility sector CEFs and real estate CEFs have been under added selling pressure as investors move money into money market funds, CDs and short-term treasuries (which now offer significantly higher yields than 2 years ago when they were offering close to 0.0%). These factors have combined to create some attractive contrarian opportunities.

Closed-End Funds (“CEFs”):

Just a quick reminder, before getting into our top 10, closed-end funds typically hold a basket of securities (often from 50 stocks or bonds to over 1,000) thereby offering some instant diversification, similar to exchange traded funds (ETFs) and mutual funds. However, unlike ETFs and mutual funds, there is no mechanism in place to ensure CEFs trade at market prices close to their NAVs, and as such CEFs can trade at wide premiums and discounts to NAV (as we saw in our earlier table), thereby creating risks and opportunities. CEFs come in a wide variety of shapes and sizes, but here are 7 things we always consider before investing in any CEF.

Top 10 Big-Yield CEFs

So with that backdrop in mind, let’s get into our top 10 big-yield CEF rankings and countdown, starting with number 10 and finishing with our top ideas.

10. Cohen & Steers Infrastructure (UTF), Yield: 9.4%

If you are an income-focused contrarian investor, the Cohen & Steers Infrastructure Fund is currently attractive for a variety of reasons. For starters, it offers the big monthly distribution payments that many investors love. Next, the Net Asset Value (NAV) is down (i.e. contrarian opportunity to buy low) and it currently trades at a larger-than-normal price discount as compared to its NAV (i.e. a characteristic many investors seek). UTF is the second “sector equity” CEF in our earlier table.

The weak recent performance is due to multiple factors including its 17% allocation to bonds (as interest rates have risen, bond prices have fallen) and its 47% exposure to utility sector stocks (the worst performing sector this year because investors have been selling utilities stocks now that money market funds, CDs and short-term treasuries offer comparable yields, and considering there is a lag between how quickly regulators allow utilities companies to raise prices to keep up with inflation). We view all of these factors as compelling contrarian opportunities because we expect bond price are stabilizing (as rate hikes slow), utility stocks are undervalued (as the market has overreacted) and UTF’s price discount versus NAV will shrink as investors realize the fund has likely sold off harder than it should have.

One risk factor to watch with this fund is that it has been using ROC to help support the distribution for many months (this has some investors concerned a distribution “right-sizing” may be coming). However, we suspect the NAV is stabilizing and the fund will continue to pay some level of very high distributions going forward (whether or not their is a distribution change), and the fund is attractively priced (as described earlier).

We recently added shares of UTF to our High Income NOW portfolio, and you can access our previous full report on the fund here.

9. Nuveen Real Estate Income Fund (JRS), Yield: 10.4%

This fund invests in real estate securities (mainly REITs—real estate investment trusts), and its performance has recently been terrible. In particular, REITs have been suffering from the quadruple-whammy of rising interest rates, inflation, slower economic growth and secular declines in demand for certain commercial real estate types (such as office and some retail, for example).

However, this fund has healthy allocations to healthier real-estate sub-sectors, such as industrial properties. And the fund also has only about two-thirds of its holdings in common stocks shares (the other one-third is in preferred shares). The preferred shares are somewhat interest rate sensitive (they have declined as rates have risen), but rate hikes are slowing and preferred shares can provide a lot more stability than common shares.

Further, this fund trades at a very large (13.4%) discount to its net asset value, a “buy low” characteristic we find attractive considering real estate pain may be slowing, and considering this fund’s attractive subs-sector real estate allocations (including office and preferred shares).

The fund’s distribution amount changes, and was already lowered this year (a good thing because it adds strength and stability to the fund, especially considering it has been using ROC to help support the distribution at a time when NAV was down).

The fund also uses a significant amount of leverage, or borrowed money (recently around 30%) which has magnified the pain as the market has come down, but which can magnify the gains on the way up. And we view the healthy amount of leverage as more prudent (and less risky) considering the one-third allocation to preferred shares.

On a go-forward basis, we view this fund as an attractive contrarian way to play the real estate sector while receiving big distribution payments.

8. Nuveen Municipal High Income (NMZ), Yield: 5.9%

Switching gears to municipal securities, the Nuveen Municipal High Income Opportunity Fund offers a compelling way for investors in higher income tax brackets to reduce taxes (municipal bonds are generally not taxable at the federal level) and still enjoy high income. On a tax equivalent basis, this fund’s yield is significantly higher than 5.9% (especially if you are in a higher tax bracket). Just keep in mind this is a good fund to consider for your taxable account (but NOT a tax-advantaged IRA account).

This fund has been sourcing the distribution with interest on the underlying municipal bond holdings (and not capital gains or ROC), and therefor the distribution amount can vary. This is painful for some investors, but it makes the fund much healthier over the long term.

Municipal bond funds in general, and this fund in particular (recently -8.9%) trade at unusually large discounts to NAV, thereby creating a very attractive contrarian opportunity in our view. We wrote this one up in detail a couple months ago, and you can access that report here.

7. Royce Value Trust (RVT), Yield: 8.2%

6. Royce Micro Cap Trust (RMT), Yield: 9.8%

Switching gears again, US small cap stocks are extremely attractive from a contrarian standpoint, and these two small cap funds (offered by small-cap specialist, Royce) are an excellent way to invest in the space if you are an income-focused investor.

You likely know that large cap stocks have been outperforming small cap stocks by a wide margin in recent years (a phenomenon that usually doesn’t persist throughout an entire market cycle), and according to Royce (and many contrarians) these two fund are due for a strong rebound relative to large caps in the quarters ahead.

Furthermore, both funds trade at attractively large discounts to NAV (13.2% and 13.5%, respectively) as fearful and emotional investors have put a lot of selling pressure on small cap stocks and these funds in particular. These funds have historically traded at significant discounts to NAV (thereby making the fund management fees more tenable), but those discounts are larger than normal now, plus small caps are also “due” for a strong contrarian rebound.

We have written about these funds in the past, and we currently own shares of both within our High Income NOW portfolio.

5. Duff & Phelps Utility & Infrastructure Fund (DPG), Yield: 9.5%

If you are a big-yield contrarian investor, the Duff & Phelps Utility & Infrastructure Fund is attractive for multiple reasons. For starters, it invests in the low-volatility and “safe” Utilities sector (which is currently underperforming and thereby creating an attractive contrarian opportunity, as we will explain). Next, it trades at a massive (and very inappropriate) discount to its NAV following a distribution right-sizing a few months ago (emotional investors have dramatically overreacted). The combination of these two factors have created a highly-compelling long-term investment opportunity for income-focused contrarian investors, as we wrote about in this new report.

4. BlackRock Health Sciences (BMEZ), Yield: 12.1%

This $1.8 billion BlackRock fund (focused on health sciences companies) recently reduced its distribution, and the market reaction has been inappropriately emotional and overly extreme. The fund now trades at a wide discount to NAV, the strategy is now much healthier going forward, and it presents an extremely attractive contrarian opportunity, in our view. We just recently wrote this one up in detail, and you can access that report here.

3. PIMCO Dynamic Income Opportunities (PDO), Yield: 12.9%

PIMCO is generally considered the industry leader when it comes to fixed-income CEFs, and we currently own multiple PIMCO funds. However, we recently increased our position in PDO (and decreased our position in PDI) for a variety of reasons, including the health of the distribution yields. You can read our detailed explanation here.

2. PIMCO Access Income Fund (PAXS), Yield: 13.1%

When it comes to PIMCO bond funds, this one is our favorite. Many investors don’t yet like it or trust it because it is still relatively new. However, it doesn’t have all the same legacy distribution challenges as other PIMCO funds with longer tenures (such as PDO and PDI). For example, PAXS came into existence AFTER most of the pandemic bond market and interest rate drama already hit, so PAXS isn’t dealing with the same short and long-term capital losses as other funds (it also isn’t dealing with the same legacy derivatives positions many other PIMCO funds used to kick their ROC cans down the road). This makes a world of difference going forward, and PAXS also trades at an attractive discount to NAV (especially for a PIMCO fund). You can read our previous writeup on PAXS here.

1. BlackRock Credit Allocation Trust (BTZ), Yield: 10.5%

This fund has a lot of attractive qualities, including a big monthly distribution, a strong management company, a very attractively discounted price (-10.9% versus NAV) and a lower level of leverage—recently around only 38%, as compared to PIMCO funds with typically 45% to 50% leverage (the regulatory limit is 50% and funds can be forced to sell things at bad prices, thereby recognizing otherwise unnecessary losses when they bump up against this limit). This is our largest position in the High Income NOW portfolio, and you can read our previous notes and reports on this fund here.

The Bottom Line

The market is currently presenting a select variety of attractive and contrarian high-income opportunities. If you enjoyed the CEF ideas shared in this report, you can also view our complete High Income NOW portfolio here. In addition to CEF positions, the portfolio also shares all 28 of our current high-income holdings, including BDCs, REITs, CEFs, dividend stocks and more.