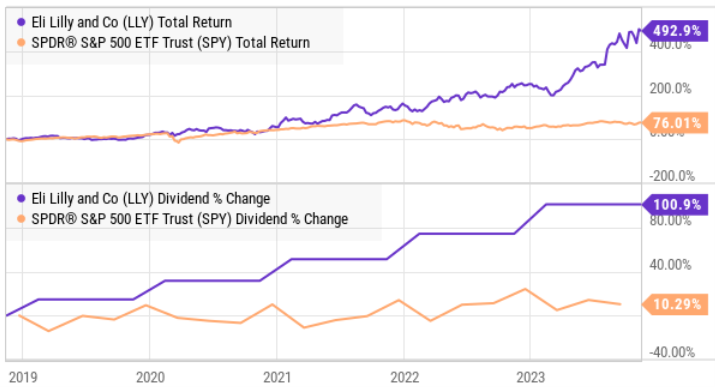

Indianapolis-based pharmaceuticals company, Eli Lilly (LLY) is a great business firing on all cylinders. Over the last five years, the shares are up over 400% and the dividend has more than doubled. And looking forward, the FDA’s new approval of diabetes drug, Mounjaro, to also address weight loss, gives Lilly added upside. However, the company faces a few big risks. In this report, we review the business, its blockbuster drugs, the dividend, share repurchases, valuation and the big risks. We conclude with our strong opinion on investing.

Overview:

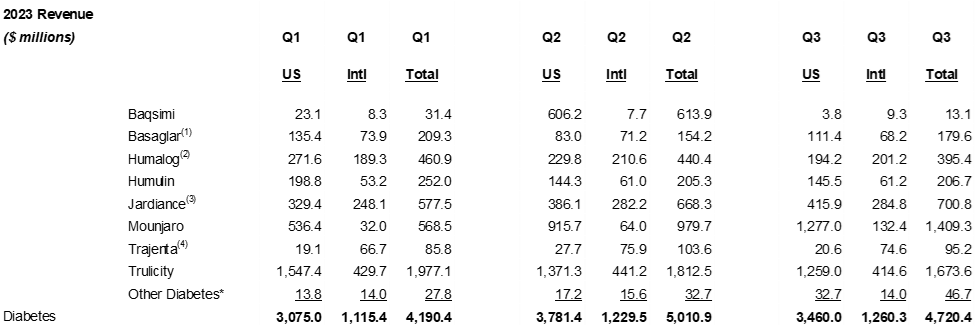

As you are likely aware, Eli Lilly is a pharmaceuticals company. And as you can see in the following table, the company offers a variety of drugs for diabetes, immunology, neurorscience and oncology. Its three biggest drugs, by revenues, are Trulicity (diabetes), Mounjaro (diabetes) and Zyprexa (immunology), collectively generating almost 50% of total revenues.

For a little more perspective on these drugs:

Trulicity: Dulaglutide, sold under the brand name Trulicity among others, is a medication used for the treatment of type 2 diabetes in combination with diet and exercise.

Mounjaro: Tirzepatide, sold under the brand names Mounjaro, Zepbound and others, is an antidiabetic medication used for the treatment of type 2 diabetes and for weight loss. Tirzepatide is administered through subcutaneous injection.

Interestingly, just this past week, a new version of Mounjaro received FDA approval to be used for weight loss. This is good news for Lilly, and gives the company (and the shares) more room for growth.

Zyprexa: Olanzapine (sold under the trade name Zyprexa among others) is an atypical antipsychotic primarily used to treat schizophrenia and bipolar disorder. For schizophrenia, it can be used for both new-onset disease and long-term maintenance. It is taken by mouth or by injection into a muscle.

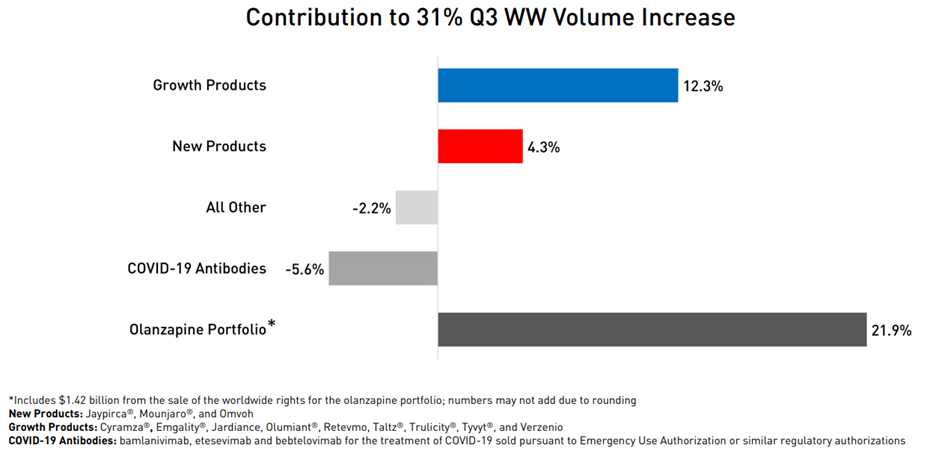

Another way to look at Lilly’s products is by “growth,” “new” and all other categories. Importantly, the growth products are growing, and the Covid drugs are in decline. Nonetheless, the overall trajectory remains attractively to the upside.

Financial Considerations:

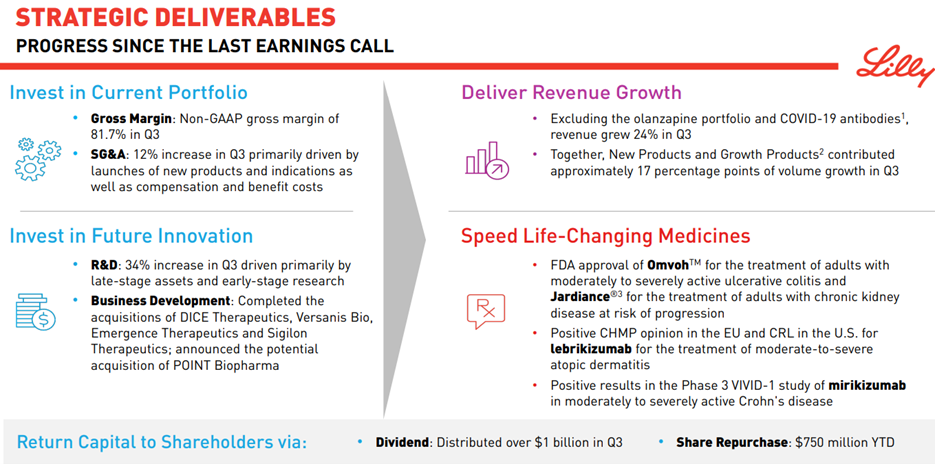

From a financial standpoint, Eli Lilly is very healthy. For starters, gross margins on the compan’s products remain very high (81.7%, non-GAAP, in Q3). And the net income margin is quite healthy too, recently at 15.6%. Additionally, Lilly has relatively low debt ~$20.3B (versus quarterly revenue of $9.5 billion). The company has an “A+/stable” credit rating from S&P. Importantly, Lilly also invests heavily in future innovation (research and development) to maintain healthy longer-term revenue growth.

Competitive Advantage

Lilly’s patent-protected products give it strong pricing power and enable the company to maintain high margins and healthy cash flow (more on cash flow later), thereby enabling it to spend heavily on research and development for its next generation of blockbusters. This puts the business in a strong position going forward.

Dividends And Share Repurchases:

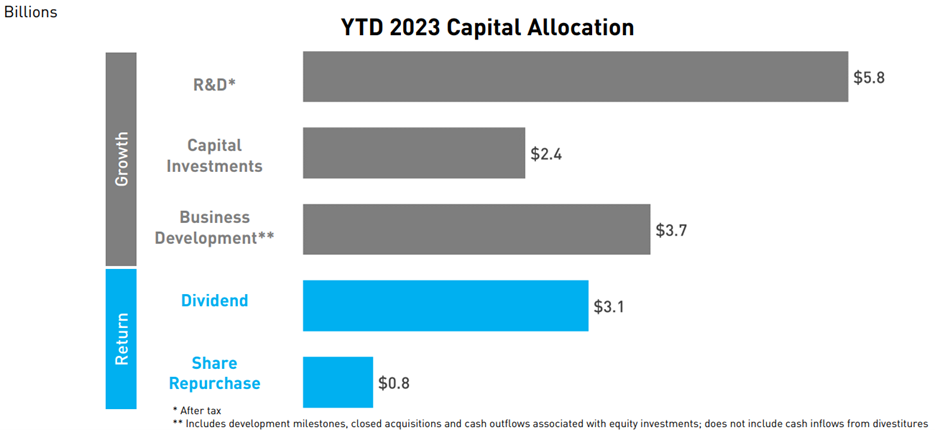

Eli Lilly generates a lot of free cash flow, to be allocated strategically. For some perspective, here is a look at 2023 (ytd) capital allocation (below). As you can see, the company is still able to pay healthy dividends (and repurchase shares) even after heavy R&D spending.

Lilly’s dividend has grown over 100% in the last five years (see our earlier chart). However, the dividend yield remains relatively low (0.8%) because the share price has grown even faster than the dividend.

Big Risks:

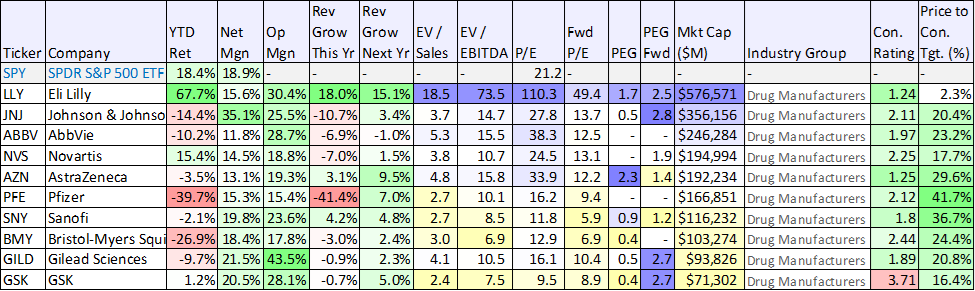

Valuation is the first big risk we’d like to point out for Eli Lilly. Specifically, as the price has risen dramatically in recent years, so have the company’s various valuation metrics, as you can see in the following table. For example, compared to peers, Lilly is more expensive on a P/E, forward P/E, EV/EBITDA and EV/Sales basis (see below).

However, despite these high valuation metrics, Lilly continues to also generate high growth. For example, revenue growth for this year and next year outpaces peers. Furthermore, on a PEG ratio basis (P/E divided by growth), Lilly becomes more reasonably priced relative to peers. The big question is whether the company can maintain such high growth to warrant its valuation.

Share Repurchases: We view the company’s ongoing share repurchases as a big risk too. Specifically, if Lilly shares are overvalued, then the money would be better off simply being returned to shareholders in the form of a dividend. However, per our earlier table, Lilly is spending a lot more on dividends than share repurchases—a good thing in our view (and perhaps an indication from management that they too believe the shares may be a little frothy).

Regulations/Lawsuits: Finally, regulations and lawsuits are always a huge risk in the pharmaceutical industry. The government (and government agencies, like the FDA) can (and often do) make sweeping decisions on drugs that can dramatically alter the profitability of a drug company like Lilly. Furthermore, the threat of large class action lawsuits also poses a huge risk.

Conclusion:

Overall, we view Eli Lilly as an exceptional wide-moat business with multiple blockbuster drugs, and a healthy product pipeline. However, the valuation is not cheap, and the company will need to sustain its high growth to warrant the valuation. Overall, we view Lilly as a reasonably priced business (per our earlier table, Wall Street analysts see limited upside, especially as compared to peers). However, the top companies (like Eli Lilly) are rarely ever super inexpensive. We are not buyers of Lilly at these prices, but it remains on our watchlist as a wide-moat industry leader.