Technology-driven payment processor, Visa (V), recently announced another big dividend hike (15.6%) and a massive $25B share repurchase program. And this industry-leading company is benefiting form the enormous digital payments secular trend. It also has one of the most impressive net profit margins you’re ever going to see. In this report, we review the business, the market opportunity, the valuation, the dividend and the risks. We conclude with our strong opinion on investing.

Visa (V), Yield: 0.8%

Visa is a payments technology company. Specifically, acccording to its investor relations site:

“Visa is a global payments technology company that connects consumers, businesses, banks and governments in more than 200 countries and territories, enabling them to use digital currency instead of cash and checks.”

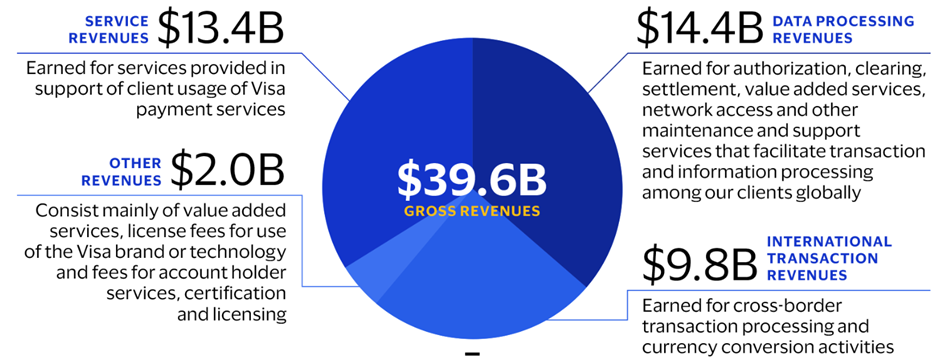

Visa is basically a credit card company that benefits from its own enormous network (more on the network later). For some perspective, here is a look at the company’s massive revenues, minus the cost of client incentives.

To give you a little more perspective, Visa transacts in 160 different currencies, it processed $11.6 trillion of payments in 2022 and it currently has ~26,500 employees.

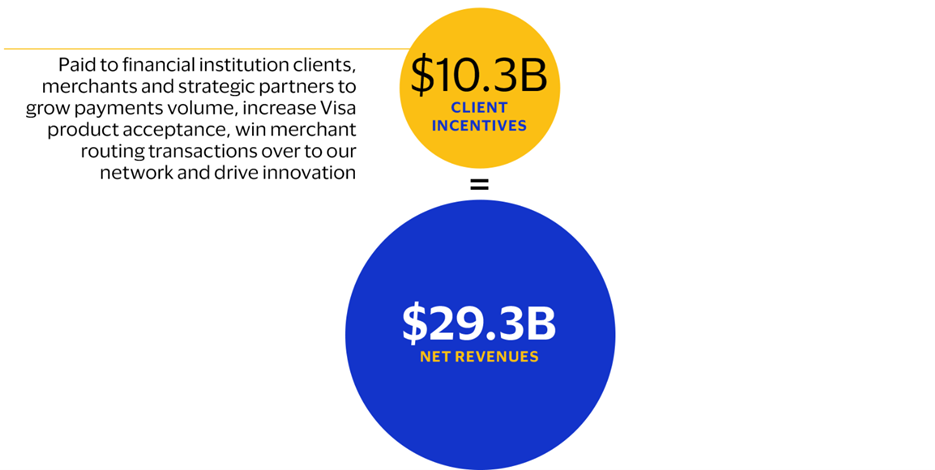

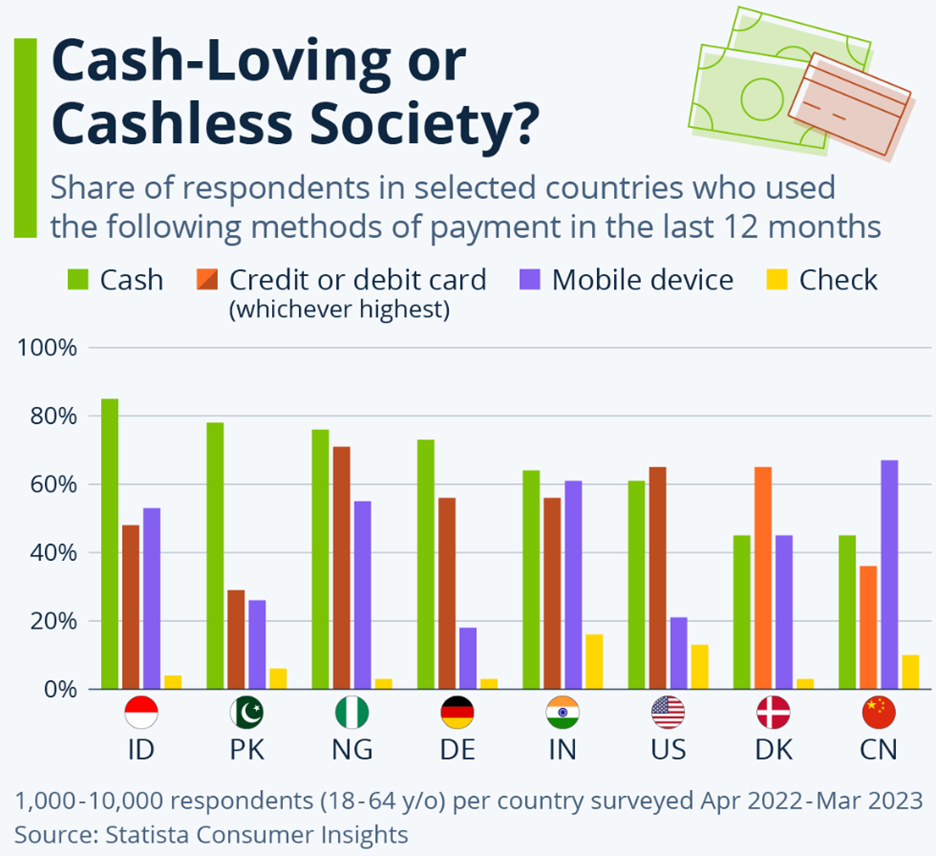

But perhaps the two most impressive financial metrics about Visa are its massive net profit margin (over 50%) and its ongoing high revenue growth trajectory (see chart below).

Both are derived from Visa’s great payments network—a seemingly insurmountable competitive advantage.

Competitive Advantage: The Network

Visa derives its competitive advantage versus everyone else from its global payments network. A network that is larger than all competitors and thereby creates advantages such as economies of scale and a “network effect.” To give you a little perspective, here is how Morningstar Senior Equity Analyst, Brett Horn, recently described the network:

Visa also processes roughly twice as many transactions as its closest competitor, Mastercard. Simply put, Visa’s position in the world of electronic payments is unparalleled. We don’t believe that building a new network with a comparable size and reach is realistic over any foreseeable time line, and view Visa’s position within the current global electronic payment infrastructure as essentially unassailable.

Visa’s payment network gives it incredible business advantages over all competitors.

Growth: Digital Revolution

Another truly impressive quality of Visa is its ongoing high growth rate derived from the ongoing digital revolution. For starters, here is a look at the company’s recent revenue growth (you can see the drop off during Covid—something the company continues to recover from, particularly with regards to international payments).

Over the last year, Visa grew revenues by 10.6%, and the company is expected to grow at a similar rate in the years ahead (for example, Wall Street’s forward revenue growth estimate for Visa is 10.4%).

And a big part of the ongoing growth is related to the digital revolution, and consumers ongoing switch to to digital from cash. According to CEO AIfred F. KeIIy, Jr, in Visa’s 2022 annual report:

“Consumer preference for digital payments has persisted as the world has recovered from the pandemic. Most consumers report that the way they paid for many goods has permanently switched to digital. The global transition to digital refIects this shift in preference — and expanding access to credentials, increasing acceptance and deepening engagement make up the three main pillars of our consumer payments enablement strategy”

and…

“And we continue to form partnerships across industries and geographies, helping more and more businesses, consumers and markets transition to the digital future.”

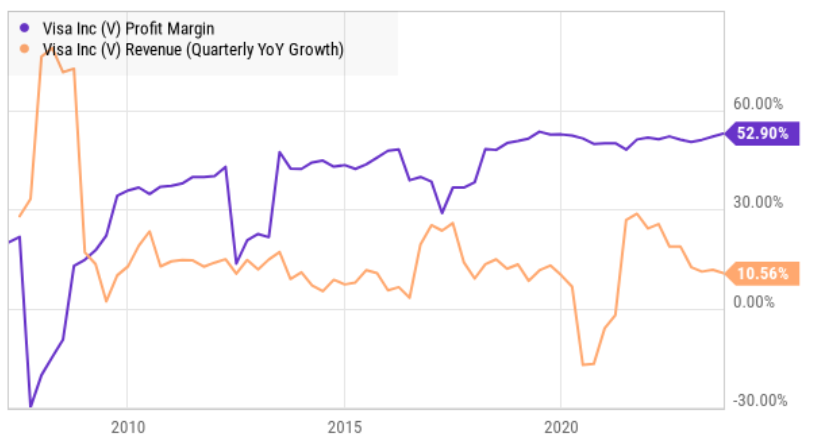

And for more perspective, here is some data on the ongoing transition from cash to digital.

Aside from the transition to digital, Visa is increasingly looking internationally for more growth (the majority of its revenue is in the US).

Valuation:

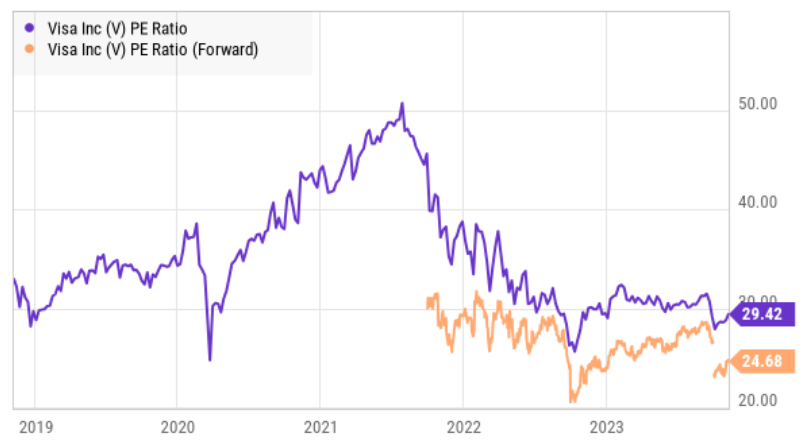

From a valuation standpoint, Visa remains attractively priced as compared to its massive profit margin and ongoing growth trajectory. With a forward price to earnings ratio of around 29.4x, some investors believe Visa is expensive.

However, considering the very high ongoing growth rate and the huge profit margins (which are significantly higher than peer MasterCard (MA)), Visa’s shares are attractively priced.

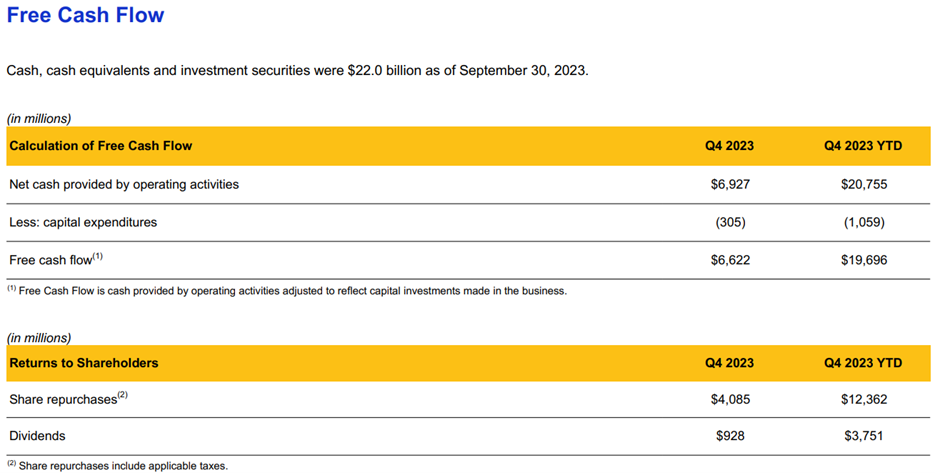

Especially considering Visa generates massive free cash flow, and continues to return significant cash to investors through growing dividends and share repurchases. Visa is a rare company that continues to grow fast and still has left over cash (tons of it) to return to shareholders (in part because it is such an asset light business to begin with).

The Dividend

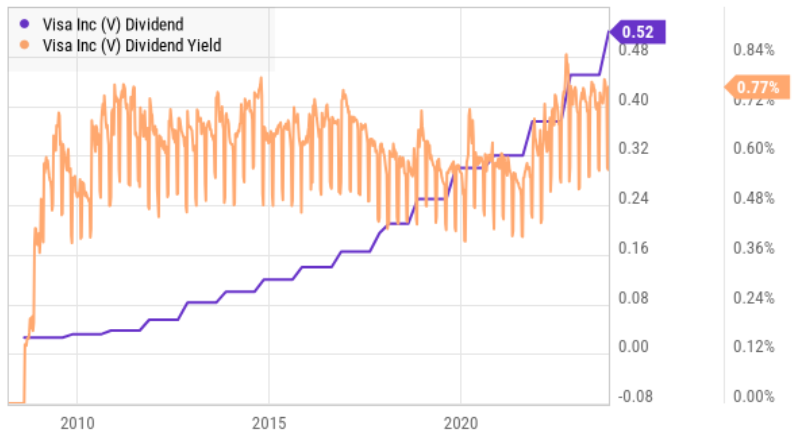

Also worth mentioning, Visa has increased its dividend per share for 15 years in a row, despite the fact that total dividend paid has been going down (because there are significantly less shares outstanding on which to pay dividends—because of ongoing share repurchases).

And while some investors decry Visa’s low current yield, “yield on cost” can also be an important metric to consider. Specifically, the current yield is low because the price keeps increasing so fast, and if you had bought a share of Visa 10 years ago at $44.88, your current “yield on cost” is over 4.0%. That is very impressive considering most companies aren’t able to grow their dividend as quickly and powerfully as Visa. And what’s more, Visa is on track to keep growing its dividend (and earnings) going forward.

For a little perspective, here is a look at the 10-year total return (price appreciation, plus dividends reinvested) of two Dow Jones stocks, Visa (0.8% current yield) and Verizon (VZ) (7.4% current yield). Visa is the total return winner, and its dividend continues to grow much faster.

Risks:

As attractive as Visa is, there are risks that should be considered. For example, Visa’s business is directly tied to the economy, and if the economy goes down, Visa’s earnings growth rate will likely follow. However, long-term, we expect the global economy to grow and Visa’s business to growth with it.

Regulation and political factors also create risk. For example, because Visa has such a dominant position, it faces risks of harsh government regulation. Further, some international governments have shown preference for local payment networks instead of Visa. Further still, Visa’s recent exit from operations in Russia is an example of a geopolitical risk.

Electronic payment disruption is another risk factor for Visa. For example, we see a constant wave of new fintech companies attempting to disrupt the industry, as well as more established fintech companies like Block (SQ), PayPal (PYPL), Stripe and others. Fortunately, Visa continues to work in partnership with many of these companies. For example, in the annual report, CEO AIfred F. KeIIy, Jr. explained:

“We continue to see mutually beneficial partnerships as key to evolving digital money movement in the future. In the past fiscal year, we signed over 400 commercial partnerships with fintechs globally, from early-stage companies to growing and mature players.”

Nonetheless, payments industry disruption remains a threat to Visa’s business. While Visa’s competitive advantages are huge there is massive incentive for disruptors to challenges Visa’s massive digital payments empire.

The Bottom Line:

Simply put, Visa is a very attractive business because of its huge profit margin, rapid ongoing revenue growth, tons of free cash flow (for ongoing share repurchases and dividend growth) and its current valuation (it’s not overly cheap, but the shares will likely continue to increase significantly over time considering the company’s massive growing opportunity and leadership position in digital payments. We currently own shares of Visa in our Income Equity portfolio and we have no intention of selling this very attractive long-term blue chip leader.