Ares Capital is a popular big-dividend (9.7% yield) business development company (“BDC”). It has a long track record of success in providing capital (financing) to diverse middle market companies. However, on a go-forward basis, you cannot feasibly underwrite all 490 portfolio companies Ares works with. Fortunately, Ares does it for you, and they’re good at it. Also fortunately, you do have the ability to assess the current market environment (i.e. the big macroeconomic challenges that are coming) and how it will affect Ares’ unique business (we also do this for you in this report). And after reviewing Ares in detail (i.e. the business, the financials, the risks), we conclude with our strong opinion on investing.

What is a BDC?

BDCs (i.e. business development companies) were created by an act of Congress in the 1980’s with the goal of helping small businesses (i.e. middle market companies) by making it easier for them to access capital. As such, BDCs are not subject to corporate taxation as long as they pay out almost all of their income in the form of dividends to investors. The investors (i.e. the people that buy/own publicly-traded BDC shares) benefit from the large dividend payments that BDCs are known for.

To oversimplify, the BDC business model basically consists of borrowing capital (at a low rate) and then lending it out at a higher rate. The BDC makes money on the net interest margin (i.e. the difference in the rate they borrow at and the rate they lend at). Obviously, this is a dramatic oversimplification, considering BDCs come in a wide variety of shapes and sizes. For example, BDCs can provide widely different types of debt and equity financing, and they can provide it to a widely different customer base (depending on each individual BDC’s area of expertise). Further, BDCs often apply various levels of leverage (borrowed money) to their balance sheets, in order to magnify their earnings from the net interest margin on their book of business. And BDCs must deal with varying levels of default (i.e. when the companies they lend to cannot pay back their loans, for example).

Current Market Environment:

Before getting into the specifics on Ares Capital, it’s worth first considering the current macroeconomic environment. For starters, here is a look at the current credit spreads on higher risk loans. We’re using the difference in rates between CCC-rated corporate bonds and US treasuries as a proxy for the types of loans BDCs make (even though BDC loans are private, and there is no readily available credit spread data available on such private loans).

As you can see, credit spreads are about normal by recent historical standards, and they also tend to blow out (widen) when the market faces distress (like it did during the pandemic, and more recently when the fed first started aggressively raising interest rates. When credit spreads are wide, that is a good indication that the chances of loans defaulting (such as the loans BDCs make) is elevated. Contrarians often like to buy when credit spreads are wider, and overly conservative investors like to sell at the first signs of widening. We prefer to consider each BDC’s unique situation in light of the current credit and interest rate environment.

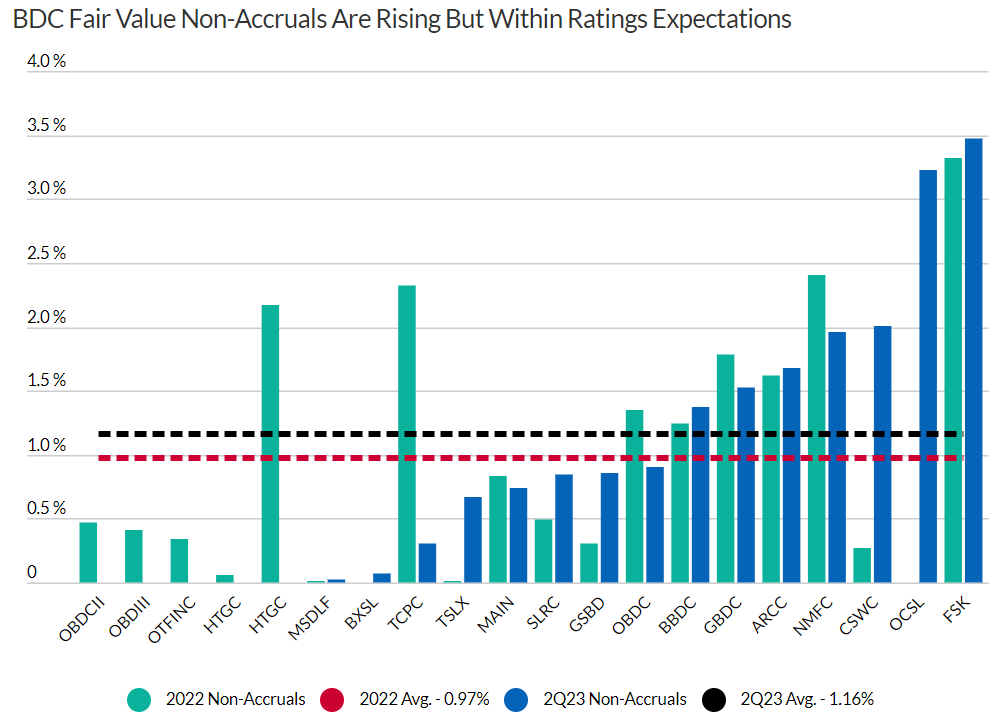

This next chart (from Fitch) shows BDC non-accrual as rising. A non-accrual is basically a loan made by a BDC whereby the borrower is not paying it back per the agreed upon terms. Non-accruals are bad, and they have been on the rise for BDCs, including Ares.

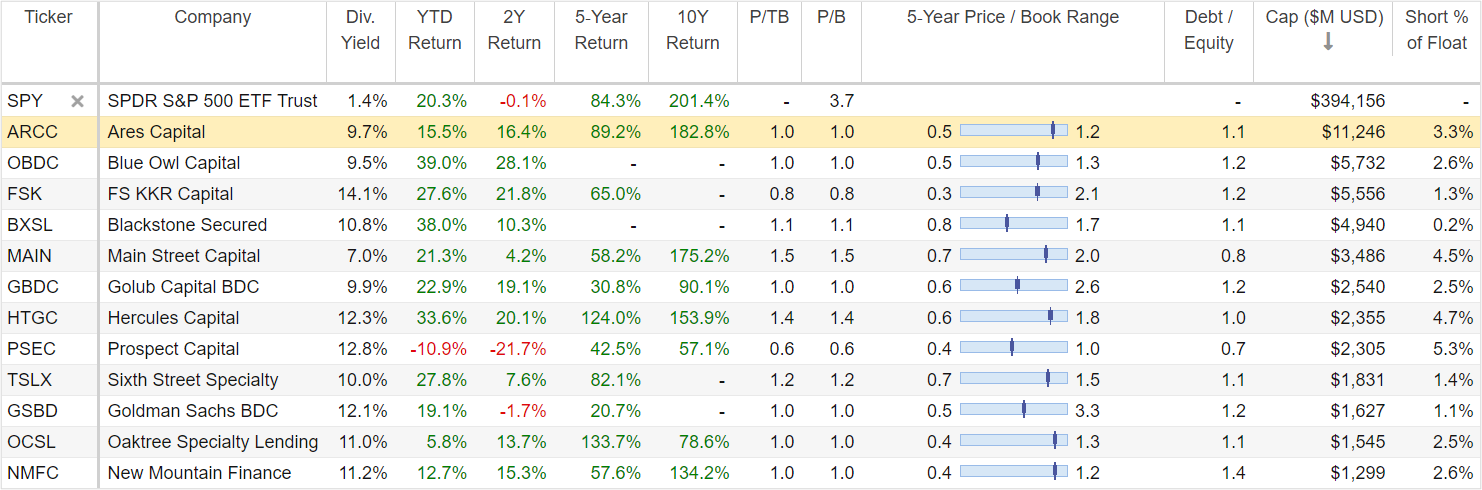

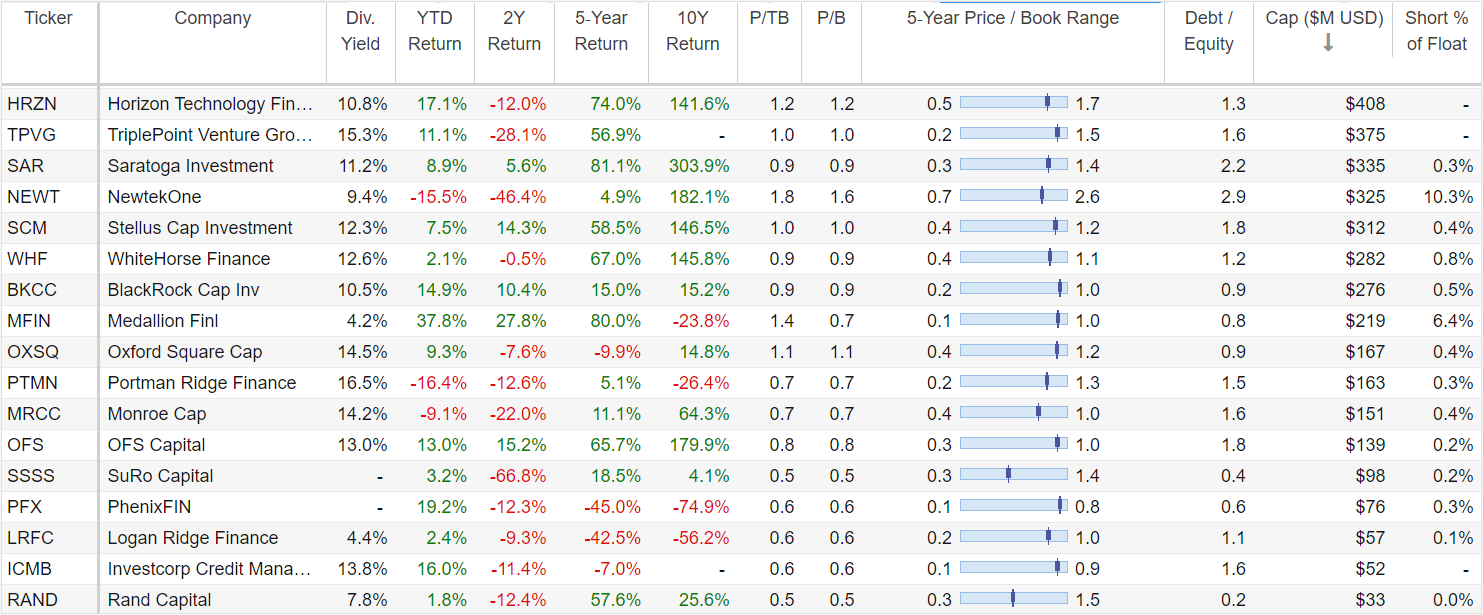

For a little more perspective, here is a look at various data points for over 40 big-yield BDCs. As you can see, returns have generally been strong this year (as many BDCs have experienced higher income thanks to floating rates loans as interest rates have risen), and price-to-book values (a common BDC valuation metric) currently hover around 5-year norms.

So with that backdrop in mind, let’s get into Ares

Overview: Ares Capital (ARCC):

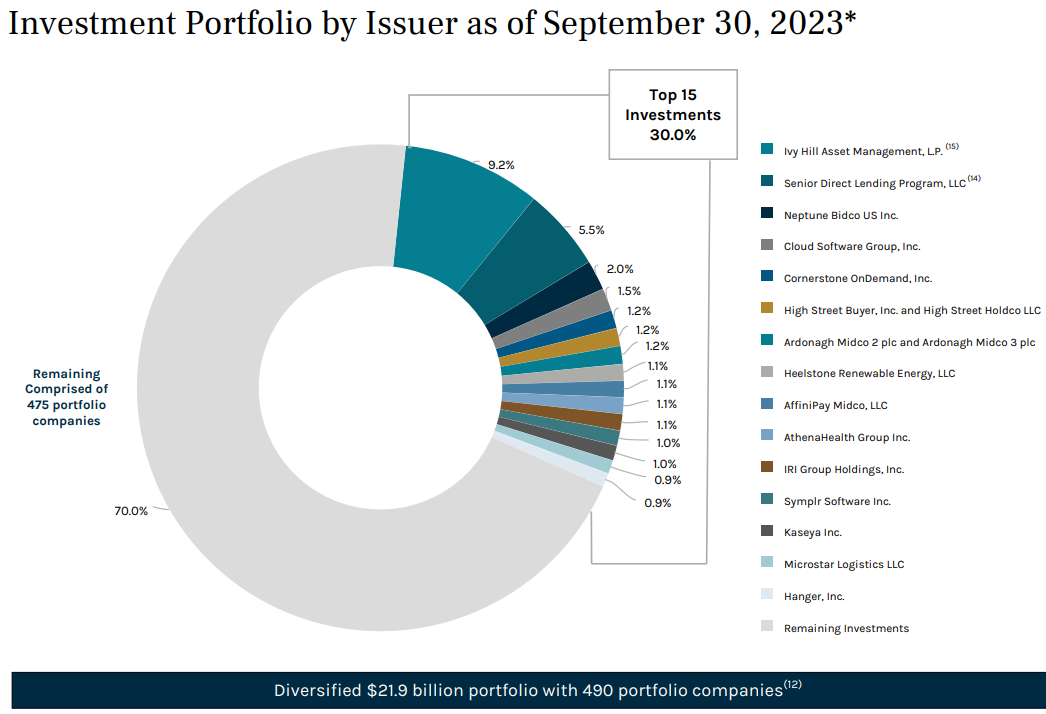

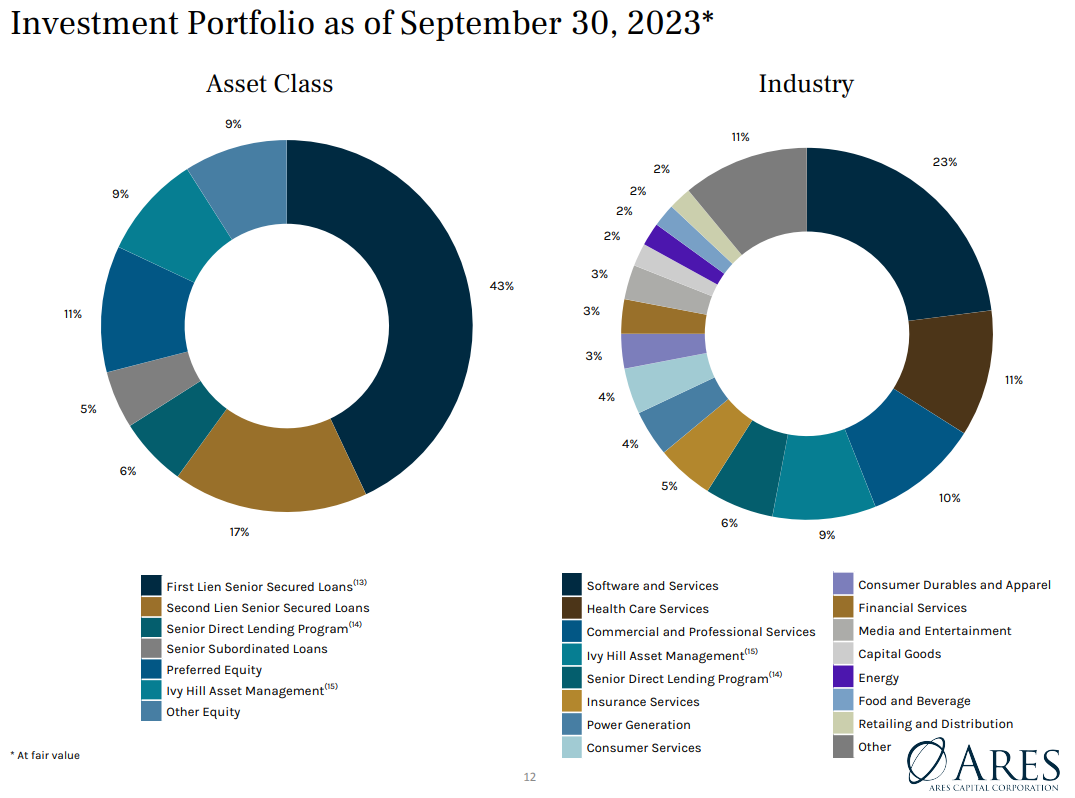

According to the company’s website, “Ares is a market-leading Business Development Company delivering comprehensive financing solutions to the middle-market.” For perspective, the following graphics provide a breakdown of financing it has provided to the 490 portfolio companies it currently works with.

As mentioned earlier, we cannot feasibly review and underwrite the deals Ares has made with all of these companies. However, we do know Ares in an industy-leading blue-chip BDC with a long track-record of success. And we also know it has faced far more challenging macroeconomic environments than the current one, and it has survived and thrived.

Further still, we can consider Ares’s aggregate financial position and performance, as we do in the next section.

Financial Performance:

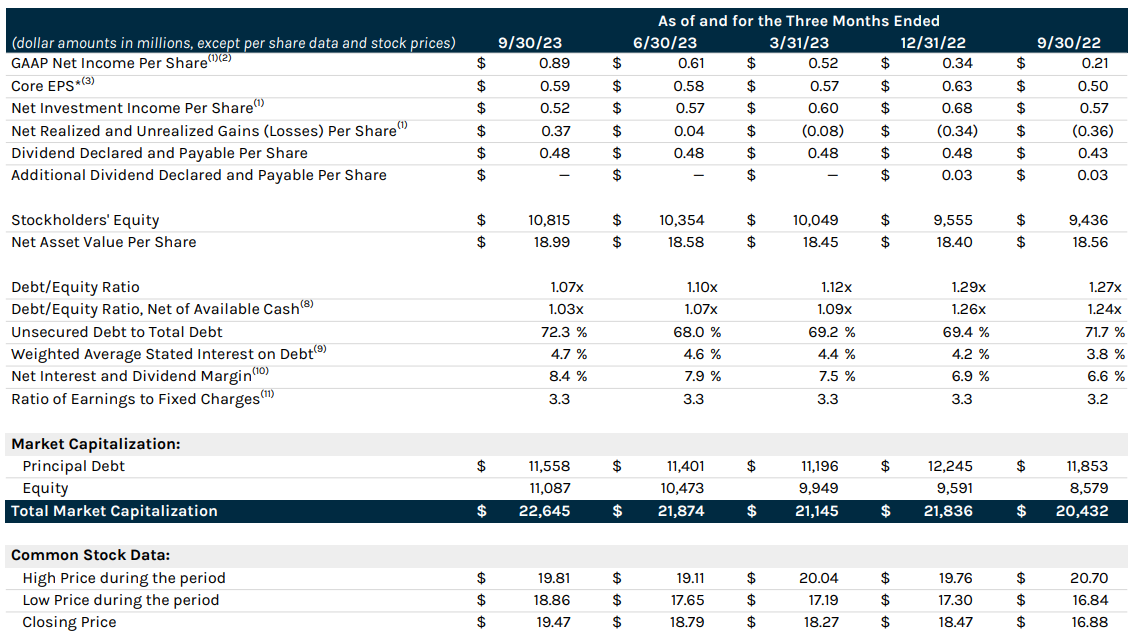

Net Investment Income: The following graphic (from Ares’ most recent investor presentation) shows the company’s net investment income per share (a very important BDC metric) has been strong, but weakened slightly in recent quarters (down from $0.57 a year ago to $0.52 most recently, and with a fair level of volatility).

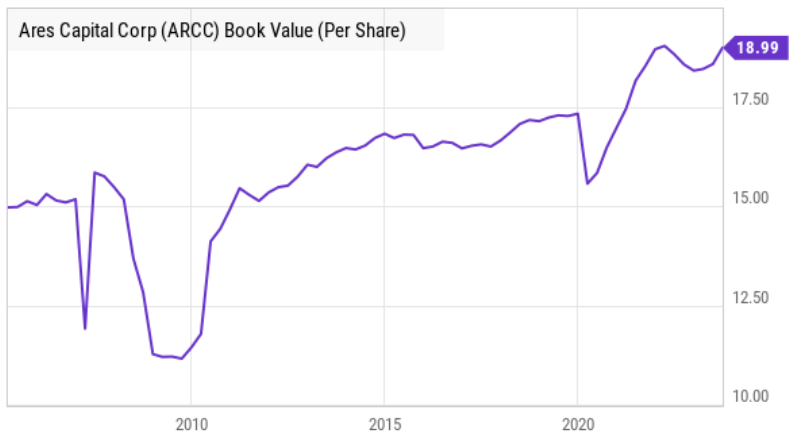

However, the above graphic also shows Ares’ book value per share has remained strong and growing. Book value is a high-level indication of a BDC’s ability to earn net investment income in the future.

And as per a recent report from Fitch Ratings:

“Portfolio growth [book value] remains muted, related largely to add-on deals, and prepayment activity is still low. Still, there is some divergence across the sector, with venture lender Hercules Capital posting portfolio and NII growth of 14.5% and 88.6%, respectively compared with 1.5% and 39.5% for Ares Capital.”

The Dividend:

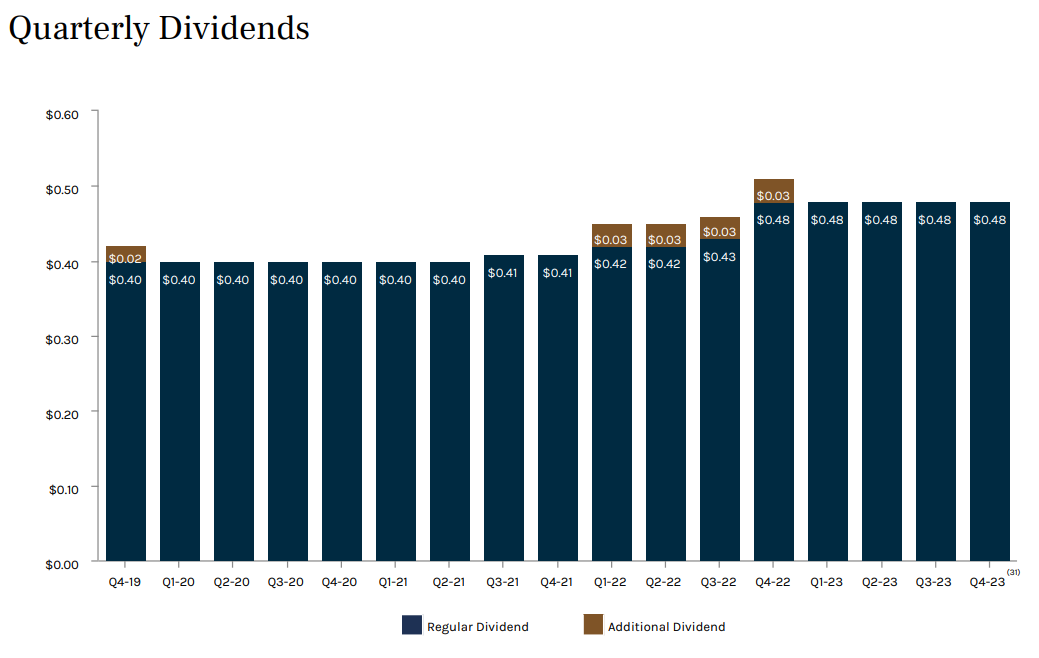

Another important BDC metric is the dividend (after all, the dividend is the reason many investors invest in BDCs), and Ares dividend has been strong.

In particular, Ares’ dividend of $0.48 per share is covered by its net investment income (from our earlier graphic) of $0.52 per share. There is volatility in NII from quarter-to-quarter, and in recent quarters (Q4-22 and Q1-23) Ares’ NII has been higher ($0.68 and $0.60, respectively), further exceeding the dividend.

Valuation:

The most common high-level valuation metric for a BDC is price to book value. Here is a look at the historical level of that metric for Ares (i.e. it currently sits fairly close to average).

Generally speaking, when a BDC trades at a price-to-book value above one, that is considered a premium, and below one—a discount. You can also see the historical five-year range of price-to-book value for many BDCs in our earlier BDC comparison table.

Risks:

Default Risk: BDCs face a wide variety of risks, but the biggest is generally the risk of default (i.e. when they don’t get paid back on their loans). As mentioned earlier, loans on “non-accrual” status have ticked up this year (a bad thing), but here is a more granular look at Ares (Ares has disposed of some non-accrual loans to make the percentages appear better).

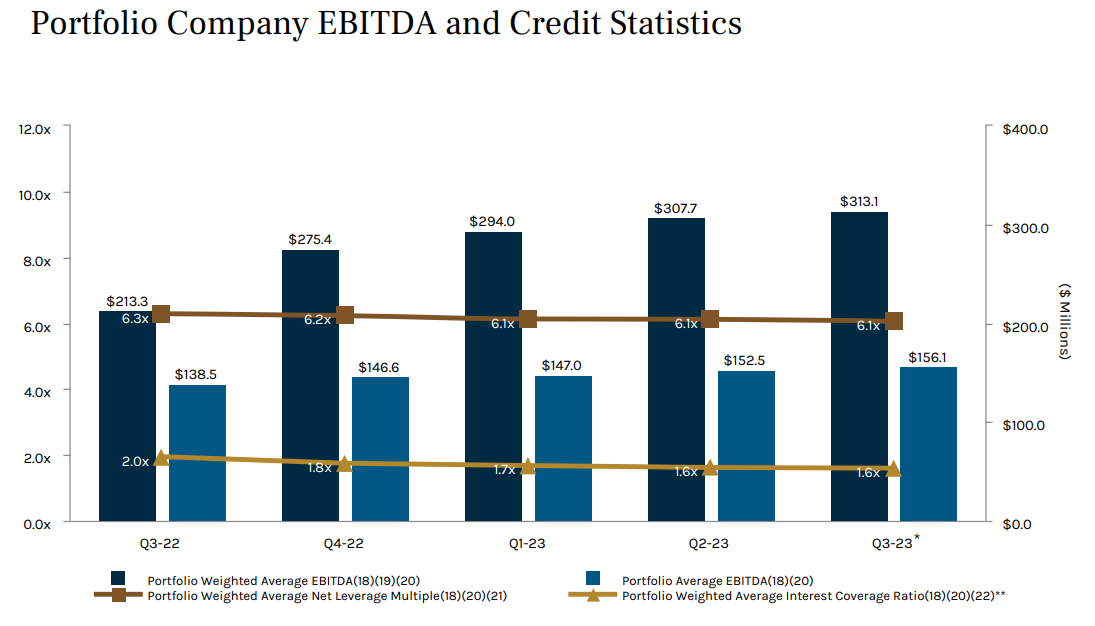

Another important metric, you can see the weighted average “interest coverage” ratio for Ares’ portfolio in this next graphic, and it has worsened over the last year. This is a result of the challenging macroeconomic environment (i.e. a slowing economy and higher interest rates combine to make it more challenging for borrowers to pay back their loans).

Recession is another big risk for Ares Capital (and BDCs in general) because if the economy slows then more portfolio companies will default. If conditions get bad enough, Ares will be forced to cut its dividend. Further, a recession could cause the book value of Ares’ investment to decline (thereby reducing its future earnings power too). Fortunately, as we saw earlier, Ares has some cushion built in (regarding dividend coverage and interest coverage) and the company has survived more challenging market conditions in the past.

Conclusion:

Overall, we view Ares as healthy, but we do not expect dramatic price appreciation in the near-term. Rather, we expect the dividend to remain relatively steady (we don’t foresee any cuts to the dividend, but the potential for large increases and/or special dividends seem muted too). However, if it is simply big steady income you are seeking, we believe Ares will continue to deliver. We are currently long shares of Ares in our High Income NOW portfolio, and we have no intention of selling anytime soon.