A lot of mumblings about mega-cap stocks due for some mean reversion and underperformance in 2024, following an amazing 2023 (so far). In the semiconductor space (i.e. chip stocks), mega-caps like Nvidia and AMD have dominated, and for good reason (i.e. their tie in to explosive growth in data centers related to Artificial Intelligence demand for chips). In this quick note, we share data on 60 chips stocks (including large, mid and small caps), and some thoughts on which names could benefit in 2024.

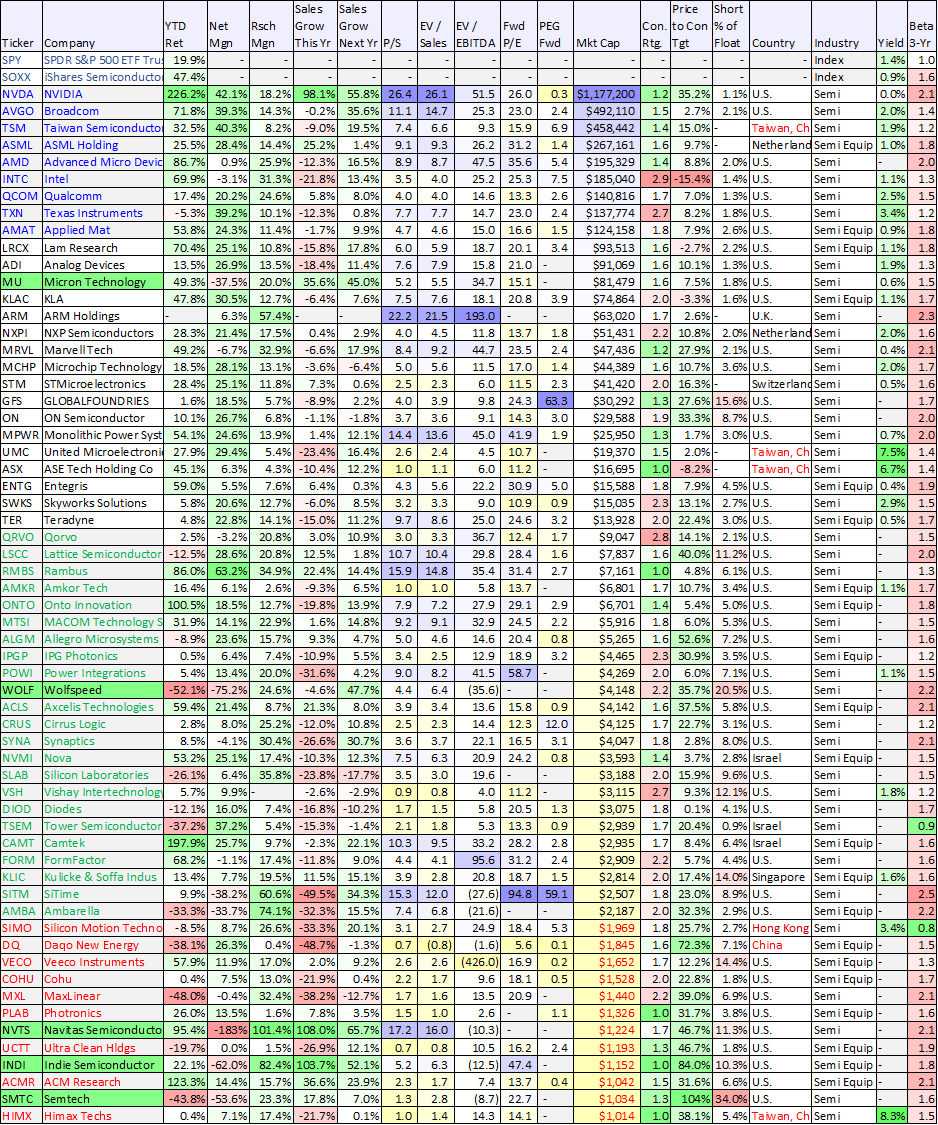

source: StockRover (data as of mid-morning, Tues Nov 28th)

Some of the most interesting data points in the above table (chip stocks sorted by market cap) are short interest and expected sales growth for next year. You can also see a variety of of valuation and performance data too.

We’ve highlighted a few non-mega-cap names (in green) that look interesting based on expected revenue growth and short interest. And if we do see the mean reversion for mega-caps in 2024 that a lot of investors keep murmuring about, some of these smaller companies could perform exceptionally well.

We’ll be digging in deeper to these names in the coming weeks, looking for particularly attractive ideas—particularly beat up names that may also benefit from artificial intelligence (data centers) and short covering.

Worth mentioning, you don’t have to be cutting edge leaders (like Nvidia and AMD) to benefit from the AI secular trend. There are a lot of related names (for example in the semiconductor equipment industry) that will benefit from the AI secular trend—which still appears to just be starting.