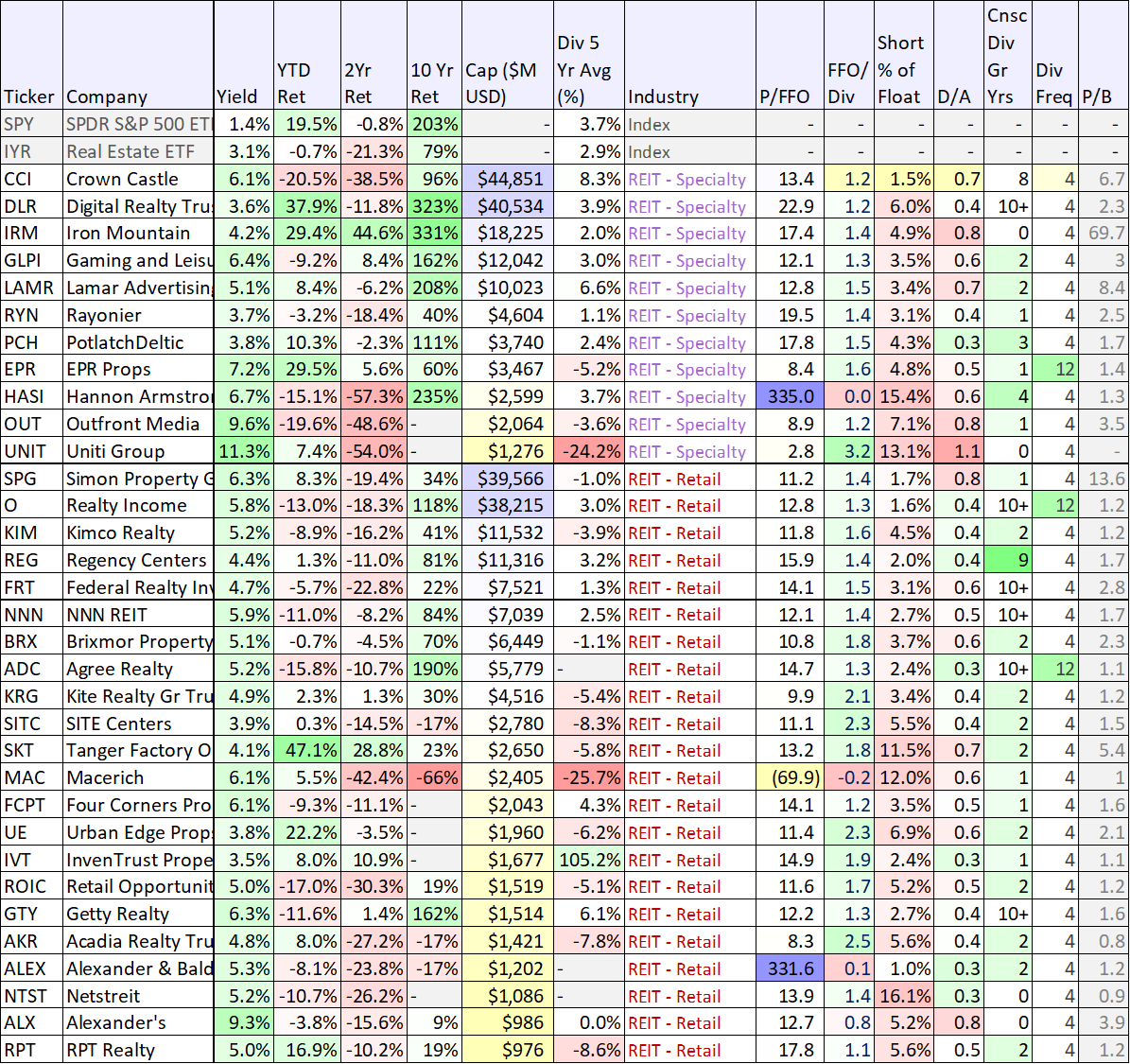

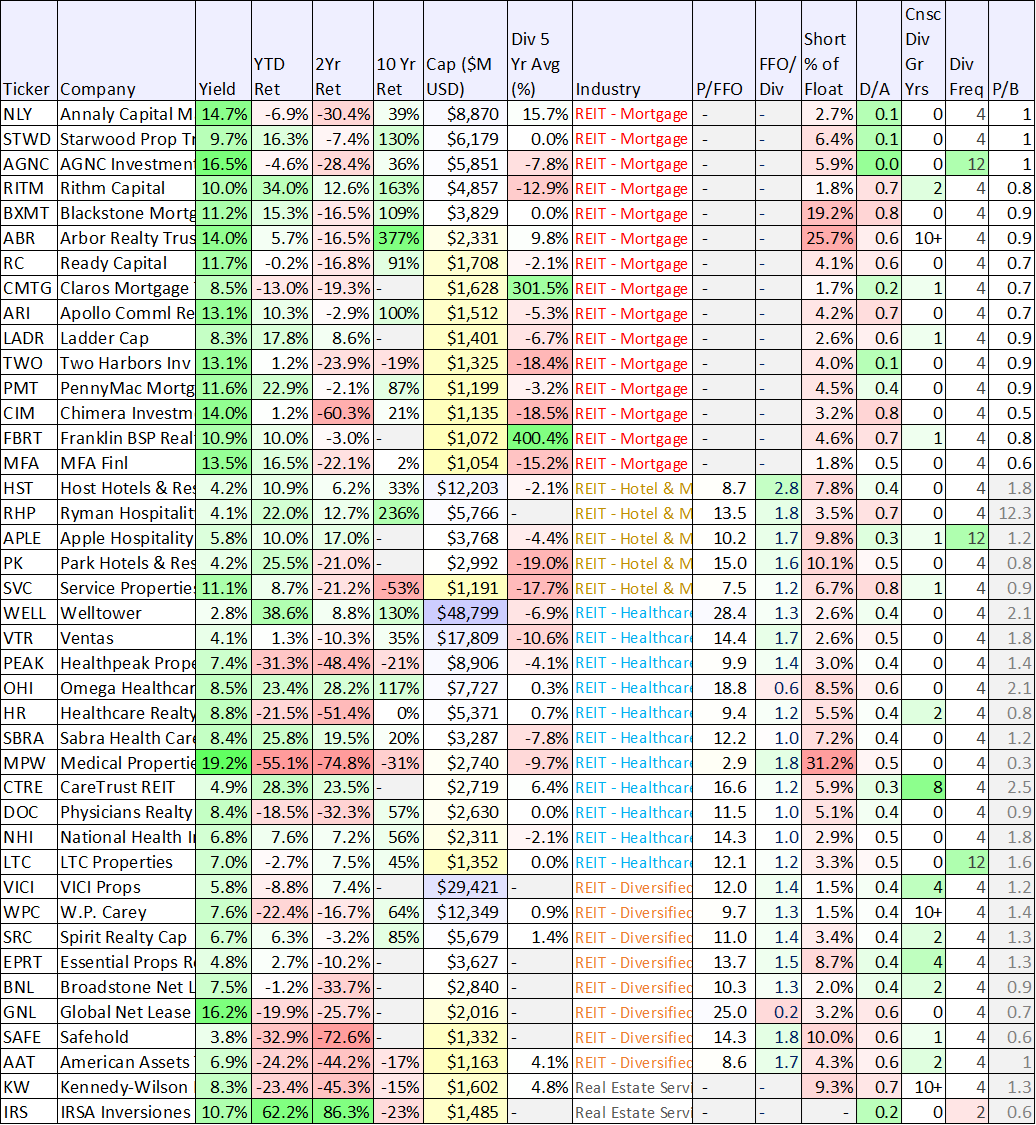

Quick Note: Sharing data on over 100 big-yield REITs, sorted by industry group. As you can see, performance has been horrendous over the last two years, for some groups more than others. The unusual 1-2-3 punch or rising interest rates, an uncertain economy and the winds of secular change (for example, work-from-home and online shopping) have all played a big part.

We currently own shares of multiple REITs across our Income Equity and High Income NOW portfolios, including:

Realty Income (O): This retail REIT is one of the financially strongest and it is trading at an attractive price, as we recently wrote about here.

WP Carey (WPC): This diversified REIT will be spinning off its office properties later this year (a good move, in our view, considering office has been decimated by permanent work-from home arrangements) as we wrote about here.

Plymouth Industrial (PLYM): We continue to like this small industrial REIT, and we like the industrial industry. Specifically, Retail REITs are getting replaced by the internet, Office REITs are getting replaced by work from home, but industrial REITs remain a critical part of the macroeconomic infrastructure.

VICI Properties (VICI): VICI is an attractive “diversified” REIT, as the dividend is covered and the P/FFO ratio is compelling. VICI own the properties for Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Overall, we view select REITs as presenting attractive contrarian opportunities. In particular, we still don’t like office, we don’t like mortgage REITs (as we wrote about here) and we don’t like most retail. However, as interest rates and the economy stabilize the group is positioned for improvement and price appreciation. REITs can be an important component of a prudently diversified income-focused income-investment strategy.