The data center company we review in this report is the epitome of a high-risk / high-reward opportunity, and the odds appear tilted strongly towards high reward (based on the massive secular opportunities: mainly explosive growth in Artificial Intelligence, and to a lesser extent blockchain hosting). This isn’t the type of stock you bet the farm on, but it’s absolutely worth considering for an allocation within a prudently concentrated high-growth portfolio. In this report, we review the business, the opportunities, valuation and risks, and then conclude with an important takeaway.

Applied Digital (APLD)

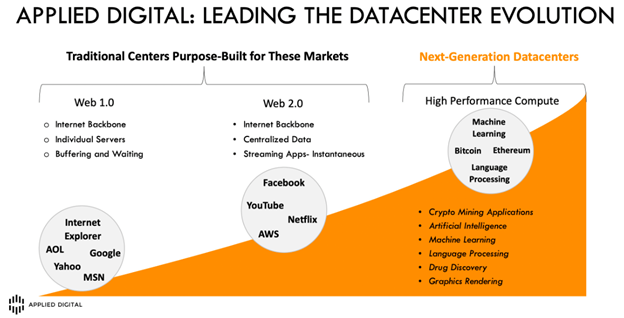

Applied Digital designs, develops and operates next-generation datacenters across North America to provide digital infrastructure solutions to the rapidly growing high performance computing (“HPC”) industry. The company is leading the data center evolution, as you can see in the following graphic:

Source: Investor presentation, May 2023.

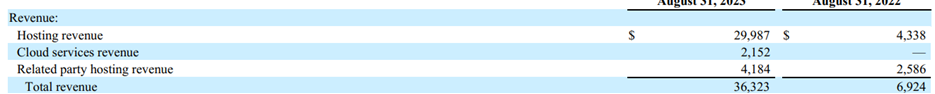

The company operates under three reportable segments, including (1) artificial intelligence cloud services (“Cloud services”), (2) high performance computing (“HPC”) datacenter hosting, and (3) datacenter hosting (“Hosting”). And as you can see in the table below, most of the company’s growing revenue currently comes from “Hosting Revenue.”

The Hosting segment is the largest (by revenue), and provides infrastructure, including energized space, and colocation services to crypto mining customers. Customers place hardware they own into the Company’s facilities and the Company provides operational and maintenance services for a fixed fee. This segement has significant upside (as crypto prices, such as Bitcoin, regain momentum), but it is the next segment that is most interesting (due to cloud AI growth).

The Cloud services segment is the most interesting it terms of growth opportunities (related to Artificial Intelligence). This segment operates through the Sai Computing brand and provides cloud services applicable to artificial intelligence. Customers pay a fixed rate in exchange for a managed hosting environment supported by equipment provided by Applied Digital.

The HPC datacenter segment designs, builds, and operates next generation datacenters which are designed to provide massive computing power and support high-compute applications within a cost-effective model.

Massive Secular Growth from AI:

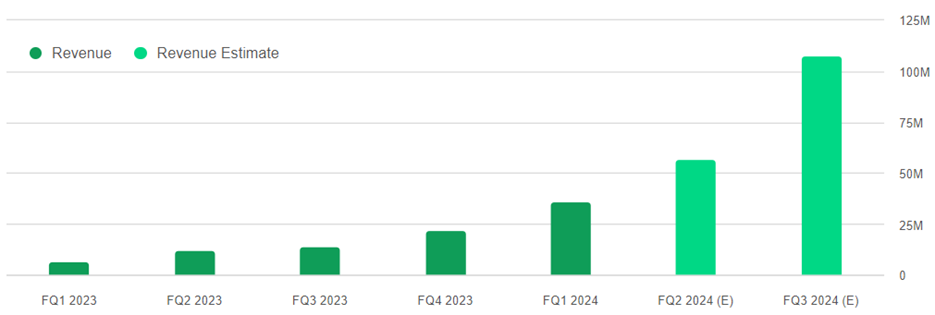

To put this company’s growth potential into perspective, here is a look recent quarterly revenue, and expected revenues going forward (revenue growth is expected to keep ramping quickly):

And to look out a little further (annually instead of quarterly), the expected revenue growth is quite dramatic (as you can see in this next chart).

The revenue growth is to be driven largely by AI growth. In particular, Applied Digital has 34,000 GPUs (semiconductor chips) on order, and expects to receive them soon thanks to its established partnerships with leading OEMs like Super Micro (mentioned earlier), Hewlett Packard Enterprise and Dell, and combined with the company’s recent “Elite Partner” status with Nvidia.

For some perspective on the current state of business and growth in each of the company’s three operations segments:

Blockchain Hosting Operations: Applied Digital currently has three blockchain hosting facilities, with its the Jamestown facility (operating at full capacity), its Ellendale facility in North Dakota (fully operational and contributing to results) and its Garden City, Texas facility (now fully energized, after short delays, and providing total hosting capacity of ~500 megawatts).

AI Cloud Services: Applied Digital's AI cloud service is gaining traction, with the recent activation of GPU clusters for Character.AI and the addition of two new AI cloud customers. The total annual contract value for AI cloud services contracts is approximately $378 million, with substantial prepayments from customers to fund capital requirements.

HPC Data Centers: The company is actively developing purpose-built HPC data centers with 300 megawatts of capacity. Discussions are ongoing with potential anchor tenants, and the aim is to secure customers for each facility, with plans to have these facilities fully operational within the next 24 months.

There are risks to Applied Digital’s growth (which we will cover in a later section of this report), but in a nutshell, demand for AI datacenters in currently extraordinary, and the company is preparing to quickly build out additional data centers (using forthcoming GPUs) as soon as additional large contracts are received (which is expected and highly likely to occur soon, based on industry demand).

Valuation:

Applied Digital is NOT currently profitable, and this scares many investors away. However, we view the negative net income as prudent as the company prepares so take advantage of massive growth opportunities ahead.

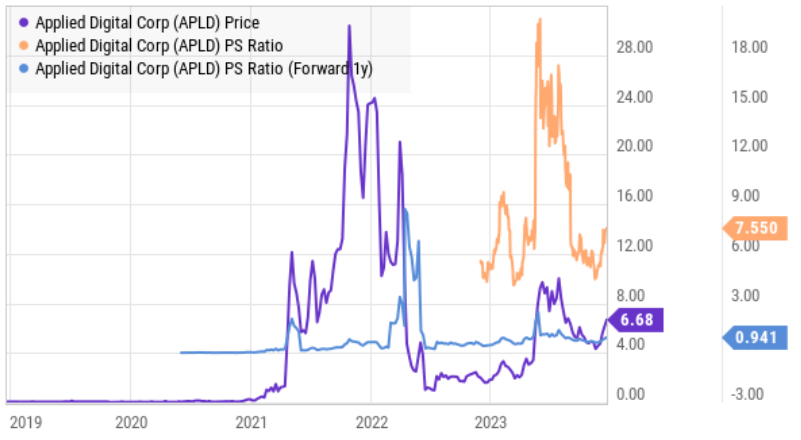

A high-level valuation metric for rapidly growing (but still not profitable) business is the price-to-sales ratio, as you can see in the following chart.

And while the current P/S ratio of 7.55x may seem expensive to some, it’s actually quite inexpensive relative to the expected growth (as we saw in the earlier revenue growth charts). And on a forward P/S basis, Applied Digital is dirt cheap (at 0.94x) as compared to the opportunity it is set to capitalize on.

In fact, Applied Digital is one of the most highly rates stocks available, as per the 7 Wall Street analysts covering the shares. They collectively rate it a “strong buy” and believe the shares have ~170% upside versus the current share price.

Risks:

Of course, Applied Digital faces a wide variety of risk factors (this is part of the reason the shares are so inexpensive). For example:

Financing: Applied Digital’s financial position continues to strengthen as revenue grows. However the company is still not profitable and it’s at the mercy of markets for financing. For example, the company continues to explore financing options for GPU purchases and they rely on financing arrangements from vendors.

GPU Supply Chain: Applied Digital remains confident in the delivery schedule for GPUs, however any disruptions or delays in the supply chain could affect the ramp-up of its AI business.

Anchor Tenant Acquisition: Any development of HPC data centers by Applied Digital is contingent on securing strong anchor tenants. Based on secular demand, securing such tenants should not be a problem, but there is no guarantee the company will be able to secure such tenants in a timely fashion.

Competition: Applied Digital has some competitive advantages (such as low cost operations for HPC by locating close to energy sources and its incorporation of customer-preferred alternative energy sources too). Nonetheless, the high demand for AI solutions also keeps the threat of new competition high as well.

The Bottom Line:

Based only on backward-looking data, Applied Digital appears over-priced and unattractive (it’s not profitable). However, forward-looking estimates (driven by disruptive secular demand) suggest the company’s recent high revenue growth is just getting started (i.e. the business has a long way to run and to accelerate). And a forward-looking price-to-sales metric (for example) suggests these shares are actually very underpriced (and the 7 Wall Street analysts covering the shares strongly agree—they rate it a strong buy).

Applied Digital is not the type of stock you “bet the farm on” (because the future is uncertain). But it is the type of disruptive business that growth investors should consider (the potential upside is huge). We do not currently own Applied Digital, but we do expect to purchase shares before year-end (we really like the powerful secular upside opportunity here).