If you are an income-focused investor, you may have noticed that popular high-dividend REITs have struggled this year. Specifically, rising interest rates and secular changes to the real estate market have kept REIT prices low (while other market sectors, such as technology, have posted strong gains). In this report, we review a blue-chip REIT closed-end fund (“CEF”) that offers a large distribution yield (currently 8.1%) and trades at a significant discount to net asset value (“NAV”). After reviewing the strategy, distribution characteristics, leverage, price and risks, we conclude with our opinion on investing.

Cohen & Steers Quality Income Realty Fund

(RQI), Yield: 8.1%

The primary investment objective of RQI is high current income through investment in real estate securities (the secondary investment objective is capital appreciation). And the fund seeks to accomplish its objectives by investing mainly in public equity real estate investment trusts (“RIETs”) as well as some bonds (recently around 12% of the fund is invested in corporate bonds) and preferred stocks (recently around 8.6% of the fund was invested in preferred stocks).

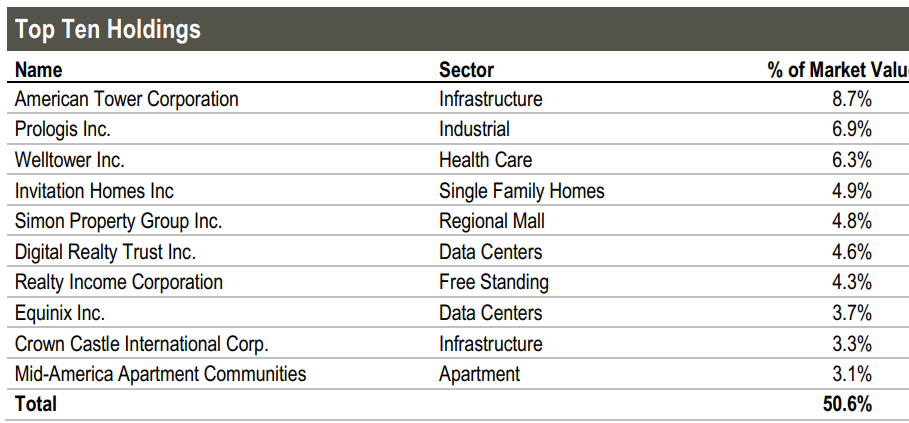

For your reference, here is a look at the fund’s recent top 10 holdings, which consists of REITs, many of which you are likely familiar with.

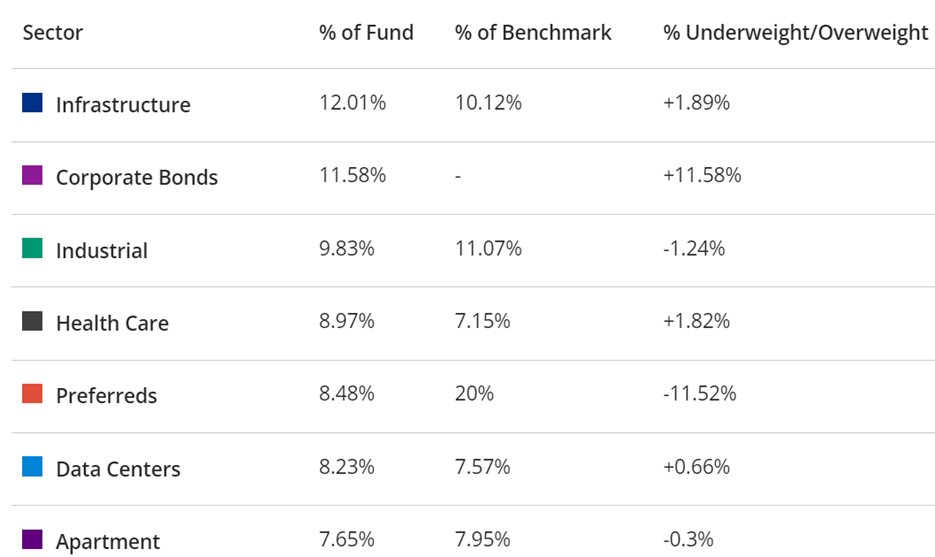

And here is a look at the fund’s top sector exposures (as of the most recent quarter end, 9/30/23).

As you can see, Corporate Bonds are the second largest at 11.58% and preferreds are the fifth largest at 8.48%.

Recent Real Estate Performance

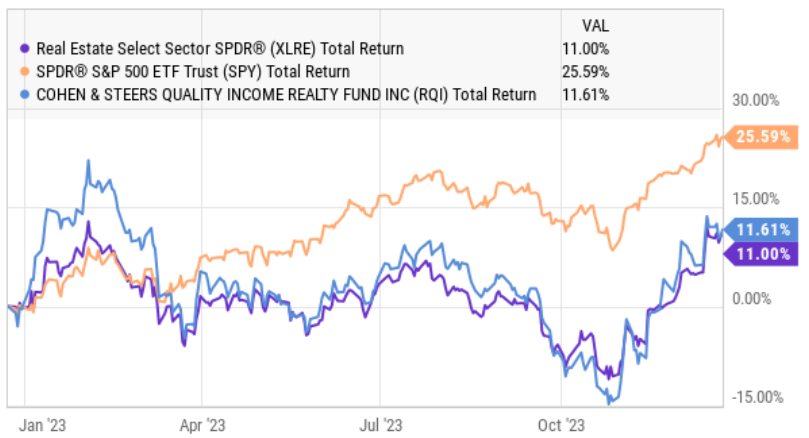

As mentioned, the real estate sector has underperformed the market recently, as you can see in the following chart.

One big reason for the weak performance has been rising interest rates. In particular, as rates rise it becomes more expensive for REIT tenants to borrow money for operations (thereby increasing the potential risk of default).

Another reason for weak real estate performance is secular change. For example, more people shop online now (this is bad for retail real estate), and more people work from home now (this is bad for office real estate).

Worth mentioning, RQI has large exposures to infrastructure and industrial real estate. These are two sub-sectors that we like because they’re arguably less impacted by the secular changes mentioned above.

Is RQI Right for You?

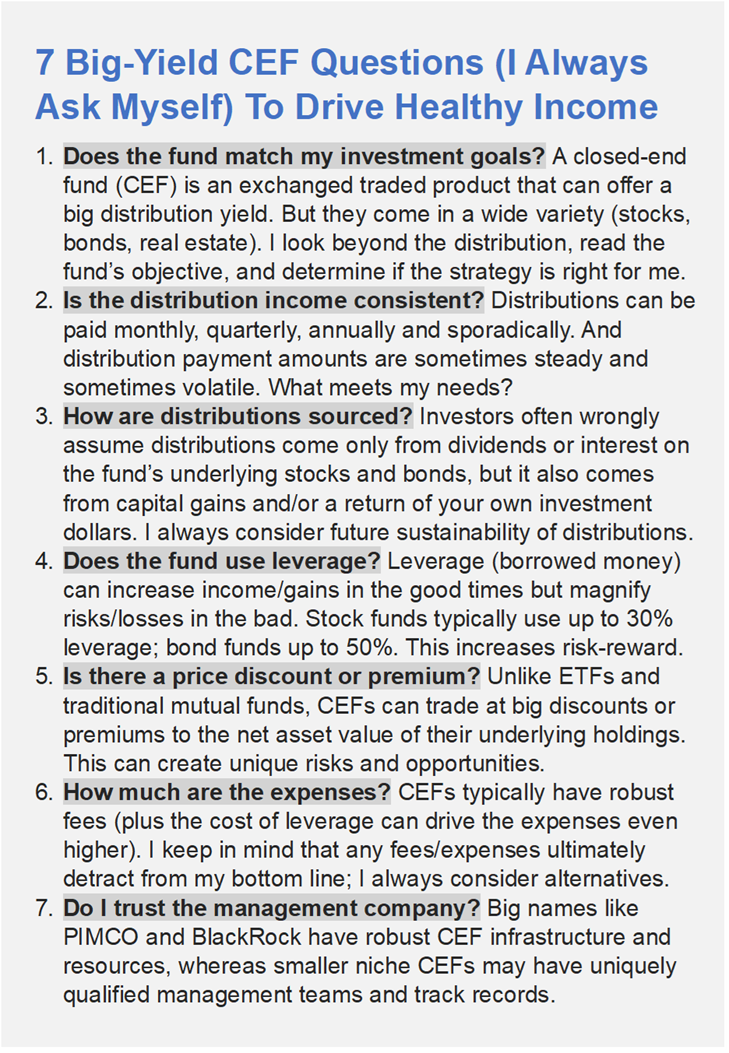

Before investing in any closed-end fund, there are 7 important questions you should always ask yourself, starting with “does the fund meet my investment goals?” More specifically, should you personally be investing in a real estate CEF? If you are an income-focused contrarian investor that likes to invest in things when they trade at a discounted price, then RQI might be worth considering.

Is the RQI distribution consistent?

RQI has paid consistent monthly distributions of $0.08 per share since 2017 (they switched from quarterly to monthly payments in 2016). Notably (but not surprisingly, the fund did reduce the distribution during the great financial crisis of 2008-2009). Nonetheless, for many investors, the recent dividend consistency is a sign of strength, especially since the distribution can fulfill important individual investor needs.

How are the distributions sourced?

Perhaps more important than distribution consistency is how the distributions are sourced. And in the case of RQI, they are being sourced from income (on the underlying holdings) and long-term capital gains (both are good).

As you can see above, RQI has not been using short-term capital gains or a return of capital (“ROC”) to source the distribution payments, and this is a good thing in terms of the fund’s health. Funds can get in trouble from a tax standpoint when too much of the distribution is from short-term capital gains (which can be taxed at a higher rate) and when too much of the distribution is sourced from ROC (which can jeopardize a fund’s long-term ability to sustain the distribution).

Leverage (Borrowed Money)

Leverage, or borrowed money, is another important consideration when investing in a CEF because it can create risks and opportunities. For example, leverage can magnify the distribution (i.e. make it larger than would be possible without leverage), but it can also magnify losses (when the market goes down, leveraged funds go down more, all else equal).

RQI recently had 29% leverage, which is significant for a “mostly” equity fund, but also prudent (considering the bonds and preferred stocks this fund holds are usually less volatile than equities (stocks) thereby making the leverage somewhat less risky). We are comfortable with this level of leverage in this fund, and believe it makes the investment opportunity more attractive.

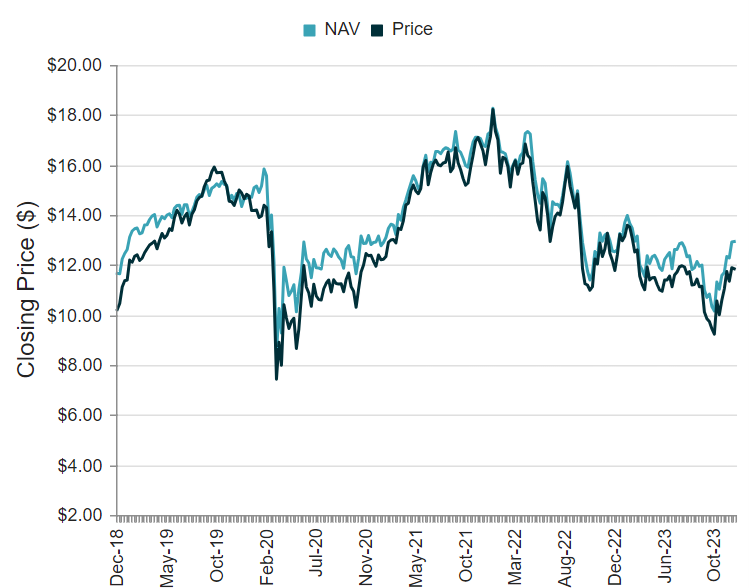

RQI Trades at a Discount to NAV

Another interesting characteristic of CEFs is that they can trade at large discounts and premiums to NAV. Specifically, NAV is the aggregate value of all the individual stocks and bonds a fund holds, and in RQI’s case, the fund trades in the public markets at a 8.4% discount to its NAV.

Unlike other mutual funds and ETFs, there is no mechanism in place to prevent CEFs from trading at large premiums and or discounts, and this can create significant opportunities and risks. All else equal, we greatly prefer to buy attractive CEFs at a price discount (not a premium).

And as you can see in the chart above, the RQI discount is large by its own historical standards. In our view, this adds to the attractiveness of this contrarian opportunity as REITs have fallen strongly out of favor in the market thereby adding selling pressure and adding to the size of the discount.

Expenses

Expenses are another important factor when investing in CEFs in particular because they are often quite significant. In RQI’s case, the total expense ratio was recently 1.91%. Important to note, approximately 1.0% of this amount is due to leverage (i.e. it costs money to borrow money). So without leverage, the approximately 0.91% expense ratio is significant, but not necessarily inappropriate (it is consistent with other funds).

Management Team

Also important to note, the expense ratio (above) includes the costs of the active portfolio management team that is selecting the individual securities and managing this fund.

The portfolio managers (above) are experienced and have the support and resources of Cohen and Steers backing them. For many investors, it makes sense to invest in a fund with an active management team to oversee the leverage, security selection and general operational management of the fund (as opposed to doing this all by yourself).

Conclusion

If you are an income-focused investor, that likes to invest in well-managed contrarian opportunities trading at a larger than normal price discount (versus NAV), the Cohen and Steers Quality Income Realty Fund is absolutely worth considering.

We currently own shares within our prudently diversified, High Income NOW Portfolio, and have no intention of selling. We’re looking forward to ongoing healthy big distribution payments and the potential for price appreciation as the discount could revert back to a smaller level (a good thing) and as the market’s current dislike for REITs may be overdone and may soon revert the other way (especially as interest rate hikes appear to be over, and as we like the fund’s specific sub-sector exposures). Long RQI.