The PIMCO Dynamic Income Fund (PDI) and PIMCO Corporate & Income Opportunity Fund (PTY) are absolute favorites among many income-focused investors. They both have long track records (one decade and two decades, respectively) of successfully delivering big monthly income payments (they currently yield 13.5% and 10.6%, respectively) and because they’ve sourced all that big income over the years without the return of capital (“ROC”) that plagues so many other high-income funds. However, a look under the hood reveals that these two PIMCO trophy funds have, in fact, been using ROC to fund their distributions (despite marketing materials that suggest otherwise). In this report, we review all the important details and then conclude with our strong opinion on investing—caveat emptor!

About PDI and PTY:

Big monthly income from a top-of-the-line management company (PIMCO) makes these two world-class closed-end funds (“CEFs”) extremely popular. We’ll explain more about what these two bond funds own momentarily, but it’s important to first quickly review the uniquenesses of CEF investments.

Unlike exchange-traded funds (“ETFs”) and other mutual funds, CEFs are “closed-end” which means they generally issue a fixed amount of shares and then trade at market prices based on supply and demand (unlike other funds which are frequently creating and eliminating shares outstanding to deal with fund flows). Because of this, CEFs often trade at wide discounts and or premiums to the net asset value (“NAV”) of their underlying holdings (this creates risks and opportunities), whereas ETFs and other mutual funds typically trade at market prices almost exactly equal to their NAVs. In PIMCO’s case, their CEFs frequently trade at large premiums to NAV because many investors appreciate the long track records of success. For example, PDI recently traded at a 10.2% premium to NAV and PTY at a 21.2% premium (investors really like these funds).

Another thing about CEFs (that arguably makes the premiums more justifiable) is they often use leverage (or borrowed money) to magnify income and total returns. Both PDI and PTY use significant amounts of leverage (recently 48% and 40%, respectively).

For reference, PDI “seeks current income as a primary objective and capital appreciation as a secondary objective.” According to PIMCO:

“The fund normally invests worldwide in a portfolio of debt obligations and other income-producing securities of any type and credit quality, with varying maturities and related derivative instruments. The fund’s investment universe includes mortgage-backed securities, investment grade and high yield corporates, developed and emerging markets corporate and sovereign bonds, other income-producing securities and related derivative instruments.

The fund will normally invest at least 25% of its total assets in privately issued (commonly known as “non-agency”) mortgage-related securities. The Fund may normally invest up to 40% of its total assets in securities of issuers economically tied to emerging market countries. The fund will normally maintain an average portfolio duration of between zero and eight years.”

It is this wide mandate, combined with PIMCO’s world-class skills and resources, that makes PDI so attractive to so many investors.

Similarly, PTY “seeks maximum total return through a combination of current income and capital appreciation.” According to PIMCO:

“Using a dynamic asset allocation strategy that focuses on duration management, credit quality analysis, risk management techniques, and broad diversification among issuers, industries and sectors, the fund seeks maximum total return through a combination of current income and capital appreciation.

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets plus borrowings for investment purposes in a combination of corporate debt obligations of varying maturities, other corporate income-producing securities, and income-producing securities of non-corporate issuers, such as U.S. Government securities, municipal securities and mortgage-backed and other asset-backed securities issued on a public or private basis.

The fund may invest a maximum of 25% of its total assets in non-U.S.-dollar-denominated securities and a maximum of 40% of its total assets in securities of issuers located in emerging market countries. The fund will normally maintain an average portfolio duration of between zero and eight years.

Consideration of yield is only one component of the portfolio manager’s approach. PIMCO also considers capital appreciation and principal preservation through intensive fundamental, macroeconomic, industry and company-specific research in making investments for the fund.”

And again, it is this wide mandate, combined with PIMCO’s world-class skills and resources, that makes PTY very attractive to many investors.

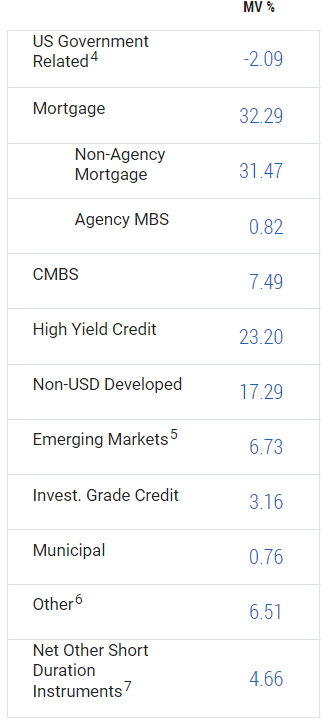

For perspective, here is a look at PDI’s recent sector allocations.

And here are the recent sector allocations for PTY:

Sources of Income:

Important to understand, closed-end funds (such as PDI and PTY) can generate their big monthly income payments from a variety of sources. For example, interest (or coupon payments) received on the underlying bond holdings, capital gains on the underlying bond holdings (both short-term and long-term) and even through a return of capital (“ROC”). ROC is generally not preferred because many investors simply don’t like having their own investment dollars returned to them as part of the monthly distribution payments, but also because ROC reduces the NAV of the fund, thereby also reducing the future earnings power of your shares (unless you’re able to reinvest the ROC distributions at NAV or lower, net of tax consequences).

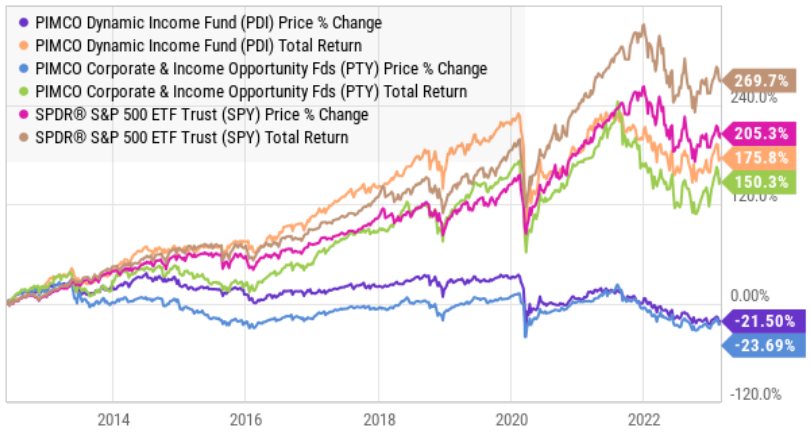

Many investors love PDI and PTY because they believe these funds never source their distributions from ROC. For example, there are no 19(a) notices on PIMCO’s website for these funds (19(a) notices are the tax filings that are typically required when there is a return of capital event), PIMCO reports no ROC in the historical distribution breakdown sections on its website, and external sources (such as www.CEFconnect.com) show no historical ROC for these funds. However, as we explain later in this report, these funds both do, in fact, source part of their distributions from ROC. For now, here is a look at the historical price returns and total returns (price return plus distributions reinvested) of PDI and PTY versus the S&P 500 (SPY).

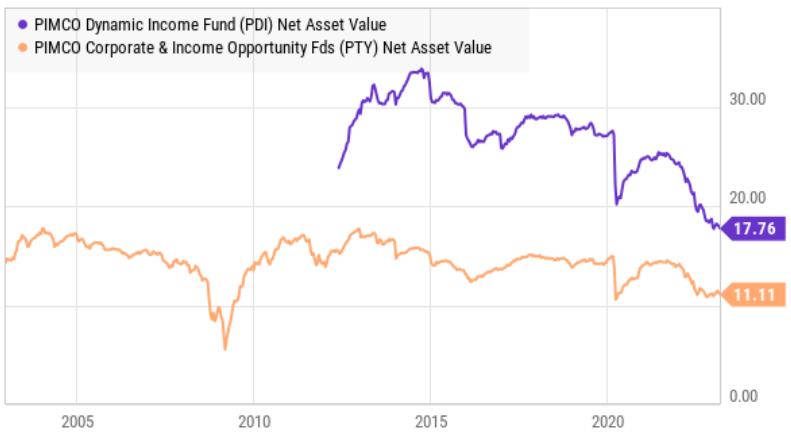

And here is a look at the historical NAV of PDI and PTY. They’ve both recently declined—partially due to rising interest rates and partially due to a return of capital, as we will show later in this report.

Reverse Engineering The Big Yields:

A lot of investors don’t really understand how PDI and PTY are able to consistently pay such large distributions, and they don’t care. Afterall, as long as the funds keep successfully delivering, why should it matter.

However, if we try to reverse engineer the big yields (i.e. how is PIMCO able to pay such high income) the numbers don’t add up. For example, most of the bonds these funds own don’t yield anywhere near the 13.5% and 10.6% yields the funds offer. For example, BB and B rated high-yield bonds currently yield only around 7.1% and 8.7%, respectively (and investment grade bonds yield even less). And these numbers are up significantly from a year ago when yields were dramatically lower (back when the fed was still artificially holding rates very low), but the funds were still paying very large distribution yields.

As mentioned, leverage (borrowed money) helps magnify the yields, but the funds only use roughly 50% and 40% leverage (to magnify the yields by roughly 1.5x and 1.4x, if there were no expenses and borrowing costs). This is still not enough to get the aggregate fund yields to 13.5% and 10.6%, respectively (especially considering much of the funds’ holdings are investment grade (significantly lower yields) and have relatively short duration and near-term maturities (significantly lower yields again).

According to CEF Connect, the average price of the bond holdings in PDI was recently around only 81 cents on the dollar, meaning they are trading at a discount and they do have price appreciation potential. This price appreciation potential (capital gains) can help fund the big PDI and PTY distributions, but it’s still not enough to reach the aggregate fund yields (especially considering interest rates have been moving so dramatically against these funds over the last year, but the funds keep paying huge distributions).

In aggregate, all the things we have described above (interest payments on the underlying holdings, leverage and potential capital gains) is still not enough to equal the total large double-digit distribution yields on PDI and PTY. So what gives?

The Story Investors Believe:

A lot of PDI and PTY investors believe PIMCO is able to make up the yield shortfall (between what they own and the yield the funds offer) though skill and flexibility. For example, some believe PIMCO is a great security selector and this makes up the difference in the yield shortfall. However, realistically PIMCO is so big and actual security selection adds so little (especially considering the funds own literally thousands of positions) it’s not enough.

Others believe PIMCO’s mandates are so wide and flexible that the funds can make up the shortfall through asset allocation decisions. However, realistically, the yields between different asset allocation opportunities and the constant diversification of the funds eliminates this as a feasible possibility.

Finally, the NAV of these PIMCO funds has fallen dramatically in recent years (as we saw in our earlier chart), and some investors believe it is because interest rates have risen sharply. Afterall, as rates rise, bond prices fall. But again, in our estimation, it’s still not enough. Something is missing that enables these funds to pay such big distribution yields.

The Missing Link: Return of Capital

The missing link between the big yields offered by PDI and PTY, as compared to the lower yields on the securities they own, is return of capital. Both funds have, in fact, been sourcing part of their distributions with ROC (despite the fact that all the marketing and third party data points are not reporting it).

For starters, PIMCO states in many places on their website that distribution rates are NOT performance! For example (emphasis ours):

“Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (ROC) of your investment in the fund. Because the distribution rate may include a ROC, it should not be confused with yield or income.”

And even though the PIMCO webpages for PDI and PTY show no return of capital in their distribution histories, and they report no “19(a) notices” for these funds, and CEF Connect shows no ROC, those sources are all significantly misleading.

It is very important for investors to recognize the difference between these funds’ daily reporting and actual GAAP accounting (i.e. what the auditors do, in this case Pricewaterhouse Coopers—who has served as an auditor for PIMCO Taxable Closed-End Funds since 1995). For example, according to PDI’s most recent annual report.

“It is important to note that differences exist between the fund’s daily internal accounting records, the fund’s financial statements prepared in accordance with U.S. GAAP, and recordkeeping practices under income tax regulations. It is possible that the fund may not issue a Section 19 Notice in situations where the fund’s financial statements prepared later and in accordance with U.S. GAAP or the final tax character of those distributions might later report that the sources of those distributions included capital gains and/or a return of capital.”

The report goes on to say:

“For instance, a portion of a Fund’s monthly distributions may be sourced from paired swap transactions utilized to produce current distributable ordinary income for tax purposes on the initial leg, with a substantial possibility that a Fund will later realize a corresponding capital loss and potential decline in its NAV with respect to the forward leg (to the extent there are not corresponding offsetting capital gains being generated from other sources).”

In plain english, the funds are using swaps (derivative instruments) to boost monthly distributions while simultaneously “kicking the tax-basis ROC can down the road” (even though the funds are, in fact, already recognizing “accounting” and “economic” ROC. And accounting and economic ROC matters because it is lowering the NAV of the funds and thereby decreasing their future earnings power.

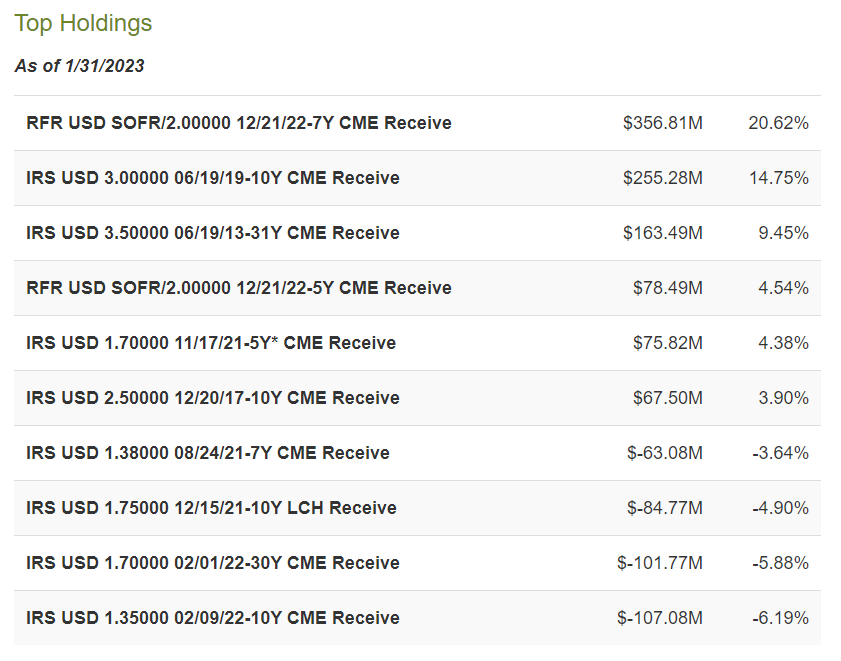

And before we give you the explicit proof of ROC, we want to first give you an idea of the scale of these derivatives activities (i.e. the swap positions in PDI and PTY are huge). For example, here is a look at the recent top holdings in PTY (IRS stands for “interest rate swap” and SOFR stands for “secured overnight financing rate” with regards to forward-looking interest rate estimates, calculated and published for 1-month, 3-month, 6-month and 12-month tenors”).

And just to make the ROC explicit, here are excerpts from the most recent PDI and PTY annual reports, showing the funds have, in fact, been sourcing part of their distributions with ROC (see the “Tax Basis Return of Capital” column).

And in reality, it is important to note that there is probably (very likely) a lot more ROC than currently being reported in even the GAAP financial statements because PIMCO has been kicking the can down the road by growing and rolling their swap positions (which can effectively delay the recognition of ROC) in hopes that interest rates will soon reverse for at least long enough to recognize some capital gains (recall the 81 cents on the dollar situation described earlier) to offset the ROC and pretend like it never existed. It’s basically an accounting shenanigan.

What’s the Big Deal with ROC anyway?

ROC hurts investors because it means they’re sourcing at least part of the distribution by returning some of your own original investment dollars to you (and thereby reducing the NAV upon which they can generate income and gains in the future). And if you own these funds in a taxable account it can hurt you even more (than if you own it in a non-taxable account) because it also reduces your cost basis (which has no immediate tax consequences), but it can increase your capital gains taxes down the road if/when you do sell. Here is what PIMCO says:

“A return of capital is not taxable, but it reduces a shareholder’s basis in his or her shares, thus reducing any loss or increasing any gain on a subsequent taxable disposition by the shareholder of such shares.”

In our estimation, PIMCO can only kick the hidden ROC can down the road for so long, and investors may eventually get hit with a big ROC as part of a distribution payment in the not-so-distant future. Said differently, the chickens will eventually come home to roost.

PIMCO needs future interest rate expectations to go down (even just temporarily) so they can recognize some capital gains (to offset the ROC currently hidden by the funds’ growing derivatives positions), especially as they back up against the 50% regulatory leverage limit (PDI in particular) which could result in forced asset sales at unfavorable “fire sale” prices thereby reducing NAV further—yuck! Anytime you use derivatives and leverage you are increasing the likelihood for an unexpected bad event.

In our view, these funds could be forced to recognize some “tax-basis” ROC soon (instead of just the minimal “GAAP” ROC they’ve already been recognizing). Investors beware (especially those that own these funds in a taxable account).

The Bottom Line:

Despite the ongoing GAAP and economic ROC, we still like PDI and PTY (we currently own both), especially in a non-taxable account. But for goodness sake—diversify! Especially considering the interest rate risk, high leverage, large premiums, heavy use of derivatives and growing potential for a large tax-based ROC event). These two PIMCO funds are good, but they’re not as great as so many investors seem to believe. We offer many attractive alternative big-yield opportunities (for investors to at least partially diversify into) within our High Income NOW portfolio.