The small cap stock we review in this report enables machines to communicate with each other and it is well positioned to benefit from vast and expanding new opportunities related to the Industrial Internet of Things (“IIoT”). It’s also being valued incorrectly because supply chain issues are being misunderstood (and they will clear up) and because it’s being valued like a traditional hardware company without proper recognition for its growing subscription revenue model (which warrants a higher multiple). In this report, we review the business, the expanding market opportunity, valuation and risks, and then conclude with our opinion on investing.

Digi International (DGII):

Founded in 1985 and based in Minnesota, Digi provides IoT connectivity products and services that allow machines to communicate with each other. The company has two segments:

1. IoT Products and Services: This segment consists primarily of distinct communications products and communication product development services. For example, Digi provides routers, modems and tools that its customers use to build, deploy and manage a wide variety of “machine-to-machine” communication solutions across a wide variety of industries.

2. IoT Solutions: This segment offers wireless temperature and other environmental condition monitoring services (specifically, “Ventus” and “SmartSense”) as well as employee task management services. More specifically:

SmartSense provides perishable goods condition monitoring services as well as automated employee workflows in the Health Care, Food Service and Logistics verticals

Ventus provides Managed Network as a Service to unmanned kiosks in the Financial Services, Lottery/Gaming, Retail and IIoT verticals.

Expanding Market Opportunity:

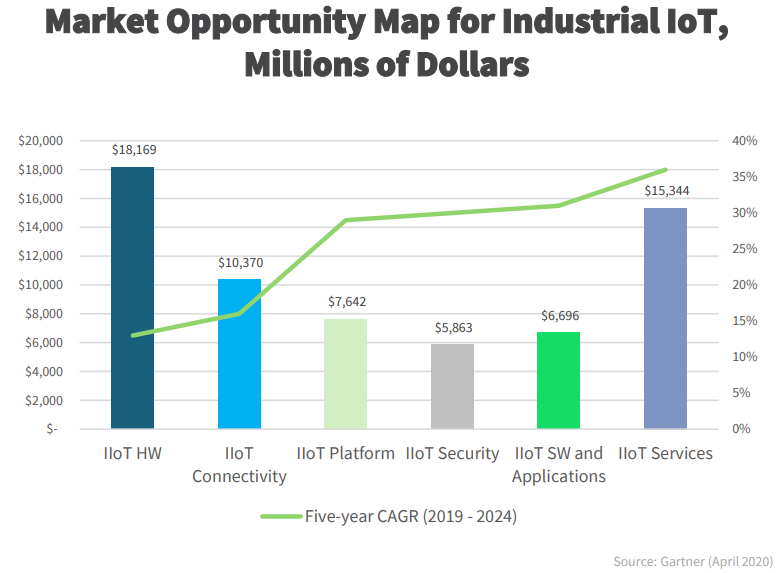

Digi’s large (and expanding) market opportunity stems mainly from massive growth in the IIoT, as well as the company’s expansion into more recurring revenue sources. With regards to the IoT, the total 2024 market opportunity is in excess of $64B (with the spectrum of IIoT technologies growing at a CAGR between 13% and 36%).

According to Digi’s latest investor presentation, the company’s:

“longstanding market that has been based on hardware and connectivity is now fueled by faster growing software, applications, and services segments

and…

“Today’s profitability is driven by foundational HW [hardware}, but it is expected profitability will expand in faster growing segments Digi is increasingly focused on.

For perspective, here is a look at the company’s revenue growth breakdown category:

Valuation:

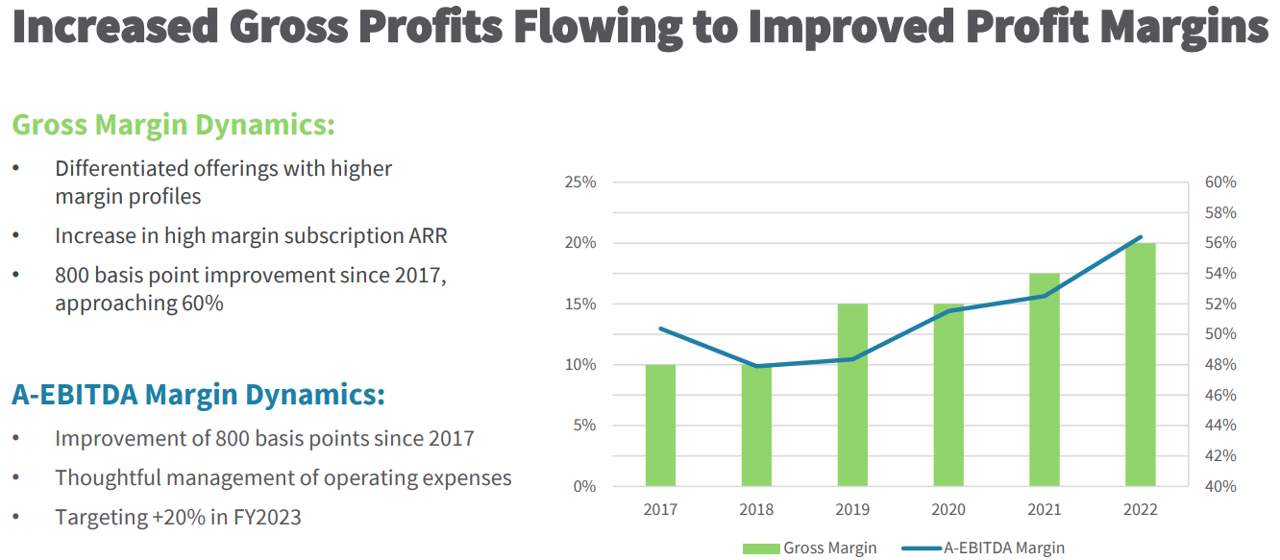

Digi currently trades at an attractive valuation relative to its ongoing growth. For example, Digi shares currently trade at around 17.9x forward earnings (non-GAAP), EV-to-Sales (forward) of 3.3x, and EV/EBITDA (forward) of 15.5x, all of which are relatively low (attractive) as compared to the company’s ongoing high growth (as described earlier) as well as the strong profitability and increasingly strong margins (see chart below).

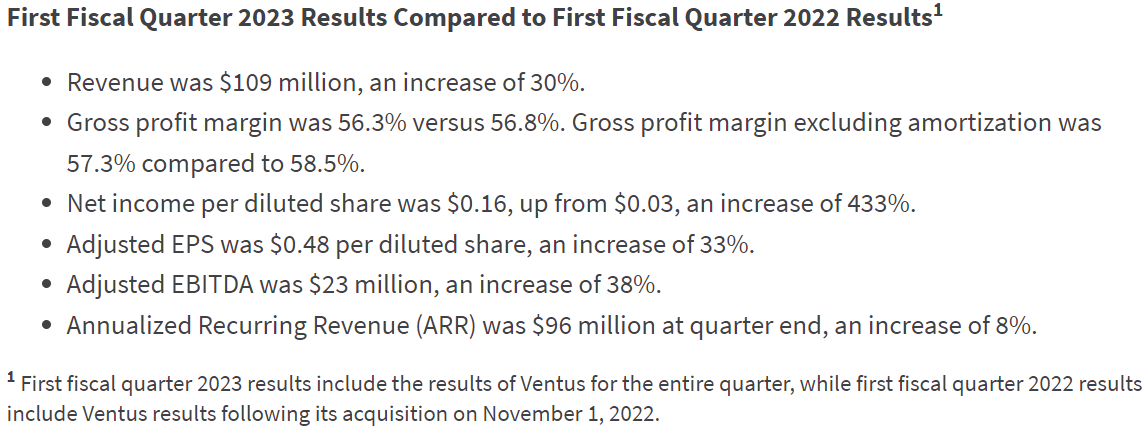

For perspective, here is a look at some additional growth highlights from Digi’s most recently announced quarterly earnings:

Also worth mentioning, as Digi continues to transition a higher portion of its revenue to subscription-based recurring revenue, it deserves a higher valuation multiple. For example, Digi trades at only 2.8x forward sales, whereas other high growth software-as-a-service businesses trade at multiples of 10x to 20x, or higher. We’re not saying Digi should reach multiples this high, but it should trade at a higher price-to-sales multiple considering its growing subscription-based recurring revenues.

Risks:

Of course Digi faces a variety of risks.

Industry Competition: For starters, Digi is a small cap business in an industry that faces consolidation risks. Digi itself recently acquired Ventus (in 2022). Also Digi supplier and competitor Sierra Wireless was recently acquired by Semtech to create a more comprehensive IoT platform. Digi likes to differentiate itself by building strong customer relationships focused on solutions rather than just products. Also Digi has built strong distribution channel. For example, a significant amount of sales run through its global network of distributors, systems integrators and “value-added” resellers, plus Digi’s direct sales team.

Supply Chain Challenges: Like many companies, Digi continues to face supply chain challenges (due to covid lockdowns) in terms of getting the parts and equipment it needs. In fact, the company’s growth has been constrained because they still cannot get all the parts they need to meet customer demand. According to CEO Ron Konezny, during the most recent quarterly call:

“We do think as the supply chain eases, there could be some normalization that occurs. But right now, we are still not able to meet all of our customer demand.”

For perspective, here is a look at some of Digi’s suppliers and partners throughout the supply chain for its products and services.

Hardware Technology — Digi works with leading, worldwide hardware technology manufactures to ensure customers have the best communications devices — from processing capacity to low-power options and 5G capabilities, Digi sources smart ideas and builds strong alliances to deliver better solutions.

Software/Services — Digi’s well-documented, open APIs make it easier to integrate customer software and services with Digi technology. Combined solutions and co-selling means customers are a step ahead of their competition.

Notably, Digi works with distributors, resellers, and channel partners, by providing programs for joint selling, training, solution integration, and more.

Backlog: Related to supply chain issues, Digi has built up excess inventory to meet customer demand. Demand remains high, but the inventory is just with regards to some parts that are constrained by supply chain distruption, and Digi wants to make sure they have these parts ready when they need them to meet the backlog of customer demand. According to Konezny:

“We continue to see elevated demand as evidenced by a strong backlog, while a gradually improving supply chain has helped us exceed our expectations. We expect those dynamics to continue throughout the balance of our fiscal year.”

According to the company’s recent shareholder letter:

“In fiscal 2022, we acquired Ventus and paid down $100 million of debt to materially de-risk our balance sheet. In fiscal 2023, we are focused on integration and execution. Our record backlog combined with our financial strength has afforded us the opportunity to secure components and finished goods to meet the needs of our customers and deliver on our backlog. Inventory increased to $81 million this quarter, up 11% sequentially. As components have become available, we have put our working capital to use strategically to ensure the most beneficial outcomes for our customers. The inventory will enable revenue as we ship against product orders in our backlog. As needed, we will continue to purchase these “golden screw” components. We expect this inventory investment to bring cash dividends to Digi for the remainder of fiscal 2023.”

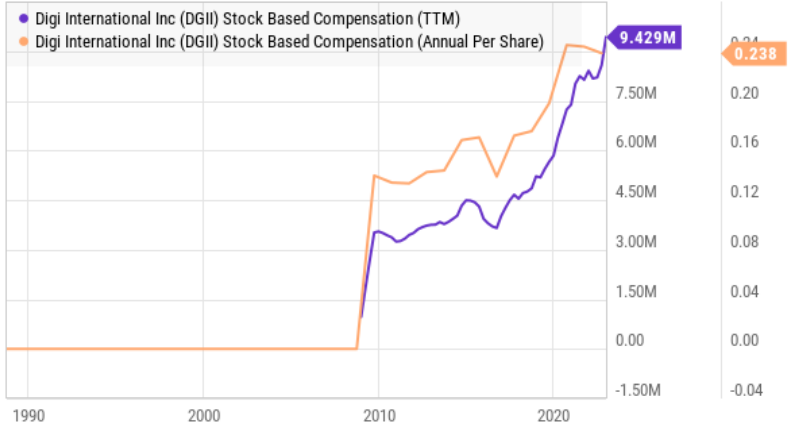

Stock-Based Compensation: One of the differences between the company’s GAAP and non-GAAP earnings is due to stock-based compensation (accounting for acquisitions, such as the Ventus acquisition, is another). Digi recently traded around $33 per share, and annual stock-based compensation has been nearly $0.24 per share.

The Bottom Line:

Digi has been growing rapidly, and it has a lot more growth potential in the medium-term (as supply chain issues resolve) and especially over the long-term (as the Internet of Things expands rapidly). Further, the market continues to value Digi like a traditional hardware company, but it should instead be assigned a valuation premium because of its expansion into software and recurring revenue solutions (which strengthen growth and typically command higher valuation multiples).

As a small cap, Digi faces risks (as described), but it also offers potentially higher rewards (i.e. the shares have a lot of long-term price appreciation potential). If you are looking for powerful long-term growth (and share price appreciation), Digi is worth considering for a spot in your prudently-diversified long-term growth-focused portfolio.