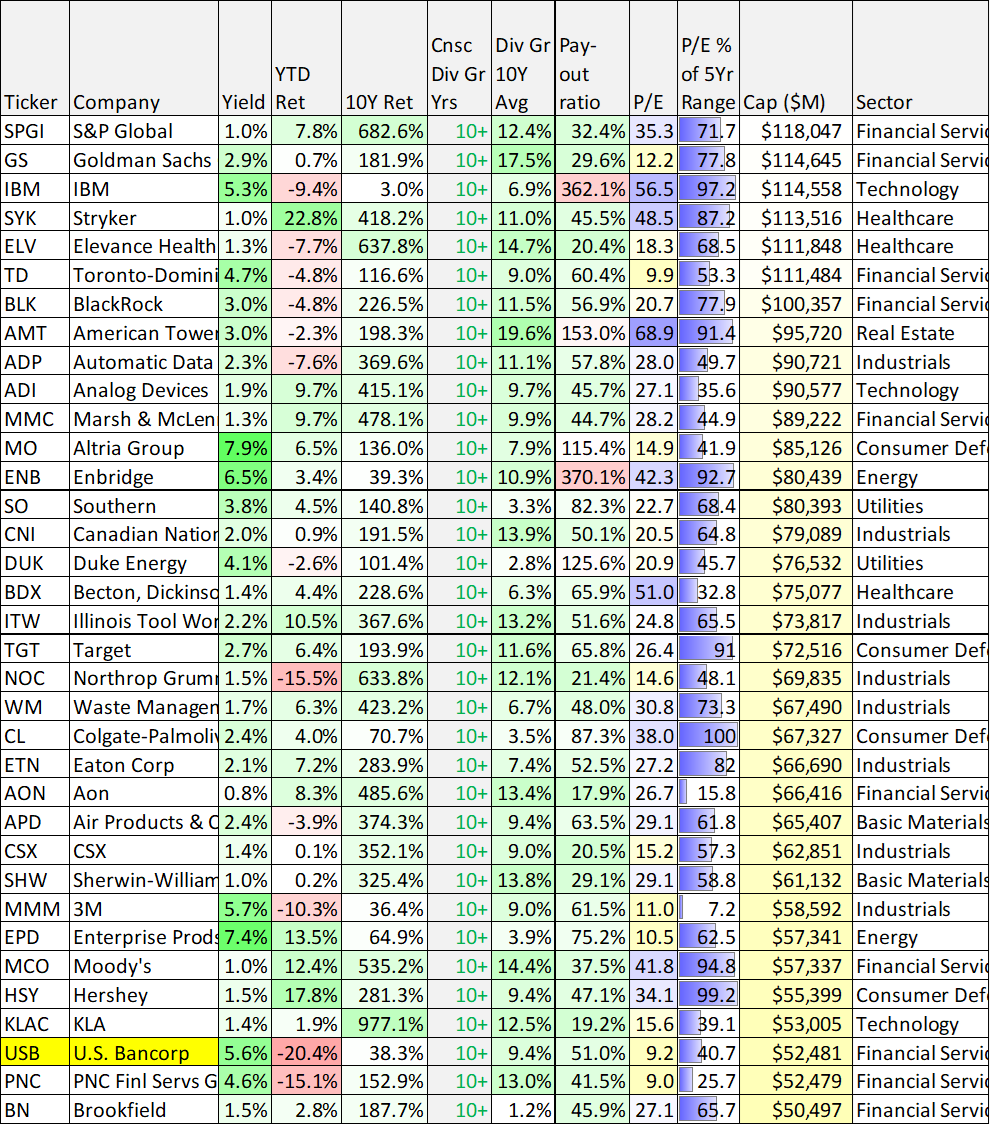

So far this year, US Bancorp (USB) is one of the worst performing stocks in the S&P 500 (it’s down over 20%), and it now offers one of the highest dividend yields (5.6%). And a lot of income-focused contrarian investors are increasingly tempted, especially considering the bank has raised its big dividend for the last twelve consecutive years in a row. After reviewing US Bancorp and its current valuation, we consider three big risks to investors (with a regulatory-induced dividend cut perhaps the biggest, as described by a recent HoldCo short-seller report), and then conclude with our strong opinion on investing.

US Bancorp (USB), Yield: 5.6%

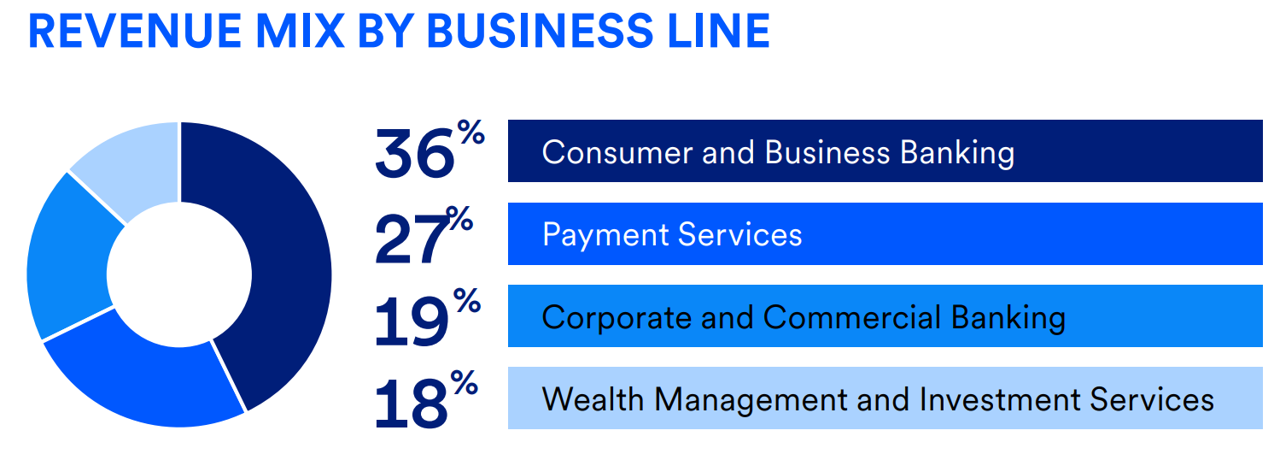

Minneapolis-based U.S. Bancorp provides a comprehensive line of

banking, investment, mortgage, trust and payment services products

to consumers, businesses, and institutions. As of year-end 2022, it had $587 billion in assets, 2,213 banking offices in 26 states and 4,052 ATMs nationwide. For your reference, here is a breakdown of the company’s revenue mix by business line.

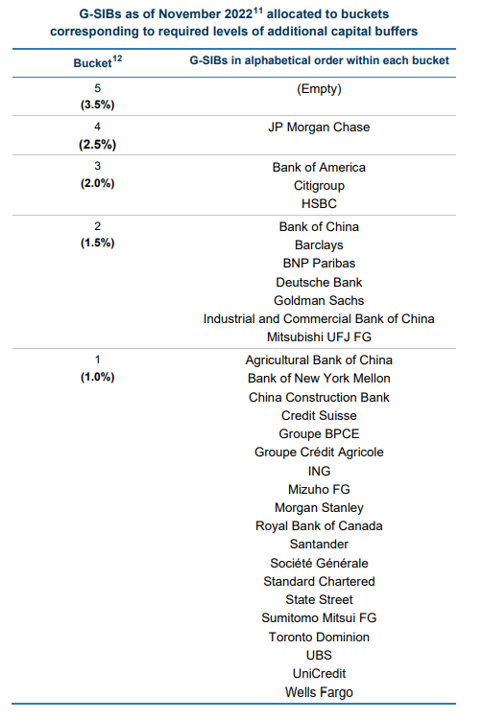

Also really important to note, USB is the largest bank in the US that is NOT considered a Global Systematically Important Bank (GSIB). The GSIB designation was developed to shore up the global banking system following the 2008-2009 “Great Financial Crisis,” and it is really important because GSIB’s are subject to more stringent capital requirements than other banks. For a little perspective, here are the GSIB banks.

And for your information, the buckets (above) are basically a measure of risk, the higher the bucket, the stricter the capital requirements are for the bank.

As we will cover later in this report, USB benefits by NOT being a GSIB because it is not subject to the stricter capital requirements (and this has made it easier for USB to payout a big growing dividend (and buy back shares) over the last decade).

Current Valuation:

For some perspective, Morningstar strategist, Eric Compton, assigns USB Morningstar’s highest ratings (he ranks USB a five-star wide-moat opportunity with “exemplary” capital allocation and says the shares have over 40% upside (his fair value is $58.00). Eric explains in an April 19th note:

“U.S. Bancorp is the largest non-GSIB in the U.S. and has been one of the most profitable regional banks we cover. Few domestic competitors can match its operating efficiency and returns on equity over the past 15 years.”

Supporting Eric’s claims, USB announced very strong quarterly earnings on April 19th, whereby non-GAAP EPS was $1.16 (beating expectations by $0.04) and revenue was $7.18B (beating expectations by by $50M). USB also announced that its important CET1 capital ratio (Common Equity Tier 1) rose to 8.5% at March 31, 2023, compared with 8.4% at December 31, 2022 (another positive sign).

Also, USB grew strategically, with its Union Bank acquisition, noting on their website:

On December 1 we completed the acquisition of Union Bank, which meaningfully increased our market share in California and made us the No. 1 SBA lender in the state.

Specifically, the acquisition added one million consumer, 700 commercial, and 190,000 business banking customers. And USB expects the transaction to be 8 to 9% accretive to 2023 EPS (note: recent quarterly GAAP EPS was only $1.04 (below the $1.16 non-GAAP number provided earlier) when you include charges for the acquisition).

Further still, USB has very strong profit margins, healthy return on equity and trades at just a small premium to book value.

USB also has strong investment-grade credit ratings (although Moody’s just downgraded them on April 21st) and is in a very healthy capital position.

Nonetheless, despite USB’s strong earnings, healthy profitability and glowing analyst reports, the shares have underperformed meaningfully this year.

Specifically, as you can see in the above chart, most banks fell sharply following the recent Silicon Valley Bank failure, but unlike other banks—USB hasn’t really rebounded. One big reason the shares are still down is the risk of a dividend cut, as described in the next section.

Three Big Risks for USB:

US Bancorp may be increasingly tempting from a contrarian standpoint, but investors should first consider three big risks.

1. A Dividend Cut, Induced by Regulation

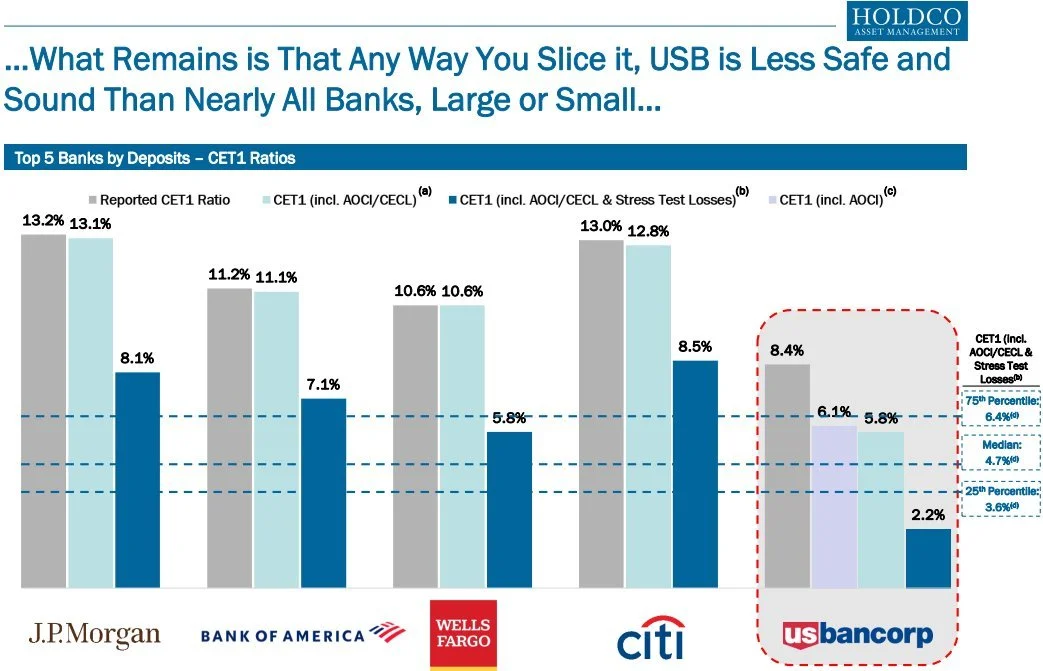

USB shares may be headed for a dividend cut, a halt to share repurchases and underperformance relative to banking stock peers, as per a recent short-seller report from Florida-based (Fort Lauderdale) HoldCo (an asset management firm run by a couple of ivy leaguers that has “raised over $1.5 billion in capital commitments”). According to the report, USB should have never been spared from the more stringent capital requirements of GSIBs (as described earlier), and may soon be subjected to these more stringent capital requirements which could cause dire consequences for USB shareholders.

First, HoldCo argues that regulators should subject USB to GSIB capital requirements because of its growing size (it will soon cross $700 billion in assets, thereby potentially triggering some bucket 2 capital requirements, as described earlier). Further, the recent Silicon Valley Bank failure rightfully has regulators looking for ways to further shore-up the banking system (and USB should have a target on its back considering it is so big—i.e. the largest non-GSIB bank in the US).

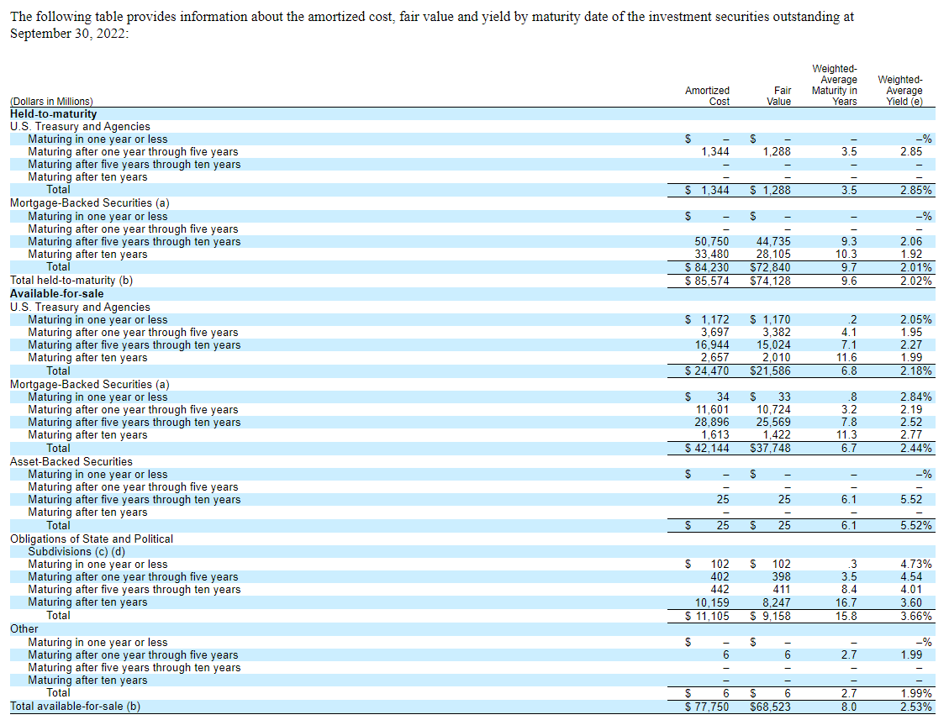

Secondly, if and when USB is subjected to GSIB capital requirements, there could be dire consequences because they’d likely be forced to mark-to-market various available-for-sale investment securities (mainly mortgage-backed securities) just like other GSIB’s do already. For example, you can see in the table below (from USB’s 10-K) that they hold a lot of securities with significant durations, which means there’d likely be very significant impairments when marked-to-market (because as interest rates have risen sharply, bond market prices have fallen sharply).

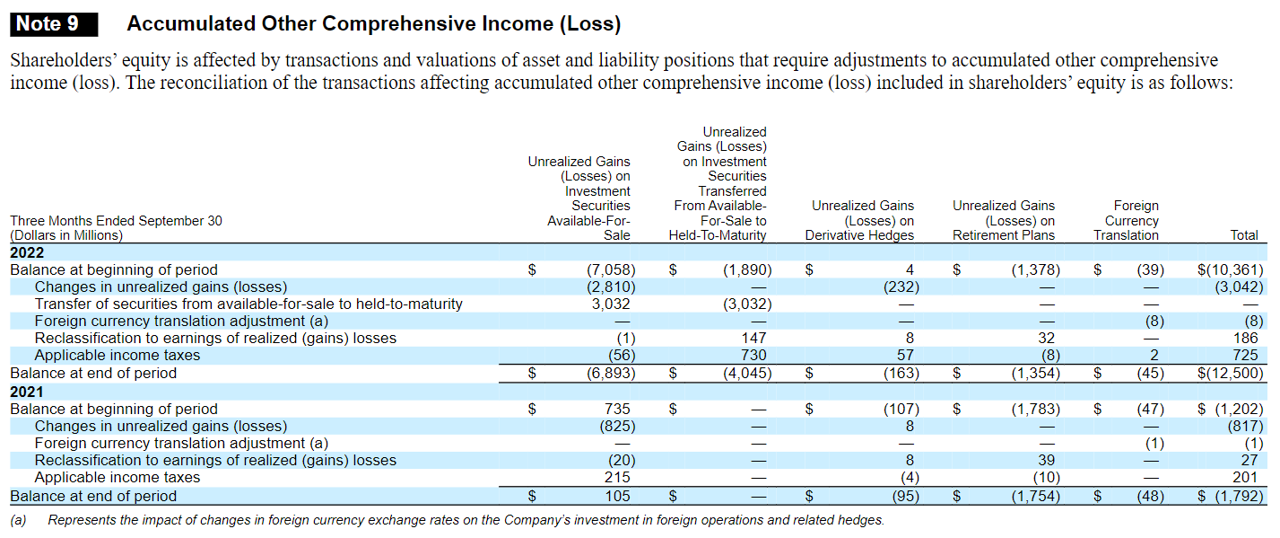

In fact, you can see below (also from the 10-K) for the three months ended September 30th, USB was already carrying very large unrealized losses related to available for sale securities, it’s just that those losses are ignored in certain capital ratio calculations because USB is not yet subject to GSIB requirements.

However, if/when USB becomes subject to GSIB requirements, there will be big capital requirement write downs thereby forcing USB to potentially cut the dividend, cease share repurchases and even raise capital (that would be dilutive to existing shareholders) all to meet the new capital requirements.

To keep this all in a little perspective, HoldCo appears to be short USB as part of a market neutral long-short trade with Wells Fargo (WFC) (a GSIB bank) on the other side. So basically, HoldCo makes money on the trade whether the market goes up or down, just as long as Wells Fargo performs better than USB.

In our view, HoldCo brings up some very good points about USB, however the situation may not be as dire as some investors interpret, considering USB shares are already down significantly, USB likely has time (months or even years) to position its balance sheet for the possibility of more stringent GSIB capital requirements, and because the last thing the regulators want to do is bankrupt one of the largest banks (USB) and they really don’t even want to panic the market in any way either. At the very least, USB faces risks that may still not be adequately priced in, and it could limit share repurchases, stop growing (or even reduce) the dividend, and may need to raise cash (which could be dilutive to shareholders). We’ll have more to say about all of this in the conclusion of this report.

2. You personally are chasing the wrong type of dividend yield

A second big risk is that by investing in USB, you personally may be chasing the wrong type of dividend yield for your own individual situation. For example, if it’s simply big steady income you are after, there are much less risky ways to achieve that, such as the more diversified big-yield stock funds included in the table below. These fund offer big yields (many of them paid monthly), some of them trade at attractive discounts to NAV (this is a unique characteristic of closed-end funds), and all of them have significant diversification (they hold many positions) thereby reducing idiosyncratic risks.

You can also access an extended version of the above data table in our new report: “100 Top Yields: REITS, BDCs, CEFs and More.”

For example, the Adams Diversified Equity Fund (ADX) in the table above holds 96 stocks (instant diversification) including financial sector stocks (the sector USB is in) and pays a minimum 6% annual distribution yield (it’s also been paying dividends for over 80 years straight!).

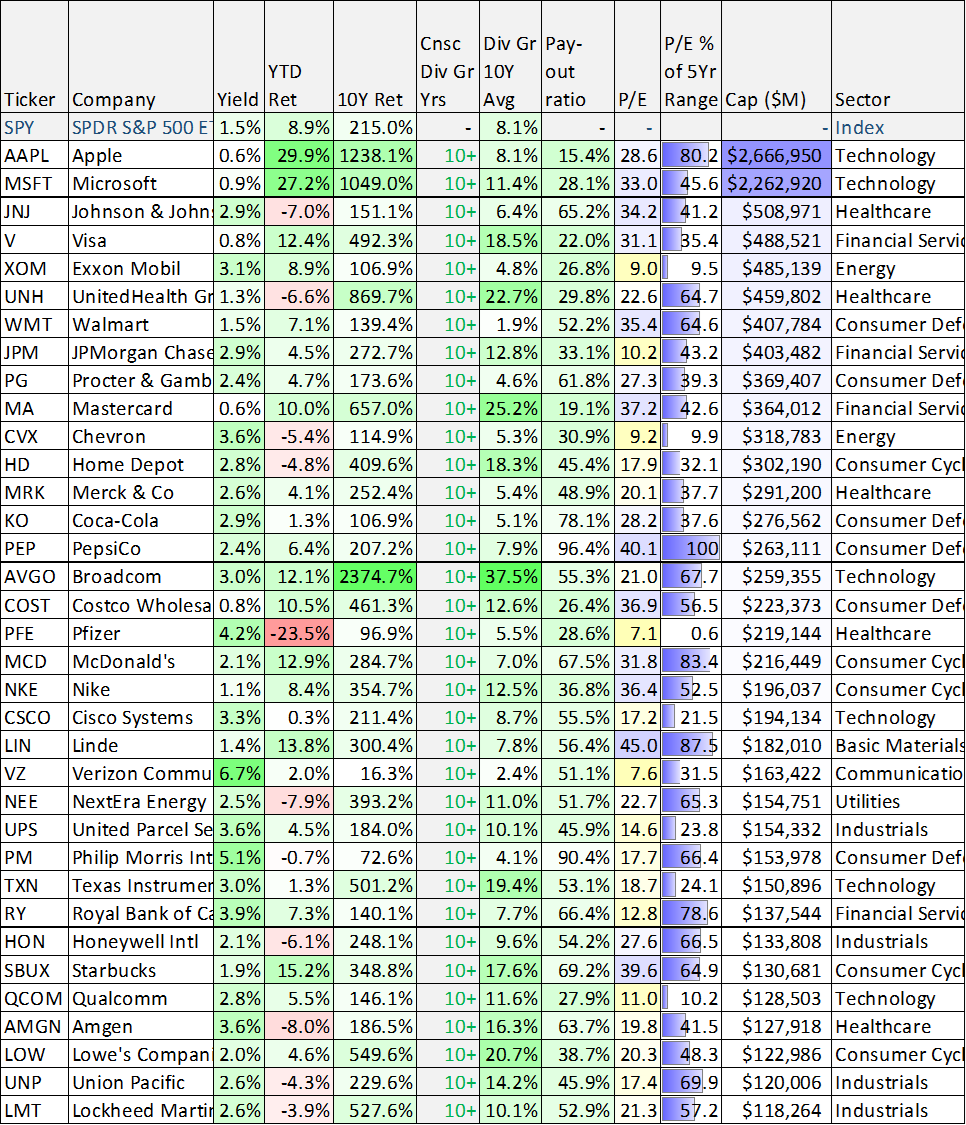

Alternatively, if you are considering investing in USB for the combination of dividend-growth and long-term price appreciation, then here is a list of blue chip dividend growth stocks from across market sectors that have increased their dividends for at least 10 years in a row and are currently trading at attractive valuations, for you to consider. And to help reduce your risks, you might consider a prudently-concentrated portfolio of these types of stocks, so you don’t end up betting the farm on USB (just because you like the big dividend and you think you can call the bottom).

data as Friday, April 28th.

And regarding the stocks in the above table, it’s fair to believe the majority of them will keep paying growing dividends and will be trading significantly higher ten years down the road (simply because of their blue chip nature, and because the overall economy will eventually get better and trade significantly higher, knock on wood); we’ll have more to say about specific stocks from the lists above in the conclusion of this report.

3. Recession is Coming, Consider Big-Yield Bond Funds

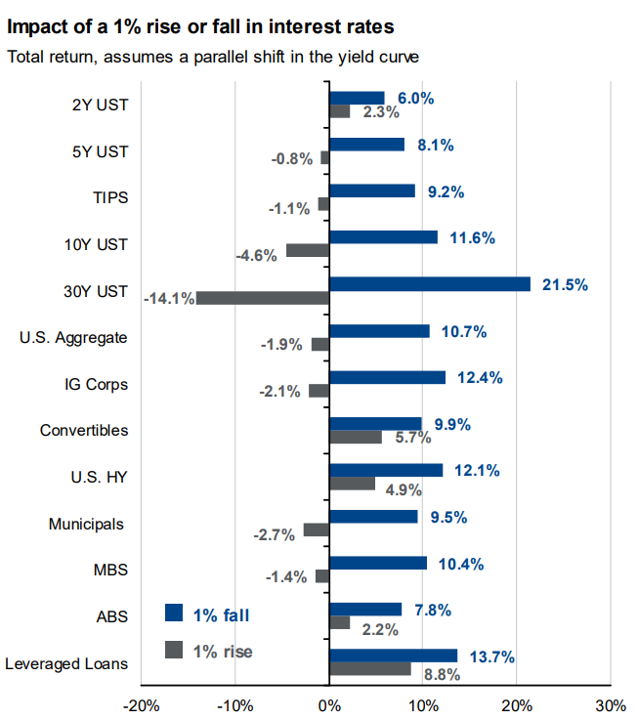

Another big risk for investors to keep in mind is that the economy is heading towards recession, and things can still get much worse before they get better, especially for stocks, and perhaps even to the strong benefit of bonds.

Here is a look at how bonds performed in 2022, one of the worst years on record.

Specifically, as the Fed rapidly increased interest rates to fight inflation, it had a dramatically negative impact on the price of bonds (as rates go up, bond prices go down, all else equal). In fact, this is similar to the phenomenon that could hurt USB if they are subjected to the same mark-to-market requirements that existing GSIB’s have been subjected to for many years.

However, here is a look at what will happen to bond prices if recession ramps up and the Fed lowers interest rates (i.e. bond prices will rise).

And as you can see in this next chart, here is a look at what the market (and the Fed) are expecting will happen to interest rates over the next year (i.e. rates will go down).

And if we are heading into a recession, the Fed could lower rates quickly to combat it. And if rates go down, that is potentially a lucrative time to be invested in bonds (and bond funds, as described below). Specifically, here is a list of top bond CEFs (closed-end funds) from well established organizations that are worth considering, especially if interest rates decline or simply stay relatively steady.

data as of Friday, April 28th, source: CEF Connect, StockRover

As you can see, two-year performance has been terrible (as rates went up, these bond funds went down). But just because you may (or may not) be upset about the terrible performance of bond funds last year, don’t let that cause you to miss out on potentially very lucrative bond fund performance in the year ahead (i.e. if the fed lowers rates, bonds will go higher). In fact, if you are a contrarian investor, bond funds may actually be a better opportunity for you than owning shares of US Bancorp. Additionally, bond funds may simply be a great complement to your existing stock portfolio. We currently own a variety of attractive big-yield bond funds in our High Income NOW portfolio.

Conclusion:

US Bancorp currently presents an extremely tempting big-yield contrarian opportunity (i.e. the fear is likely overdone, and that’s often a very lucrative time to buy). However, investors should know the significant risks (as described above) before jumping in. We’ve elected not to purchase shares of USB at this time, in favor of many more compelling risk-reward opportunities (such as select top ideas from our new report: “100 Tempting Big Yields: These 4 Worth Considering”). However, at the end of the day, it is critically important to select only investment opportunities that are right for you, based on your own personal situation. We believe disciplined goal-focused long-term investing will continue to be a winning strategy.