The market has been climbing a wall of worry this year and the economy is teetering on an ugly recession. The fact that the yield curve is steeply inverted (see chart below) has contributed to recent bank failures (Silicon Valley and First Republic), and more things in the economy are going to break. That said, the stock market tends to recover well before the recession is over. In this report, we share five attractive dividend stocks that are particularly compelling from a contrarian standpoint considering the share prices are down, the dividends remain strong, and we expect both (share prices and dividends) to get even significantly better over time.

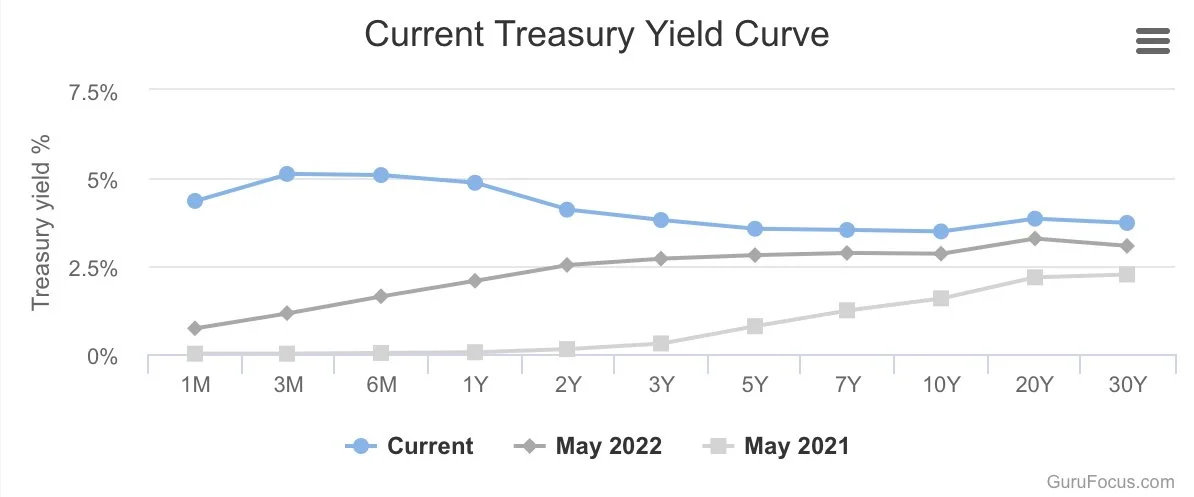

Inverted Yield Curve (Recession Warning)

An inverted yield curve (when short term rates are higher than long-term rates) is often a recession warning, and that is the situation we continue to be in now (as you can see in the chart below). Specifically, the 6-month treasury rate is currently at 5.06%, compared to 1.38% last year, and compared to a 10-year treasury rate of 3.53%.

The inverted yield curve is part of the reason for recent bank failures (Silicon Valley and First Republic), and it signals that the economy could still get worse as more things “break.” However, certain companies will weather the recession better than others (such as the five dividend-paying blue chips we review below) and the stock market tends to recover well before the recession is over (i.e. stocks are forward looking).

1. Johnson & Johnson (JNJ), Yield: 2.9%

Johnson & Johnson currently offers a dividend yield of 2.9%, the dividend has been increased ever year for many decades in a row, the dividend is very well covered (the recent payout ratio is 65%), the business is extremely steady thanks to its diverse healthcare segments (it’s a wide moat business), and the share price is down this year while the market is up. This has created an attractive contrarian opportunity in our view as the shares now trade at at only 15.4 times forward (non-GAAP) earnings. Johnson & Johnson is attractive here if you are a long-term income-focused contrarian investor.

2. International Business Machines (IBM), Yield: 5.3%

While some investors view this 5.3% dividend yielder as a dinosaur, it’s starting to look increasingly attractive considering revenue and earnings per share have both finally started growing over the last two and one years, respectively (the 2019 Red Hat acquisition has helped stem IBM’s very slowly dying mainframe business), and continued growth in both is expected. IBM trades at only 13.9 times earnings and 13.2 times forward earnings (both non-GAAP), yet the shares are down this year as the rest of the market is up. We also like IBM’s improving margins. IBM has increased its dividend every year for multiple decades, and the shares are worth considering if you are a contrarian and a divided-growth investor.

3. Royce Value Trust (RVT), Yield: 8.3%

Small cap stocks have been particularly weak this year, and that makes the Royce Value Trust even more compelling in our view.

We’ve written about this one multiple times in the past, and we really like its long track record of outperformance as well as its large distribution yield (it’s a closed-end fund, so the distribution is based on mostly long-term capital gains in addition to the dividends paid on the underlying small cap shares held in this fund). And considering RVT trades at a large 12.9% discount to its net asset value (“NAV”), it’s really hard to ignore here from an income-focused contrarian standpoint, We currently own shares.

4. Royce Micro-Cap Trust (RMT), Yield: 8.7% Yield

Similar to RVT, RMT is also managed by Royce, but focuses on micro-cap stocks. And micro caps have performed even worse than small caps (as you can see in the chart above), and this makes them even more attractive from a contrarian standpoint considering the market will get better and this diversified fund is a great way to play the eventually rebound considering it has a long history of outperformance, it offers a compelling big distribution and it currently trades at an attractive 12.2% discount to its NAV. We currently own shares.

5. BlackRock (BLK), Yield 3.0%

Last on our list is a company that has gotten increased media attention for the wrong reasons. In particular, BlackRock has fallen under increased scrutiny because some investors don’t like its focus on “sustainable” investing and/or ESG investing (Environmental, Social and corporate Governance). However, the reality is that BlackRock is a huge asset management company, and when the market rebounds its earnings will rebound more. In particular, BlackRock generates fees as a percentage of its assets under management, so when the market goes up, BlackRock’s AUM goes up and its fee revenue goes up. BlackRock has a beta over one (1.29) which means it is more sensitive to the market than the average stock, yet the shares are down this year. BlackRock will post strong earnings as the market recovers and these shares will go higher. It also offers a healthy 3.0% dividend yield that has been increased every year for over a decade straight. If you don’t mind the recent negative media attention, BlackRock is an attractive long-term contrarian dividend growth opportunity.

The Bottom Line:

If you are a long-term income-focused investor that likes contrarian opportunities (i.e. buying things when they’re out of favor) all five of the opportunities above present attractive opportunities considering their healthy yields and because the shares are down while the businesses remain strong.