If you are seeking big steady income, from a top-shelf manager, that currently trades at a discount to NAV, and may be set for dramatic price appreciation heading into the end of 2023 (as fed rate hikes peak and then are expected to reverse), the 11.7% annual yield (monthly pay) closed-end fund (“CEF”) we review in this report is worth considering.

PIMCO Access Income Fund (PAXS), Yield: 11.7%

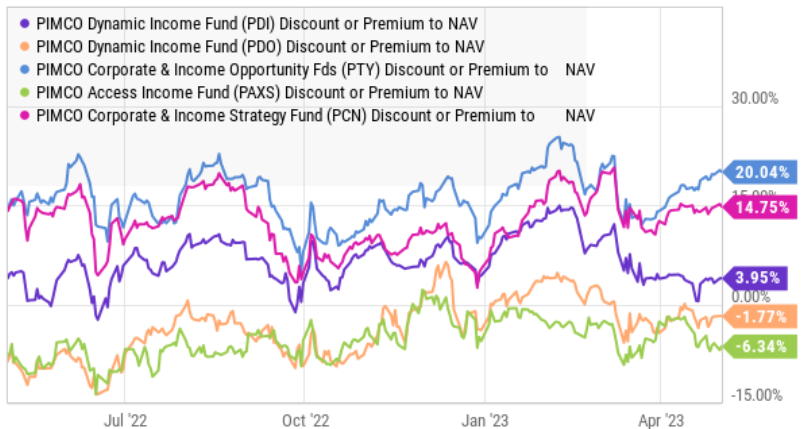

PAXS is a relatively new bond CEF (launched in 2022) from well-established (and highly-respected) PIMCO. It’s never decreased its distribution (in its short history) and it has already paid a special (extra) dividend too. These are the main characteristics that a lot of income-focused investors seek, and it’s attractive that this growing fund ($1.3 billion in assets) trades at a discount to NAV of ~6.3% (most PIMCO funds trade at a premium) and charges a relatively lower fee than other PIMCO funds (all else equal, we greatly prefer to buy attractive funds at a discounted price—not a premium).

Bond Fund Interest Rate Risk:

This fund holds bonds, which are highly sensitive to interest rates (the fund’s duration, a measure of interest rate risk, is around 3.6—reasonable), and as rates have risen rapidly over the last year (the fed has been hiking rates aggressively to battle the high inflation that they helped create through pandemic stimulus in recent years prior), bond prices have fallen (see chart below for perspective on how historically bad 2022 was for bonds).

However, with the Fed’s interest rate hikes widely expected to reverse by year-end (as per CME Fed Futures FedWatch Tool), things could be about to change for PAXS—in a good way (i.e. if rates go down, bond prices go up—and that’s in addition to the big monthly income this fund pays).

Leverage and Derivatives:

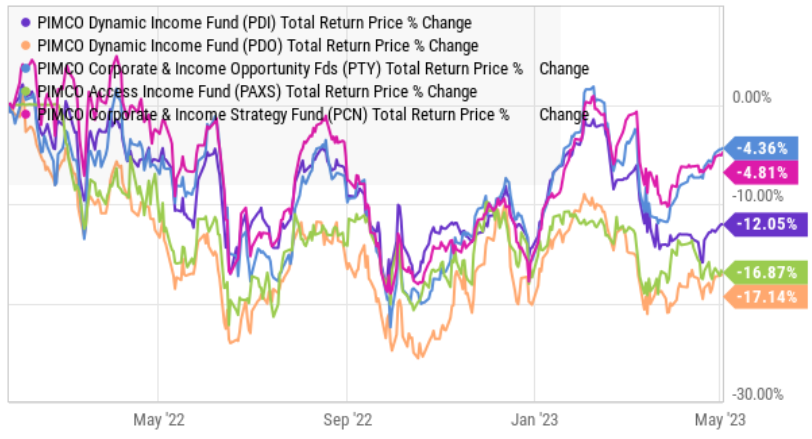

A few caveats with this fund (and bond CEFs in general), PAXS uses both leverage and derivatives. The leverage (or borrowed money) can help magnify returns in the good times (such as if rates fall in the second half of this year), but also can magnify the losses in the bad times (such as the last year as rates have risen PAXS and other bond funds have fallen significantly in price). Leverage for this fund was recently 46.4% which is significant (near the 50% regulatory limit for bond CEFs), but also consistent with other PIMCO bond funds.

Regarding derivatives (such as interest rate swaps) this also creates risk for bond CEFs (and PIMCO uses a lot of them). For starters, we’re not fearful that the derivatives may default (because they are traded through the Chicago Mercantile Exchange, which requires dramatically more than ample reserves to ensure the derivative instruments don’t default), but mainly because derivatives confuse investors. For starters, PIMCO only reports the market value of the derivatives on their website instead of the notional value, which effectively makes the use of derivatives seem dramatically less prevalent than they really are. And secondly, the derivatives (such as interest rates swaps) can effectively delay (i.e. kick the can down the road) on ROC—something a lot of investors hate.

Return of Capital Risk

ROC, or return of capital, is essentially when a fund sources a distribution payment by returning some of the investors’ own capital. Investors generally prefer when the distributions are sourced from actual interest (or dividends) on the underlying holdings (or through long-term capital gains), and investors frequently try to avoid funds with ROC.

The reality is that most PIMCO bond funds have been sourcing part of their distributions with ROC (because as interest rates have fallen—they’ve not been able to source distributions from capital gains and/or interest/dividends) and effectively hiding it from investors through interest rate swaps. This isn’t innately a bad thing (for investors mainly interested in high income—the primary objective of this fund—ROC is acceptable from time to time and to an extent). However, it is bad that PIMCO basically hides it from investors (through opaque derivatives and shady notional-vs-market-value reporting) because they know darn well investors are trying to avoid it.

The Bottom Line

The bottom line on PAXS is that it is attractive right now (if you are an income-focused investor) because it does pay big steady monthly income and the share price may be set to rise significantly in the second half of 2023 as interest rates are widely expected to reverse course (i.e. go lower) in the second half of 2023 (lower rates are good for bond fund prices).

However, investors need to recognize that because of ROC on these funds their long-term total returns (i.e. price returns plus distributions as if they were reinvested) may continue to be lower than the yield. Said differently, you still come out ahead if the fund pays you an 11.7% annual distribution yield, but the price falls by 3% on average every year. In fact, if you are an income-focused investor—this may be exactly what you are looking for.

We are currently long shares of PAXS in our Blue Harbinger “High Income NOW” portfolio, and have no intention of selling.