“Dogs of the Dow” is an investment strategy that essentially involves investing in the 10 Dow Jones stocks with the highest dividend yields. In this report, we review the strategy and then dive into one name from the list that is particularly attractive. Specifically, we review a healthcare sector Dog of the Dow with a compelling 3.8% dividend yield and a low stock price as compared to its value. We conclude with our opinion on investing.

Amgen (AMGN), Yield 3.8%

The company we review in this report is Amgen, a biotechnology company (pharmaceuticals) that trades at an attractive valuation and offers a growing dividend (and higher than normal dividend yield). But before getting into the details on Amgen, let’s first review the “Dogs of the Dow” strategy.

Dogs of the Dow

According to Investopedia, "Dogs of the Dow" is:

“an investment strategy that attempts to beat the Dow Jones Industrial Average (DJIA) each year by leaning portfolios toward high-yield investments. The general concept is to allocate money to the 10 highest dividend-yielding, blue-chip stocks among the 30 components of the DJIA. This strategy requires rebalancing at the beginning of each calendar year.”

The strategy has a bit of a contrarian focus, and investopedia goes on to explain:

“Dogs of the Dow relies on the premise that blue-chip companies do not alter their dividend to reflect trading conditions and, therefore, the dividend is a measure of the average worth of the company. In contrast, the stock price does fluctuate throughout the business cycle.”

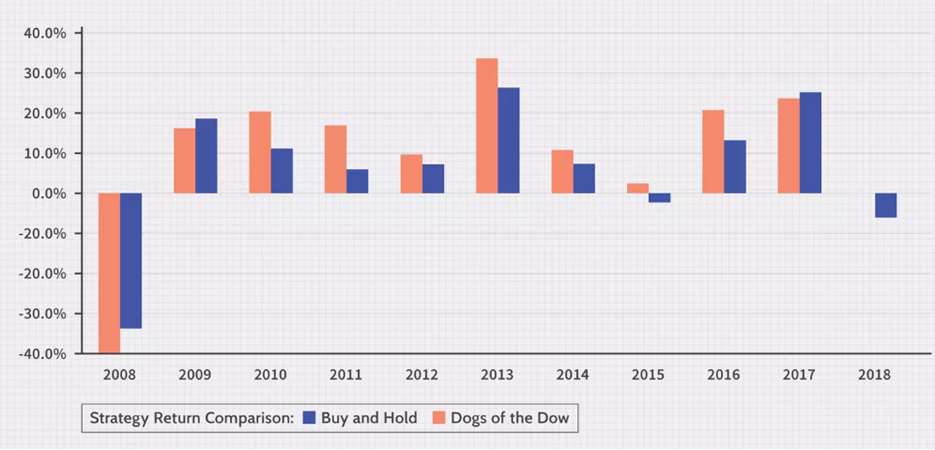

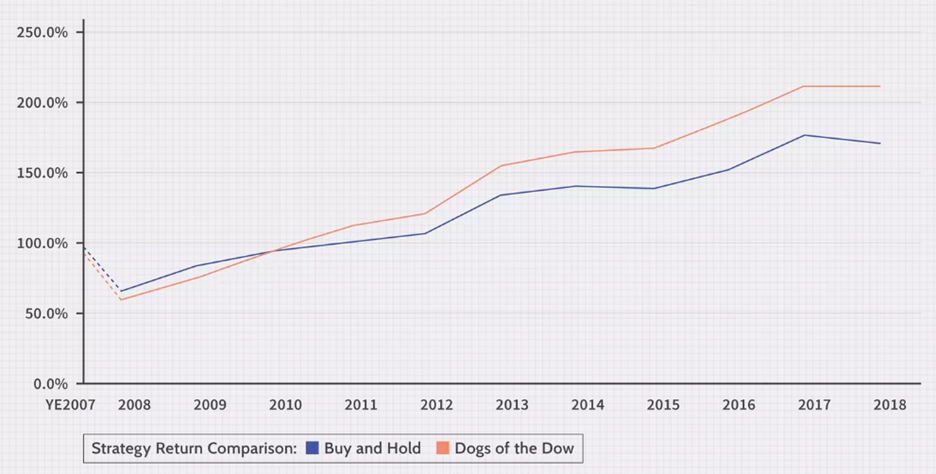

In recent years, the Dogs of the Dow strategy has produced relatively strong returns (outperforming the total Dow) as you can see in the charts below.

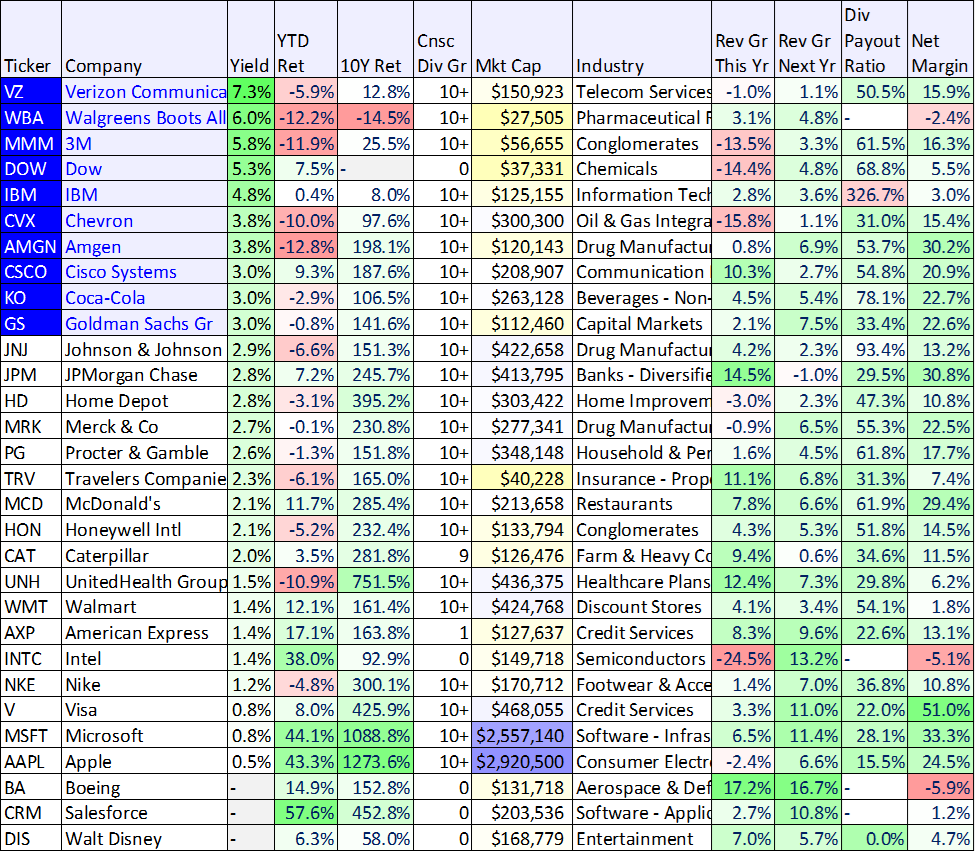

And for reference, here is a look at the 2023 Dogs of the Dow.

And here is a look at the updated performance and dividend yields of all 30 Dow Jones stocks so far this year.

As you can see above Amgen remains a Dog of the Dow so far this year.

Amgen Overview:

As mentioned, Amgen is a large drug company (it has a $118.7 billion market cap). And according to its company fact sheet:

Amgen is committed to unlocking the potential of biology for patients suffering from serious illnesses by discovering, developing, manufacturing, and delivering innovative human therapeutics.

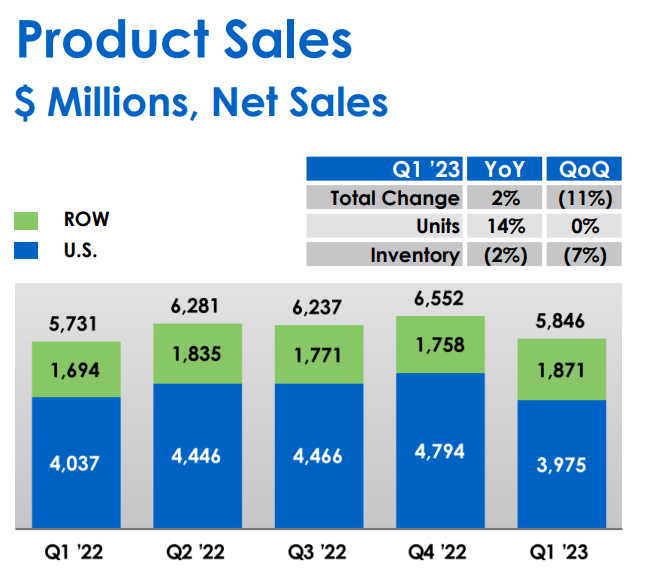

Amgen focuses on inflammation, oncology/hematology, bone health, cardiovascular disease, nephrology, and neuroscience areas. And for a little perspective, you can view the company’s diversified product mix in the following chart.

For reference, Amgen is headquartered in Thousand Oaks, California and approximately 70% of its sales are in the US. You can view a few of Amgen’s major competitors (AbbVie, Pfizer Novartis) in the following table.

4 Reasons Amgen is Attractive:

Attractive Business: For starters, Amgen offers a diversified product line (see above) that is profitable (+30% net profit margin) and growing (see chart below).

Growth is not at a rapid pace currently, but it is growing (a good thing) and very profitable.

Further, Amgen has a compelling pipeline of new drugs, including cholesterol drug Repatha and migraine drug Aimovig. Additionally Lumakras and Tezspire appear increasingly attractive.

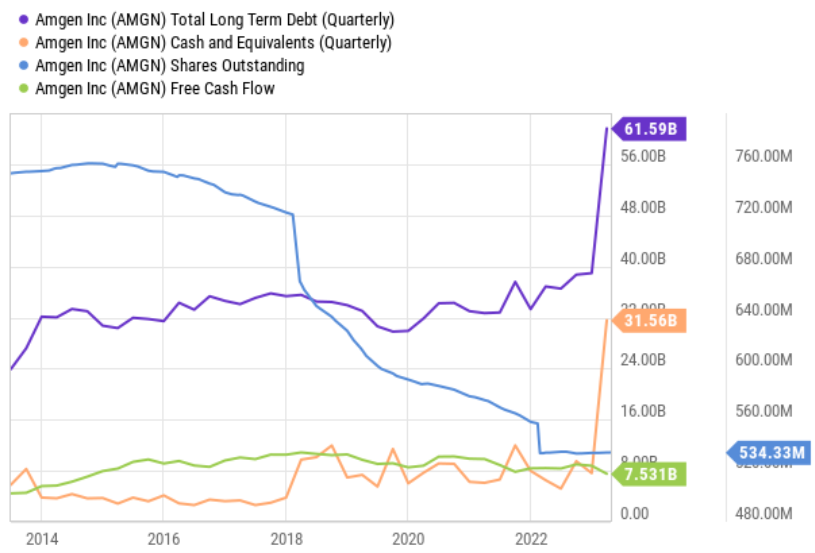

Healthy Balance Sheet: In addition to an attractive business, Amgen also has a healthy balance sheet, and continues to generate strong free cash flow. You may note the spike in long-term debt (in the chart below), which was for the planned acquisition of Horizon Therapeutics (which is currently facing regulatory scrutiny—more on this later), and the spike in debt is offset (currently) by the spike in cash (again for the Horizon acquisition—which is consistent with Amgen’s growth goals (both organically and inorganically).

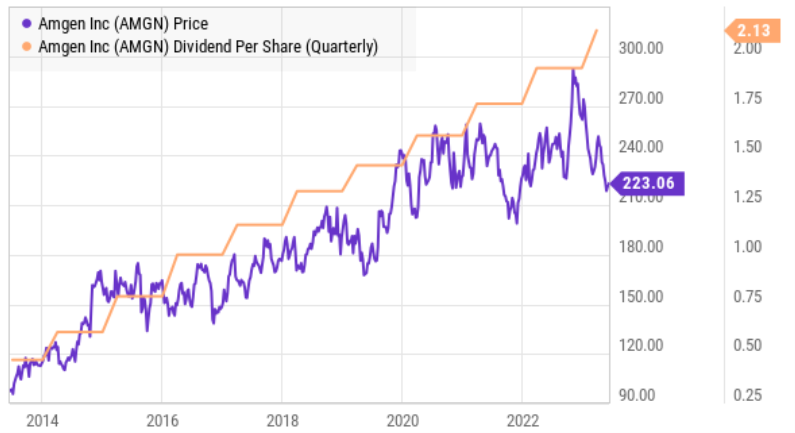

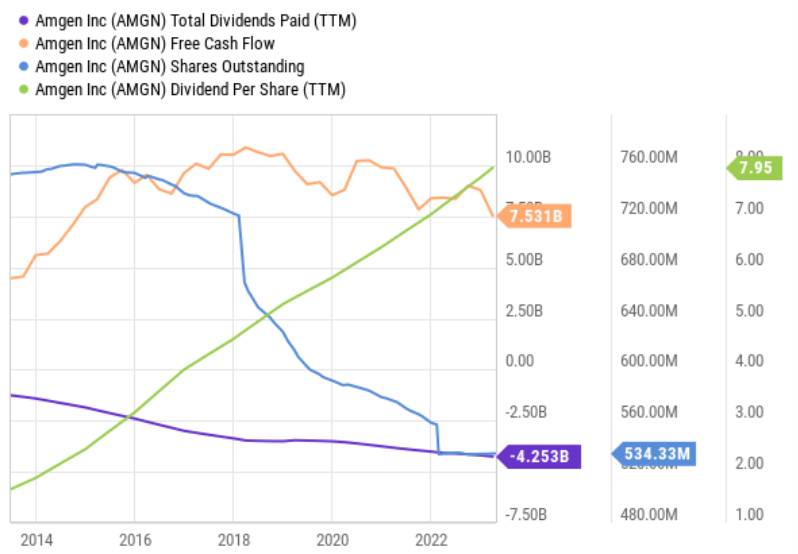

Powerful Dividend: Another attractive Amgen quality is its powerful dividend. The dividend has been increased (significantly) for 11 years in a row, and the current yield is high by historical standards (attractive in our view considering the health of the business). Also important to note (as you can see in the chart below), Amgen has been buying back shares (blue line) and its dividend payout (purple line) is well covered by free cash flow (orange line).

So even though Amgen’s total dividend payout has been decreasing (because they keep buying back shares—a good thing) the dividend per share continues to increase significantly (green line) which is a very good thing for income-focused dividend-growth investors.

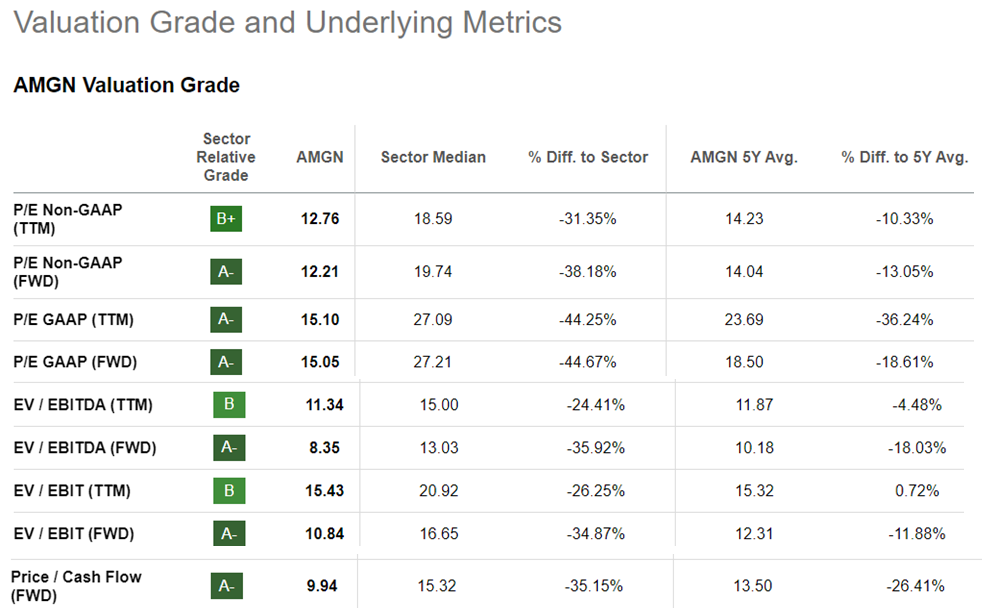

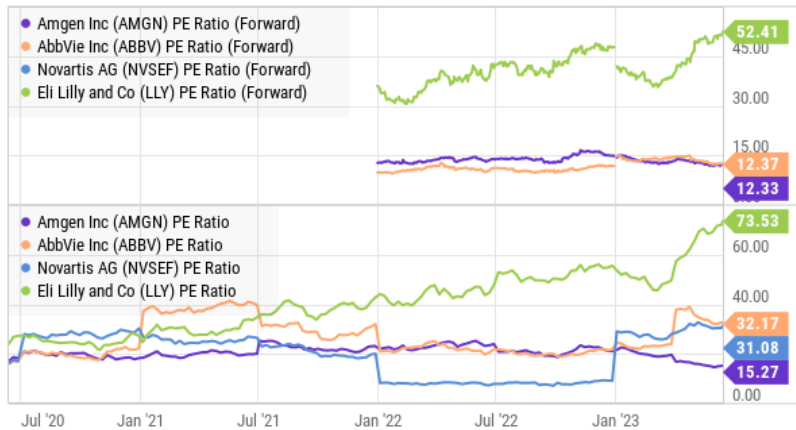

Compelling Valuation: From a valuation standpoint, Amgen is on sale. Specifically, it trades at only 12.2 times forward earnings (low compared to the healthcare sector and low compared to its own history).

Amgen also trades at an attractively low valuation as compared to other big pharmaceutical companies too, as you can see below.

For a healthy, high-profit-margin, big-dividend-growth company, Amgen shares are priced compellingly.

Risks: Of course, Amgen does face risks too. For example, the FTC has recently put the breaks on Amgen’s proposed acquisition of Horizon (what would be Amgen’s largest acquisition ever at $27 billion) thereby interfering with the company’s growth strategy.

Further, Amgen faces standard industry risks (which are largely baked into the price) including lawsuit risks, competition from biosimilars and regulatory reimbursement headwinds. However, Amgen is well-positioned to deal with these risks considering its diversified product lines, pipeline, strong balance sheet, and powerful bottom line profits,

The Bottom Line:

If you are a dividend growth investor that likes to purchase stocks at compelling valuations, Amgen is absolutely worth considering. It is a standout “Dog of the Dow” that is well positioned to continue its track record of strong profits and growing dividends. We do not currently own shares of Amgen, but it is high on our watchlist, and we may add shares soon.