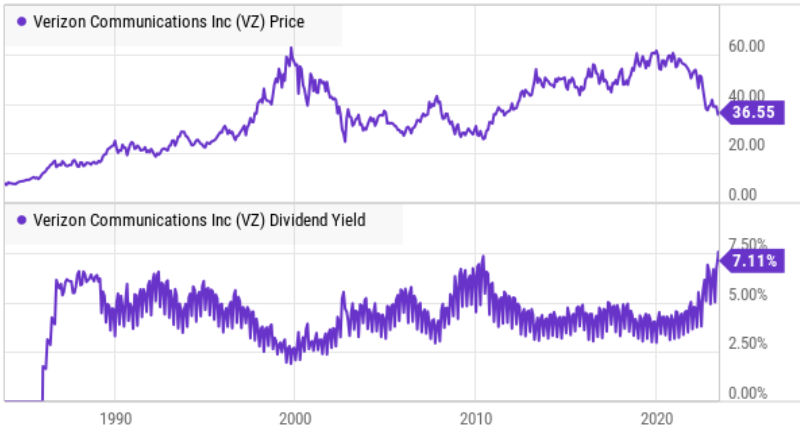

If you are an income-focused value investor, Verizon (VZ) shares offer a well-covered 7.2% dividend yield and currently trade at an attractive price relative to the value. From a contrarian standpoint, Verizon is a Dog of the Dow, and its low beta may be exactly what some investors are looking for as the overall stock market has risen sharply this year while the economy remains on uncertain ground. In this report, we review Verizon’s business, its dividend, the current valuation and the risks (including rumors of Amazon’s desire to offer wireless service as part of its $139 annual Prime membership). We conclude with our strong opinion on investing.

About Verizon:

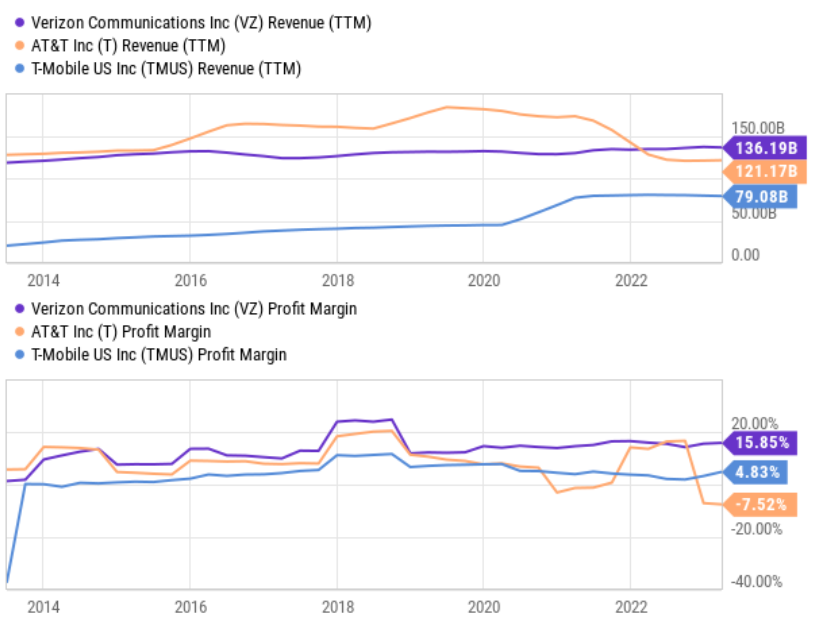

Verizon is one of the three main US telecom companies (AT&T and T-Mobile are the other two), and it has long been known for offering superior wireless coverage (although the competitor networks have largely caught up in recent years).

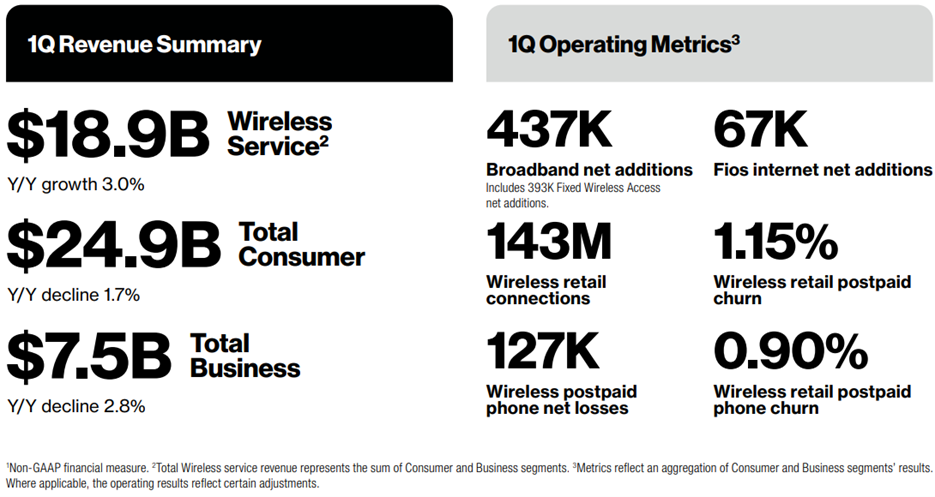

Verizon divides its business into “Consumer” and “Business” segments, but it’s really better understood as wireless versus wireline. Specifically, Verizon’s wireline business is in decline and expensive to maintain, whereas the wireless business contributes virtually all of the company’s overall profit (the net profit margin was recently 15.85% (superior to AT&T and T-Mobile).

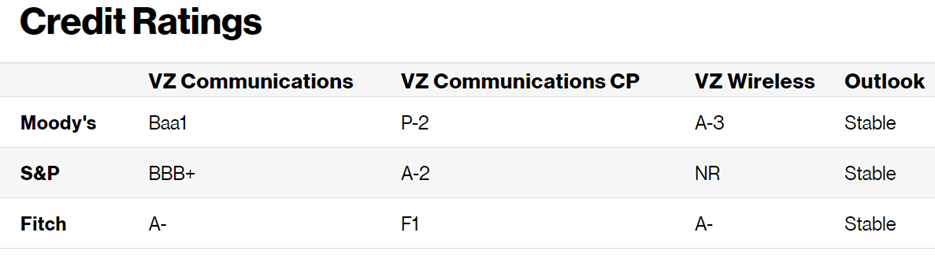

Interestingly, Verizon took on a lot of debt in 2021 to dramatically expand its spectrum (and thereby improve its wireless service, a good thing), and also did so at a time when interest rates were lower (also a good thing). Verizon maintains stable investment grade credit ratings from the three main ratings agencies (as you can see below) and its debts are spread out for decades into the future (good for risk management purposes).

source: Verizon Fixed Income

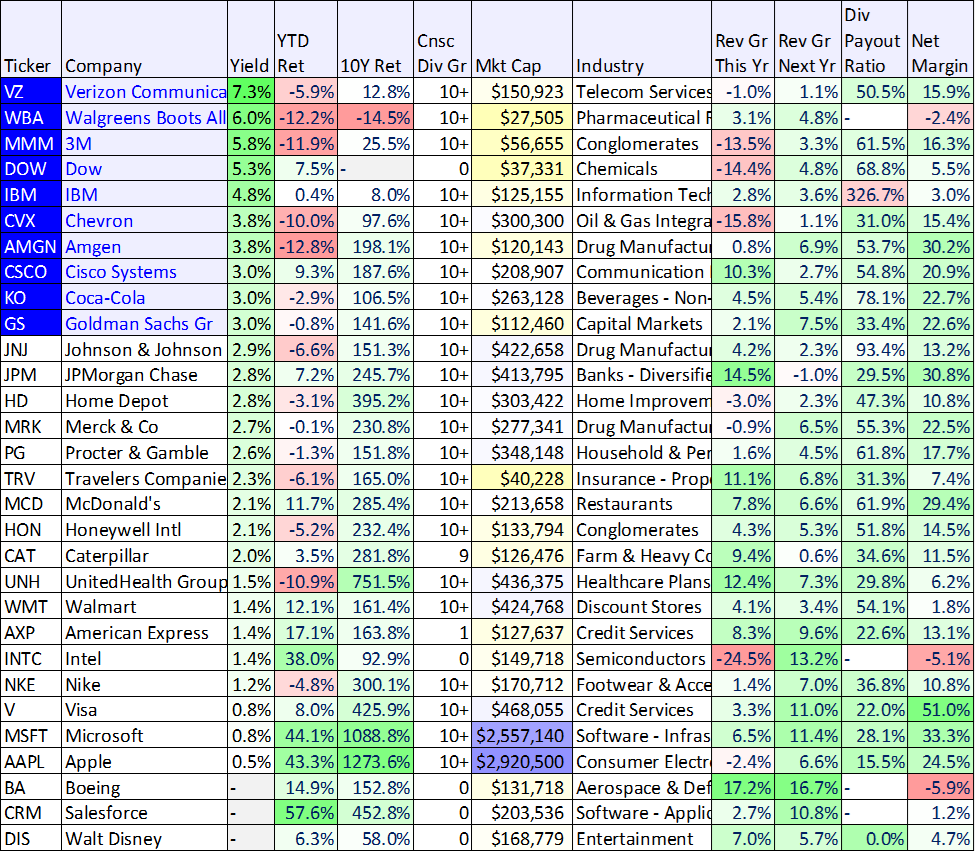

Also interesting, Verizon is a “Dog of the Dow,” a contrarian strategy that involves purchasing the top 10 dividend yield stocks in the Dow Jones Industrials Average at the start of the year. The Dogs of the Dow strategy has produced superior returns (as compared to the overall Dow in recent history), and you can view the dividend yield and recent performance of all 30 Dow Jones stocks below.

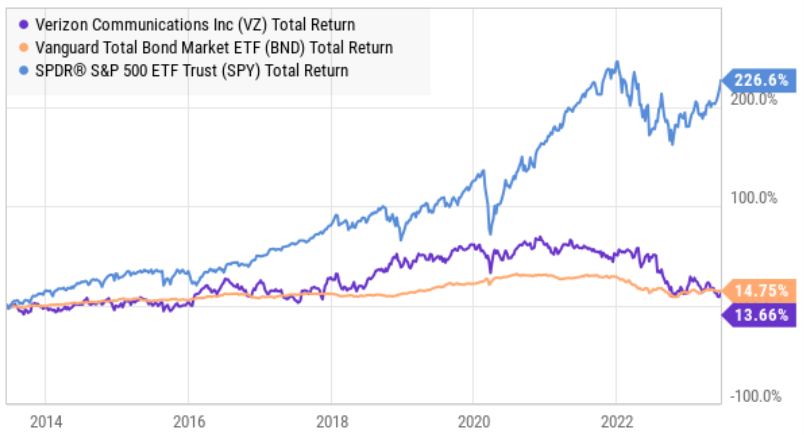

Also worth noting, while Verizon’s valuation and dividend yield are both attractive (as we will cover in more detail below), its future growth expectations are low (as you can see in the table above). Verizon is not a high-flying growth stock, but rather it is an attractively-priced, low-beta (recently 0.35) dividend growth stock (the dividend has been increased for 18 years in a row). And a lot of investors have historically purchased the shares as a bit of a bond proxy. As you can see below, Verizon’s total return (price gains plus dividends reinvested) over the last decade has been a lot closer to a bond market index (BND) than a stock market index (SPY).

And with the stock market currently sitting at precarious levels (in the minds of some investors) Verizon may be attractive, particularly as a high-income contrarian play.

The Dividend

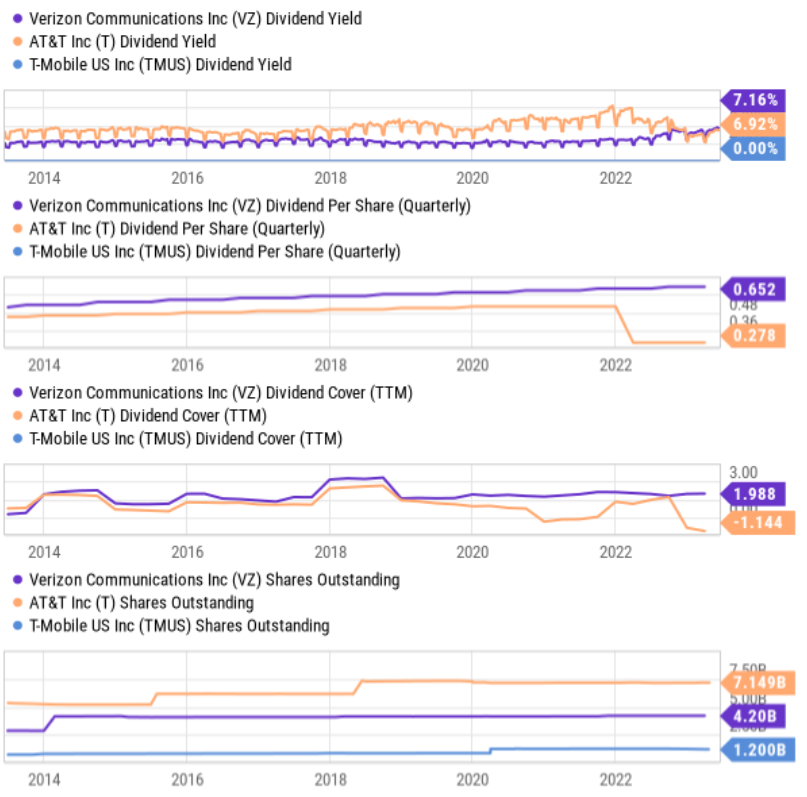

As mentioned, Verizon has increased its dividend for 18 years in a row, and it is well covered by earnings and free cash flow. This is more than competitors can say, considering T-Mobile doesn’t pay a dividend and AT&T had to cut its storied dividend in 2022 (which we warned about way back in 2015).

You can see important dividend-related metrics (for Verizon, AT&T and T-Mobile) above, such as current (and historical) yield (Verizon’s is current attractively high), dividend coverage ratio (as compared to earnings) and share outstanding (Verizon hasn’t been diluting existing shareholders by issuing new shares like AT&T and T-Mobile).

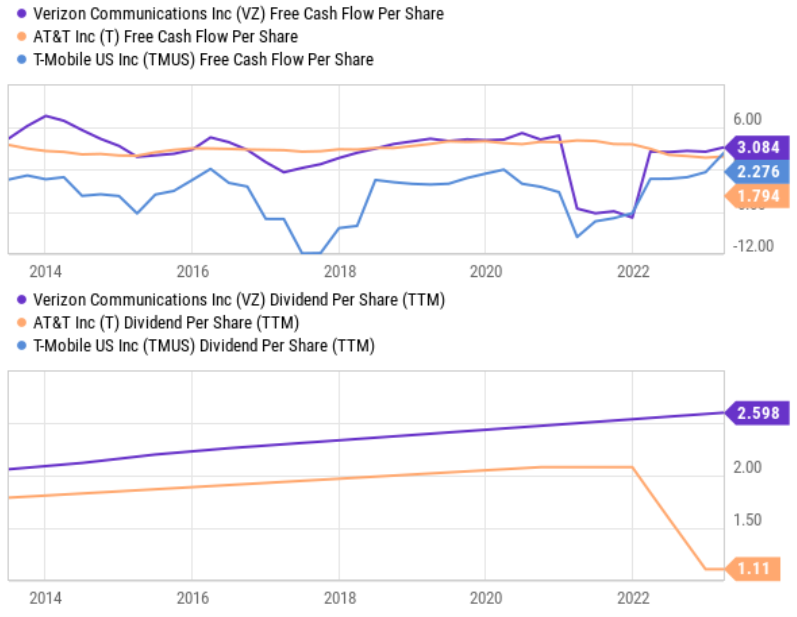

And for a little more perspective, here is a look at free cash flow per share versus dividend per share (another indication of the health of Verizon’s dividend).

In our view, Verizon’s dividend continues to be safe and well supported by the underlying business.

Valuation:

Verizon currently trades at only 7.9x forward earnings, which is extremely low (attractive) for a company with a 15.9% profit margin. The main reason is the lack of long-term growth. As we saw in our tables and charts, Verizon is growing at a low rate as wireline is basically in secular decline and as the wireless market becomes saturated and commoditized. Nonetheless, Verizon’s profits and dividends are attractive, especially as considering it trades at only around 11.8 times its very strong free cash flow generation.

In our view, these shares can easily trade at significantly higher valuation multiples, especially if investors begin to switch from growth to value in the second half of this year (again, as many investors believe the market is getting to far ahead of the economy).

Risks:

Verizon does face a variety of risks. For starters, the company (and the industry’s) wireline business is expensive to maintain and not profitable, and the wireless industry is increasingly commoditized and runs the risk of competitors getting into a price war (which would hurt them all). Another risk is regulation. For example government regulators control the spectrum needed to operate a wireless network therefore they have the ability to create new competition (and or raise prices) by releasing new spectrum. Further still, technology innovation presents another risk factor that could impact the industry (as wireline was once believed to be a “forever” necessity, but is now largely replaced by cord cutting and wireless).

Amazon (AMZN) disruption presents another risk. Rumors recently surfaced that Amazon (known for disrupting many industries) in considering offering wireless service as a way to increase the stickiness of subscribers to its $139/year annual Prime memberships. A problem Amazon has with Prime is customers coming and going frequently. By tying Prime to wireless service, customers would be much less likely to leave.

Amazon and telecoms have been quick to dismiss the rumors, but it is not entirely far fetched. For example, Google Fi Wireless, which operates as a mobile virtual network operator, as it runs on T-Mobile’s network.

Per a June 2nd note from Morningstar Director, Michael Hodel:

We expect any wholesale agreement with Amazon would be structured to ensure that the winning carrier is economically indifferent between adding a retail customer or an Amazon customer, with Amazon taking on customer acquisition and service costs. Anything less favorable only promises a race to the bottom as carriers then compete for an agreement with Walmart, etc.

While Verizon is profitable and the big dividend appears very safe, the industry is prone to disruption and risks going forward that should not be ignored.

Conclusion:

If you are looking for spectacular long-term growth, don’t invest in Verizon—it’s not right for you. However, if you are an income-focused investor that is attracted to the big dividend yield (which we believe is very safe) and the low share price (which we believe is too low as compared to the company’s profits and cash flows), Verizon is worth considering for investment, especially if you believe the market is getting a little too greedy as compared to the current state of the economy.