The company we review in this report is already benefiting from the massive secular growth in Artificial Intelligence (“AI”) and Machine Learning (“ML”). And it is positioned to keep benefiting massively in the years ahead thanks to its leading solutions, innovation, sticky customer base and very strong balance sheet. This one was loved (during the pandemic bubble) then hated (when the bubble burst), but the business has only been getting stronger and the shares are still inexpensive relative to where we expect them to be in five years and beyond. In this report, we review the business, the growth, the opportunity, the valuation and the risks. We are currently long these shares with no intention of selling.

Introduction: Palantir (PLTR)

Palantir (PLTR) offers a software platform that employs advanced data analytics and AI/ML algorithms (artificial intelligence / machine learning), enabling organizations to efficiently analyze both structured and unstructured data. The company’s software platform is capable of handling vast amounts of data from diverse sources, enabling clients to extract valuable insights for various applications. With its three main software solutions (Gotham, Foundry, and Apollo), Palantir provides a robust infrastructure for seamless data integration and operation across different environments, catering to both commercial and government entities. To seize opportunities in the growing AI market, Palantir has also introduced its own AI-based platform known as AIP, expanding its product offerings and strengthening its position in the industry. In this report, we analyze Palantir’s business model, its market opportunity, financials, current valuation and risks, and then conclude with our opinion on investing.

Key Takeaways:

Driving Platform Stickiness Through Expanding Capabilities and AI/ML Integrations.

Leveraging Large and Fast-Growing Big Data Analytics and Generative AI Markets.

Expanding Customer Base Amidst Low to Moderate Concentration Risk.

Declining Stock Based Compensation Expenses Drove First Quarterly GAAP Profitability, Signaling Positive Shift.

Growing Top & Bottom Lines Despite Macro Headwinds.

Strong Balance Sheet with Healthy Improvement in Cash Flows.

Promising Future with Abundant Opportunities for Additional Growth.

A PDF version of this report is available here.

Overview:

Founded in 2003, Palantir provides a software platform that leverages data analytics and AI/ML algorithms, allowing organizations to effectively analyze a diverse set of structured and unstructured data with great efficiency. While its initial focus was on serving government accounts, including defense organizations and intelligence units, the company has recently expanded its services to encompass diverse commercial sectors such as finance, healthcare, energy, and transportation. The company’s software is utilized for various applications such as counterterrorism, fraud detection, disaster response, supply chain optimization, and healthcare analytics. Palantir’s advanced algorithms help its customers extract valuable insights from datasets and identify patterns and trends to make informed predictions. As of Q1 2023, Palantir's software has been adopted by over 60 industries globally, serving a total of 391 customers.

The company generates revenue by offering subscription-based access to its software, which is hosted within its dedicated environment called "Palantir Cloud." The company also provides ongoing operating and maintenance services. Furthermore, it offers software subscriptions and ongoing operating and maintenance services for customers who prefer to host the software within their own environments, referred to as "On-Premises Software". Palantir's portfolio consists of three primary software platforms: Gotham, Foundry, and Apollo. These platforms serve as essential infrastructure, facilitating the smooth integration of customers' data and operations, thereby enabling them to deploy and operate the software in nearly any environment.

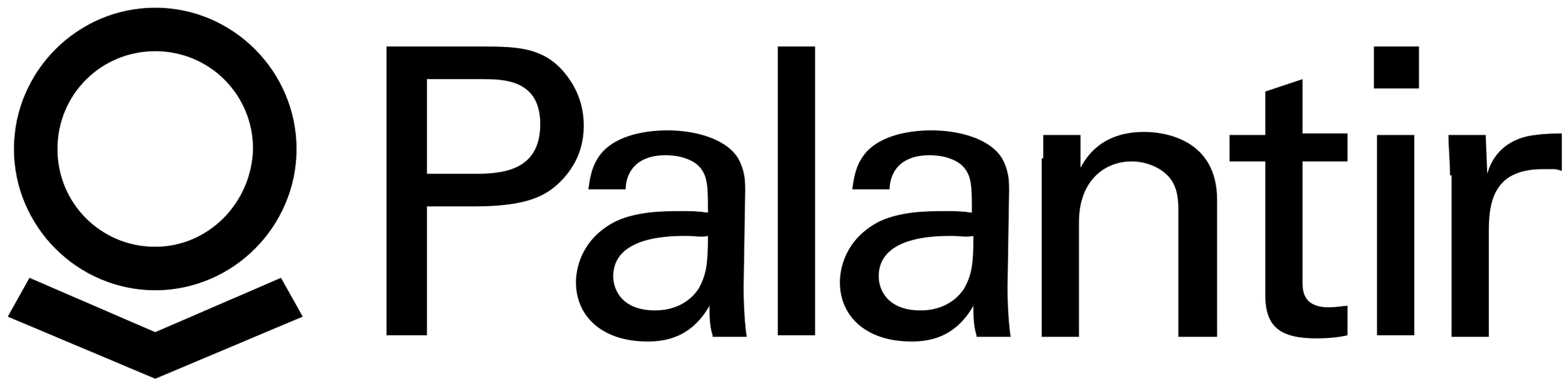

Palantir operates through two segments: Government and Commercial, which accounted for 55% and 45%, respectively to the company's total revenues in Q1 2023. In terms of geographical distribution, the majority of its revenue (64%) is generated from the US, followed by the rest of the world (27%) and the UK (9%), as shown in the chart below.

Source: Company’s 10-Q

Driving Platform Stickiness Through Expanding Capabilities and AI/ML Integrations

Palantir has developed three primary software platforms: Gotham, Foundry, and Apollo. Gotham and Foundry help organizations organize and utilize their data effectively, with Gotham being used by defense agencies, intelligence groups, and disaster relief organizations for over a decade. Apollo acts as a control layer for cloud systems, ensuring smooth operation. Palantir is expanding Gotham by incorporating AI improvements for cyberattack stages and targeting specific industries like shipbuilding in Korea. In Q1 2023, Palantir closed its first $1M deal for Apollo and received positive feedback for the Foundry Ontology SDK, a software solution that enables data scientists to connect their models with real-world decisions, streamlining model deployment and facilitating continuous communication for improved decision-making and business impact.

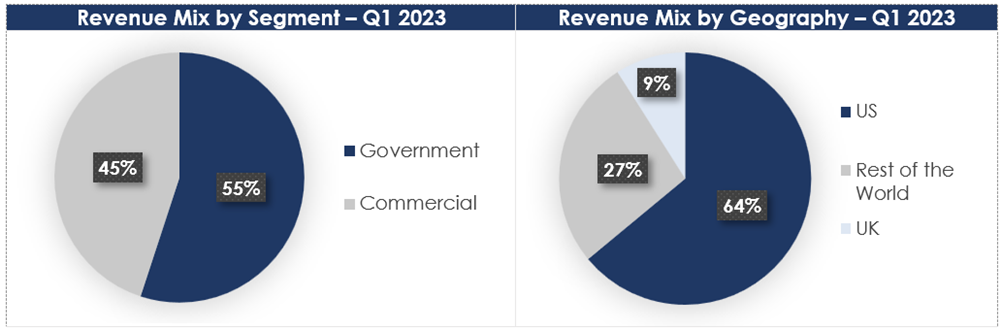

The company has recently introduced its Artificial Intelligence Platform (AIP), which integrates existing software platforms with Large Language Models (LLMs) and robust AI tools, enabling real-time interaction and data-driven decision making through a secure AI chatbot. While similar to ChatGPT in terms of generative AI, AIP offers superior data-driven analytical capabilities, a controlled environment, enhanced security, and visually appealing human readable graphs and charts. In a more recent development, Palantir has been granted a contract by the US Special Operations Command (USSOCOM) to provide technology solutions that enhance enterprise capabilities using AI/ML. This multi-year contract is worth up to $463M.

Source: Investor Presentation

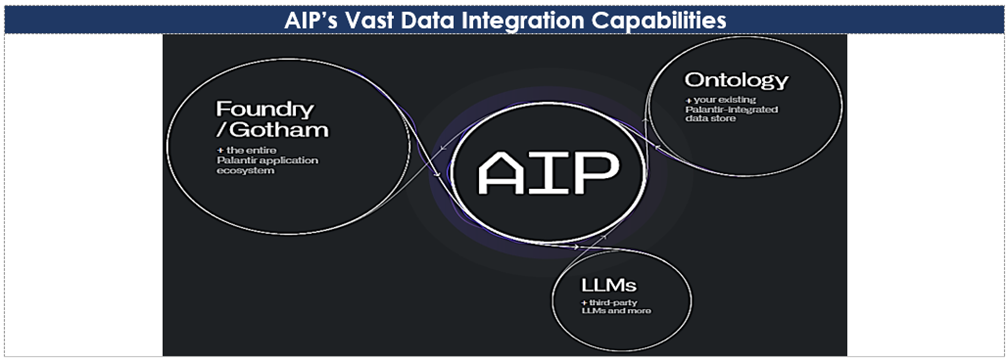

Palantir has introduced two versions of the Artificial Intelligence Platform (AIP): AIP for Defense and AIP for Business, with plans for a phased launch. AIP prioritizes compliance with legal and ethical guidelines when deploying powerful AI tools and Large Language Models (LLMs). It consists of three pillars: AIP Core for smooth deployment across diverse networks, AIP Action Graph for robust security features and governance, and AIP Control Plane for secure digital records of operations. AIP seamlessly integrates with existing platforms like Gotham and Foundry, enabling customers to make intelligent decisions, implement advanced automation, and gain strategic advantages. Palantir aims to deliver value quickly and make a meaningful impact through AIP.

Source: Company’s Website

Leveraging Large & Fast-Growing Big Data Analytics and Generative AI Markets

The global big data analytics market is projected to reach $745B by 2030, growing at a CAGR of 13.5% from 2023 to 2030, driven by the increased data volume due to the rise of IoT (the “Internet of Things”). Industries such as banking, healthcare, retail, agriculture, and telecom/media are generating massive amounts of data through digital solutions. Data discovery and visualization are expected to dominate the market as the need for better data interpretation grows. The recent launch of Palantir's generative AI platform, AIP, has also significantly expanded its Total Addressable Market (TAM). The global Generative AI market is estimated to be worth $14B in 2023 and is expected to grow at a CAGR of 34.3% to exceed $110B by 2030. Considering the big data analytics and generative AI market, Palantir's TAM exceeds $300B. With annual revenue of nearly $2B, the company has ample room for substantial growth.

Expanding Customer Base Amidst Low to Moderate Concentration Risk

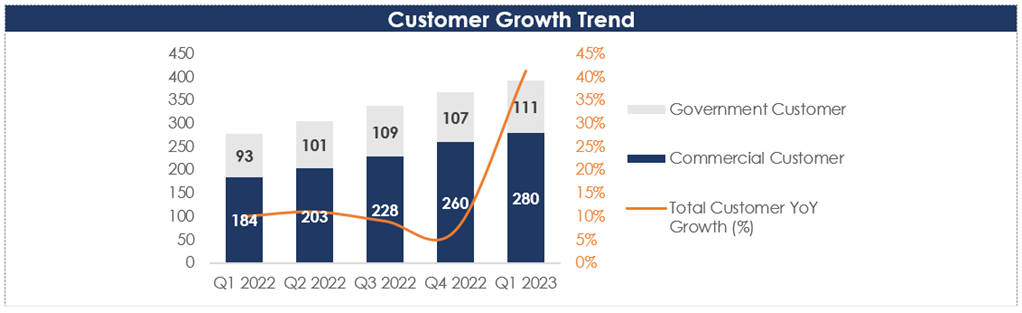

In Q1 2023, Palantir added 114 new customers compared to the previous year, consisting of 96 commercial customers and 18 government customers, bringing the total count to 391. This represents a 41% YoY increase from 277 customers in Q1 2022. The main driver of this growth was a solid 52% YoY expansion in commercial customers, growing from 184 to 280 and accounting for nearly 72% of the total customer count.

Source: Company’s filings

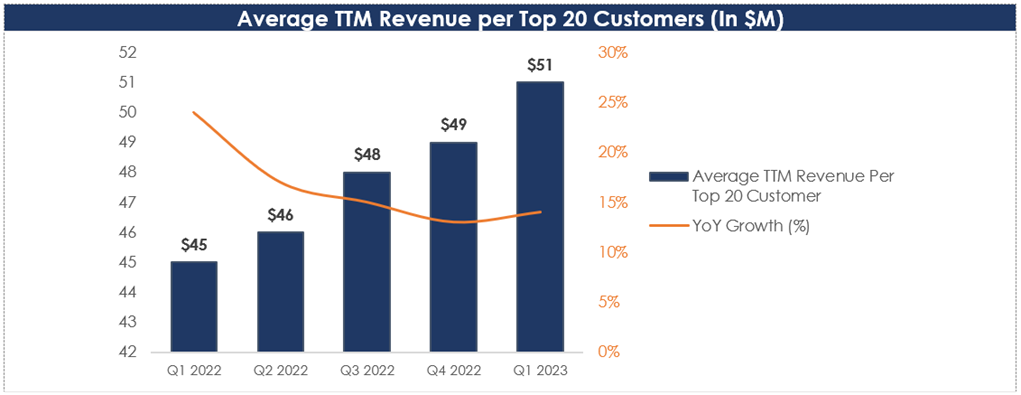

The company has maintained a net dollar-based retention rate of over 100% signifying superior customer satisfaction. In fact, the company's top three customers have consistently contributed 20% of revenue and have maintained an average seven-year business relationship, showcasing loyalty and ongoing partnerships. Additionally, the average revenue per top twenty customers on a TTM basis has also been consistently rising, reflecting the sticky nature of the company’s platform.

Source: Company Filings

However, as with other high growth technology companies, Palantir is also faced with low to moderate concentration risk. Specifically, one of the company’s government customers accounted for 10% of the total revenue in Q1 2023, which poses a notable risk considering the sensitivity of the data handled by the company's platform. As such, issues with a single government customer such as a data breach could create a contagion effect and can potentially impact the entire government customer base, resulting in significant revenue downside. On a positive note, having a significant revenue contribution from government can help ensure stability in cash flows and provide opportunities to secure larger contracts. Additionally, it helps the company sustain growth, even during market downturns.

Declining Stock Based Compensation Expenses Led First Quarterly Profitability, Signaling Positive Shift

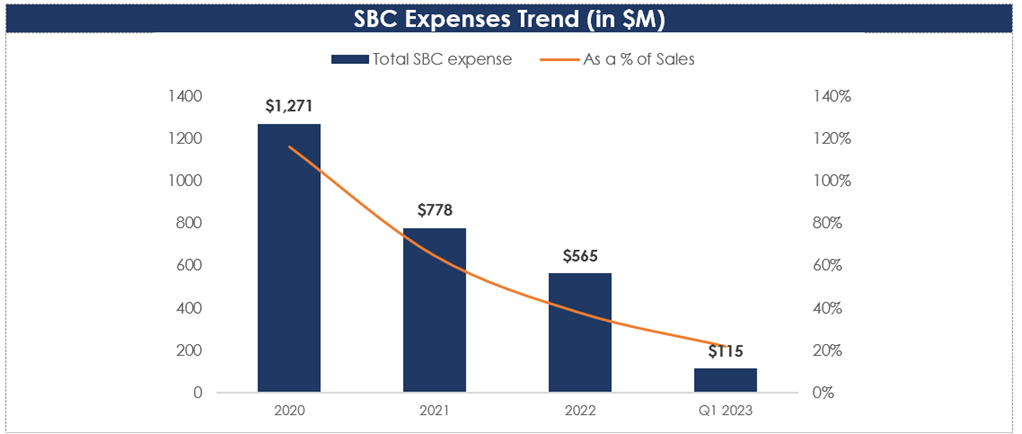

Palantir's substantial Stock Based Compensation (SBC), which it offers to attract top talent, has been a subject of scrutiny for a long time. However, in recent quarters, the company has taken steps to reduce its significant SBC payouts. In fact, the percentage of SBC relative to sales has decreased from 116% in 2020 to 22% in Q1 2023. In dollar-term, SBC expenses declined from $1.3B in 2020 to $115M in Q1 2023. This decline in SBC expenses has played a pivotal role in Palantir's achievement of its first-ever quarterly operating profit on a GAAP basis. In Q1 2023, the company reported a profit of $4.1M, compared to an operating loss of $39.4M in Q1 2022.

Source: Company Filings

Additionally, we analyzed Palantir's SBC as a percentage of sales in comparison to other high-growth technology companies. Our analysis revealed that the company's SBC percentage aligns with the industry average of its peers. This indicates that Palantir's SBC expenses are being effectively managed, and as the company scales further, these expenses, even though non-cash, are likely to further decrease.

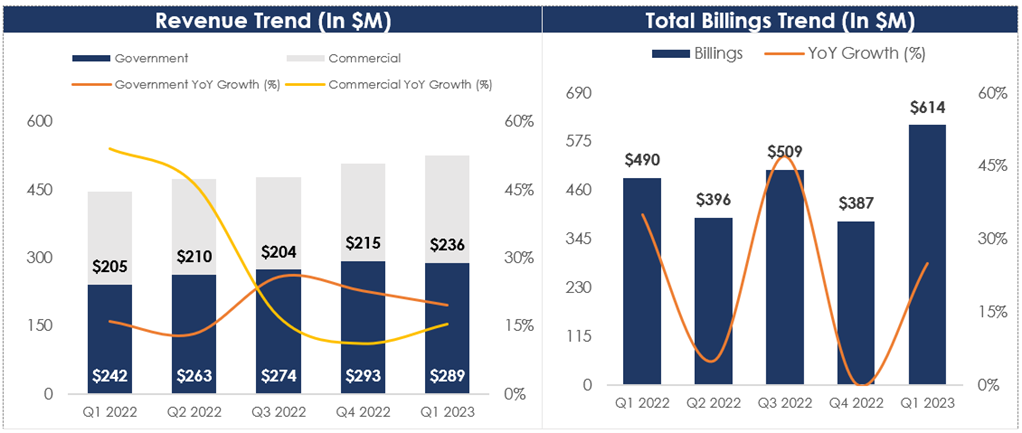

Promising Revenue and Billing Growth Coupled with Enhanced Profitability

In Q1 2023, the revenue increased 18% YoY to $525.2M, driven by improved demand from both government and commercial customers. Revenue from government business grew 20% YoY to $289.1M, supported by rising revenue from US customers which grew 22% YoY to $229.8M. Revenue from commercial business also saw a positive trajectory, with a 15% YoY increase to $236.1M. This growth was fueled by the re-acceleration of the US commercial business, surpassing $100M in revenue for the first time and achieving $107.0M with a strong 26% YoY growth. In Q1 2023, the company witnessed 25% YoY growth in total billings, reaching $613.M, showing strong product demand and successful contract acquisitions along with potential for customer attraction and retention.

Source: Company Filings

As per Alexander C. Karp, Chief Executive Officer & Co-Founder:

“We have achieved an annual growth rate of nearly 30% in our most important market during a period of significant macroeconomic uncertainty and without the benefit of the broader awakening across sectors and industries to the potential of large language models and other forms of generative artificial intelligence. And we anticipate that the development of AIP will mark an even more significant moment in our advance.”

On the profitability front, the adjusted gross profit grew 17% YoY to $426.7M on higher revenues. However, the margin fell 20bps YoY to 81.3% on higher hardware and other costs related to new projects. On the operational side, the adjusted operating profit rose 7% YoY to $125M. However, on a margin basis, the adjusted operating margin declined 250bps YoY to 23.8%. This decrease was primarily driven by higher sales and marketing expenses, including elevated payroll costs and increased travel and office-related expenses.

Source: Company Filings

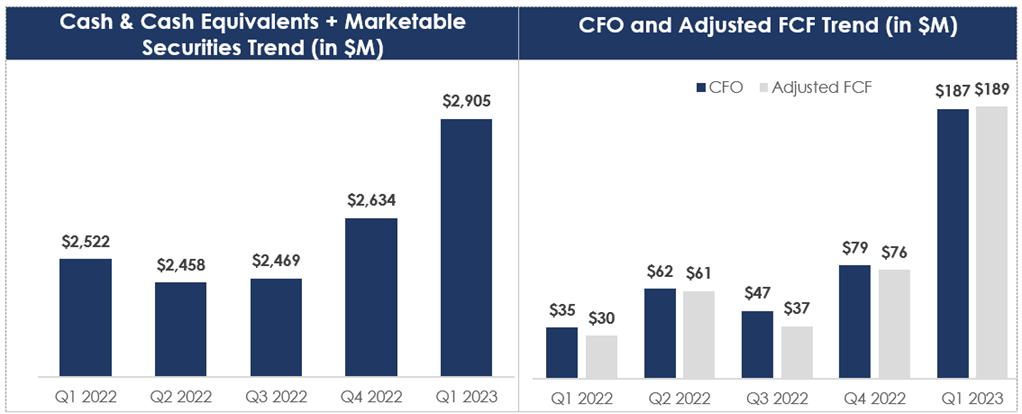

Strong Balance Sheet with Healthy Improvement in Cash Flows

Palantir ended Q1 2023 with $2.9B in cash, cash equivalents, and marketable securities and has no major debt on its balance sheet, which lends financial stability and indicates that the company has sufficient liquidity to meet its short-term obligations and pursue growth opportunities. This would further help Palantir to take up product portfolio expansion, particularly in a growing AI market, and enhance its competitiveness. In Q1 2023, Cash Flow from Operations (CFO) increased significantly to $187.4M compared to $35.5M in Q1 2022. This growth can be attributed to the favorable timing of customer payments and vendor payments. Also, adjusted Free Cash Flow (FCF) grew to $188.9M in Q1 2023 from $29.8M in Q1 2023, led by lower capital expenditure (1% of sales in Q1 2023 vs 3% in Q1 2022) and the achievement of profitability in Q1 2023 compared to a net loss in Q1 2022.

Source: Company Filings

Valuation

Palantir's stock has experienced a remarkable rally, surging nearly 150% year-to-date. This impressive performance can be attributed to the introduction of new product platforms and a heightened focus on AI offerings. Despite this positive momentum, it is worth noting that the stock still remains more than 50% below its peak in 2021. In terms of valuation, Palantir currently trades at a price-to-sales multiple of 15x on a forward basis. This places the company at a slight premium compared to its peers. However, this premium can be justified due to several factors. Firstly, Palantir has consistently secured new customers and expanded its offerings among existing customers, indicating its ability to maintain its revenue momentum. Additionally, the company has recently entered the large and rapidly expanding AI market, which presents significant untapped opportunities for expansion.

Source: Seeking Alpha

Risks

Intense competition: Palantir operates in a highly competitive market for data analytics and software solutions, competing with industry leaders such as Snowflake, Splunk, IBM, Salesforce, Microsoft, Tableau, and Oracle. Despite fierce competition, Palantir has been recognized as a leader in AI/ML platforms by Forrester Research in its Q3 2022 report. This represents Palantir's strengths and its ability to provide effective solutions that meet customer needs in a highly competitive environment.

Source: Investor Presentation

Conclusion

Palantir’s strong platform capabilities, expanding customer base, and AI-based platform position it for long-term growth in the thriving big data analysis and generative AI market. The company's solid balance sheet, improving cash flow generation, and zero debt contribute further to its financial stability. Additionally, Palantir's growing commercial customer base and comprehensive capabilities will overtime make the platform more attractive. We view this as an attractive opportunity for patient, long-term investors, who are looking to capitalize on the secular AI tailwind.