There are many ways to identify top investment opportunities, and one strategy is to screen the universe based on important fundamental metrics and then dig deeper into the names that look attractive. In this report, we share data on 40+ high-profit-margin and high-sales-growth stocks, and then dig deeper into four that are particularly attractive. We have a special focus on Lithium Americas Corp (LAC), including a review of its business, its growth potential, its valuation and risks. We conclude with our strong opinion about investing in high-profit-margin and high-sales-growth stocks in the current challenging macroeconomic environment.

40+ High-Profit-Margin Businesses

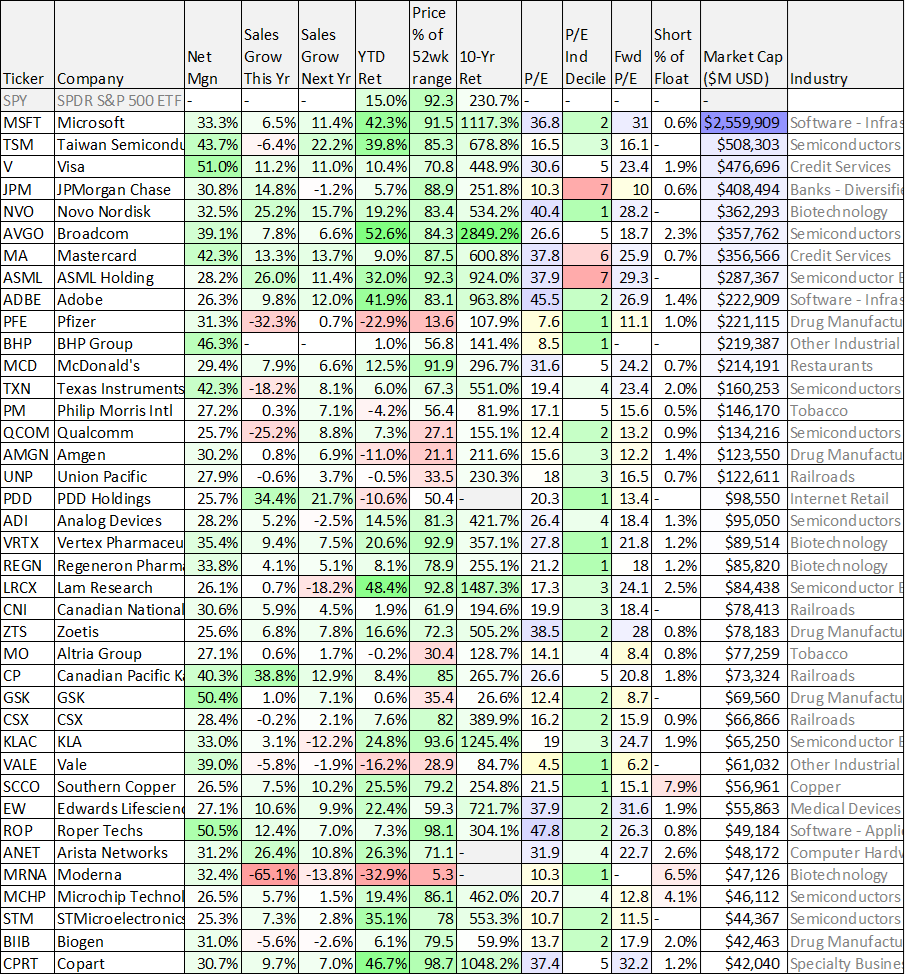

For starters, we’re sharing data on 40+ high-profit-margin businesses below. Profit margin is basically net income as a percent of total revenues. And in this case, we are sharing the top ~10% of stocks that trade on either the New York Stocks Exchange or the Nasdaq, in terms of high profit margins. Specifically, to be in this group, a profit margin (see “Net Mgn” column) of at least 30% was required.

You likely recognize many of the names on the list (it is sorted by market cap). And we believe high profit margin is very important in the current challenging macroeconomic environment. Specifically, the US fed just took a break from hiking interest rates (although the BOE just raised 50 basis points), but as rates are expected to go higher, profits are more important than ever.

More specifically, the high-growth stocks we share in the next table (later in this report) perform really well in a low or decreasing interest rate environment, such as during the pandemic bubble of 2021, because low interest rates and high market valuations made it easier for them to fund growth through borrowing (and low interest rates) and by issuing more shares (at high valuations). However, now that interest rates are higher (and expected to keep rising), current profits are more valuable than ever.

40+ High-Revenue-Growth Stocks

In this next table, we share 40+ stocks with among the highest revenue growth rates of companies trading on the New York Stock Exchange or the Nasdaq. Many of these stocks have fallen hard from their pandemic highs in 2021 (for the reasons we explained above, such as increasing interest rates). However, some of the stocks on this list have such powerful secular trends supporting their growth that higher interest rates won’t stop them from succeeding (especially considering interest rates aren’t currently that high by historical standards anyway).

1. Lithium Americas (LAC)

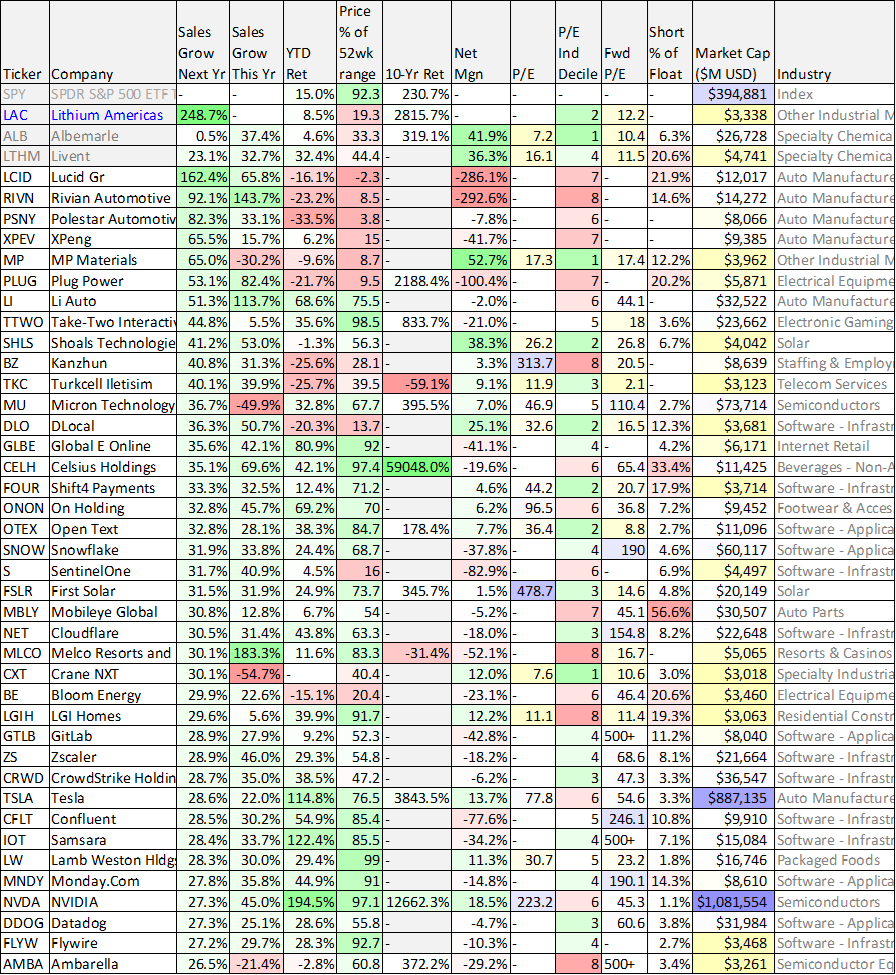

One name from the above high-revenue-growth table that really stands out (because of its very high expected revenue growth rate next year) is Lithium Americas Corp. As you can see in the table, its expected growth is +248.7% and worth digging into deeper, as we do in the following paragraphs.

About Lithium Americas

LAC is a materials (mining) company that explores for Lithium deposits in the United States and Argentina. The company owns interests (and is currently developing) three lithium assets. Specifically, two in Argentina (Cauchari-Olaroz and Pastos Grandes) and one in the US in Nevada (Thacker Pass). Interestingly, LAC currently has no significant revenues (the lithium assets are currently under development). For perspective, here is a look at the company’s recent revenues and profits.

It is the company's Cauchari-Olaroz assets that are beginning production this year, while Thacker Pass should start producing sometime around 2025-2026, and Pastos Grandes will begin producing after that.

Also important to note, LAC plans to split into two businesses later this year (“Lithium Argentina” which will own the two Argentina assets, and “Lithium Americas” which will own the Nevada assets). Shareholders will end up owning shares of both companies.

Growth Potential: Why is Lithium so Important?

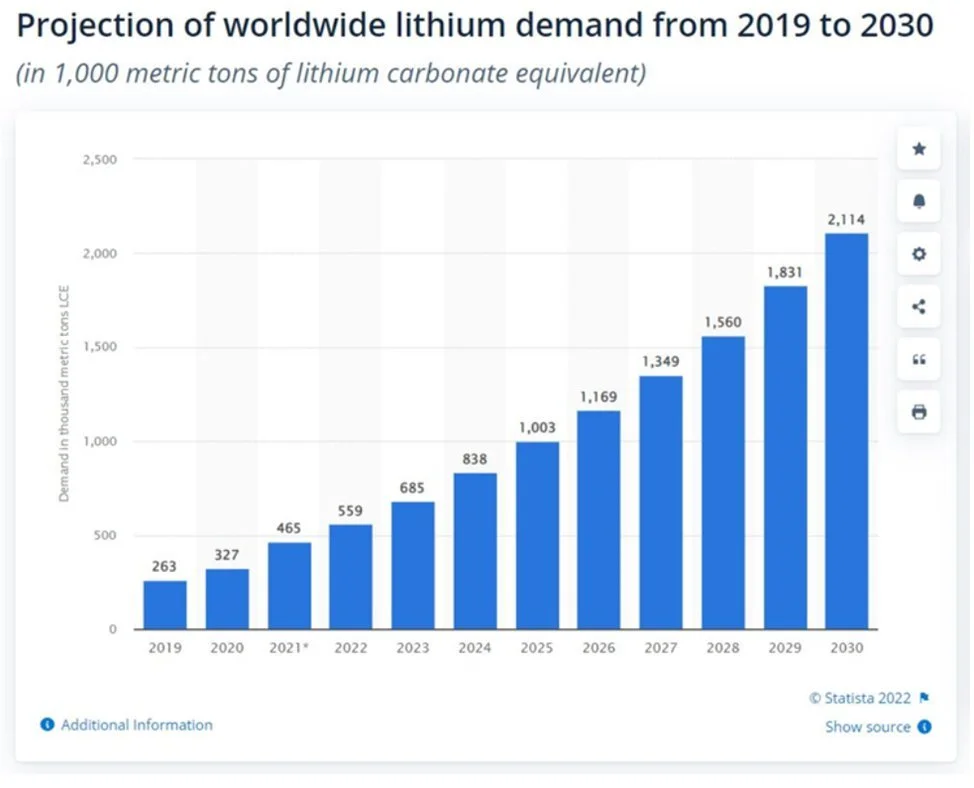

If you don’t know, lithium is increasingly important to the global economy because it is used to make batteries for electric vehicles. So as the world works to reduce carbon emissions, lithium is extremely important. For example, you can see in the following graphic just how dramatically lithium demand is expected to grow in the coming years.

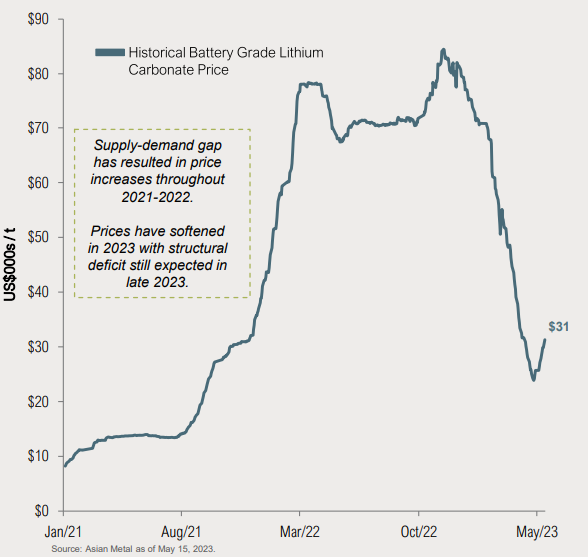

Also, for just a little more perspective on lithium supply and demand dynamics, you can see the recent price of lithium and the share price of three top lithium companies (Lithium Americas, Albemarle (ALB) and Livent (LTHM)) below.

However, according May 22nd note from Morningstar Strategist, Seth Goldstein:

We forecast lithium prices will average over $36,000 per metric ton from 2023 through 2030, leading to solid profits for low-cost producers. With the current stock prices implying prices around $20,000, much of the bad news is already priced in.

So basically, the current lower lithium prices are expected to go higher, and this will be a really good thing for lithium producers such as LAC.

General Motors (GM) Investment in LAC:

Also important to note, in an indication of the high quality lithium LAC is expected to produce (as well as the demand for it), General Motors (GM) recently made the largest investment ever by an automaker ($650 million, across two tranches) in battery raw materials from Lithium Americas Corp.

Further still, new reports suggest there may be a shortage of lithium supplies (a good thing for LAC).

Valuation:

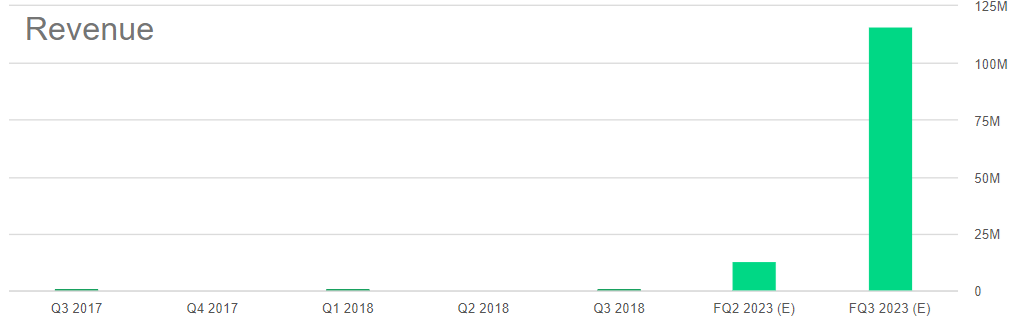

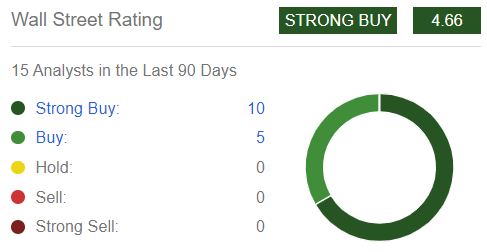

There is a lot of speculation and assumption involved in valuing LAC because it has essentially no revenues (and no profits) yet. However, as we saw above, demand for lithium is expected to increase dramatically over the next decade, and the price of lithium is also expected to increase significantly too (both good for LAC). Here is a look at the average Wall Street Analyst rating of the shares (it’s a “strong buy”).

LAC has ownership of key assets and plenty of capital to fund their development. And the assets are expected to come online and ramp up significantly in the second half of this year.

For a little more perspective, you’ll note the very high profit margins and low price-to-earnings valuation metrics of LAC peers Albemarle and Livent in our earlier table. However, bear in mind these companies are similar, but have differences (for example, Albemarle doesn’t produce only lithium). Nonetheless, as the only pure play American lithium company, Lithium Americas Corp has very significant demand and upside price appreciation potential in the years ahead (and the shares are down quite a bit, as you can see in our earlier chart).

Furthermore, LAC currently trades at ~$20.12 per share, which is only 4.4x 2024 non-GAAP EPS estimates of $4.57 (as we saw in the EPS chart provided earlier).

Risks:

There are a lot of risks to the price of LAC. For starters, it’s not generating revenue or profit yet, so its valuation is basically speculation about future earnings potential. And a lot of things could go wrong. For example, the demand for electric vehicles (and lithium batteries) may not be as great as expected. Also, the price of lithium may fall directly if there is too much supply. Further still, delays in production for LAC’s lithium assets could also hurt the share price. Despite what appears to be a major opportunity for the company, the future is still highly uncertain. Basically, LAC appears to be a high risk—high reward opportunity at this point. We’ll have more to say about investing in LAC in the conclusion of this report.

2. Albemarle (ALB)

Albemarle Corporation is a specialty chemicals company based in Charlotte, North Carolina. It operates in three divisions: lithium (68.4% of 2022 revenues), bromine specialties (19.3% of 2022 revenues) and catalysts (12.3% of 2022 revenues). And unlike Lithium Americas, Albemarle is already profitable. In fact, per our earlier table, it has a very impressive 41.9% net profit margin, revenues are on a high growth trajectory (especially from demand for lithium, its largest business segment) and it trades at an attractively low forward price-to-earnings ratio of 10.4x (placing it in the lowest (most attractive) decile in its industry).

However, unlike Lithium Americas, Albemarle is not a pure play on lithium company (it has other business segments as described above). And depending on your objectives, this can be a good thing or a bad thing. We view the diversification as a good thing, and we currently own shares of Albemarle in our Blue Harbinger Disciplined Growth Portfolio. However, we believe Lithium Americas Corp has more upside potential (albeit risky) than Albemarle. So depending on your goals, Albemarle is another lithium name worth considering.

3. Altria (ABC), Yield: 8.6%

Altria is basically a cigarettes company (under the premium brand Marlboro) and the stock screens extremely well in our profit margin table (27.1% net profit margin—impressive!) but extremely poorly in our sales growth table (0.6% and 1.7% growth, this year and next). This makes sense considering tobacco is an industry basically in secular decline (it’s bad for your health), but it’s still extremely profitable (because government regulation has made it virtually impossible for any new companies to enter the industry).

We’re highlighting Altria from our tables above because it is a good example of the importance of knowing your goals as an investor. For example, if you are looking for long-term growth and capital appreciation, Altria is probably a bad investment for you (for example, its 10-year total return in our table is only 128.7% versus 230.7% for the S&P 500 index—a trend we expect to continue long-term) because the industry is in secular decline.

However, if you are an income-focused investor, Altria may be a terrific option for you because it pays such a large dividend that is well covered by its cash flow. And companies like Altria should pay a large dividend because they don’t have good opportunities to reinvest in business growth (again, the government regulates the heck out of the cigarette industry, and the industry is basically in secular decline). We wrote up Altria in detail earlier this year, and you can access that report here.

4. Paycom (PAYC)

Finally, we want to highlight a stock that screens well in terms of profit margin and revenue growth. Afterall, at a time when the macroeconomic environment is challenging for growth, it helps if your company is already profitable (Paycom’s net profit margin was recently 21%—which is phenomenal compared to other high growth stocks which have negative net profit margins). Further, Paycom is expected to grow revenues at over 20% this year and next. These are very impressive numbers for Paycom!

Paycom is a software-as-a-Service (“SaaS”) company that provides cloud-based human capital management (HCM) solutions for small to mid-sized companies in the United States. And there are a few things that make Paycom particularly attractive. For starters, software is a high-margin business to begin with, and in Paycom’s case they provide software for payroll solutions—an area that is even more sticky (once a company sets up payroll, they’re not likely to switch it). Paycom serves small and mid-sized companies which are much easier to gain as customers than large companies (which are historically served by Automatic Data Processing (ADP)). However, as small and mid-size companies grow they become large companies. And in addition to that growth, Paycom offers a variety of additional services (land-and-expand) that further fuels its high growth rate.

If you are looking for high-profits and high-growth, Paycom is a stock that is worth considering.

Conclusion:

When you are trying to identify top investment opportunities, screening the universe (based on important fundamental metrics) is one place to start (assuming you then dig deeper into understanding the reasons certain stocks screen well). In this report, we’ve screened based on profit margins and sales growth, and the differences can help highlight varying investor goals (e.g. current income versus long-term compound growth).

Lithium Americas is one name that stands out for high growth (revenues are expected to increase by 248.7% next year), and we believe the company looks attractive upon closer review (it’s a pure play lithium opportunity and will benefit from a long-term secular trend considering electric vehicle demand for lithium-based batteries is just getting started). Further still, once the business is in full swing, it will likely have high margins too. If you can handle higher uncertainty risk, we believe Lithium Americas has tremendous long-term price appreciation potential. We do not currently own shares, but it is high on our watchlist for a spot in our prudently-concentrated long-term Disciplined Growth Portfolio.