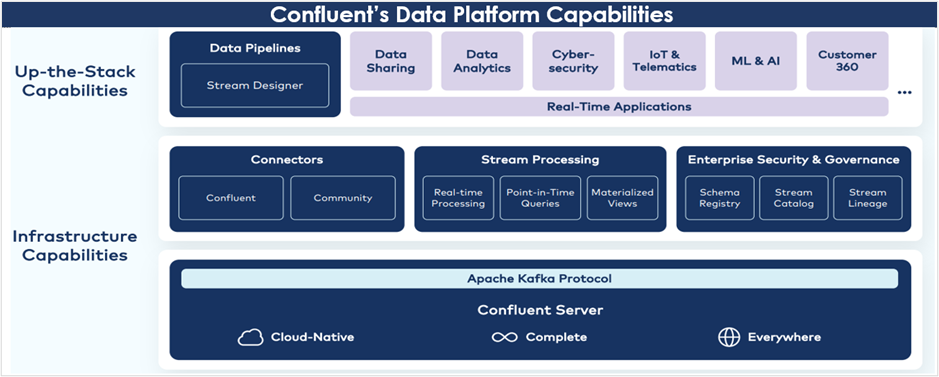

This company is on a mission to “set data in motion.” It provides a data platform which is designed to help businesses manage and process data in real-time from various sources. Traditional database technologies typically focus on storing and retrieving data that is at rest, meaning data that has been persisted to disk or stored in databases. In contrast, Confluent's platform is built around Apache Kafka, an open-source distributed streaming platform, which enables the processing of data in motion or data streams. The company also has plans to integrate its platform with popular AI systems, further expanding its product offerings and strengthening its position in the industry. In this report, we analyze Confluent’s business model, its market opportunity, financials, valuation, risks, and then conclude with our opinion on whether the company’s stock offers an attractive risk-reward opportunity.

Key Takeaways:

Strong Durability of Product and Well-Positioned to Capitalize on the Growing Shift to Cloud.

Expanding Customer Base and Increasing Revenue Contribution from High-Value Customers Provides Revenue Stability.

Secular Tailwind of Digital Transformation and Cloud Migration in Growing Total Addressable Market (TAM)

Promising Revenue Growth but Building a Profitable Business Key.

Healthy Balance Sheet subsidizing continued Cash Burn.

A pdf version of this report is available here.

Overview: Confluent (CFLT)

Confluent traces its origins to 2010 when its founders - Edward Jay Kreps, Neha Narkhede, and Jun Rao created Apache Kafka, an open-source data streaming platform, during their time at LinkedIn. Apache Kafka has since grown into a highly successful open-source project, with over 75% of Fortune 500 companies estimated to be using it. Leveraging this strong foundation, the three founders started Confluent in 2014 to commercialize the technology, offering enterprise grade capabilities for Kafka through Confluent Cloud. The company went public in June 2021 and raised over $800M.

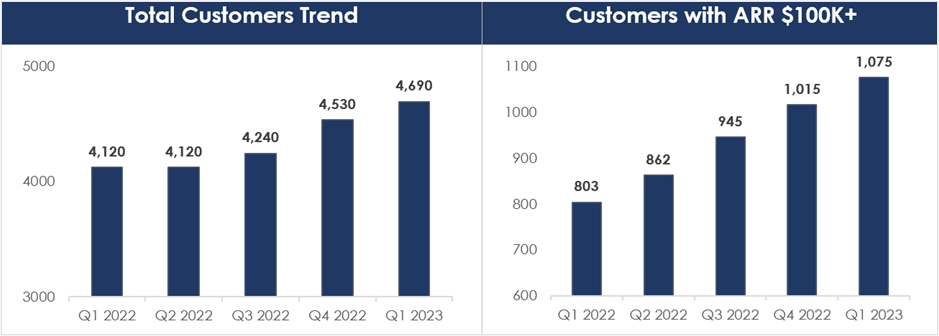

The value proposition of Confluent’s software is that it effectively monitors and captures numerous events within an organization, such as sales, orders, trades, and customer responses. It then processes these to generate real-time insights and directs them into the respective databases of the company. With the increasing complexity of businesses, including the presence of data across multiple cloud platforms and on-premise servers, the demand for Confluent's data streaming products has experienced a significant surge. The company has expanded its services to encompass diverse commercial sectors such as financial services, technology, consumer & retail, healthcare, transportation, communications and media, manufacturing and insurance. As of Q1 2023, Confluent serves a total of 4,690 customers in more than 100 countries worldwide.

The company’s sources of revenue are Subscriptions and Services. Subscription revenue is derived from term-based licenses, which also include post-contract customer support, maintenance, and upgrades, for its enterprise-ready self-managed Confluent Platform. Additionally, the company also derives recurring revenue from a fully managed cloud-native software platform called Confluent Cloud which can run on all major clouds such as AWS (AMZN), Google (GOOGL), and Azure (MSFT). Services revenue consists of revenue from professional and education services.

In Q1 2023, subscriptions and services revenue made up 92% and 8% respectively of total revenue. In terms of geographical distribution, most of its revenue (60%) is generated from the US, with the balance 40% generated from international markets, as shown in the chart below.

Source: Company’s 10-Q

Strong Durability of Product and Well-Positioned to Capitalize on the Growing Shift to Cloud

The past year has witnessed substantial changes in the economic environment, with businesses facing immense pressure from inflation and recession fears and a significant drop in funding for private tech companies. Amidst all this, Confluent has not only continued to show very strong gross retention but has also seen its revenues grow consistently.

Confluent caters to mission-critical custom software applications for its customers which require them to invest substantially in software engineering resources. Due to these high investments, these applications typically focus on the most valuable use cases and have a long lifespan. Consequently, the underlying data platforms used by these applications also tend to persist over the same extended periods.

Confluent’s data platform serves as a hub that connects various teams and applications rather than being limited to a single application. It publishes data streams that can be used by multiple applications and teams, and as usage of this data platform increases, it gets stickier and more challenging to replace. Each application has the flexibility to choose or abandon specific features within the platform independently, leading to diverse dynamics within the ecosystem.

Source: Investor Presentation

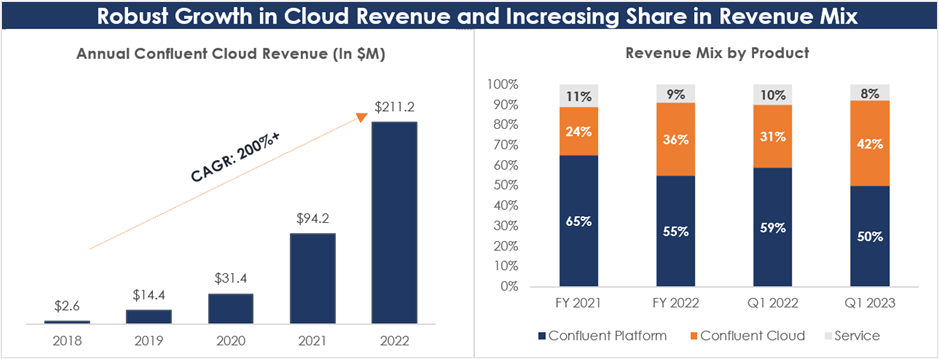

Confluent Cloud, the company’s fully managed cloud-native software platform, has seen robust revenue growth in recent quarters and is primed to grow further--driven by international expansion and accelerating adoption of cloud services.

Confluent Cloud has a deep technical moat – it offers a more comprehensive set of features and functionality as compared to an open-source self-managed software. But another important factor contributing to the moat is the inherent Total Cost of Ownership (TCO) advantage of the cloud offering. A self-managed software system requires heavy spending in two areas – infrastructure (computer, storage, networking, and other additional tooling) and human capital (software engineers and operations people). Confluent Cloud drives infrastructure savings with multi-tenancy, intelligent tiering of data, networking, and data replication. It has real-time monitoring and checks and can automatically detect and remediate problems, thus providing it a substantial advantage in the cost of human management as well.

Source: Investor Presentation

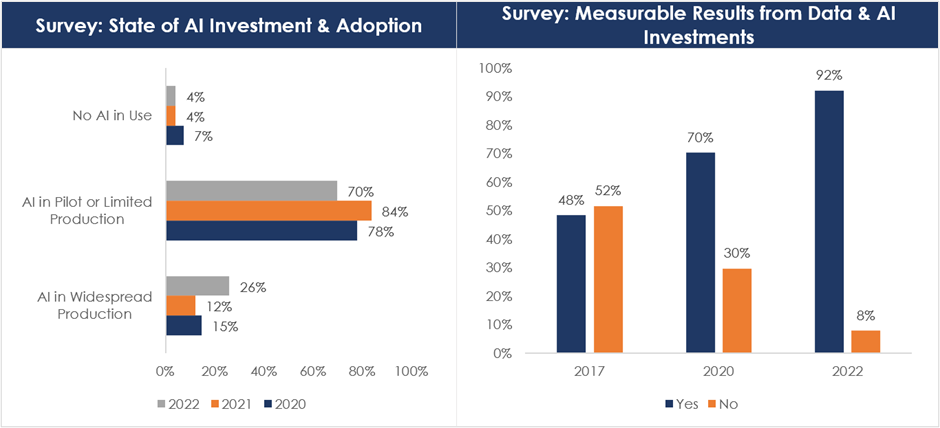

Enabling Real-Time Data Analytics and Powering the Growing AI Market

The AI/ML market is at a turning point, and organizations worldwide will require robust real-time data analytics solutions to effectively capture and analyze data from various sources. According to the 2022 Data and AI Leadership Executive Survey by New Vantage Partners, 97% of respondents reported investing in data initiatives, marking the fourth consecutive year of such investments. However, only 26% of participants have implemented AI on a large scale, while 70% have AI projects in pilot or limited production stages, indicating significant growth potential for AI implementation.

With the growing prominence of device-generated data over human-generated data, there is an urgent need for improved systems to handle data distribution and processing. This is precisely where Confluent's platform plays a crucial role. It enables organizations to meet the data processing requirements for AI model training and automated decision-making, positioning it to benefit from the increasing adoption of AI technologies across various industries.

Expanding Customer Base and Increasing Revenue Contribution from High-Value Customers Provides Revenue Stability

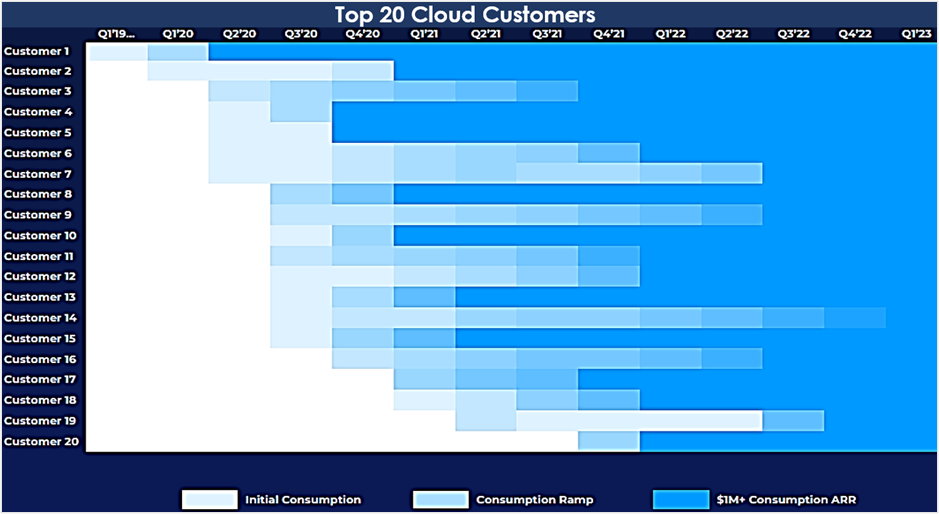

In Q1 2023, Confluent added 160 new customers, ending the quarter with approximately 4,690 total customers, up 14% YoY. Driven by use case expansion, the growth in Confluent’s large customer base continues to be robust. The company added 60 customers with $100,000 or more in ARR, bringing the total to 1,075 customers, up 34%. These large customers contributed more than 85% of total revenue in the quarter. This strong revenue contribution from large customers provides stability during market fluctuations, as these customers are generally less impacted by short-term macro factors compared to smaller customers or Small and Medium-Sized Businesses (SMBs).

Source: Investor Presentation

The company has maintained a consistent dollar-based Net Retention Rate (NRR) of over 130% for the past eight quarters. NRR is a measure of the company’s ability to upsell its offerings to existing customers and Confluent’s consistently high NRR implies superior customer satisfaction.

Confluent faces less customer concentration risk as compared to other emerging high growth technology companies owing to its large and diversified customer base. It is also important to note that Confluent Cloud customers make up most of its total customers. Here, an easy and frictionless landing of customers with Pay-As-You-Go and expansion in underpenetrated segments are strong levers of growth.

Source: Investor Presentation

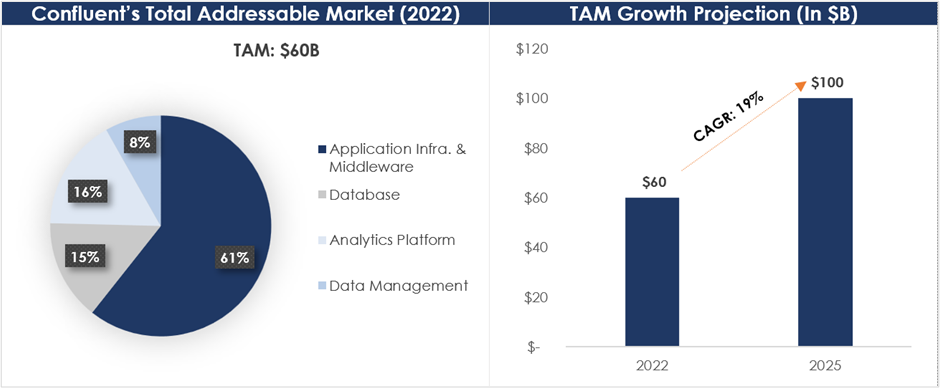

Secular Tailwind of Digital Transformation and Cloud Migration in Growing Total Addressable Market (TAM)

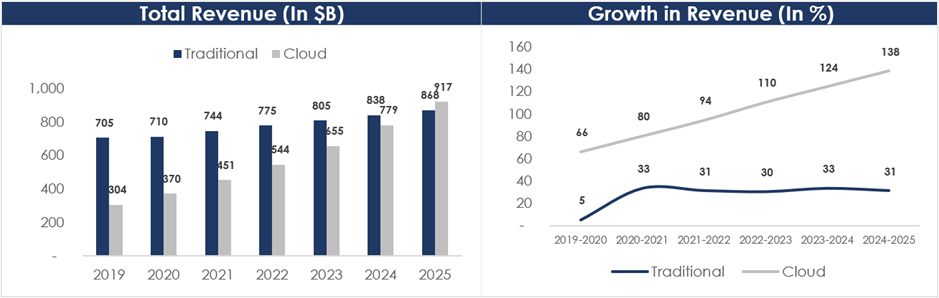

Gartner estimates that more than half of Enterprise IT spending within the application software, infrastructure software, business process services and system infrastructure markets will shift to cloud by 2025. The data suggests that approximately 51% of IT spending or $917B in dollar-terms will transition from traditional on-premises solutions to cloud solutions. This represents a notable increase from the 41% recorded in 2022. As the trend towards cloud adoption continues to accelerate, Confluent is well-positioned to benefit from the increasing demand for its cloud-based offerings.

Source: Gartner

Source: Investor Presentation

Promising Revenue Growth but Building a Profitable Business Key

In Q1 2023, total revenue increased 38% YoY to $174.3M. Subscription revenue grew 41% YoY to $160.6M and accounted for 92% of total revenue. Within subscription, Confluent Platform revenue grew 16% YoY to $86.9M and accounted for 50% of Total revenue. Confluent Platform outperformed relative to management expectations driven by strong performance in the public sector vertical. Driving the growth in total revenue was Confluent Cloud which grew 89% YoY to $73.6M.

The company emphasizes Remaining Performance Obligations (RPO) as a key business metric. RPO denotes the amount of contracted future revenue from a customer that has not yet been recognized as of the end of each quarterly period. RPO for the first quarter was $742.6M, up 35% YoY. Although healthy, growth in RPO was impacted by a decline in average contract duration, additional budget scrutiny which elongated the deal cycle and a higher base last year owing to an eight-figure deal.

Overall, Revenue and RPO trends reflect solid organic momentum of the business led by strong product demand and successful contract acquisitions. For the full year 2023, management expects total revenue to be in the range of $760M - $765M, representing growth of 30% to 31%, as the demand environment for data streaming and the solutions offered by Confluent continues to be robust.

Source: Company Filings

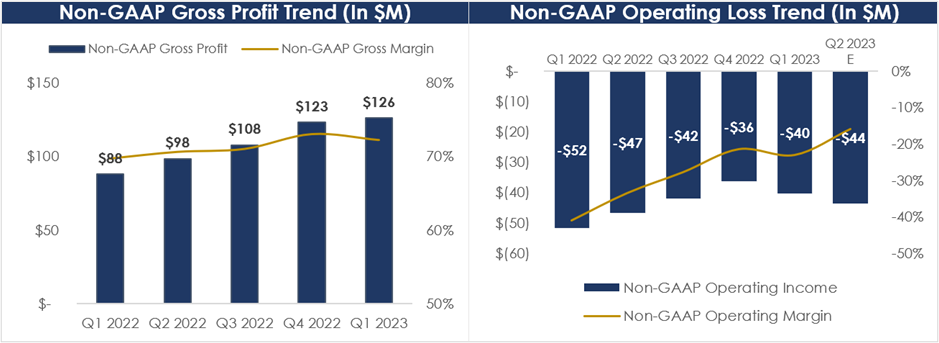

On the profitability front, the company reported healthy gross margins driven by continued improvement in the unit economics and scaling of Confluent Cloud. Non-GAAP gross profit margin was 72.2% in Q1 2023, up 250 basis points as compared to last year. However, the company has been reporting operating losses since inception. In Q1 2023, it recorded $40.3M in non-GAAP operating loss reflecting a slight improvement as compared to an operating loss of $51.7M in Q1 2022. Non-GAAP operating margin improved 18 percentage points to negative 23.1%. This was driven in part by revenue growth and an improvement in operating expenses as a percentage of sales, most notably in sales and marketing expenses.

For the full year 2023, management expects non-GAAP operating margin to be approximately negative 14% to negative 13% and targets to achieve breakeven in Q4 2023. Management's optimistic outlook on profitability is welcome but investors should keenly monitor to ensure that the company is keeping up with its medium and long-term targets.

Source: Company Filings

Healthy Balance Sheet subsidizing continued Cash Burn

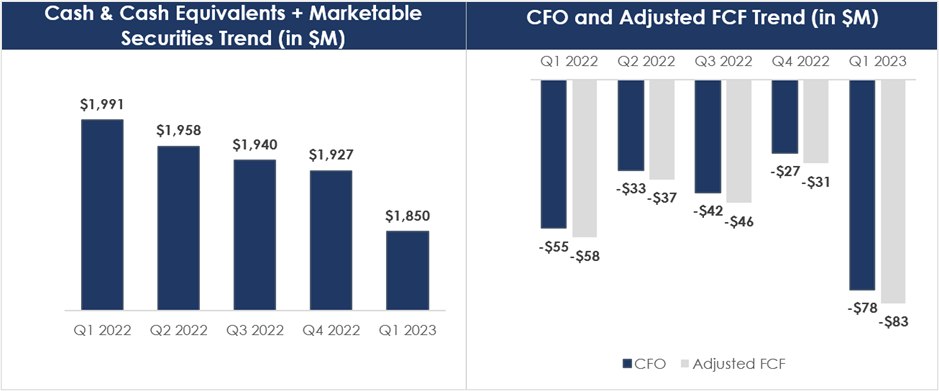

Confluent ended Q1 2023 with $1.85B in cash, cash equivalents, and marketable securities. In December 2021, the Company issued $1.1B aggregate principal amount of 0% convertible senior notes due 2027. These notes do not come with regular interest payments and will mature in 2027 unless converted, redeemed, or repurchased earlier. As of March 31, 2023, the 2027 notes were not convertible and hence classified as long-term debt on the company’s Balance Sheet. Besides this, the company has no other long-term debt. A healthy cash balance and no sizeable long-term debt lend financial stability, but the company continues to burn cash at a fast pace.

In Q1 2023, the company’s Free Cash Flow (FCF) burn increased significantly to $82.9M compared to $58.4M in Q1 2022. FCF margin was at negative 47.5%, declining 1 percentage point as compared to last year. FCF in Q1 was negatively impacted by restructuring charges, acquisition of Immerok in January 2023 for $54.9M in cash, employee stock purchase plan and corporate bonus payout.

Source: Company Filings

Valuation

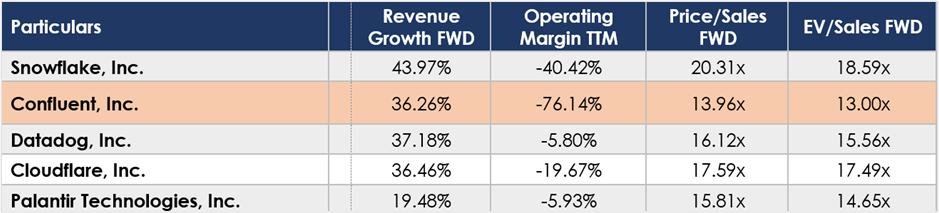

After a tumultuous 2022 which saw Confluent’s market cap dropping ~70%, the stock has staged an impressive recovery so far in 2023, up ~69% YTD. That said, the stock is still nearly 60% below its all-time high reached in 2021. In terms of valuation, Confluent currently trades at a price-to-sales multiple of 14x on a forward basis. This places the company at a slight discount compared to its peers. While the company platform’s durability along with a substantial revenue contribution from large customers are positives, going forward, the catalyst for the stock to bridge the valuation gap with its peers would be profit and FCF generation. Overall, we believe the risk-reward ratio is attractive for investors.

Source: Seeking Alpha

Risks

Intense competition: Confluent faces direct competition from IT teams that build their own data infrastructure on top of Apache Kafka or other open-source software. Cloudera Dataflow, TIBCO Messaging, and Red Hat AMQ Streams are some of the legacy vendors competing with Confluent for on-premise solutions. In cloud, the company faces intense competition from cloud giants including AWS, Microsoft, and Google that have their own data streaming platforms such as AWS Kinesis, Azure Event Hubs, GCP Pub/Sub and Dataflow. Adding to increased business risk is the fact that Confluent Cloud is currently offered on public clouds provided by AWS, Azure, and GCP, making them both competitors and partners.

Despite this intense competition, Confluent is holding up well. The company is relatively early in this category as compared to its peers, giving it a slight advantage in terms of understanding the problems businesses face and offering solutions that can be adopted by its customers with ease. It is worth highlighting the portability of Confluent Cloud, which means that it is not tied to a particular public provider but is offered in all three major ones. It can also be hosted on a customer’s private cloud if they wish to do so.

Last year, Confluent was named the best stream processing platform on G2, based on the responses of real users. Confluent is also highly rated on Gartner. This represents the company’s strength and its ability to stack up well against its competitors.

Source: Investor Presentation

Conclusion

The data-in-motion market is increasingly appealing for IT resource allocation. This gives Confluent significant growth potential, both within its existing customer base and untapped markets. Fuelling growth momentum is the company’s cloud-native offering which should benefit from the ongoing shift towards cloud adoption. The adoption of AI is also advantageous for Confluent as it enhances the real-time streaming of data. Management has plans to integrate the company’s platform with popular AI systems, further expanding platform capabilities.

The macroeconomic outlook remains uncertain and companies are becoming more cautious with their expenditure, leading to longer sales cycles for companies like Confluent. Despite this, long-term demand for data streaming solutions remains promising.

Confluent has proved that it supplies mission-critical services to its customers by registering robust growth during a highly challenging economic environment. Considering the current risk and reward dynamics, we view this as an attractive opportunity for patient, long-term investors, who are looking to capitalize on digitalization and cloud migration tailwinds.

Note: We currently have no position in Confluent, but we have added it to the watchlist for our Disciplined Growth Portfolio.