Income investors, focused primarily on generating big steady income, can still enjoy some price appreciation too. And now that interest rate volatility is decreasing, attractive high-income opportunities are increasingly emerging. In this report, we first share and discuss comparative data on over 100 big-yield closed-end funds (“CEFs”) and over 40 big-yield business development companies (“BDCs”), and then rank our top 10 favorites (with yields ranging from 6.0% to over 12.0%), starting with #10 and counting down to our very top ideas.

100+ Big-Yield Closed-End Funds:

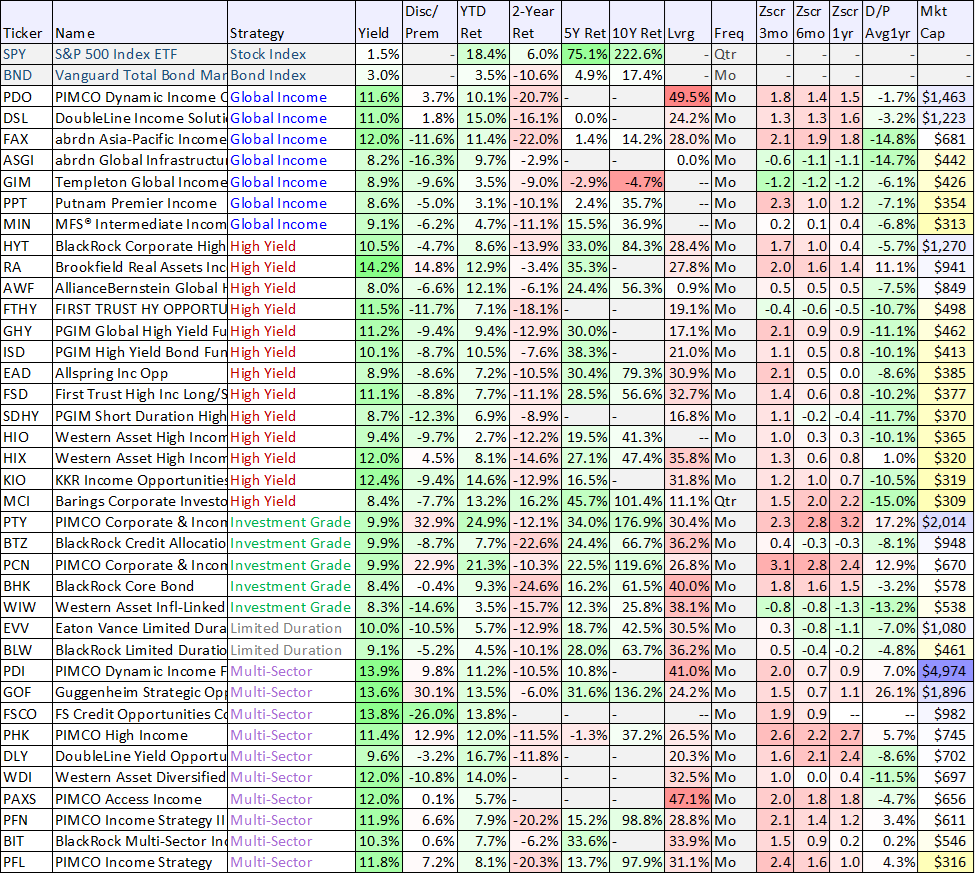

Closed-end funds are often an income-investor favorite thanks to the big, steady (often monthly) distribution payments they can make to investors (yields are frequently in excess of 6.0% to 10.0%). CEFs are basically pooled investment vehicles (they can own many individual stocks or bonds for example) that trade on an exchange under a single ticker, thereby offering some instant diversification benefits. However, they come in a wide variety of shapes and sizes, and have multiple nuances that investors should consider, as you can see in the following table.

(data is as of market close on Thursday, July 13th).

A few observations (from the above table) are worth considering. For starters, you may notice (in the 2-year total return column) that bond-focused CEFs have performed terribly. This period roughly coincides with the steep interest rate hikes (or expectations thereof) that have happened over the last two years. Specifically, as interest rates rise—bond prices fall (all else equal). And the last two years have been historically bad for bonds. Importantly however, the rate of interest rate hikes has been slowing, and this is relatively good news for bond CEF returns going forward.

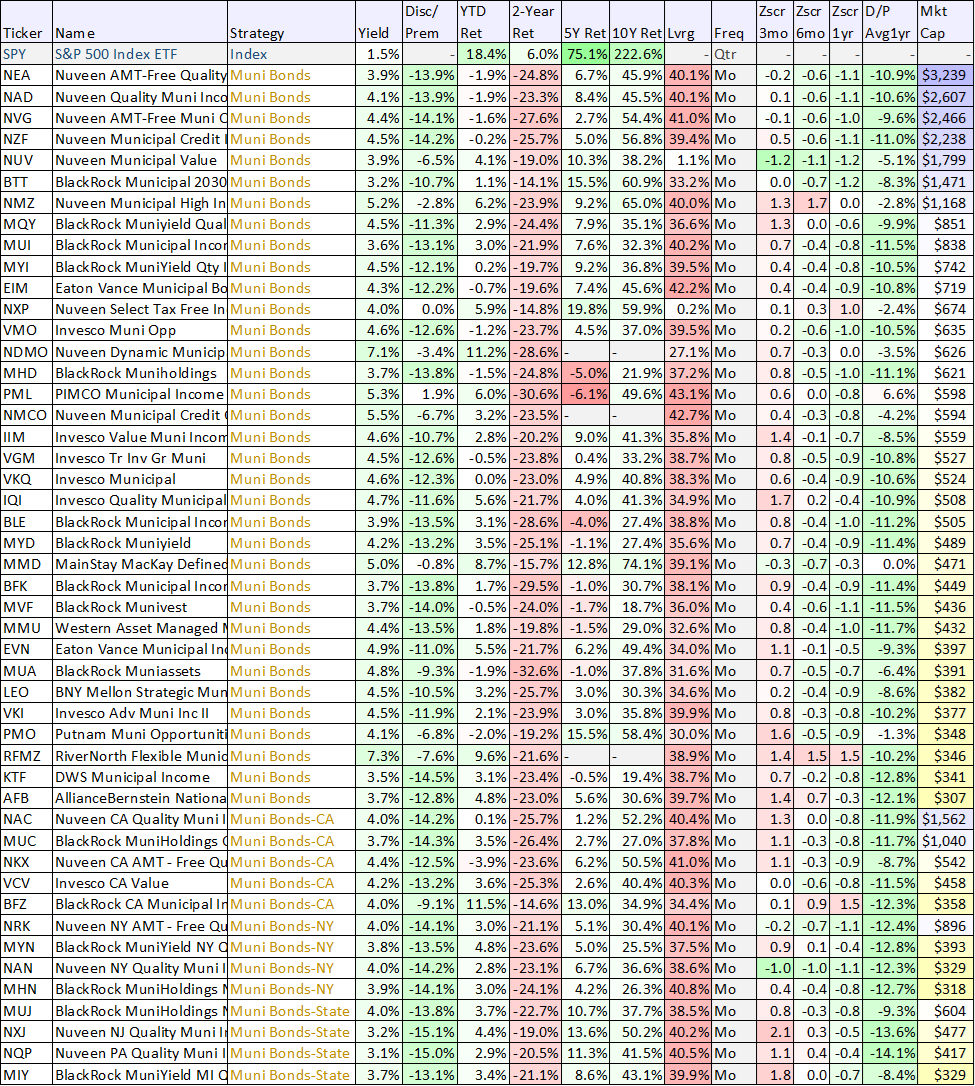

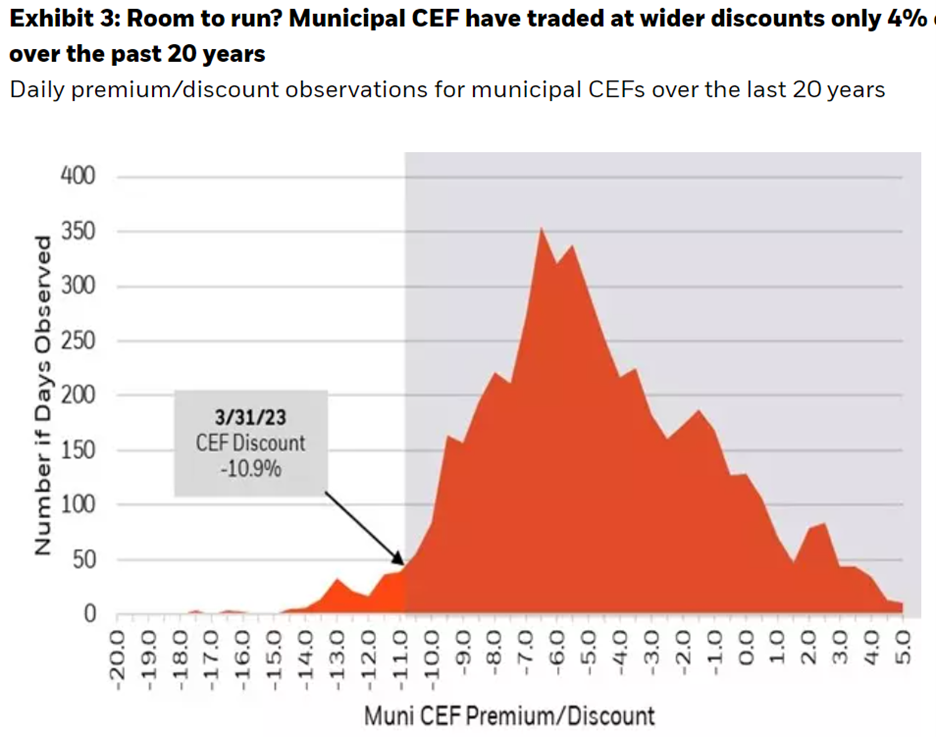

You’ll also notice that municipal bond performance has been absolutely horrendous. Not only have returns been poor, but the discounts at which muni bond CEFs currently trade relative to their net asset value (“NAV”) is historically large, as you can see in this next chart.

Also worth mentioning, “z-scores” in the earlier table show that many CEFs are expensive while others are not. The z-score is the current discount or premium minus the average discount or premium divided by the standard deviation. It’s a way to allow investors to compare funds on an apples-to-apples basis, and a z-score more negative than negative-2 suggests a fund is selling at a discount that is particularly larger than normal.

Finally, you’ll notice in the first CEF table that we’ve included a stock benchmark (the S&P 500 ETF (SPY)) and a bond benchmark (BND), so you compare the performance of these funds to a generic benchmark over time.

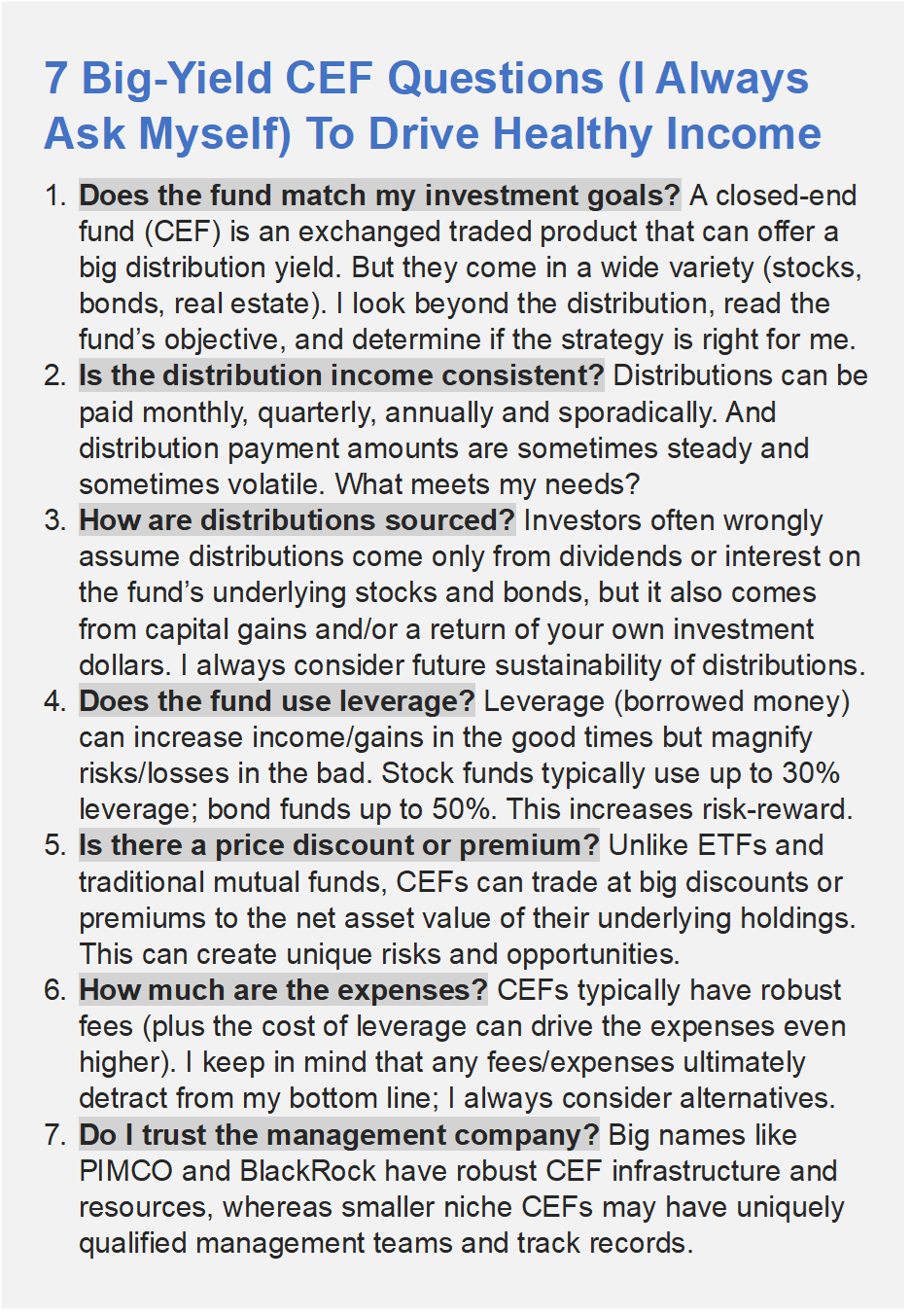

We’ll get into more detail on specific CEFs that we like later in this report, but from a high level, here are seven questions worth asking before investing in any CEF, no matter the type.

40+ Big-Yield BDCs

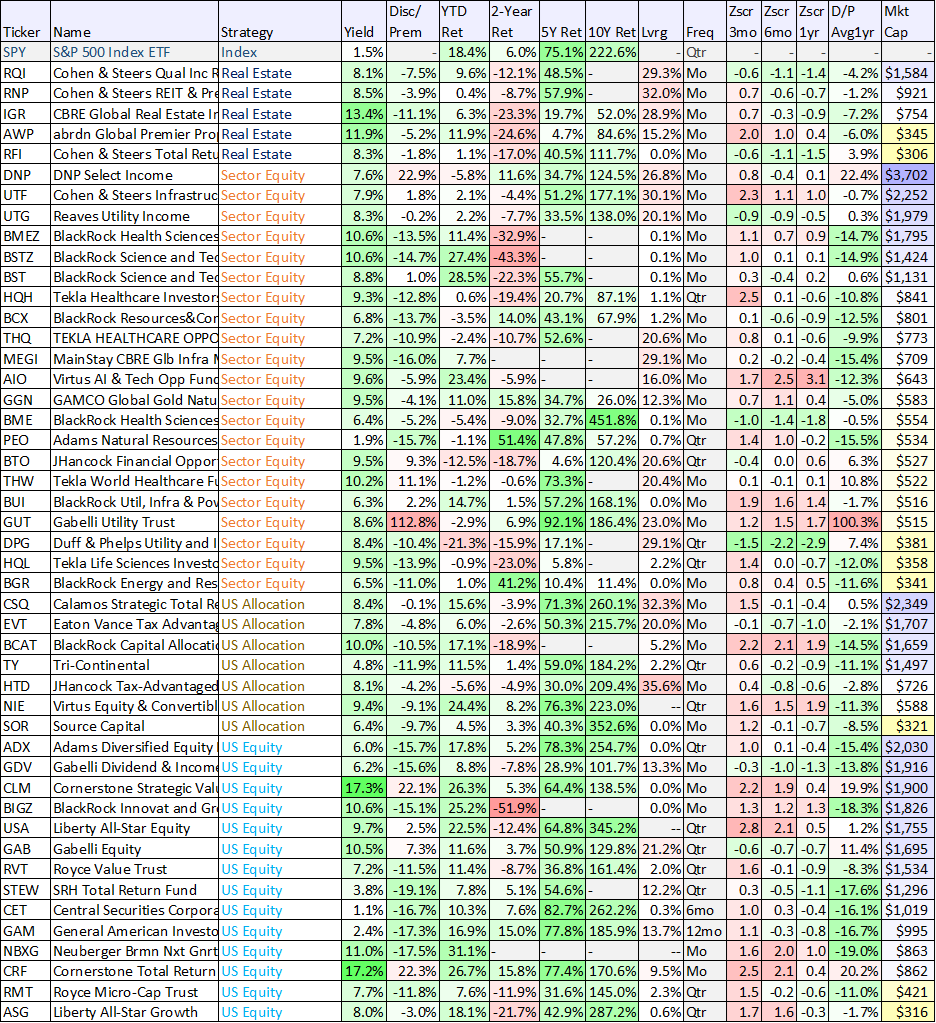

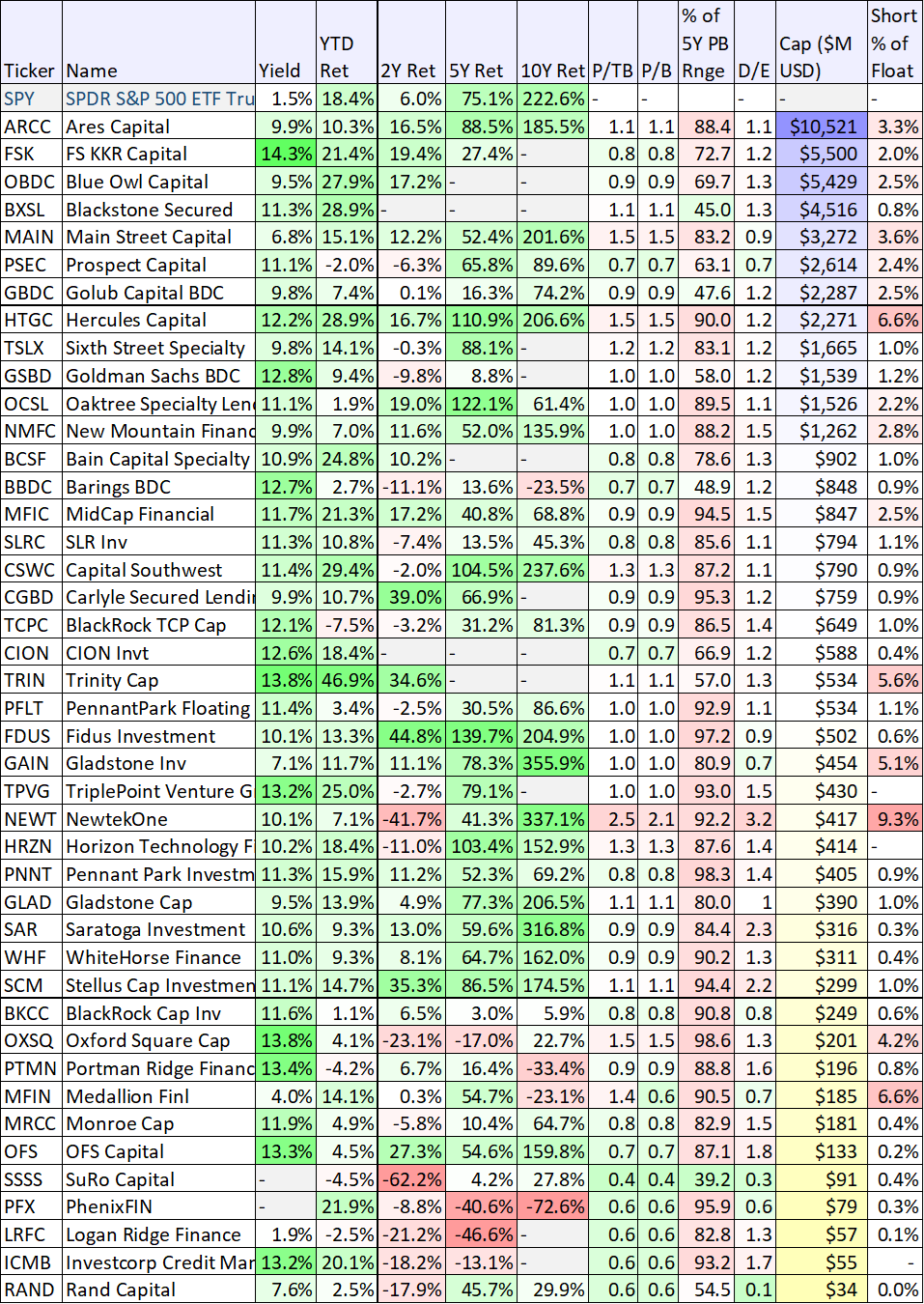

This next table shows some important performance metrics for over 40 big-yield business development companies (“BDCs”). BDCs basically provide financing (they mostly lend money) to middle market companies (that range dramatically in size and strategy). One specific BDC may provide loans to hundreds of middle market companies, so investing in a BDC provides some instant diversification in this regard. BDCs were created by an act of Congress (to help support small businesses) and can avoid corporate income tax if they pay out their income as dividends (thus the big dividend yields for BDCs in the following table).

(data is as of market close on Thursday, July 13th).

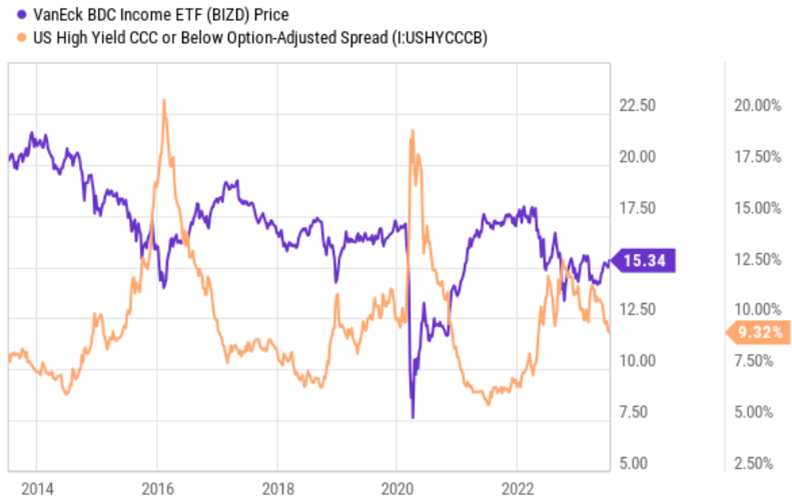

A few things worth noticing in the above BDC table is that BDCs have generally performed much better than bond CEFs (even though they’re both basically different types of financing/lending). In addition to interest rates, BDC can be more sensitive to credit spreads (i.e. the difference in interest rates between highly rated and lowly rated bonds) because BDCs often lend to companies that are more sensitive to the market and credit cycles. For reference, here is a look at historical credit spreads as compared to the performance of BDCs (as measured by the VanEck BDC Income ETF (BIZD)), and as you can see—when credit spreads widen, BDC prices go down (to adjust for the higher perceived risk of default by portfolio companies BDCs have provided financing to).

Another observation from the above table, some of the more technology-sector-focused BDCs (and early-stage-financing BDCs) have higher levels of short interest (basically people betting against the shares). Some interpret this as a sign of risk, but it may also create an opportunity to benefit from a potential short-squeeze (i.e. if market conditions keep improving, and BDC share prices keep going up, short-sellers could be forced to buy back the shares they’ve borrowed to sell short, thereby creating even more upward pressure on the share prices).

Finally, also consider the price-to-book values in the above table. This is one of the most basic high-level ways to value a BDC. Specifically, those trading above one are said to trade at a premium, and those below one—at a discount. BDCs generally provide updates to book value quarterly. And because quarterly results are usually released a month or two after the quarter has ended—there is a lag. Fortunately, we can estimate where book values are headed based on how the market has performed (such as the credit spread chart we provided earlier—if credit spreads are narrowing then book values are likely increasing).

Top 10 Big Yield CEFs, BDCs, Ranked

So with that backdrop in mind, let’s get into our top 10 rankings.

10. BlackRock Multi-Sector Income (BIT), Yield: 10.3%

Simply put, we like (and own) this big-yield bond fund for a variety of reasons (it’s in the “multi-sector” section of our earlier CEF table). For starters, the distribution yield is large, it has been consistent since inception in 2013, and the fund has also occasionally paid additional special dividends. Further, BIT currently trades at only a very small premium (+0.6%) to NAV, it is managed by world-class manager BlackRock (they have loads of resources and “economy of scale” advantage, read about it here) and it uses a prudent amount of leverage (recently ~33.9%). BlackRock also has relatively lower expenses than many other popular CEFs (also a good thing per our earlier list of “7 CEF Questions”). Finally, it has some conservative interest rate exposure (duration was recently 3.1 years) so if rate hike expectations slow, this fund has some attractive upside (and that is in addition to its big steady monthly distribution payments to investors).

9. Cohen & Steers Qual Inc. Realty (RQI), Yield: 8.1%

RQI invests in real estate securities (mainly real estate investment trusts, or “REITs), and does so mainly through common equity REITs, but also preferred shares and bonds. RQI is particular attractive now for a variety of contrarian reasons.

For starters, real estate has been particularly beat up over the last two years as interest rates have risen, but we see select “buy low” contrarian opportunities (such as RQI). Specifically RQI almost totally avoids the particularly troubled office REIT sector (a good thing in our view as that group will continue to face pressure as more people permanently work from home).

We also really like this fund’s exposure to bonds and preferred stocks because interest rates are set to finally stop increasing so rapidly (fed funds futures are predicting the fed may actually start lowering rates through the end of the year) and lower rates are good for bonds and preferred shares (as rates fall, bond prices go up).

Finally, this fund trades at a significant discount to NAV (~7.5%) and has a healthy history of consistent dividend payments (plus ocassional additional special dividends) that are sourced from mainly income (dividends) on the underlying holdings (and not necessarily a return of capital).

We wrote this one up in detail here, but if you are looking for attractively priced steady high income, RQI is absolutely worth considering (we own shares).

8. PIMCO Corporate and Income (PTY), Yield: 9.9%

Regarding “a bird in hand is better than two in the bush” we are including this big-distribution bond fund (PTY) in our top 10 because of its massive distributions, which have been paid without interruption since the fund’s inception over 20 years ago. And not only are the distributions steady, but PTY also occasionally pays additional special dividends too. Further, this fund pays distributions monthly (instead of quarterly or annually) another characteristic a lot of investors really appreciate.

However, in full disclosure, we do own PTY, but we just recently reduced our position size because the performance has been so strong recently. Specifically, the year-to-date performance has been very strong and the premium to NAV has risen very significantly (note: premiums are often “par for the course” for PIMCO funds—the leader in the industry).

Again, it seems interest rake hikes by the fed may finally be almost over (bond funds have been hurt badly by the recent rapid rate hikes because as rates rise, bond prices fall). We like PTY and we own shares. If you are looking for big steady income, PTY is absolutely worth considering.

7. Ares Capital Management (ARCC), Yield: 9.9%

Switching gears to BDCs, Ares is the largest publicly-traded BDC in the US. It has a large well-diversified portfolio of investments (mainly loans to businesses in need) across market sectors. It also has an investment grade credit rating and a well run business. We’ve previously written about ARCC in great detail here.

Ares announced quarterly earnings at the end of April (and is expected to announce again at the end of this month), and the results were solid. In particular, we were concerned as interest rates rise (and recession fears were rising) that too many of Ares loans would start going bad. However, Ares reassured its loan portfolio is in good shape and it has plenty of capital to weather the storm. We own several BDCs in our Blue Harbinger portfolios (because of the industry’s attractiveness), but Ares standouts (we own shares of Ares) for its financial strength and industry leadership position.

6b. Royce Value Trust (RVT), Yield: 7.2%

6a. Royce Micro-Cap Trust (RMT), Yield: 7.7%

Coming in at number 6 on our list are two attractive small cap stock funds from Royce Investment Partners. For starters, these funds each own a widely diversified portfolio of small cap stocks, and Royce has a long history of outperforming their respective benchmarks. Furthermore, we believe now is a particularly attractive time to invest in small (and micro-cap) stocks from a contrarian standpoint. Specifically, small caps are generally considered riskier than the market, and therefore have performed worse than the S&P 500 over the last two years as market fear was higher. But as fear is subsiding, small caps have more room to rebound, and thereby present an attractive contrarian opportunity at this point in the market cycle.

Historically (at this point in the cycle), now has been an extremely attractive time to own small and micro-cap stocks, and these funds offer big yields and attractive share price appreciation potential. We like and own both. We’ve written about these funds previously, and you can access those reports here and here.

5. Oaktree Specialty Lending (OCSL), Yield: 11.2%

We recently purchased shares of Oaktree Specialty Lending as a replacement for Owl Rock Capital (recently renamed Blue Owl Capital (OBDC)). We wrote about the trade in detail here, but basically Blue Owl’s owners have been feuding (lawyers are involved now), so we decided to take profits (Blue Owl has been a top performer for us). Blue Owl Capital may continue to perform extremely well going forward, but where there is smoke there is often fire. You can read our recent full report on OCSL here, but we basically like it because its big dividend is well covered, the balance sheet is strong and the company is helped by moderately rising interest rates (thanks to floating rate loans). It also trades at a reasonable valuation and has opportunities for growth.

4. Adams Diversified Equity Fund (ADX), Yield: +6.0%

Adams is a stalwart equity CEF that has been paying distributions for over 85 years, and it currently trades at a slightly larger discount to NAV than normal (a good thing). The discount is especially good because the fund’s underlying holdings have been performing well this year (it has a somewhat heavier exposure to technology stocks—which have been leaders this year), and that means the fund may be on track to paying a very healthy fourth quarter distribution.

Specifically, ADX pays three smaller distributions in the first three quarters of the year, followed by a bigger one in Q4 that brings the aggregate annual yield to 6.0% or more (we’re guessing more this year). The fund typically does not use any leverage, and the distributions are comprised of dividends (on the underlying stock holdings) plus capital gains on those holdings (rarely does it ever return any capital as part of the distribution).

We like this fund for longer-term income-focused investors because it provides exposure to equity markets that some income-investors miss (because they’re so focused on bonds). If you can handle the lumpy quarterly distributions, this fund is worth considering (we own shares) and we have previously written in detail about it here.

3. PIMCO Access Income Fund (PAXS), Yield: 12.0%

This fund was previously our top ranked CEF, but we’ve recently bumped it down a few notches because the performance has been so strong and the shares don’t trade at a discount anymore (they’re currently at a small 0.1% premium—not bad at all for a PIMCO fund).

PIMCO is the premier bond fund manager, and this fund is still particularly attractive. Some investors may turn their backs on this fund because it is newer and less established than some other popular PIMCO bond funds. However, PAXS has established a healthy track record so far, it has very similar holdings as other popular PIMCO funds (in terms of asset allocation, leverage at 47.1% and interest rate risk as measured by duration at 3.97 years).

Further still, we like bonds as interest rate hikes seem to be slowing and the fed may even cut rates in the second half of this year (as rates go down, bond prices go up). We are still maintaining a large allocation to this fund in our High Income NOW portfolio (it was previously 7.5%, but now the target is down to 5.0%), and we look forward to more big monthly distribution payments and the potential for some very healthy price appreciation ahead. We have written about this one in the past, and you can view those reports here.

2b. PIMCO Dynamic Income Opps (PDO), Yield: 11.6%

2a. PIMCO Dynamic Income (PDI), Yield: 13.9%

PIMCO is top notch when it comes to high-income bond funds, and these two funds standout as particularly attractive. PIMCO bond funds often trade at large premiums to NAV, but these funds are quite reasonable trading at 3.7% and +9.8%, respectively.

The funds use significant leverage (or borrowed money) to magnify returns and income for investors (around 41.0% for PDI and 49.5% for PDO, near the regulatory 50% limit for bond funds). And with duration (or interest rate risk) of around 3.8 year (PDI) and 3.6 years (PDO), both funds are sensitive to interest rates. However, with interest rate hikes from the US fed now widely expected to be slowing (and potentially even reductions by the end of the year) this bodes well for these two top notch big yielders. We’ve written in more detail about the risks and rewards of these two funds here and here, but we like them both enough to to keep them ranked highly and with 5.0% weights in our High Income NOW portfolio.

1. BlackRock Credit Allocation (BTZ), Yield: 9.9%

Some investors believe BlackRock is “second-rate” as compared to PIMCO, but the fact of the matter is the firms invest in similar bonds (and derivatives), and simply put, BTZ is a well-managed high-quality big-yield bond fund currently trading at a large discount to its NAV (-8.7%).

The fund has a longer duration than some other bond funds (currently 6.1 years) which means it can potentially earn higher yield (pure yield, not return of capital) and it may have more price appreciation potential as interest rate hikes by the US fed may be almost over and are increasingly expected to turn to cuts (interest rate decreases) towards the end of this year (as rates go down, bond prices go up… good for this fund).

Again, some investors prefer PIMCO over BlackRock, and BlackRock funds don’t usually command the big price premiums (versus NAV) as PIMCO funds, but the holdings will benefit from the same interest rate and credit risk exposures, and BTZ is priced attractively. We just recently increased our allocation to BTZ in our High Income NOW portfolio, and we look forward to more big monthly income and the potential for very healthy price gains ahead.

Conclusion:

If your primary investment objective is to generate big steady income, then the opportunities included in this report are attractive and worth considering. Not only do they pay big steady distributions (many of them monthly), but they also offer the potential for price appreciation too. Just be sure that they are consistent with your own personal investment goals before investing. Disciplined, goal-focused, long-term investing continues to be a winning strategy.