Business Development Companies (BDCs) are another income-investor favorite thanks to their very large dividends and potential for price gains. In this report, we review an attractive BDC that has positioned itself for solid performance ahead (i.e. potential dividend and price increases). We review the business, the market, the dividend safety, valuation and risks, and then conclude with our opinion on investing.

Oaktree Specialty Lending (OCSL), Yield: 11.2%

Oaktree Specialty Lending provides financing (mainly first, and sometimes second, lien loans) across a variety of industries. OCSL is regulated as a BDC, under the Investment Company Act of 1940. And as a regulated investment company, OCSL is required to pay out over 90% of its profits to shareholders (that’s why BDC dividends are so big).

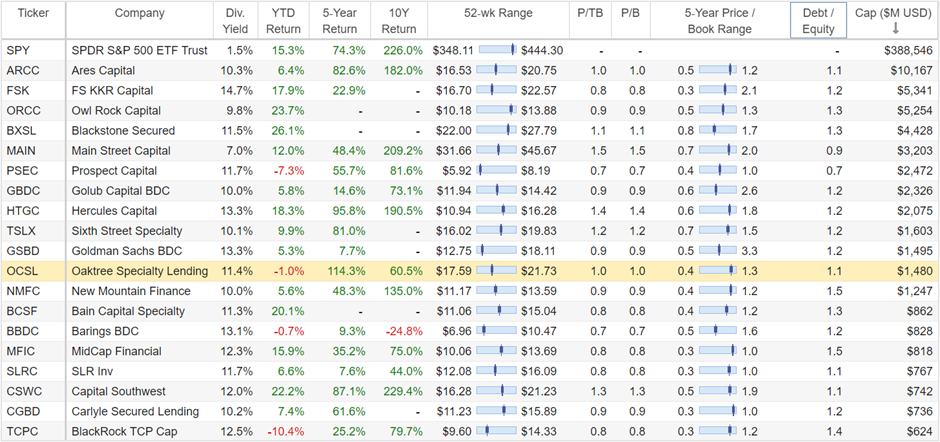

For reference, here is some high level data on OCSL versus 40 other big-dividend BDCs (we’ll refer back to this table throughout this article).

From a high-level, BDCs lend out the money on their balance sheet at a really high interest rate (in OCSL’s case, they have an 11.9% weighted average yield on debt investments, and they also magnify that a bit higher by using some leverage or borrowed money—as you can see their debt-to-equity ratio in the table above is 1.1x—so they have a little bit of borrowed money).

For a little more perspective, here is a look at OCSL’s investment portfolio (they currently have provided financing to 165 different companies).

First lien loans are safer than second lien loans, but they’re both secured by business assets (88% of OCSL’s loans are senior secured debt investments). And OCSL is diversified across market industries, with “Application Software” currently the biggest (see above).

For reference, OCSL loans to middle market companies (the average OCSL portfolio company’s EBITDA is $133 million). And also 88% of the loans are floating rate (a great thing in a rising interest rate environment).

Current Market Conditions

After an ugly 2022, the stock market has posted gains so far in 2023, but the economy is still weak (teetering on an ugly recession, as the fed is expected to resume rate hikes following the most recent pause). And to put this in perspective, OCSL has recently put two (of its 165) loans into non-accrual status (which basically means they’re not fully paying their loans).

For example, one non-accrual loan is related to a San Francisco condo deal that is going bad as the tech industry slowdown hits the market (recall the tech industry has experienced a lot of layoffs over the last year, and many of those companies are based in the San Francisco area). The other non-accrual loan is related to an “advanced material sciences company” that has invested in new technology for the packaging and containment of biological drugs and molecular diagnostics. And this second company built up infrastructure to support the COVID industry, but has been forced to retool its production for other areas as the pandemic industry has slowed.

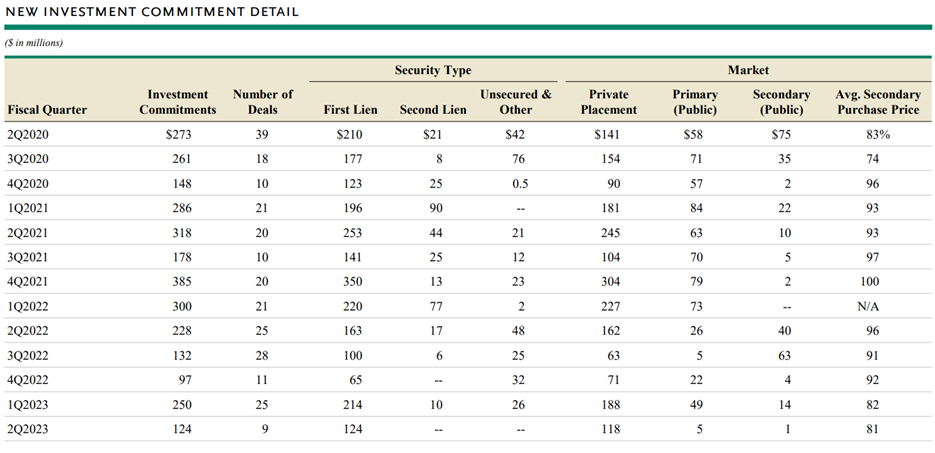

For a little more perspective, you can see in the following table that the number of investment deals in the most recent quarter has slowed (as the economy has slowed).

Nonetheless, OCSL continues to find attractive new deals in the current market environment.

Strong Liquidity Position

Despite the recent slowdown, OCSL remains in a strong liquidity position to weather any further deterioration to market conditions, even though management assured multiple times during the most recent quarterly call that the two non-accrual loans are isolated (and not indicative of broader market challenges). Specifically, OCSL ended the most recent quarter with $44 million of cash and $335 million of undrawn capacity on credit facilities. This leaves plenty of capacity for new investments and to support the dividend (more on the dividend later). Also, OCSL does have an investment grade credit rating (a good thing) from Moody’s and Fitch.

Opportunities Ahead:

On a go forward basis, OCSL believes it has ample opportunities to increase its returns from higher interest rates on floating rate loans, rotating into higher yielding investments and from the realization of synergies related to its recent merger with OSI2 (as described below).

Recent OSI2 Merger:

As mentioned above, OCSL recently completed (on January 23, 2023) its merger of the “Oaktree Strategic Income II” fund (“OSI2”), which added $572 million of investments at fair value. And for refence, OCSL had $3.2 billion in total investments at the end of Q2.

There merger adds some operational efficiencies and economies of scale, and it is not the fund’s first merger (OCSL also merged with Oaktree Strategic Income (OCSI) in 2021.

At the time of the merger, it added some costs (and the company issued almost 16 million shares in the first quarter in connection with the merger), but on a go-forward basis it leaves OCSL is a stronger position, and it is now the 11th largest BDC (by market cap) in our earlier table.

Also worth noting, OCSL amended its existing investment advisory agreement to waive $9.0 million of OCSL’s base management fees as follows:

$6.0 million at a rate of $1.5 million per quarter (with such amount appropriately prorated for any partial quarter) in the first year following closing of the merger and $3.0 million at a rate of $750,000 per quarter (with such amount appropriately prorated for any partial quarter) in the second year following closing of the merger.

On a go-forward basis, OCSL is now in a stronger position (even though the shares have underperformed other BDCs so far this year (see performance in our earlier table, above).

Valuation:

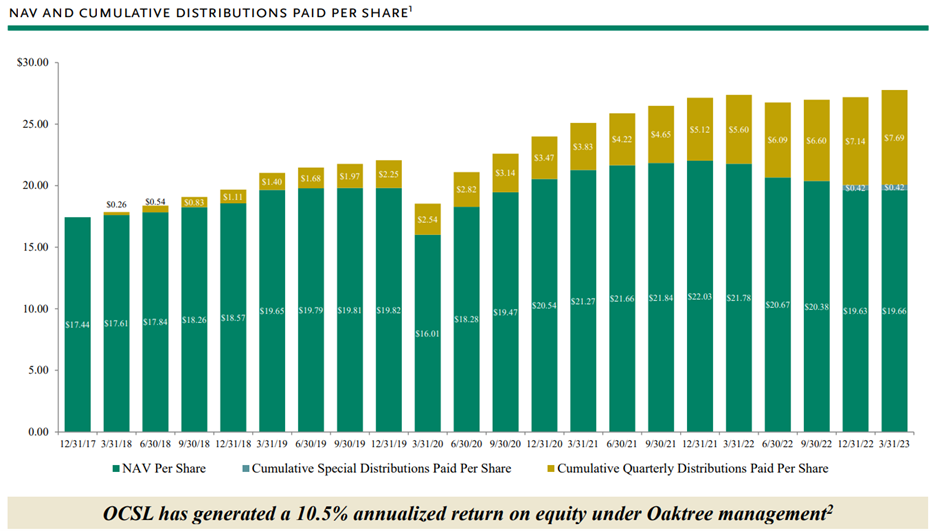

OCSL has been around since 2007, but Oaktree didn’t manage it until 2017 (when it took over from Fifth Street Capital). As such, Oaktree has been able to grow the NAV per share since that time, while also steadily growing the dividend per share (see graphic below).

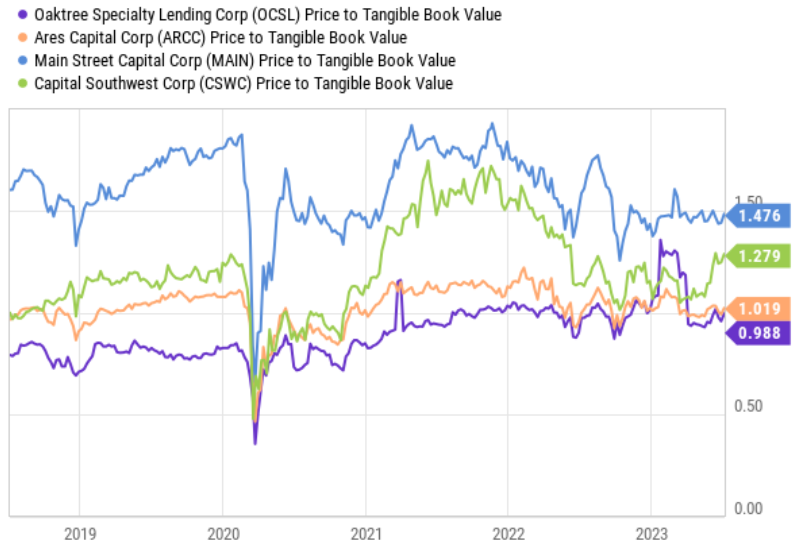

And on a price-to-book-value basis (one of the most basic BDC valuation metrices), OCSL currently trades at par (1.0x) which is fairly consistent with its own history and attractive for investors considering the company has improved its financial and industry position now that the OSI2 merger is behind it.

OCSL also has a reasonable debt-to-equity ratio (see earlier table), and plenty of dry powder wherewithal in the form of access to liquidity. And for perspective, here is a look at OCSL’s historical price-to-book-value ratio as compared to a few other popular BDCs.

The company’s reasonable valuation, conservative use of debt and strong liquidity position make the shares attractive, especially considering the big, well-covered dividend.

Dividend:

As you can see in our earlier graphics, OCSL has grown its dividend per share over time (a good thing for income-focused investors) and it has also increased its dividend in each of the last 4 years (something only three other BDCs can match or beat, namely Hercules Capital (4 years) Barrings BDC (4 years) and Capital Southwest (9 years)). Also important to note, because BDCs don’t pay corporate income tax (as long as they pay out their profits as dividends) BDC dividends are generally not qualified dividends (i.e. OSCL’s dividend generally does not qualify for the lower “qualified” dividend tax rate). However, OCSL did pay out a special (extra) dividend at the end of 2022:

“The Board of Directors also declared a special distribution of $0.14 per share [not 3-for-1 reverse stock split adjusted] payable in cash on December 30, 2022 to stockholders of record on December 15, 2022 to offset an increase in taxable income driven by gains on foreign currency forward contracts and equity investments held through a taxable subsidiary.”

And very importantly, the dividend remains well covered by net investment income, as you can see in the following table.

Specifically, net investment income has been $0.63 per share in each of the last two quarters, whereas the dividend per share has been only $0.54 and $0.55 (i.e. well covered).

Risks:

Of course OCSL faces risks that should be considered. Perhaps most importantly, if the economy goes into an ugly recession OCSL would likely be impacted negatively because its 165 portfolio companies would face increased financial stress and more of them could move into non-accural status (i.e. more than the current two, which represent 2.5% and 2.4% on the debt portfolio at constant fair value basis). However, OCSL maintains a strong and relatively conservative balance sheet that can help it weather financial challenges.

Another risk is that OCSL continues to merge with other investment funds. This can bring merger expenses, dilutive assets and may result in the issuance of more shares (to the dilution of current investors).

The Bottom Line

Oaktree Specialty Lending currently presents an attractive opportunity if you are an income-focused investor. Specifically, the big dividend is well covered, the balance sheet is strong and the company is helped by moderately rising interest rates (thanks to floating rate loans). It also trades at a reasonable valuation and has opportunities for growth. We have owned OCSL is the past (we owned OCSI, which merged into OCSL), but we do not own the shares currently (we currently own other BDCs, including Ares Capital (ARCC), Main Street Capital (MAIN) and Owl Rock Capital (ORCC)). However, OCSL remains high on our watchlist, and we could be compelled to add shares in the near future considering its currently positioned attractively in the market.