Market fear has ticked up slightly over the last week as interest rate hikes are expected to resume and this could pour water on the red hot stock market rally so far this year, especially high-growth stocks. However, it’s our contention that this short-term noise won’t matter for select top growth stocks which will be driven higher by strong execution supported by incredible disruptive secular trends (including generative AI, the great cloud migration and the world’s insatiable desire for more efficient sources of energy). In this report, we share high-level data on the current state of the market, company-specific fundamental metrics on over 50 top growth stocks, and then review three specific stocks from the list that represent particular compelling businesses going forward.

The Market:

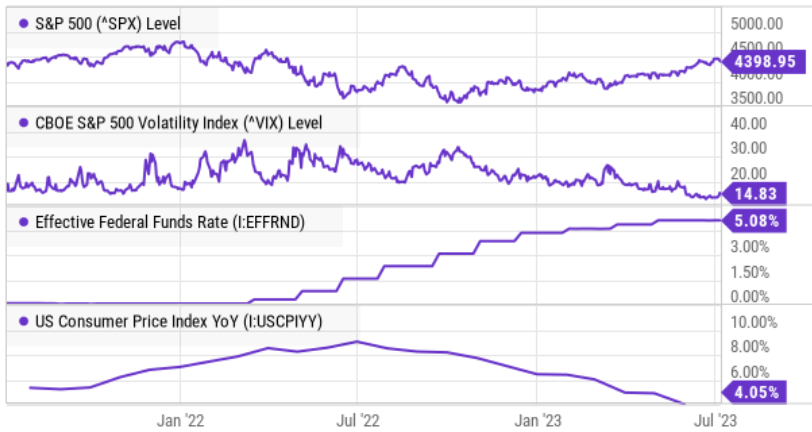

Despite the strong gains for the stock market this year (it’s up 15.3%) it’s still basically flat over the last two years (as you can see in the chart below).

And while some people are increasingly nervous because the market “fear index” (VIX) has ticked up in the last couple weeks (see above), it’s still relatively low by historical standards.

Further, some investors are fearful because the fed is expected to resume interest rate hikes later this month. However, rates are still reasonably low by historical standards, and rate hikes have been slowing and are expected to increase at a slower pace going forward (as per the latest meeting minutes released this past week), another relatively good thing for the market.

Further still, the high inflation that the fed is hiking rates to combat (CPI was 9.0% one year ago, see chart above) continues to trend significantly lower (a good sign for investors), and it may revert to the more historically normal ~2% level soon.

And even though some economists are still calling for recession, the economy is stronger than it was two years ago (inflation-adjusted Real GDP is now higher), and the stock market is usually many months ahead of the economy in terms of its health.

And in another potential good sign, some economists are now saying there will be no recession (or that it already happened and no one noticed), especially following the latest fed meeting minutes released this past week.

So despite the fear some media pundits unrelentingly push, the economy is not in terrible shape, and that clears the way for stocks (some more than others) to perform well going forward.

50 Top Growth Stocks

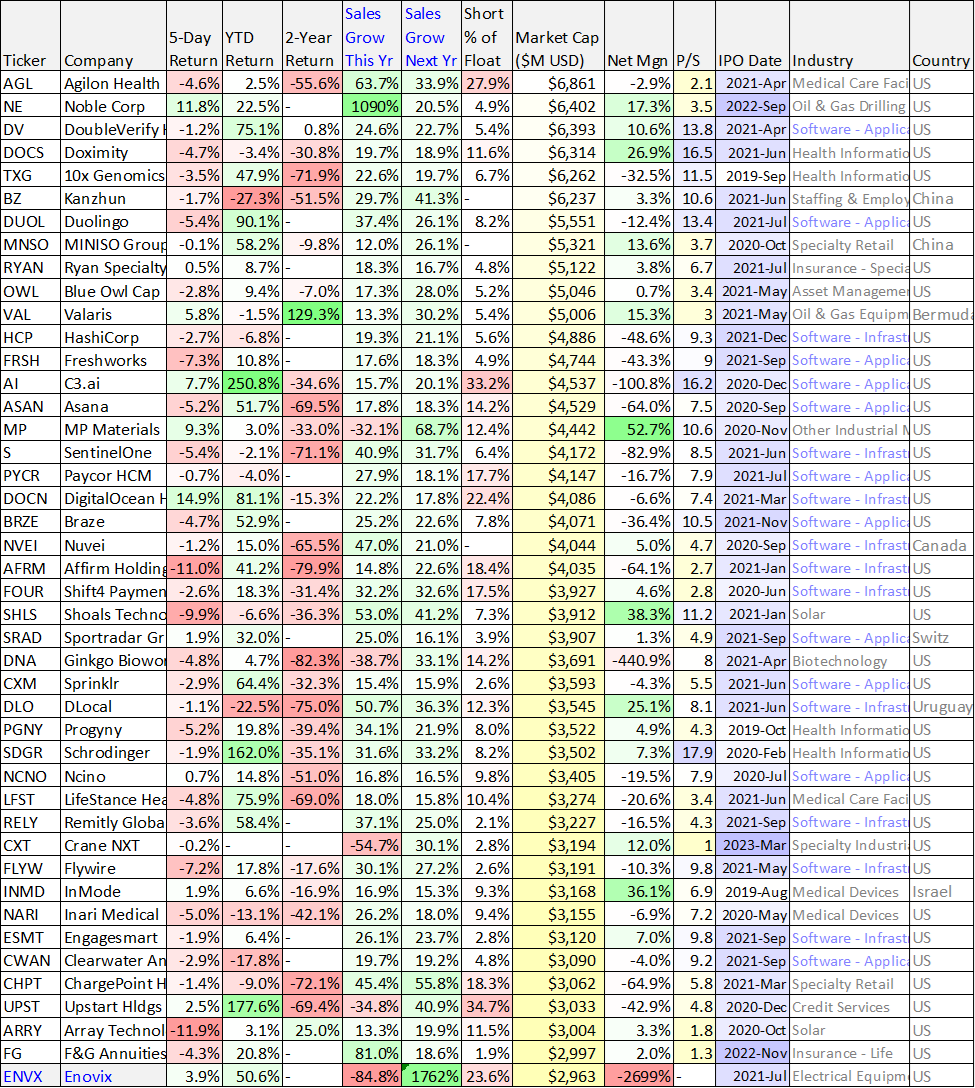

Top growth stocks (those with high revenue growth rates) can be particularly sensitive to the economy. For example, we share over 50 top revenue growth stocks in the following table, and many of them soared to extremely high levels during the pandemic (as fiscal and monetary stimulus created a very strong tailwind), but then crashed when the pandemic bubble burst (i.e. as monetary and fiscal policies shifted from dovish to hawkish to fight inflation).

To be included in the following table, we required an expected revenue growth rate for next year of at least 15% and a market cap of at least $3 billion. The table is sorted by market cap (and we also included a handful of big tech names for comparison purposes). As you can see, the year-to-date returns have been very strong for many of these names (i.e. they are up much more than the S&P 500), but many of the 2-year returns are still terrible (as the 2-year number captures a significant portion of the pandemic bubble bursting).

You likely recognize at least a few of the names in the above table.

A few more things worth noting about the above stocks, many of them began trading publicly in the last few years as you can see the “Initial Public Offering” date column (because the companies wisely offered their shares publicly when valuations were high), and many of them are not yet profitable as you can see in the “Net Margin” column (something that can be particularly challenging in a rising interest rate environment, thus the big price drops over the last two years).

The table also includes price-to-sales ratios (if this valuation metric is over 10x then the company better have some pretty extraordinary growth opportunities to support it), and recent short-interest amounts, representing people betting against the stock (those with very high short interest could experience strong price gains if the market keeps going higher and short sellers are forced to buy back the shares thereby putting upward pressure on the price in what is known as a “short squeeze”).

Lastly, you can see many of these high growth stocks are in the software industry (software is “eating the world”) and most of them are based in the United States.

Three (3) Top Growth Stocks Worth Considering

The three specific stocks we review next all have very high expected growth rates, they’re all benefiting from a powerful secular trend (including artificial intelligence, the great cloud migration and/or the world’s insatiable demand for efficient energy sources), they’re all relatively recent IPOs (in the last few years) and despite this years very strong gains—they’re all trading dramatically lower than their all time highs. And importantly, all three businesses continue to improve significantly from a fundamental standpoint.

1. Datadog (DDOG)

Datadog is a very high growth “observability and security” platform for cloud applications, and it is a huge beneficiary of “the great cloud migration.” Specifically, Datadog’s highly-regarded solutions monitor data across the technology stack to help businesses secure their systems, avoid downtime, and ensure customers are getting the best user experience.

As members know, we purchased shares of Datadog in March (in the $60’s), and it is increasingly attractive following its latest earnings release, whereby it beat revenue and earnings estimates and also raised forward guidance (the shares now trade around $100). Growing revenues at a very impressive rate (and with gross margins near 80%, and an impressive land-and-expand track record), yet still trading at only 14.8 times forward sales, Datadog continues to present a highly attractive long-term buying opportunity. We are currently long Datadog, and you can access our recent full report on the company here:

2. Palantir (PLTR)

Palantir is basically a software company, and it is positioned to benefit dramatically in the years ahead from the massive secular growth in Artificial Intelligence (“AI”) and Machine Learning (“ML”) (especially thanks to the company’s leading solutions, innovation, sticky customer base and very strong balance sheet).

Palantir is a “busted pandemic-era IPO.” Specifically, the stock was loved (during the pandemic bubble) then hated (when the bubble burst), but the business has only been getting stronger and the shares are still inexpensive relative to where we expect them to be in five years and beyond. In the following report, we review the business, the growth, the opportunity, the valuation and the risks. We are currently long these shares with no intention of selling.

3. Enovix (ENVX)

This is the most speculative idea on our list, and potentially the most lucrative (if things continue to progress for the company). Enovix is a manufacturer of advanced lithium-ion batteries. And this “early-stage public company” (it’s a “busted pandemic IPO stock) is well-positioned to benefit from growing demand, including mobile, Internet of Things (IoT) and electric vehicles. What sets Enovix apart (versus the competition) is its energy density advantage (achieved through design and architecture choices) and silicon anode technology (learn more in our full report linked below). Importantly, Enovix also addresses key safety concerns.

Here (below) is our full report, whereby we review the business model, market opportunity, financials, valuation and risks. If you can handle this stock’s very high risk-reward profile, the shares are absolutely worth considering. We are long Enovix.

The Bottom Line:

The economy continues to improve as inflation slows, interest rate hikes moderate and GDP continues to climb higher. Of course conditions are always dynamic and near-term volatility can be frustrating, but over the long-term we believe an improving economy will continue to drive the stock market higher.

The specific high-growth stocks described in this report are particularly attractive (if you are a growth stock investor) because of their high revenue growth trajectory, continuing fundamental improvements and the strong secular trends that support them. We currently own all three and have included them in our July Top 10 Growth Stock report.

However at the end of the day, you need to select only investment opportunities that are right for you, based on your own individual situation. We believe disciplined, goal-focused, long-term investing will continue to be a winning strategy.