If you are an income-focused investor, Energy Transfer (ET) offers a tempting 9.7% yield. Especially considering the stable fee-based income, the healthy distribution coverage ratio and the ongoing volume growth trajectory. However, there are variety of big risk factors that investors should consider, including debt levels, master limited partnership (“MLP”) tax considerations, a somewhat undisciplined management team, the lack of a strong competitive moat, rising interest rates, regulations, environmental concerns and the overall volatility profile of the industry. In this report, we provide an overview of the business, consider the attractive qualities that make the distribution so tempting, review the risks, evaluate the current valuation and then conclude with our opinion on investing.

Overview: Energy Transfer (ET), Yield: 9.7%

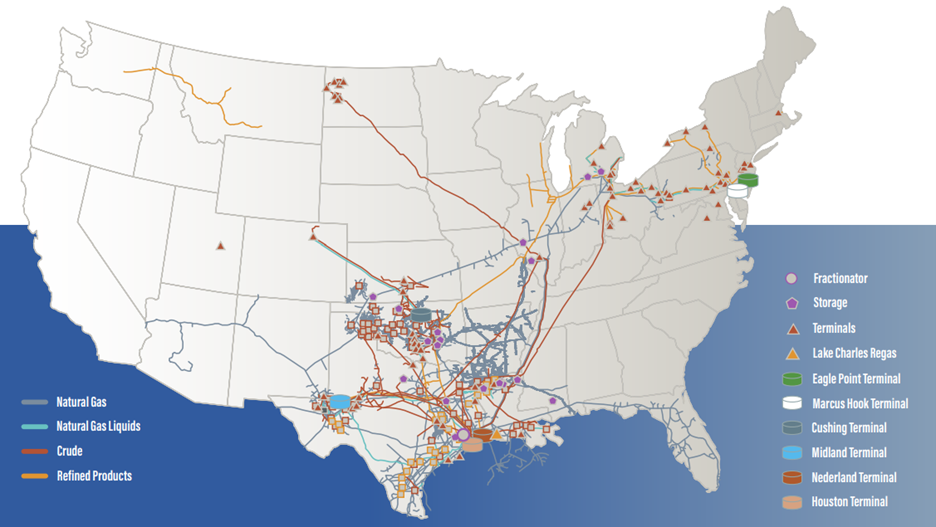

Energy Transfer (ET) owns and operates nearly 125,000 miles of pipeline and associated infrastructure in 41 states (and with a strategic footprint in all major U.S. production basins).

The oil and natural gas products that move through the company’s pipelines are an integral part of modern life in ways many people don’t think about (for example, oil and natural gas are critical inputs in producing the clothes you wear, the food you eat and the transportation you use). And for perspective, Energy Transfer transports approximately 30% of all U.S. natural gas produced, 35% of all U.S. crude oil produced and exports more NGLs (natural gas liquids) than any other company or country (approximately 20% of the world market).

Energy Transfer divides itself into five operating segments, including Natural Gas, Crude Oil, NGL & Refined Products, Intrastate & Interstate and SUN/USAC/Other (as you can see in the chart below).

And in addition to Energy Transfer’s core segments, according to the company’s website:

Energy Transfer has also taken a stake in various operations held by multiple subsidiaries, which include retail propane, natural gas marketing services, natural resources operations, and natural gas compression services, among others.

Energy Transfer’s wholly-owned subsidiary, Dual Drive Technologies, Ltd. (“DDT”), provides compression services to customers engaged in the transportation of natural gas, including ET’s other segments. Energy Transfer also owns the general partner interests, 46.1 million common units of the limited partner interests in USA Compression Partners, LP (“USAC”), which acquired CDM Resource Management from Energy Transfer in the second quarter of 2018. In addition, Energy Transfer owns the general partner interests, incentive distribution rights and 28.5 million common units of Sunoco LP (“SUN”).

Further, the company’s subsidiaries are involved in the management of coal and natural resources properties and the related collection of royalties. Energy Transfer also earns revenues from other land management activities, such as selling standing timber, leasing coal-related infrastructure facilities, and collecting oil and gas royalties. These operations also include end-user coal handling facilities.

A Very Tempting Big Yield:

If you like big income, then Energy Transfer is hard to ignore for multiple reasons. For starters, the company continues on a strong trajectory of growth:

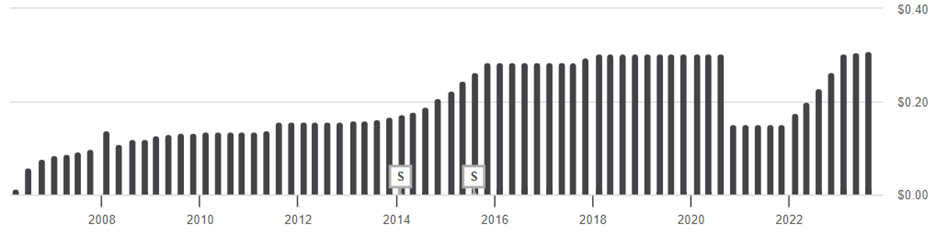

Distribution Growth: The company just recently announced a healthy increase to its quarterly cash distribution (to $0.31 per common unit from the previous $0.3075), as you can see in the chart below.

Volume Growth: And the distribution increase is supported by record operating volumes across several segments, as per the company’s most recently announced results, including:

NGL fractionation volumes were up 5%, setting a new Partnership record.

NGL transportation volumes were up 13%, setting a new Partnership record.

Midstream gathered volumes increased 8%, setting a new Partnership record.

Intrastate natural gas transportation volumes were up 3%, setting a new Partnership record.

Interstate natural gas transportation volumes were up 17%.

Crude transportation and terminal volumes were up 23% and 15%, respectively.

Inorganic Growth: Acquisitions have been another source of growth for the company. For example, in May, Energy Transfer completed its acquisition of Lotus Midstream (for total consideration of $930 million in cash and approximately 44.5 million newly issued common units) and thereby opportunistically adding to ET’s Permian pipeline network.

Future Growth: Further still, as per the latest earnings release, Energy Transfer continues to “target a 3% to 5% annual distribution growth rate, while… maintaining sufficient cash flow to invest in our incredible backlog of growth opportunities.”

Stable Fee-Based Earnings: Importantly, ET’s distribution is supported by stable fee-based earnings. Specifically, approximately 90% of the company’s EBITDA is fee-based, which mean it can be significantly less volatile than the income of other energy sector companies that are more dependent on highly-volatile energy prices for earnings.

Distribution Reinvestment: According to the company, "Energy Transfer LP’s Distribution Reinvestment Plan (the Plan) is available to all owners of Energy Transfer LP common units and is an excellent way for ET owners to reinvest their distributions.” Noteworthy, “Common units purchased through the Plan will be sold at a discount ranging from 0% to 5% (currently set at 0.0%) and investors will not pay any service fees, brokerage trading fees or other charges.”

Dynamic Big Risks:

Despite all of the attractive qualities of Energy Transfer’s big distribution, there are also a wide variety of risk factors that investors need to consider.

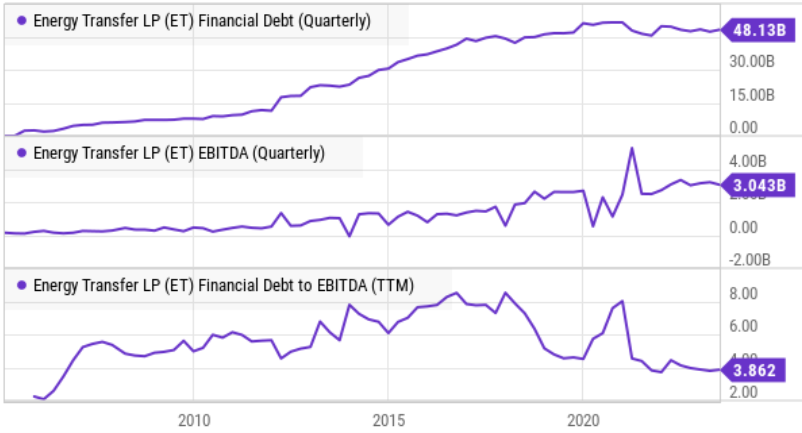

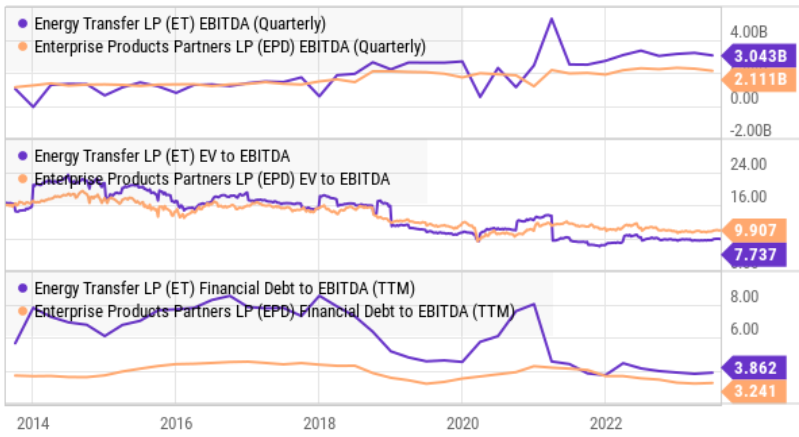

High Debt: As you can see in the following chart, Energy Transfer’s debt load grew significantly over the last decade.

The debt was used to fund growth, but it also create risks. Bringing down the debt has been a stated goal of management. Here is what Co-CEO Tom Long had to say about it on the last quarterly call:

“As you know, we have focused on the debt. We're very, very obviously pleased to have it down into our 4 -- kind of 4.5 range kind of at the top of it. So we'll continue to look at moving down maybe towards the lower end of that like we mentioned in the prepared remarks. But moving on past the debt side, the balance sheet side of it, we're going to continue to focus on a lot of the projects that we've talked about here.”

Energy Transfer continues to maintain an investment grade credit rating from all three of the major rating agencies.

Also noteworthy, Energy Transfer has a variety of preferred shares outstanding. Preferred shares are often considered a stock-bond hybrid, whereby they can offer some healthy distribution income and lower volatility. Preferred shares generally don’t have the same price appreciation potential as common shares, and they are also ahead of common shares in the capital structure (meaning in a default share, preferred investors could get some money back when common shares are totally wiped out).

MLP/K-1 Considerations: As a Master Limited Partnership, Energy Transfer brings tax-related challenges for some investors, including the receipt of a K-1 statement at tax time. Here is what the company has to say about that on its website:

Energy Transfer LP (ET) is a publicly traded master limited partnership. Unitholders are limited partners in the Partnership and receive cash distributions. A partnership generally is not subject to federal or state income tax. However, the annual income, gains, losses, deductions, and credits of the Partnership flow through to the Unitholders, who are required to report their allocated share of these amounts on their individual tax returns as though the Unitholder had received these items directly.

Energy Transfer will not pay any federal income tax. This allows for a higher potential cash flow payout to unitholders. Instead, each unitholder will be required to report on his or her income tax return his or her share of our income, gains, losses, and deductions without regard to whether corresponding cash distributions are received. As a result, a unitholder’s share of taxable income, and possibly the income tax payable by the unithholder with respect to that income, may exceed the cash actually distributed to the unitholder. Since MLPs generally pay more cash distributions than the amount of taxable income allocated, the tax basis of the unitholder is decreased by the difference between total cash received and taxable income reported. Cash distributions will become taxable if the unitholders’s cost basis is reduced to zero. It is the responsibility of each unitholder to investigate the legal and tax consequences under the law of pertinent states and localities of his or her investment in Energy Transfer.

Further still, some midstream companies have been abandoning the K-1 structure, in some cases creating significant one-time tax pain for investors.

Rising Interest Rates: higher interest rates also creates a risk for debt-heavy businesses, such as Energy Transfer, because as rates rise so does the cost of borrowing (which could put additional stress on the business. Fortunately, as you can see in the table below, some of the impact and challenges of higher rates is dispersed through a laddered bond maturity structure as you can see in the following table.

Undisciplined Management Team: Some investors argue that Energy Transfer’s founder and current Executive Chairman, Kelcy Warren, lack financial discipline thereby introducing significant risk for the company. After founding the company in 1996, he grew it from a small intrastate natural gas pipeline operator to the massive organization it is today. However, he took on a lot of risk to do it, and he is part of the reason the company’s current debt level is viewed as high by many investors.

However, Warren still own a significant portion of Energy Transfer (see table below), and certainly cares about its continued success and viability.

In fact, approximately 13% of the company is owned by insiders. Important to note, Kelcy Warren has unique voting rights that cannot easily be diluted below 20%, as described in the company’s annual report.

“The majority owner of our general partner has rights that protect him against dilution. Through his controlling interest in our general partner, Kelcy Warren owns all of the outstanding Energy Transfer Class A Units, which represents an approximately 20% voting interest in the Partnership. Under the terms of the Energy Transfer Class A Units, upon the issuance by the Partnership of additional common units or any securities that have voting rights that are pari passu with the Partnership common units, the Partnership will issue to the general partner additional Energy Transfer Class A Units such that Mr. Warren maintains a voting interest in the Partnership that is equivalent to his voting interest in the Partnership with respect to such Energy Transfer Class A Units (approximately 20%) prior to such issuance of common units. As a result, Mr. Warren is partially protected against the dilutive effect of additional common unit issuances by the Partnership with respect to voting. As of December 31, 2022, the Partnership had outstanding 765,896,700 Energy Transfer Class A Units.”

Important to note, in 2020 Energy Transfer introduced new co-CEOs, arguably thereby adding some much needed additional discipline to the operations of the organization.

No Economic Moat: According to Morningstar, Energy Transfer’s business lacks any significant “moat.” As per sector strategist, Stephen Ellis:

“We believe Energy Transfer has no economic moat. Energy Transfer's diversification across the U.S. energy value chain increased its share of assets and earnings from no-moat commodity-sensitive businesses with more volatile earnings.”

Regulations and Environmental Consideration: regulations and environmental considerations pose another risk the company has to deal with. For example, US Department of Energy recently threw a wrench into Energy Transfer’s Lake Charles LNG export project in Louisiana by refusing the company’s rehearing request. Further still, Energy Transfer continues to face costly regulatory challenges with regards to the Dakota Access Pipeline.

Current Valuation:

Energy Transfer shares are relatively inexpensive as compared to peers (such as Enterprise Products Partners) on an EV/EBITDA basis, as you can see in the following chart.

Arguably, Energy Transfer is assigned a lower valuation because of the high risks (such as those described in the previous section). However, considering the company has addressed most of the risks (by improving debt/leverage ratios and installing discipline through the new co-CEOs) Energy Transfer units are undervalued. In fact, most Wall Street Analysts have a “Strong Buy” rating on Energy Transfer, as you can see in the following graphic.

Morningstar sector strategist Stephen Ellis (mentioned earlier) recently upgraded his price target (following the most recent quarterly earnings release in early August) to $17.50, thereby suggesting Energy Transfer has 27% upside (and that is in addition to the big distribution yield).

Conclusion:

If you can handle the K-1 at tax time, Energy Transfer is worth considering for investment, especially within the constructs of a prudently diversified portfolio (because a diversified portfolio can help offset the bouts of idiosyncratic volatility the midstream industry occasionally suffers). In our view, Energy Transfer has been working to address the big risk factors (as described in this report) and now the shares are undervalued, especially considering the very large distribution yield. If you are an income-focused investor, Energy Transfer is absolutely worth considering for investment.