The company we review in this report harnesses the power of atomic ions found in nature to develop quantum computing systems that are widely regarded as surpassing traditional computer technologies in both quality and scalability. Founded in 2015 and first trading publicly in late 2021, the company is relatively small, but growing rapidly and supported by very large long-term secular disruption opportunities. We review the business, the market opportunity, financials, valuation, risks and then conclude with our opinion on investing.

Key Takeaways:

Leveraging trapped-ion quantum technology, which is touted for its low error rate.

Leading in a market that is nascent and poised for significant expansion.

Hitting technological milestones earlier than expected.

Strong top-line and bookings growth, indicating robust demand pipeline.

Navigating early-stage growth and investments via robust balance sheet.

The stock is down almost 50% to its peak in late 2021, offering patient and long-term focused investors a more attractive entry point.

A PDF version of this report is available here.

Introduction: IonQ Inc (IONQ)

IonQ stands as a prominent player in the realm of quantum computing. The company develops its quantum systems employing trapped-ion technology as its cornerstone. This innovative approach harnesses the power of atomic ions found in nature and is widely regarded as surpassing other commonly utilized technologies in both quality and scalability. Presently, IONQ extends a selection of three distinct quantum systems to clients. These systems enable customers to execute their algorithms in the cloud, utilizing traditional computers for the task. However, as the company forges ahead in the development of cutting-edge technologies tailored to tackle intricate challenges, the viability of algorithm execution on conventional computers could present notable cost and complexity hurdles. This will offer IONQ the prospect of generating additional hardware revenue, driven by the growing need for more advanced solutions. In this report, we analyze IONQ’s business model, its market opportunity, financials, valuation, risks, and then finally conclude with our opinion on investing.

What is Quantum Computing?

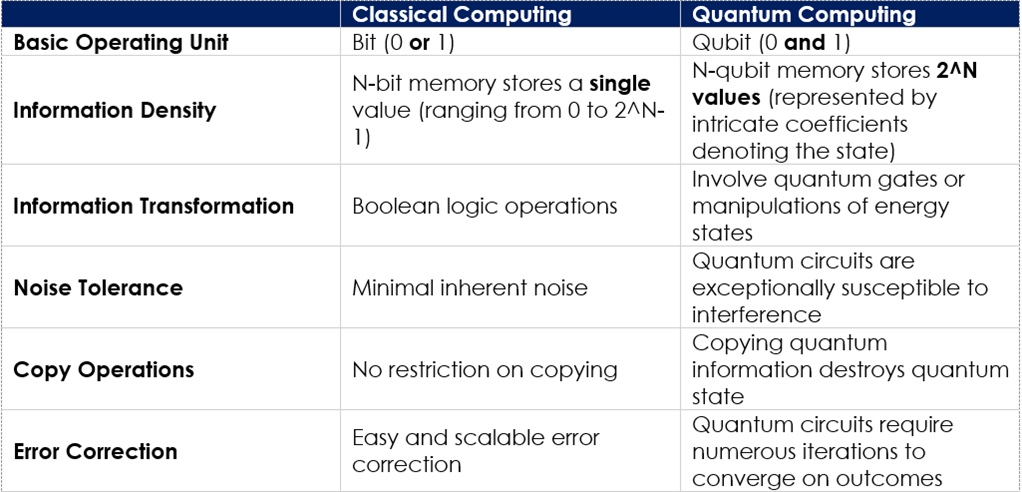

Quantum Computing is a swiftly emerging revolutionary technology harnessing the principles of quantum mechanics to tackle contemporary intricate challenges that classical computers are incapable of handling. While conventional computing relies on bits, denoted as 0 (off) and 1 (on), to store data, quantum computing operates through quantum bits (qubits). These qubits, being fundamental units, can exist in a state of both 0 and 1 simultaneously, a phenomenon known as superposition. This unique attribute enables quantum computers to effectively address a range of complex issues that traditional computers would struggle to solve or would require an impractical amount of time - examples include simulating quantum systems, performing number factoring for decryption, and solving complex optimization problems.

Source: The Quantum Daily

Overview:

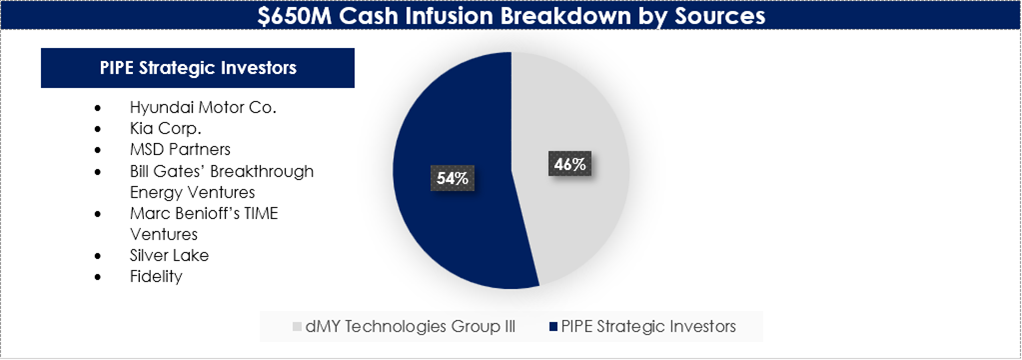

Founded by its current CTO and Chief Scientist, Jungsang Kim, along with Dr. Chris Monroe in 2015, IONQ emerged after a collective research journey of over two decades in the field of quantum physics. The company secured $2M in initial funding from New Enterprise Associates as seed capital, followed by an additional $20M infusion from prominent backers like Google Ventures (GOOGL) and Amazon Web Services (AMZN). Under the leadership of its current President & CEO, Peter Chapman, IONQ garnered an additional $55M in investment from notable stakeholders, including Samsung, Lockheed Martin (LMT), Airbus Ventures, Bosch, HP, and Mubadala. IONQ chose to go public in October 2021 by engaging in an unconventional route through a Special Purpose Acquisition Company (SPAC). This strategic move entailed a merger with dMY Technologies Group III, a SPAC. The company received $650M in cash and 64% ownership of the newly combined entity.

Source: Forbes

The company generates revenue through various avenues related to quantum computing and its services. Below is a breakdown of the revenue sources.

Source: 10-Q

Leveraging Trapped-Ion Qubits Touted for its Low Error Rate

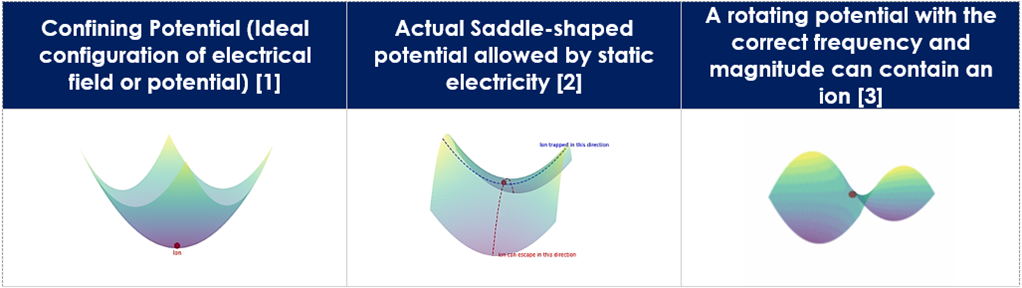

Numerous quantum computing technologies are currently available in the market, encompassing superconducting, photonics, silicon-based, spin qubits, trapped ions, and various others. IONQ specializes in utilizing trapped ion qubits formed from ytterbium, a rare-earth metal isotope. To understand trapped ions, it's essential to grasp the concept of ions. Ions are atoms that have undergone electron loss or gain, resulting in an electrical charge. Due to their charge, ions prove challenging to confine using static electric fields, as they consistently migrate between areas of high and low potential based on their charge (see chart [2]). Trapped ion technology employs an oscillating electric field to confine ions within a Paul trap (see chart [3]). Through this oscillating electric field, stable equilibrium zones are generated, effectively containing the ions. These oscillating fields can be finely adjusted to create forces countering the ions' movement, thus counteracting their inherent tendencies. Once trapped, the ions can be cooled and manipulated into distinct quantum states using lasers emitting various frequencies.

Source: Pennylane

Trapped-ion qubits offer various advantages compared to other quantum technologies. These include extended periods of coherence, the ability to individually control each qubit, accurate high-quality operations, and more. According to the company's investor presentation, their method of error correction is particularly efficient. The company only needs 16 unstable qubits, known as "dirty" qubits, to produce a single error-corrected qubit. In contrast, other quantum systems require thousands of these unstable qubits to achieve the same error correction. It's important to note that qubits are highly sensitive to their surroundings and can easily lose their special properties (like being both "0" and "1" at once) due to factors such as temperature, electromagnetic signals, and other interactions.

Source: Investors Presentation

Leading in the Market that is Nascent and Poised for Significant Expansion

Based on the 2019 study conducted by BCG titled "Where will Quantum Computers Create Value – and When?", the present stage of quantum computing is defined by the era of Noisy Intermediate-Scale Quantum (NISQ) devices. These devices possess the capability to execute practical and distinct operations, although they do so at a notable error rate that hampers their functionality. Over the forthcoming 10 to 20 years, this period is projected to witness widespread quantum advantage. During this phase, quantum computers are poised to exhibit superior performance, predominantly in industrial applications of significance. Following the span of broad quantum advantage, the trajectory of quantum computing is anticipated to transition into the era of full-scale fault tolerance. In this phase, quantum devices are set to become mainstream and are projected to create significant value. In fact, as per the report, quantum computing is expected to add $450B - $850B incremental operating income, evenly split between incremental annual revenue streams and recurring cost efficiencies across a wide variety of industries by 2050.

Source: BCG

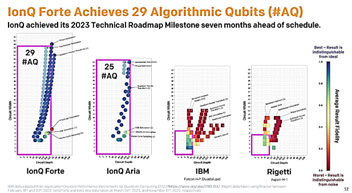

Hitting Technological Milestones Earlier than Expected

Since going public in late 2021, the company has significantly ramped up its investments in research and development. This strategic maneuver has led to a noteworthy improvement in the precision and dependability of its quantum systems, as gauged by Algorithmic Qubits (AQ). In the year 2022, the company effectively accomplished its goal of reaching 25 AQ by unveiling IonQ Aria. Interestingly, it surpassed its 2023 technical roadmap target by seven months by introducing IonQ Forte, featuring 29 AQ. It is worth noting that each additional AQ roughly equates to a doubling of valuable computational capacity. The company's subsequent pivotal technical objective is to reach 35 AQ, a task that will progressively become more demanding and costly for its clients to simulate on conventional computers. As such, it is highly likely that as the company continues to hit its forthcoming milestones, there will likely be an increase in hardware revenue, as customers choose to purchase quantum systems rather than utilizing their classical computers to run simulations on the cloud. To address potential future demand, the company will open the first quantum computing manufacturing facility in the US, supported by the US Congressional delegation from Washington state.

“Our next major technical milestone is achieving 35 AQ, which is particularly significant. At 35 AQ, simulating the operations of quantum algorithms using classical hardware can become exceedingly challenging and costly. We expect at 35 AQ, some customers will have an increasingly clear business case for running models on actual quantum computers, rather than attempting to simulate those models with classical computers.” – Peter Chapman, President & CEO

Source: Investors Presentation

IonQ Forte, initially limited to select partners, has now been expanded for use in both commercial and government contexts, alongside other systems such as IonQ Aria (#AQ 25) and IonQ Harmony (#AQ 11). The company’s partners are actively implementing algorithms or have signed agreements to utilize IonQ's quantum platform for algorithm executions in the future.

Source: Press Releases

Strong Top-Line and Bookings Growth, Indicating Robust Demand Pipeline

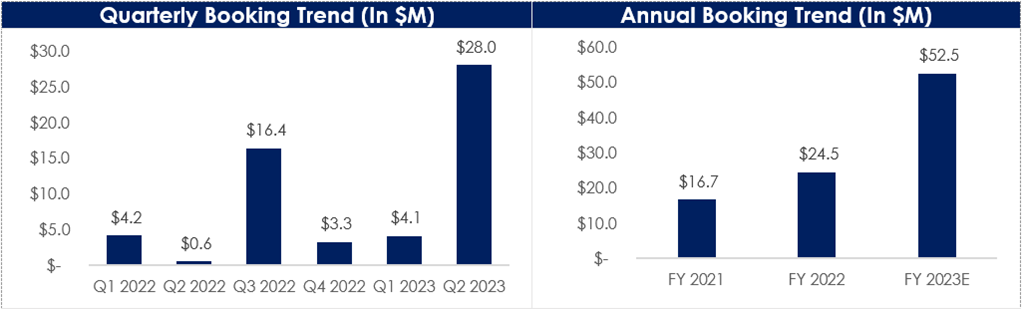

As a nascent disruptor in its initial phases, IonQ has witnessed a strong upward trend in revenue over the past three years, aligning with the company's initiation of commercial activities. In Q2 2023, the company reported $5.5M in total revenue as compared to $2.6M in Q2 2022, translating into a YoY growth of 112%. The driving forces behind this expansion are the robust demand for the company's quantum systems delivered through cloud technology, coupled with the company's ability to achieve technological milestones ahead of schedule, leading to the earlier execution of customer contracts.

Source: Company Filings

IonQ achieved $28M in new bookings in Q2 2023, bringing total bookings to $32M on a YTD basis and total cumulative bookings to $100M within the first three years of its commercialization journey. Given rising interest in its systems, IonQ has revised its guidance for both revenue and bookings. The company's revised projections anticipate revenue ranging from $18.9M to $19.3M, while bookings are expected to fall within the range of $49M to $56M in 2023.

Source: Company Filings

Navigating Early-Stage Growth and Investments via Robust Balance Sheet

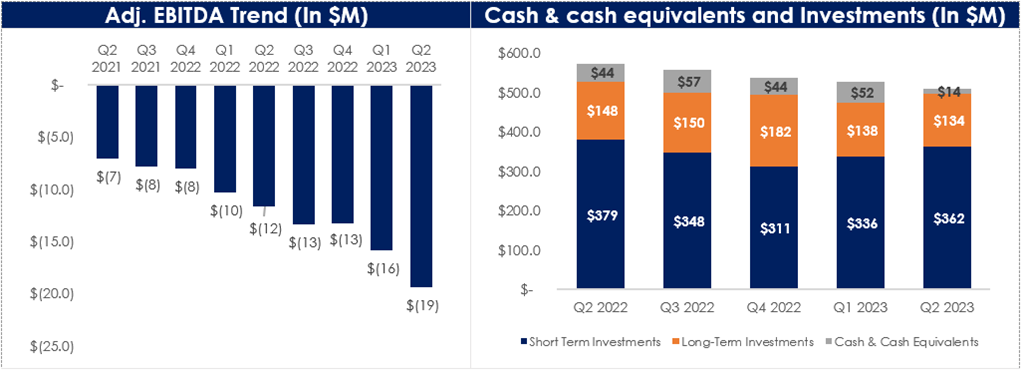

Similar to other rapidly growing companies in their early stages, IonQ is grappling with challenges related to achieving profitability. In Q2 2023, the company registered an adjusted EBITDA loss of $19.4M, a notable increase from the $11.6M adjusted EBITDA loss reported in Q2 2022. This loss can be attributed primarily to a significant surge in research and development expenses, which is justifiable given the company's positioning within the rapidly evolving quantum computing landscape. Despite these losses, we believe that IonQ boasts a robust financial position capable of supporting its internal investments. By the end of Q2 2023, the company had amassed $509M in cash, cash equivalents, and investments. Assuming that IonQ continues to report adjusted EBITDA losses of $62 million on a TTM basis in the future, the current cash reserves of $509M are deemed sufficient to sustain these losses for the subsequent 8 years.

Source: Company Filings

Valuation

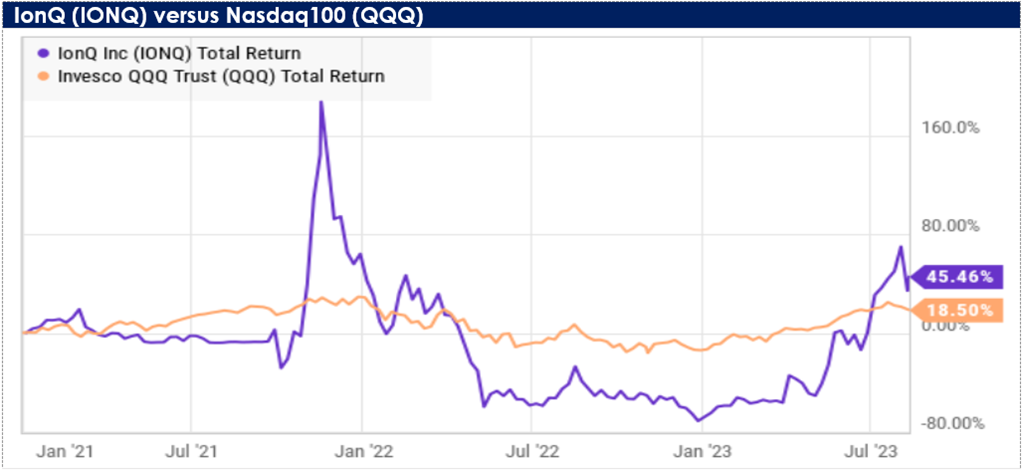

In the last year, IonQ’ stock has seen a substantial increase of around 120%, attributed to its endeavors in commercialization and successful partnerships. However, it is still hovering at almost 50% discount to its peak value in late 2021. Due to its nascent developmental phase, the conventional approach of evaluating the company’s valuation through market multiples is inappropriate. Despite that, considering the potential of the quantum computing market, we believe that the company’s market capitalization of $2B could ascend further as it attains successive technical milestones, improving the quality of its quantum computing systems.

Source: YCharts

You’ll note in the chart above, that IonQ is a “high-beta” stock, with the shares rising and falling significantly more than the overall market (as measured by the Nasdaq 100). As such, the shares may rise dramatically on the next market rally. However, over the mid- to long-term, the market valuation will be dependent on demand (i.e. the rate of demand growth for quantum computing solutions) and IonQ’s ability to meet that demand as a continuing innovator and market leader. As mentioned, the long-term opportunity is very large, thereby leaving plenty of room for this company to continue growing rapidly.

Risks

Customer Concentration Risk: The majority of the company's revenue comes from three significant customers, i.e., those contributing over 10% of the total revenue. While concentration risk is worth keeping an eye on, we believe that it will diversify as quantum computing market moves into the phase of widespread adoption.

Intense competition: IonQ operates within a fiercely competitive market landscape. Its rivals include industry giants like IBM (IBM), Google (GOOGL), Honeywell (HON), Intel (INTC), and Microsoft (MSFT). Moreover, it faces competition from emerging contenders like Rigetti (RGTI), Xanadu, D-Wave Systems (QBTS), and Quantum Computing Inc (QUBT). Despite the intense rivalry, IonQ's quantum technology based on trapped ions stands out, boasting numerous advantages over alternative approaches, particularly in terms of scalability and fidelity.

The company's most recent quantum systems, the #29 AQ IonQ Forte and #25 AQ IonQ Aria, clearly outperform IBM's Falcon r4P (Guadalupe) and Rigetti's Aspen-M-1 in terms of quantum advantage and quality. This is evident from the comparison provided below. Furthermore, IonQ's utilization of trapped-ion technology allows each successive hardware generation to become more compact and cost-effective to produce. This provides the company with a significant edge over the hardware development of competitors like IBM and Google.

Source: Investors Presentation

Conclusion:

IonQ stands out with its trapped-ion quantum technology, strategically placing the company within the fast growing quantum computing market, which is currently in its early phase of expansive development. As a pure play quantum computing entity, backed by co-founders with substantial expertise in quantum research spanning several years, the company possesses a distinctive advantage over its competitors. This advantage was evident through the company's recently unveiled IonQ Forte that excels in both quality and scalability relative to other available systems in the market. Considering the substantial market potential and significant strides already achieved, we perceive this as a promising prospect for patient investors who believe the notion that “quantum computing is the future.”