Hercules is a big-dividend (9.4% yield, not counting supplemental dividends) business development company (“BDC”) that we purchased in March and that has now experienced significant share price gains since the Silicon Valley Bank panic at that time (Hercules provides financing in the same high-growth / venture-backed lending space). And the shares now trade at a very high price-to-book valuation. In this report, we review the business, current market conditions, the company’s financial position, dividend, valuation and risks. We conclude with our opinion on investing.

What is a BDC?

Before getting into the details on Hercules, a quick review of BDCs in warranted. For some high-level background, here is what we wrote about BDCs in our previous report on Hercules:

Business Development Companies (“BDCs”) were created by Congress in the 1980s as a way to help small businesses (middle-market sized) get access to capital. BDCs invest in businesses by providing them debt and sometimes taking an equity position. BDCs can generally avoid paying corporate taxes by paying out most of their income as dividends (you generally still have to pay taxes on the dividends you receive from BDCs—if you own them in a taxable account).

BDCs are subject to a variety of other stipulations. For example, they are regulated by the SEC under the Investment Company Act of 1940, their leverage is limited to approximately 2:1 debt/equity (unless an SEC exemptive order exists to exclude SBA debt) and investments are required to be carried at fair value. The majority of the board of directors must be independent, they offer managerial assistance to portfolio companies and they are subject to comprehensive disclosure requirements under the 1934 Act.

BDCs can come in a wide variety of shapes and sizes, often focusing on different market sectors, geographies and types of financing arrangements. And of course, BDCs are often an income-investor favorite because of their often big steady dividend payments to investors.

Hercules Is Unique:

Hercules is unique because it is the largest BDC focused on high-growth and venture-backed businesses. It is also internally managed (this can help reduce expensive conflicts of interest, as compared to externally-managed BDCs). For reference, Hercules began trading publicly (on the New York Stock Exchange) when it completed its initial public offering (“IPO”) in 2005. On its website, Hercules describes itself as:

“the leading and largest specialty finance company focused on providing senior secured venture growth loans to high-growth, innovative venture capital-backed companies in a broad variety of technology, life sciences and sustainable and renewable technology industries. Since inception (December 2003, prior to the2005 IPO), Hercules has committed more than $17 billion to over 600 companies and is the lender of choice for entrepreneurs and venture capital firms seeking growth capital financing.”

As you can see below, the majority of the loans provided by Hercules are floating rate (a good thing in a rising interest rate environment) and they are diversified across a variety of industries and geographies (easier for Hercules to do considering its relatively larger size as compared to most other BDCs).

Also worth noting, Hercules provides mostly senior secured first lien loans (which are safer as compared to second position or unsecured loans). And the company also does have some equity and warrant positions too (thereby providing additional future upside for shareholder’s total returns). For a little more color, you can see select examples of Hercules portfolio companies in the graphics below.

The Current Market Cycle:

One thing you may realize is that by focusing on mainly growth-oriented companies, Hercules is particularly sensitive to the market cycle. For example, when the market is booming “high-beta” growth companies tend to boom even more, and when the market is struggling—growth companies can struggle even more.

For some perspective, here are a few charts (above and below) showing how venture-capital (high growth) company investments can speed up and slow down with the market cycle. For example, notice activity was very high during the 2020-2021 pandemic “growth” bubble, but very slow so far this year.

During the most recent quarterly call, Hercules CEO/CIO Scott Bluestein had this to say about the market cycle:

“As the market environment for new deals in our asset class continues to improve over the coming quarters, we believe that having a strong and diversified balance sheet with maximum liquidity will be a key differentiator for our platform and best positions Hercules to capitalize on the market opportunity that we believe is in front of us.”

Bluestein is basically acknowledging (with an optimistic spin) that the market has slowed.

Silicon Valley Bank Disruption:

Another big event this year that impacts the industry in which Hercules operates, was the Silicon Valley Bank failure. If you recall, SVB was focused heavily on providing financing to venture/growth investors and that bank failed, thereby sending shockwaves throughout the market.

The failure of SVB has also created opportunities for non-bank financers (such as Hercules). For example, here is was Bluestein had to say about it on the most recent quarterly call.

“We do think that over the last three or four months, we have begun to benefit from what happened with Silicon Valley Bank in March of this year. But it is our strong view that the opportunity is going to continue to get better over the coming quarters and over the coming years. Silicon Valley Bank was the largest player in the space over the last 40 years.”

The new deal flow that may materialize for Hercules as a result of the SVB failure may be part of the reason for the company’s current relatively high valuation (on a price-to-book value basis) as we will cover later in this report.

Strong Financials

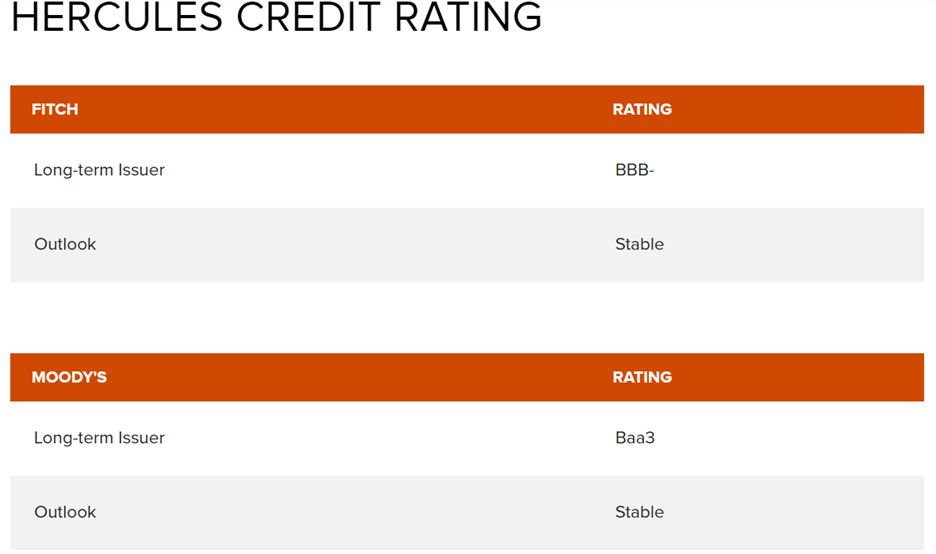

One factor that makes Hercules particularly attractive versus other BDC peers focusing on the same space (besides Hercules’ larger size and economies of scale) is its currently strong balance sheet and financial position. For starters, Hercules does have (just barely) an investment grade credit rating (unlike many of its “below-investment-grade” peers.

And in particular, Hercules has a relatively low amount of leverage (debt to equity is just above 1) and lots of liquidity. Note, you can see debt-to-equity ratios for peers in the table later in this report.

And as mentioned earlier, CEO/CIO Scott Bluestein believes the company’s strong liquidity position will be a key differentiator and competitive advantage going forward.

Further still, Hercules is a very solid business in terms of the high yields on its portfolio assets, as well as the very healthy net interest margins.

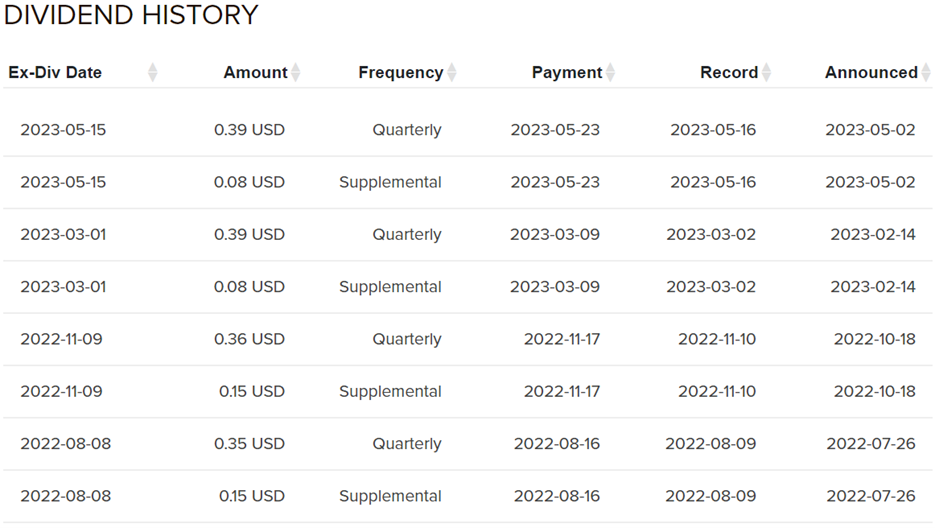

The Dividend: 9.4% Yield (not including supplemental)

And it is the healthy earnings yields and net interest margins (noted above) that allow Hercules to maintain its strong dividend payout. The yield is currently 9.4% ($0.40 quarterly), but higher if you include the supplemental dividends (see table below). Also, Hercules has increased its annual dividend the last four years in a row (this is only exceeded by Capital Southwest (CSCW) and Gladstone (GAIN) which have increased theirs 7 and 10+ years consecutively, respectfully.

In the most recent quarter, Hercules net investment income per share was $0.53 (thereby exceeding the $0.40 dividend per share).

Important to note, Hercules defaults investors to receiving the dividend in the form of more shares. So if you want to actually receive the dividend payments in cash, you have to notify the company. Here is how Hercules explains it:

We have adopted a distribution reinvestment plan (the "DRP"), through which all distributions are paid to our stockholders in the form of additional shares of our common stock, unless a stockholder elects to receive cash as provided below. In this way, a stockholder can maintain an undiluted investment in our common stock and still allow us to pay out the required distributable income. No action is required on the part of a registered stockholder to receive a distribution in shares of our common stock.

Valuation:

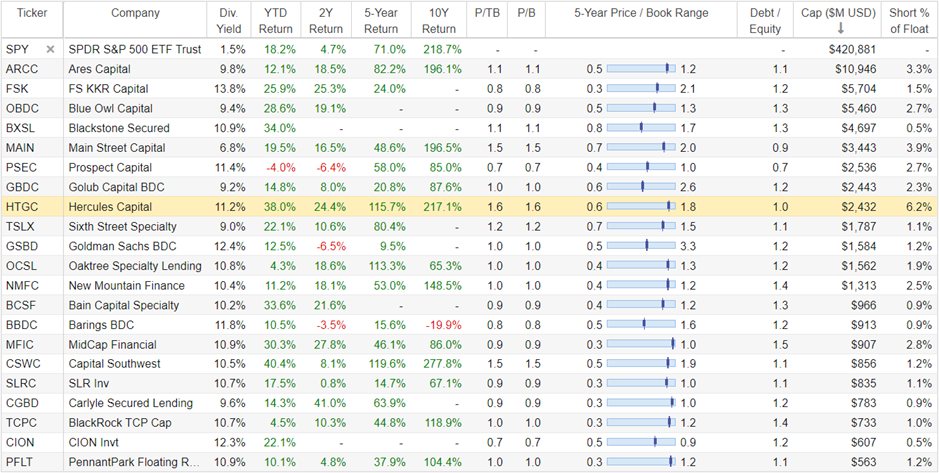

From a valuation standpoint, shares of Hercules appear expensive relative to history. For example, it currently trades at 1.6x book value, the high end of its historical range of 1.1x - 1.8x (and significantly higher than almost all other publicly traded BDCs). It also has a significantly higher level of short interest (or people betting against the shares) than peers.

There are a few likely explanations for the currently rich Hercules valuation. For starters, the shares have been rallying hard since they crashed earlier this year as Silicon Valley Bank failed (many growth-focused BDCs fell particularly hard at this time because of contagion fears—SVB and growth-BDCs often had many of the same clients), and investors have perhaps gotten carried away (and the shares are simply overpriced now—as supported by the high short interest in our earlier table).

Another explanation is that Hercules price-to-book value is high now in anticipation of a significant increase in business going forward (as CEO/CIO Bill Bluestein mentioned, Hercules expects to benefit in the quarters ahead by the void created by Silicon Valley Bank that will not be filled entirely by its acquirer Citizens Bank).

Yet another explanation is that as interest rates have risen, investors expect Hercules to benefit more than other BDCs because of its much higher “floating rate” portfolio. For perspective, this next chart is from last year, but it gives a good illustration of just how far out there Hercules is with regards to floating rates as compared to peers.

And more recently (from Hercules’ most-recent earnings presentation), here is how the company describes the impacts of dynamic interest rates on its earnings per share (remember, rates have risen dramatically this year).

Risks:

Of course Hercules faces a variety of risk. For example, if interest rates fall significantly then the company will have significantly lower earnings per share (as you can see in the chart above). Also, if interest rates go higher—that is expected to benefit the company, however it can also increase the amount of portfolio company defaults if it becomes too financially difficult to meet the higher interest payment obligations.

Another risk is the high current valuation (as measured by price-to-book value) as covered earlier (if the valuation returns to more normal levels—then the share price could fall significantly). This may be the assumption of the current high level of short interest (people betting against the shares of Hercules). Further still, weakness in the overall economy can cause more portfolio companies to fail thereby creating challenges and losses for Hercules.

Also, although Hercules currently benefits from lower fixed rate borrowing, those loans will eventually mature and require new financing (likely at higher rates). You can see the company’s current debt capital stack (including maturity dates/years) in the following graphic.

Noteworthy, Hercules just announced the offering of additional public shares thereby causing the share price to fall. Some investors like to purchase more shares just after such an offering, but additional offerings are likely to come again at some point down the road.

The Bottom Line

We purchased shares of Hercules in March of this year (shortly after the Silicon Valley Bank failure) when the share price was significantly lower than it is now. This is how we explained the purchase at that time:

Hercules shares have gotten caught up in the whole Silicon Valley Bank mess. Specifically, Hercules had an extensive working relationship with SVB (as both competitor and collaborative). As such, as SVB failed, panicked sellers sold Hercules, and the shares are now down significantly (and the yield is significantly high).

To be fair, the HTGC selloff is not exclusively related to SVB. The entire market cycle is at a point that does not favor earlier stage high-growth investments (such as the ones HTGC invests in).

We believe Hercules has the financial wherewithal to survive the market cycle, and may even benefit from the SVB demise (in some regards, it means less competition for HTGC)…

Overall, we’re using this low point in the market cycle to pick up shares of this attractive big-dividend BDC following steep share price declines.

We continue to own Hercules now (it is one of four BDCs that we currently own, including also ARCC, MAIN and OCSL—we recently sold OBDC on management concerns). We’re not increasing our Hercules position at this time (because the valuation is high), but we’re not selling either.

Specifically, Hercules is financially strong (whereas many peers have weakened), it is benefitting from higher rates, it will likely benefit further from the Silicon Valley Bank failure (as it continues to pick up more business), and the market cycle will eventually recover (whereby venture and growth investments will be stronger).

It feels a bit odd to own Hercules with a price-to-book value so high (recently 1.6x), but the business continues to grow and has significantly more long-term upside prospects in the years ahead. If you are an income-focused investor, we continue to believe Hercules is worth considering for a spot in your long-term income-focused portfolio.