Quick Note: Palantir released quarterly earnings after the close on Monday whereby the company raised forward guidance and announced a $1 billion share repurchase plan (both good things). It is growth in demand for the company’s Artificial Intelligence platform that is most interesting.

Here is a copy of the newly released shareholder letter from CEO Alex Karp. It is absolutely worth a read:

August 7, 2023

I.

The scale of the opportunity in front of us has never been more significant.

We announced the release of our Artificial Intelligence Platform (AIP), which allows large language models to operate within the confines of the enterprise and on privately held data, less than three months ago.

The platform already has users across more than one hundred organizations, including some of the largest enterprises in the world from the healthcare, finance, automotive, and energy sectors.

A scramble is taking place throughout the United States and around the world to deploy the software solutions that will allow institutions to domesticate the large language models that have thus far operated primarily in the wilds of the open internet.

But the barriers to entry to building the architecture that is required from both a technical and governance standpoint to integrate language models into the workings of a sprawling organization have been higher than many initially anticipated.

As a result, the demand for AIP is unlike anything we have seen in the past twenty years. We are currently in discussions with more than three hundred additional enterprises to deploy AIP within their organizations, all of which are searching for an effective and secure means of adapting the latest large language models for use on their internal systems and proprietary data.

We have built the integration platform that they require, and the traction we are seeing, only months after its release, has been transformative for our company.

II.

Our total revenue grew to $533 million in the second quarter.

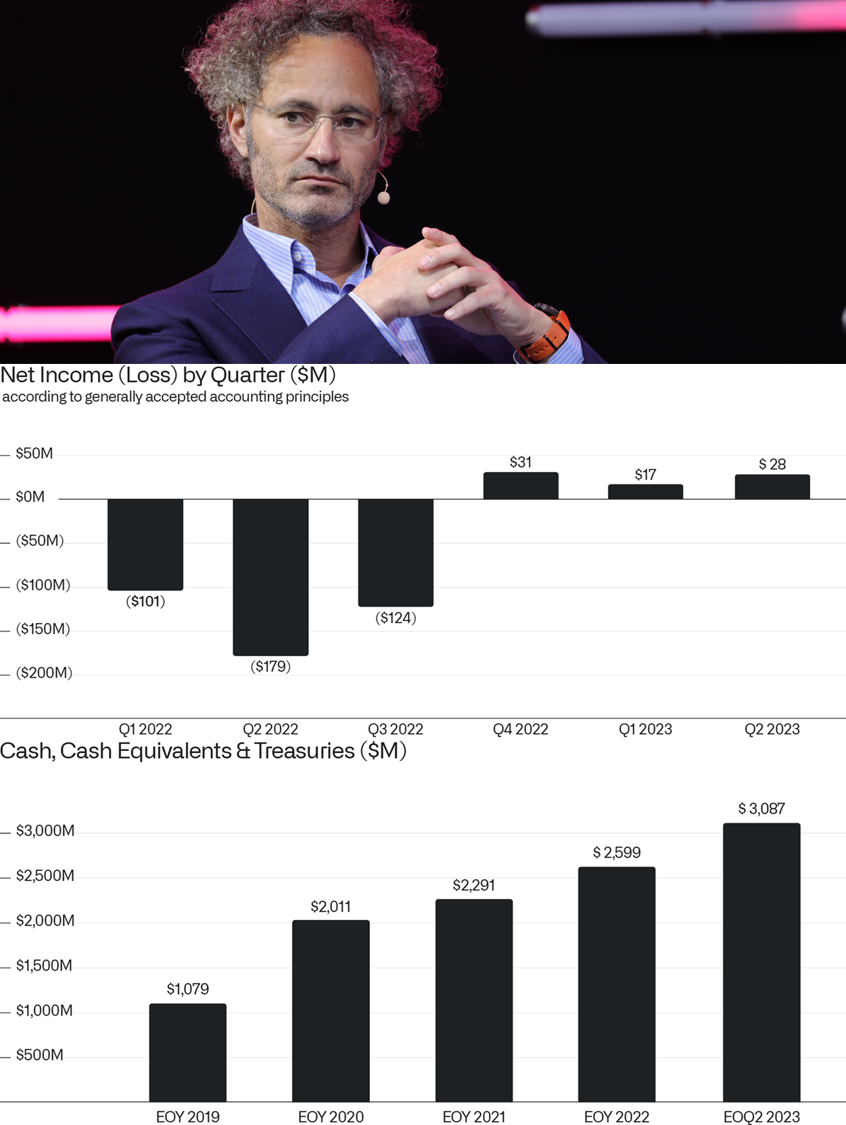

We also delivered another consecutive quarter of profitability, our third in a row, as we continue on our path of sustained and durable earnings.

In Q2 2023, we generated $28 million in net income according to generally accepted accounting principles.

We earned an operating profit for the second quarter in a row, with our income from operations growing to $10 million. In addition, our cash from operations reached $90 million, marking our tenth consecutive quarter of positive cash flow.

We expect to remain profitable on both a quarterly and annual basis this year. As a result, we anticipate that we will become eligible for inclusion in the S&P 500 after we report our financial results for Q3 2023 in early November. At that point, we will have been profitable on a cumulative basis over the preceding four quarters.

III.

We had $3.1 billion in cash and cash equivalents in the bank as of June 30, 2023.

These reserves have grown over the years as a result of a business that has steadily increased its share of a market that is itself rapidly expanding. We generated $250 million in excess cash in the first half of this year alone.

With strength comes freedom.

Our board of directors has approved a common stock repurchase program, the first in our history as a public company. The program is authorized to repurchase up to $1 billion of the company's Class A common stock.

The scale of the opportunity that lies ahead has increased significantly in recent months. And we intend to capture it.

Sincerely,

Alexander C. Karp

Chief Executive Officer & Co-Founder

Palantir Technologies Inc.