The Income Equity Portfolio Tracker Sheet has been updated for September, and there are a few new buys and sells (we highlight them in this note). As a reminder, the objective of the Income Equity Portfolio is “steady income and long-term capital appreciation” by investing in blue-chip companies with earnings growth potential, attractive valuations (multiple expansion opportunity) and prudent capital allocation (including reinvesting in the business, dividends, share repurchase and strong balance sheet management).

Here is the link to the Tracker Sheet and details on the buys and sells are included below.

Complete Sales:

Applied Materials (AMAT): This very-profitable semiconductor equipment manufacturer is up over 50% this year, the P/E is getting rich, and our exposure to the Technology sector was already getting a little heavy for this “Income Equity” strategy.

Stag Industrial (STAG): This industrial REIT has performed very well, and we needed to make room for new opportunities. We still have exposure to industrial REITs in the portfolio through our position in Plymouth (PLYM).

3M Corp (MMM): Between continuing lawsuit expenses/risks and a lack of growth, it was time to move on from this once great Industrial sector company, based in Minneapolis.

State Street (STT): The yield is tempting, but the company has little growth and the valuation is not particularly compelling. We also already have healthy exposure to the Financial sector, and needed to make room for new opportunities.

Vanguard Value ETF (VTV): This has been a “catch all” placeholder. We sold the shares of this passive index ETF to make room for new opportunities.

Data

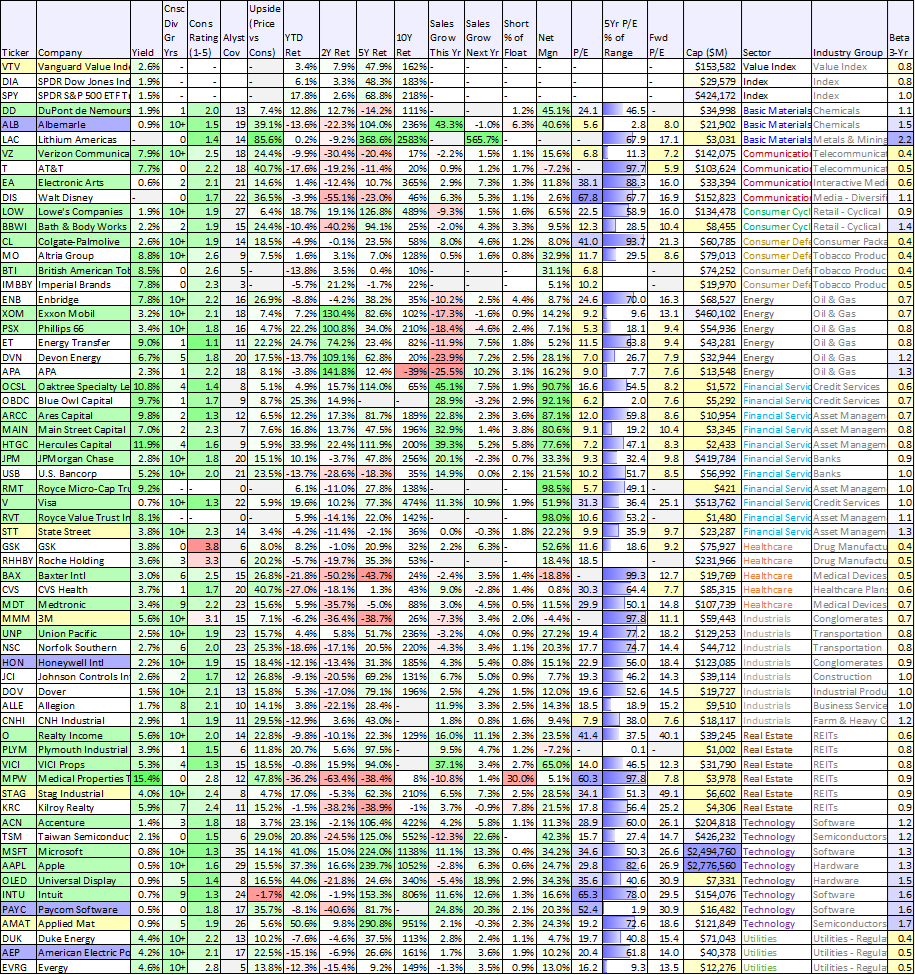

For reference, here is updated data (as of mid morning on 11-Sept-23) on the new buys (blue/purple), sells (yellow), stocks we own in the Income Equity Portfolio (green) and a few additional interesting names (white).

New Purchases:

Albemarle (ALB): Shares of this lithium-focused mining company are simply far too inexpensive to ignore. Lithium is a requirement for electric vehicle batteries. And despite growing demand, the share price has fallen. The company is very profitable (+40% net margins) and the dividend has been increasing every year for nearly three decades straight.

American Electric Power (AEP): Utilities stocks (such as AEP) have been weak this year as investors have moved money out of the sector (know for higher dividend yields) and into bonds (interest rates have been on the rise). However, the selling pressure on Utilities has created some attractive valuations and entry points. We previously had no Utilities sectors stocks in the portfolio (other than some passive exposure through VTV which we sold—see above), and AEP is an attractive 4.2% yield way to play the sector.

Paycom (PAYC): This payroll and human resources technology company (Software-as-a-Service) has impressive growth, an attractive valuation (the shares are down) and they just recently implemented a (small) dividend (making it eligible for the Income Equity Portfolio). The market cycle is real, and when we emerge on the other side of the current macroeconomic slowdown, Paycom shares are likely going much higher.

Honeywell (HON): After dumping one Industrial sector Stock (3M) we replaced it with another one (Honeywell). Honeywell operates a diversified technology and manufacturing company worldwide, and the share price is attractive considering its strong profit margins, steady growth trajectory and reasonable valuation. And considering its strong dividend yield, this blue chip is hard to ignore.

The Bottom Line:

Disciplined goal-focused long-term investing continues to be a winning strategy. The Income Equity Portfolio does not offer the highest yield (that’s our High Income NOW Portfolio) and it doesn’t offer the most explosive growth either, but it does offer a compelling mix of growth and income, that meets the needs of many investors. At the end of the day, you need to invest only in the opportunities that are right for you.