The BlackRock Health Sciences Term Trust (BMEZ) just announced a distribution cut, and now trades at an usually large discount to Net Asset Value (“NAV”). We review the fund and offer our opinion on investing.

Summary:

BlackRock Health Sciences Term Trust (BMEZ) announced a distribution cut and trades at a large discount to NAV.

BMEZ focuses on investing in health sciences companies and utilizes an options writing strategy.

The fund is a "Term" Trust and intends to dissolve in 2032, offering investors a liquidity event at NAV.

Overview (BMEZ):

For starters, here is the BMEZ investment approach, according to the BlackRock website:

BlackRock Health Sciences Term Trust’s (BMEZ) (the “Trust”) investment objective is to provide total return and income through a combination of current income, current gains and long-term capital appreciation. Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities of companies principally engaged in the health sciences group of industries and equity derivatives with exposure to the health sciences group of industries. The Trust utilizes an option writing (selling) strategy in an effort to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns.

That’s a lot to take in, so let’s break it down into the following key points:

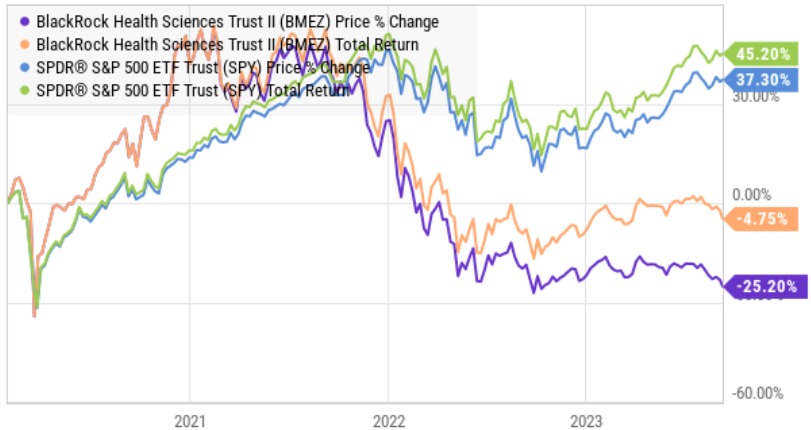

1. BMEZ seeks current income and long-term capital appreciation. So far, the current income part has arguably worked out (more on this later) since the fund’s inception in 2020, as you can see in the following chart (note these are actually distributions, not dividends). However, a recent distribution cut announcement was made (more on this momentarily).

Further, the long-term capital appreciation part hasn’t worked out so far, as you can see the weak performance since inception in this next chart (total return in the price return plus distributions reinvested).

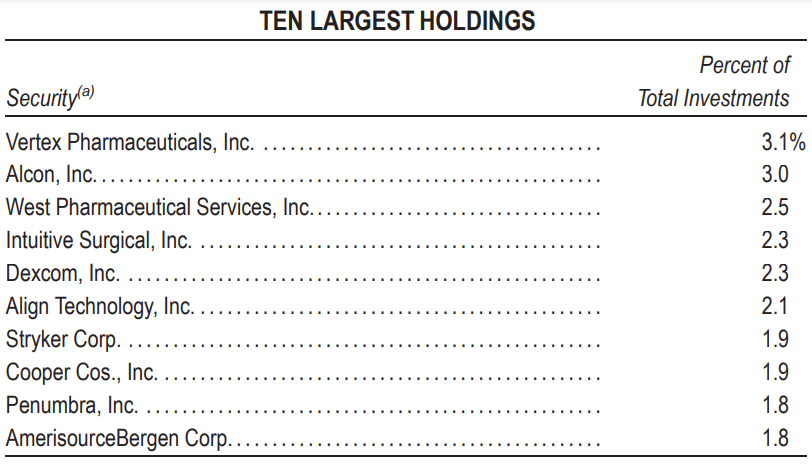

2. BMEZ typically invests in health sciences companies. For reference, the fund recently held 179 positions, and here is a look at the top 10 (you likely recognize at least of few of these healthcare companies).

3. BMEZ uses an options writing strategy to enhance current gains. To implement this strategy, BMEZ writes (sells) call and put options in an effort to collect premium income and enhance risk-adjusted return. The main caveat with an option selling strategy is that while it can increase income and change the volatility profile of the fund, it can also limit long-term gains. This is the trade off (risk-versus-reward).

4. BMEZ is a “Term” Trust. This means the fund intends to dissolve on or about January 29, 2032, whereby investors receive their money back (i.e. a liquidity event) at NAV. There are several stipulations whereby the liquidity event may occur slightly before or after the date, but this is a Term fund nonetheless. Here is how BlackRock describes it on its website:

BMEZ has a contingent limited term structure and will offer investors a liquidity event at net asset value either at the Dissolution Date (as indicated below) or in connection an Eligible Tender Offer (as discussed below). The Trust intends to dissolve on or about January 29, 2032 (the “Dissolution Date”) in accordance with its Agreement and Declaration of Trust; provided that the Board of Trustees of the Trust (the “Board”) may vote to extend the Dissolution Date: (i) once for up to one year, and (ii) once for up to an additional six months, to a date up to and including eighteen months after the initial Dissolution Date (which date shall then become the Dissolution Date). Each holder of common shares would be paid a pro rata portion of the Trust’s net assets upon dissolution of the Trust. The Board may also vote to cause the Trust to conduct a tender offer, as of a date within twelve months preceding the Dissolution Date (as may be extended as described above), to all common shareholders to purchase 100% of the then outstanding common shares of the Trust at a price equal to the NAV per common share on the expiration date of the tender offer (an “Eligible Tender Offer”).

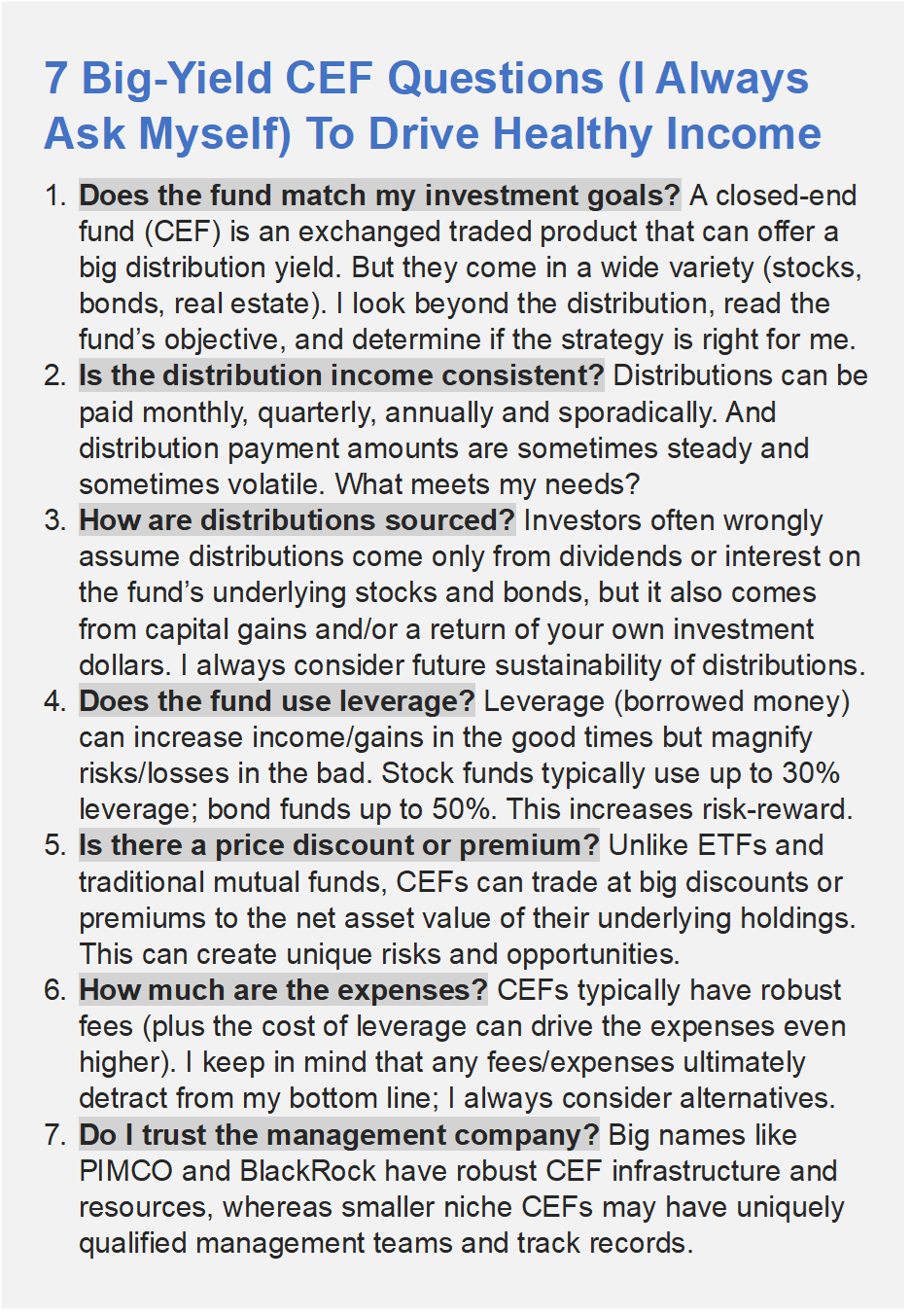

7 Key Big-Yield CEF Questions:

So with that backdrop in mind, let’s consider BMEZ through our “7 Question” CEF framework, as described below.

1. Your Investment Goals: Before you consider investing in BMEZ, make sure you are comfortable with an allocation to healthcare stocks, as described above. The returns of this fund will likely “zig and zag” with a high correlation to the performance of the healthcare sector (health sciences, in particular).

2. Distribution Consistency: We saw earlier that BMEZ does have a history of steady growing monthly distribution payments since its inception (this is the main reason a lot of investors invest). However, the “source” of these distributions has been a problem (as we discuss next). Furthermore, BMEZ just announced a distribution reduction going forward, as per this press release. Specifically, on a go forward basis, BMEZ “will pay monthly distributions to shareholders at an annual rate of 6% of the Fund’s 12-month rolling average daily net asset value to be calculated 5 business days prior to declaration date.” The BMEZ share price is down since this announcement was made on September 8th.

3. How are the distributions sourced? As you can see in this next chart, 100% of the distribution on BMEZ has recently been sourced from a return of your own capital. This can be very negative as it reduces the fund’s NAV and thereby reduces its future earnings power. Return of Capital can be acceptable from time to time (to help keep the distributions steady), but too much ROC can be a cause for concern.

In the case of BMEZ, it is a relatively new fund, so it did not have a lot of capital gains stored up over the years (that it could use to source the distributions) like other funds do. Rather, BMEZ was launched fairly recently in 2020, and immediately faced challenges of steep pandemic price declines, thereby giving the fund some almost immediately capital losses (and thereby forcing it to use some ROC to support the distribution). On a go-forward basis, this fund is in a much better position (as the market—and the fund’s underlying holdings—have been rising), and considering the go-forward distribution rate has been reduced.

4. Does the fund use leverage? BMEZ typically does NOT use leverage (other than a small 1-2% amount due to accounting flows). This reduces upside potential relative to some other funds, but also reduces risks too.

5. Is there a price discount? BMEZ currently trades at a large and attractive 17.0% discount as compared to its NAV (the discount just got wider after the new distribution reduction announcement). This discount is large even by BMEZ historical standards, and it is similar to buying all of the underlying holdings on sale. Of course the discount can get larger or smaller over time, but when this fund reaches its term in (or around) 2032, investors will be cashed out at the full NAV.

6. How much are the expenses? The management fees and expenses on this fund are fairly typical for a CEF, but significant nonetheless. Specifically, the total management fee was recently 1.25% and when you add in expenses, the total expense ratio was recently 1.32%. Normally, we’d try to avoid any fund with an expense ratio this high (because it detracts from your performance), but because this fund trades at such a large discount to NAV, we believe the total expense ratio is acceptable.

7. Do You Trust the Management Company? BlackRock is a world-class fund company with deep resources available to support the management of this fund. Relative to some smaller lessor know fund companies, BlackRock is much less of a cause for concern.

The Bottom Line:

Considering the big price discount to NAV (following the reduced distribution announcement), and the fact that the distribution is a lot healthier (more sustainable) going forward, an investment in BMEZ comes down to your interest in the health sciences sector and your need for monthly income. We view this fund as attractive on a go-forward basis, and currently own shares in our High Income NOW portfolio. If you are an income-focused investor that likes to buy things on sale, BMEZ is worth considering.