You’re likely aware electric vehicle (“EV”) sales are on a high-growth trajectory. And you may also sense the growing popularity of Rivian Automotive (RIVN) Trucks, SUVs and Electric Delivery Vans. But are Rivian shares a buy, sell or hold? In this report, we review Rivian’s business model, its market opportunity, financials, valuation, risks, and then conclude with our strong opinion about investing in Rivian.

Introduction: Navigating the competitive EV landscape with Product Differentiation and Vertical Integration

Rivian Automotive engages in the design, development, and manufacturing of electric vehicles and related accessories. These vehicles are sold directly to consumers in consumer and commercial markets. The company further enhances its offerings with a comprehensive set of exclusive, value-added services that cater to the entire lifecycle of the vehicle, fostering deep relationships with its customers.

Summary:

Premium EVs with Technology as a Differentiator.

EV Market set for Sustained Growth but Competition is Intense.

Growing Production and Deliveries Boost Revenue, Profitability remains a Work in Progress.

Healthy Balance Sheet Accommodating Cash Burn.

Promising Investment Considering Uptick in Production, Solid Financial Position, Improving Gross Profit per Vehicle and Platform Expansion.

A PDF version of this report is available here.

Overview:

Rivian was initially established under the name Mainstream Motors in 2009 by R.J. Scaringe, an MIT graduate with a background in engineering and lean manufacturing. Scaringe grew up near Melbourne, Florida, where he developed a passion for working on automobiles alongside a neighbor. Although Rivian initially aimed to produce luxurious electric vehicles, with a sporty coupe prototype unveiled in 2011, this project was eventually abandoned. Instead, the company redirected its attention to SUVs, a strategic move as numerous other electric vehicle startups have opted for luxury EV sedans instead. The company is headquartered in Irvine, California and has a manufacturing plant in Normal, Illinois. It also has facilities in Carson, California; Plymouth, Michigan; Vancouver, British Columbia; Wittmann, Arizona; and Woking, England and is planning to construct an additional $5B factory in Georgia.

Rivian follows a direct-to-customer model that manages all aspects of sales, delivery, service, and resales internally, eliminating the need for third-party franchise dealerships. By employing a digital-first strategy, facilitated by the website and mobile app, the company emphasizes convenience, transparency, efficiency, and scalability.

The Rivian ecosystem consists of interconnected components, including vehicle technology, Rivian Cloud, product development and operations, products and accessories, services, and data analytics. These elements work together to provide seamless and tailored experiences, drive customer satisfaction, build brand loyalty, and maximize the full lifecycle value of Rivian vehicles. Currently, vehicle production takes place in Illinois with an annual capacity of up to 150,000 vehicles. The upcoming facility in Georgia is anticipated to have a manufacturing capacity of 400,000 vehicles annually.

Premium EVs with Technology as a Differentiator

Rivian's consumer portfolio includes innovative vehicles redefining the pickup truck and SUV segments. In 2021, the company commenced the delivery of its first-generation consumer vehicles, the R1T and R1S, both built on the R1 platform. R1T is a two-row, five-passenger electric pickup truck and R1S is a spacious all-electric SUV designed to comfortably accommodate up to seven passengers and their belongings. Both vehicles share identical battery, propulsion, and chassis systems, ensuring a uniform and consistent performance experience for drivers. The vehicles incorporate proprietary advanced technology systems encompassing vehicle electronics, batteries, electric drives, chassis, ADAS, and digital user experience management, with the ability to enhance and expand functionality through Over-the-Air (OTA) updates.

In the commercial sector, the company introduced the Rivian Commercial Vehicle (RCV) platform, which serves as the foundation for Electric Delivery Van (EDV). This EDV was collaboratively designed and engineered by Rivian in partnership with Amazon (Rivian’s largest shareholder), marking Amazon as the first commercial customer to order 100,000 of these electric step-in vans on a global scale, with potential for modifications. These vehicles are designed for large-scale production and deployment in a centrally managed fleet, prioritizing driver comfort and ease of operation. The aim is to offer customers a reduced Total Cost of Ownership (TCO) while supporting eco-friendly deliveries in alignment with carbon neutrality objectives.

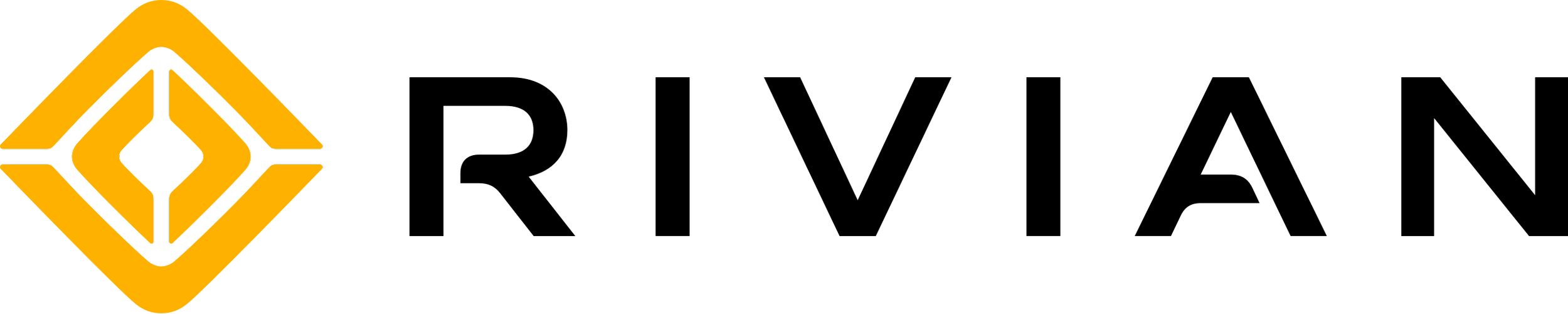

In Q2 2023, Rivian achieved a significant production milestone, manufacturing 13,992 vehicles, marking a 50% increase compared to the first quarter. Notably, 70% of these units were R1S vehicles. This was the first time R1S quarterly production surpassed that of the R1T, a positive development given that R1S is more profitable. In the last two quarters, the company has also successfully integrated the in-house Enduro Motor into both consumer and commercial vehicles. This integration not only enhances cost efficiency but also extends the market potential for Rivian vehicles. The company has raised its production guidance to 52,000 total units for the full year 2023.

Source: Shareholder Letter

A significant long-term competitive advantage lies in Rivian’s strategy of vertically integrating its network architecture, in-vehicle computers, full vehicle software stack, and propulsion platform. This approach allows it to exercise complete control and continuously enhance every aspect of the vehicle's software, digital experience, and driving dynamics, a factor well-received by customers and acknowledged with industry awards like the Best Ownership Experience for Premium Battery Electric Vehicles by J.D. Power. The vehicle software architecture supports manufacturing operations by providing in-line diagnostics to enhance quality control and with fleet expansion, the company anticipates realizing significant cost savings and augmenting customer value through predictive service and repair operations.

In 2024, the company plans to enhance its vertical integration strategy and advanced software capabilities by introducing a new generation of network architecture, integrated into the R1 platform and forming the foundation for the R2 platform. The updated architecture is anticipated to drive cost reduction, reduce vehicle weight, and enhanced manufacturing efficiency. Rivian expects that this next-gen network architecture will play a pivotal role in its efforts to substantially reduce material costs per vehicle.

EV Market set for Sustained Growth but Competition is Intense

The US is experiencing a significant shift towards electric vehicles, with all states actively developing a national EV charging network backed by the Infrastructure Investment and Jobs Act (IIJA). Driven by incentives from the Inflation Reduction Act (IRA), the auto industry is making substantial investments in high-paying jobs, new EV manufacturing facilities, battery production, and EV component processing. Additionally, the US Environmental Protection Agency (EPA) has proposed emissions standards across vehicle classes, setting the stage for a transformative shift in the market. The US EV market size was valued at $63B in 2022 and is projected to grow at a CAGR of 18% to reach $162B in 2028.

The EV market is becoming increasingly competitive, with both established automakers and startups vying for market share. While Tesla continues to lead the full electric market, its share has decreased from 75% in 2022 to around 65% in 2023 due to increased EV production by other brands such as Ford. With a diverse market and subsidies in play, traditional manufacturers such as Ford, GM, and VW are expected to continue gaining market share.

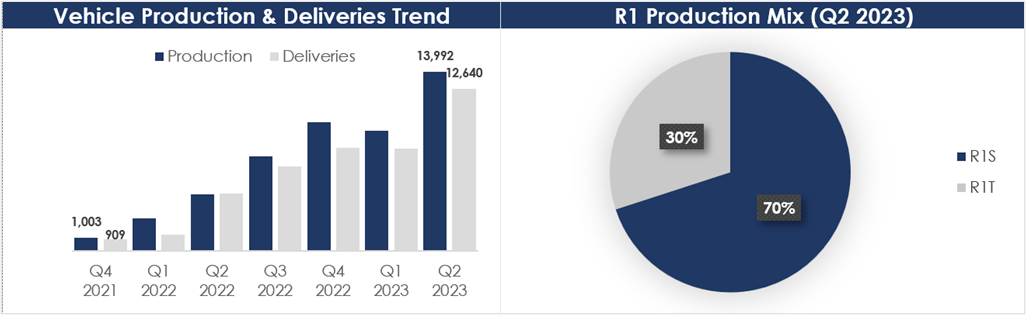

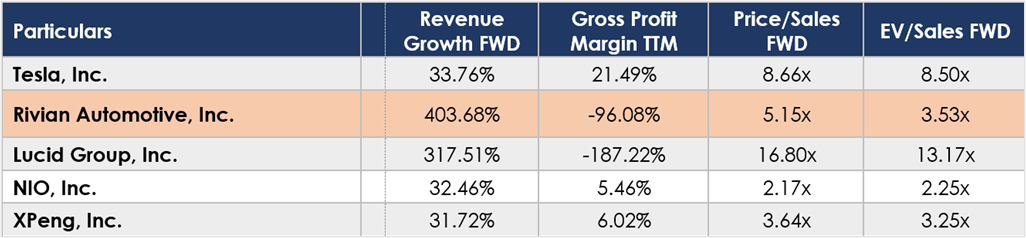

Analyzing the financials of US listed pure-play EV start-ups provides valuable insights. Tesla, operating at a different scale, exhibits the strongest gross margin. However, others like Rivian are in the early ramp-up stages. Rivian's existing negative gross margin is a concern, and margin improvements should be closely tracked as the company's factories become more efficiently utilized.

In terms of cash and short-term investments, Tesla remains the clear leader, but Rivian is also in a comfortable position to execute its strategic plans.

Source: Seeking Alpha

While some EV manufacturers have opted for the easier path of outsourcing components or manufacturing, Rivian's approach aligns with Tesla's model, emphasizing vertical integration across key aspects of the business, including software, electronics, self-driving technology, propulsion, and battery systems. This is likely to lead to a lower cost structure and greater product development flexibility in the long run and positions Rivian well in the competitive landscape.

Growing Production and Deliveries Boost Revenue, Profitability remains a Work in Progress

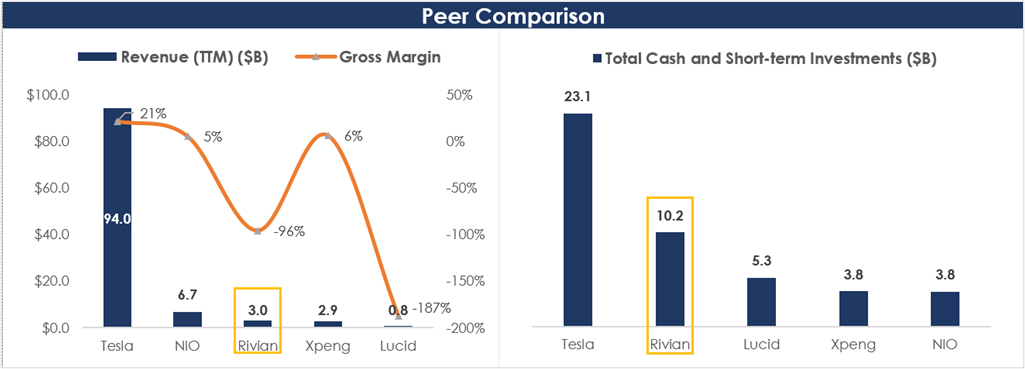

In Q2 2023, total revenue increased 208% YoY to $1.1B, driven by a significant increase in production and deliveries. Total revenue for the quarter included $34M generated from the sale of regulatory credits. Management has highlighted that the sale of regulatory credits will continue to rise over time; however, it may vary quarter to quarter.

For the full year 2023, the company increased its production forecast by 2,000 units to 52,000. Rivian manufactured 24,337 electric vehicles in FY 2022, indicating the potential for a 114% YoY production growth in FY 2023. Improving supply chain conditions and the ramp-up of the in-house Enduro Motor line are significant factors driving near-term production performance for the company.

Source: Shareholder Letter , Company Filings

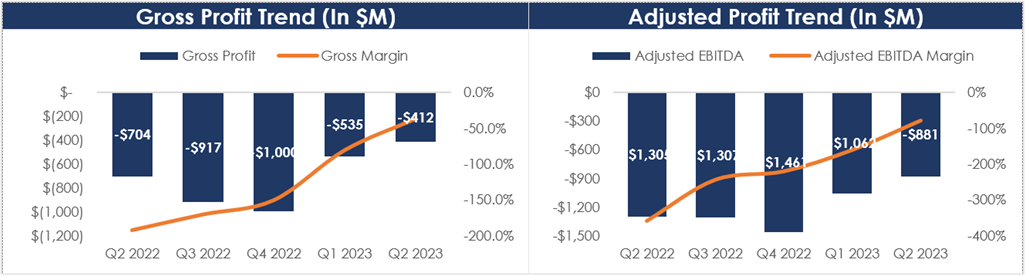

On the profitability front, Rivian reported a gross profit margin of -37% in Q2 2023, an improvement of 4,400 basis points as compared to the last quarter. The company also achieved an increase in gross profit per vehicle of around $35,000. This is attributed to several key factors, including fixed cost leverage, reductions in material costs, and higher revenue per vehicle delivered. The strategic move to replace the previously outsourced Bosch motors with its in-house Enduro motors has allowed Rivian to improve its cost efficiencies while enhancing supply chains. Additionally, the ongoing trend of a more favorable mix of R1S (which commands higher prices and is more profitable) compared to R1T in the vehicle deliveries mix is expected to contribute to the company's path toward achieving gross profit positivity in the near term.

The company continued to streamline its operating expenses while making substantial investments in core in-vehicle technologies and enhancing the customer experience. Total operating expenses excl. stock-based compensation in Q2 2023 decreased to $715M compared to $775M in the corresponding period of the previous year. The primary factor contributing to this reduction was layoffs that the company announced earlier this year as a part of broader cost-cutting measures.

Rivian’s focus on improving gross profits and optimizing operating expenses led to a significant $424M improvement in Adjusted EBITDA compared to the previous year. Adjusted EBITDA margin was at -79% in Q2 2023 as compared to -359% in Q2 2022. For the full-year 2023, management revised its guidance of Adjusted EBITDA upward to -$4.2B.

Source: Shareholder Letter

Healthy Balance Sheet subsidizing continued Cash Burn

Rivian ended Q2 2023 with $10.2B in cash, cash equivalents and short-term investments and $2.7B in long-term debt. The company is experiencing significant cash outflow, reporting a negative FCF (Non-GAAP) of $1.6B in the second quarter of 2023. Ample cash reserves and minimal debt levels appear sufficient to sustain operations as the company works towards improving production and profitability but continuous cash outflows may necessitate a capital raise in the future.

Source: Company Filings

Valuation

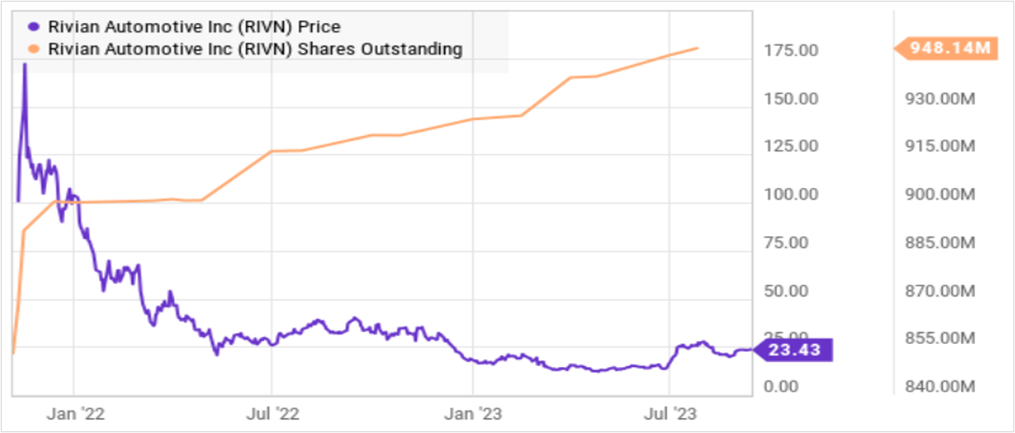

Rivian went public in late 2021 and the stock saw a vertical move up, resulting in a market capitalization exceeding $150B. The stock has considerably retreated from those peaks down more than 80%. Despite a faster growth trajectory, RIVN is currently trading at a forward Price to Sales ratio of 5.2x, which is at a large discount to Tesla.

While risks pertaining to delivery prospects and uncertain macroeconomic outlook could weigh on valuations in the short-term, the stock has significant upside potential in the long-run given its product differentiation, premium offerings and continued progress towards profitability.

Source: Seeking Alpha

Risks

Share Dilution: Rivian burned through $6.4 billion in cash in 2022, and despite its strong balance sheet cash position, it seems likely the company will need to sell more shares to raise cash down the road. While cash raises help fuel growth, they’re also dilutive to the positions of existing shareholders.

YCharts

Intense competition: The competition within the EV industry is escalating and is expected to continue to increase until market consolidation occurs. The current competitive landscape in the US EV market is predominantly led by Tesla (TSLA), with well-established automakers like Ford (F) and General Motors (GM) also vying for market share. Additionally, international competitors like NIO (NIO) and XPeng further contribute to the industry's competitiveness. Even within Rivian's specific sub-sector, competition is fierce, with several strong contenders already in the market or soon to be, including Tesla's Cybertruck, Ford's F-150 Lightning, and General Motors' Hummer EV. These competitors boast advantages such as brand recognition, customer loyalty, extensive distribution and service networks, as well as robust financial resources, which may pose challenges for Rivian's market positioning.

Unionization: Rivian workers are currently not unionized. However, the United Auto Workers (UAW) has a consultant assigned to Rivian and is interested in a unionization win. Unionization can impact the cost structure and create production halts, thereby posing a potential future risk.

Supply chain disruptions: The EV industry is susceptible to various risks stemming from supply chain disruptions. Shortages of critical components result in delayed production and increased costs, affecting the ability to meet customer demands. Fluctuations in supply chain availability also result in increased working capital requirements leading to reduced cashflows. Although Rivian’s vertical integration strategy lends it a strong competitive moat, the company is not completely immune to supply chain disruptions.

Conclusion

Two critical factors to consider while evaluating EV stocks in their early ramp-up phase are: balance sheet strength during early losses and progress towards profitability. Rivian concluded the last quarter with $10.2B in cash, cash equivalents, and short-term investments. Despite significant cash burn, the company has ample resources to fund operations as it increases production and could secure additional capital if necessary.

In terms of profitability, Rivian is making consistent progress with improving gross profit per vehicle, and cost-efficiency enhancements, aiming to achieve gross-profit-positive status in 2024. Notably, the R1S (SUV) has surpassed the R1T (truck) in production, offering higher profitability due to its higher sticker price. Furthermore, Rivian's management anticipates that its next vehicle platform R2, scheduled for launch in 2026, will extend the brand's presence in a significantly broader and promising market segment.

The combination of uptick in production and deliveries, solid financial position, improving gross profit per vehicle and the introduction of a new platform which is set to expand market reach makes Rivian an attractive opportunity. That said, investing in a relatively early-stage company carries inherent risks and competition is intensifying in the EV industry. Considering the current risk-reward dynamics, we view Rivian as a cautious Buy with a portfolio allocation strategy aligned to withstand potential capital losses.