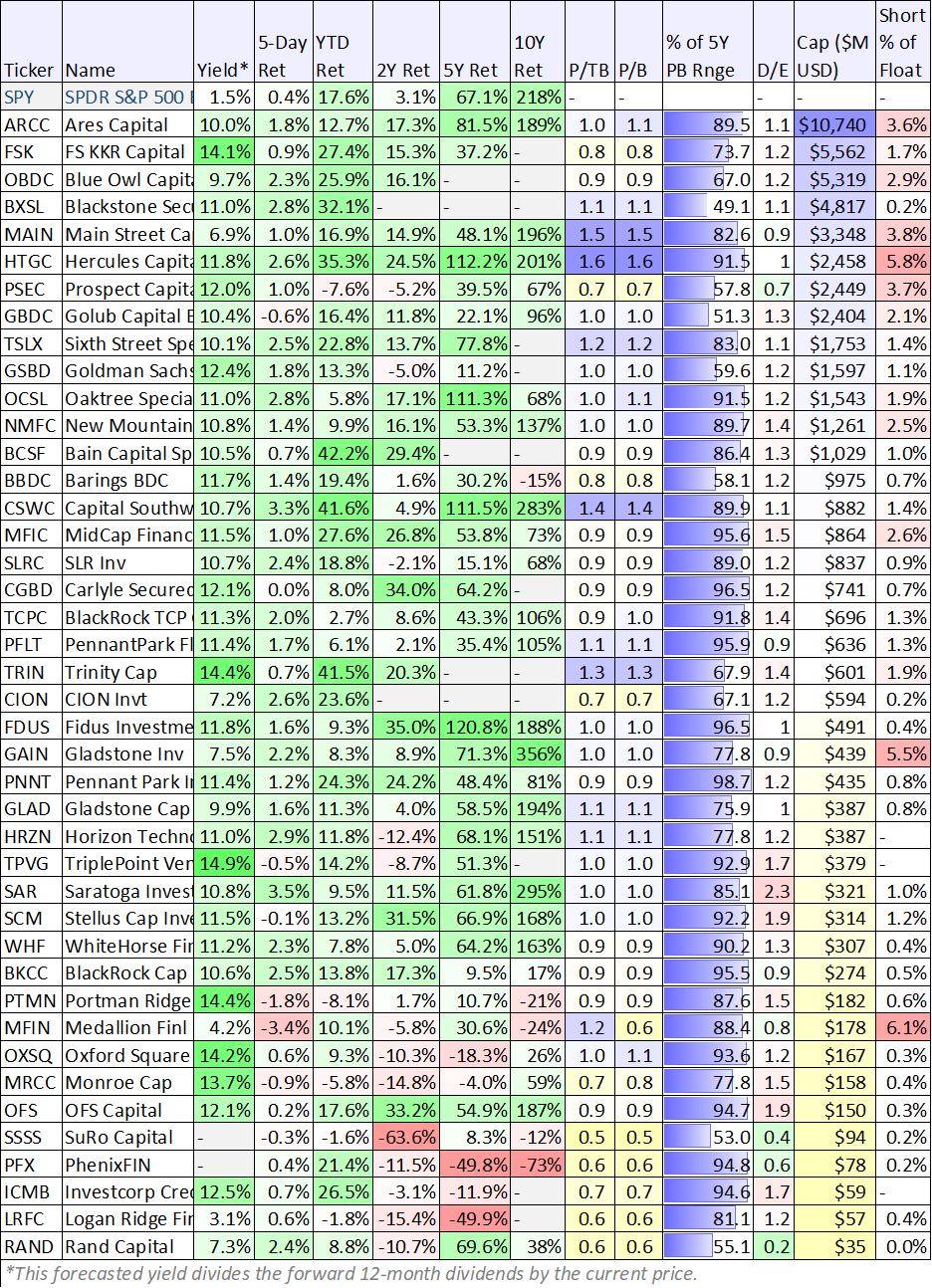

Here is a look at updated performance for BDCs over recent (and longer) time periods. As you can see, the group has been strong this year, with many outpacing the S&P 500 yet still trading below reported book value. A few key observations, starting with Ares Capital and then moving on to some of the more “growth-focused” BDCs below.

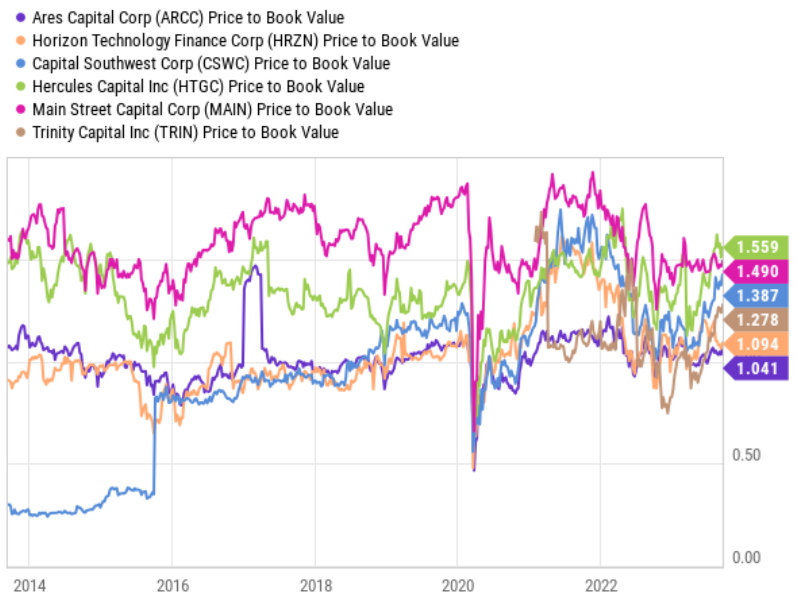

Ares Capital: As mentioned, Ares performance is positive this year (on a total return basis), but still lagging the S&P 500 and other BDCs. Ares is the large bellwether blue-chip BDC, and one we own in our High Income NOW portfolio. Ares also continues to trade at a reasonable price-to-book-value, compared to history, as you can see below.

You’ll also notice that many of the technology-and-growth-focused BDCs trade at high price-to-book values (such as Horizon (HRZN), Hercules (HTGC) and Trinity Capital (TRIN). We view this more as a sign that book value will be increased at the next quarterly financial release (and the price is simply reflecting the likely book value increases). A lot of growth-focused BDCs sold off hard earlier this year and last year as the Silicon Valley Bank debacle hit (SVB operates in the same space as a lot of growth-focused BDCs) and as growth investment overall had been struggling as interest rates were increasing rapidly.

Credit Spreads

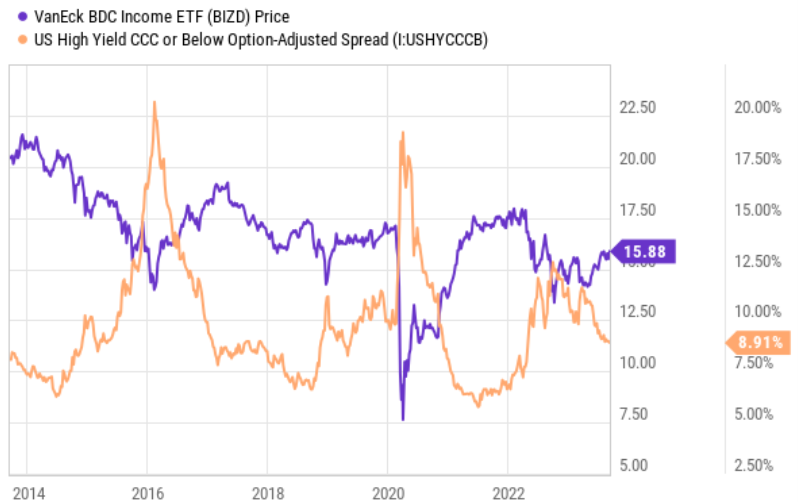

You’ll also see in this next chart the strong correlation between credit spreads and BDCs (as measured by the VanEck BDC Income ETF, (BIZD)). In some regards, BDCs are like junk bonds (because BDCs often lend to riskier companies than traditional banks). However, BDCs also diversify the risk through many loans and often have better underwriting abilities than traditional banks too (which often follow only an over-simplified, regulatory-driven, cookier-cutter approach to lending).

The current low credit spread (i.e. the difference in interest rates on safe treasuries and riskier “junk” bonds is an indication that the markets are currently very calm.

The Bottom Line:

BDCs can be an important part of an income-focused investment portfolio. We currently own shares or Ares (ARCC) (which we believe is attractively priced), Hercules Capital (HTGC) (which has a high price-to-book value, but we expect that to come down as the book value is written up next quarter), Main Street (MAIN) and Oaktree Specialty Lending (OCSL) (we just bought this one most recently—a couple months ago) in our High Income NOW (and Income Equity) Portfolios.

Considering the strong performance so far this year, and the very low current credit spreads, we are not adding more BDCs at this time.