If you like big-yield income, you’ve likely come across the oil & gas midstream industry. The group can offer impressive high income, plus total returns that are less correlated with the overall stock market (because of the steady fee-based income these companies generate). But there are a few things you need to consider before investing. In this brief report, we share comparative data on the 12 biggest companies in the group, plus a few important caveats on investing in them.

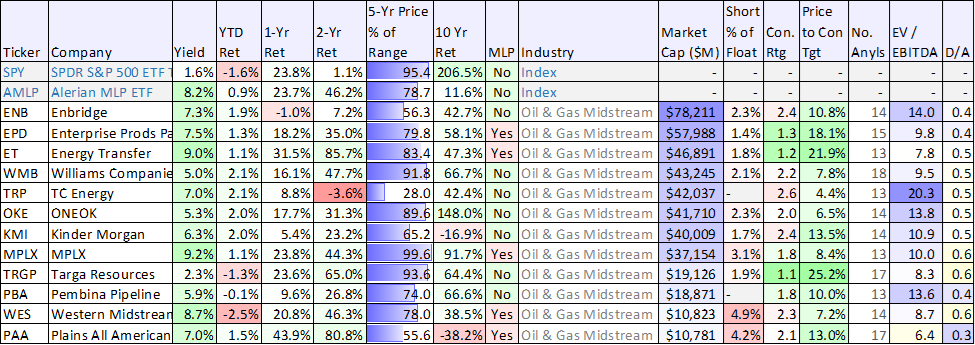

Top 12 big-yield midstream companies, compared

For starters, here is a look at the data. As you can see, the yields are impressive, but the 10-year total returns are not as impressive (as compared to the S&P 500 index). You’ll also notice several of these companies receive better Wall Street Analyst ratings (1.0 is the best rating, 5.0 is the worst) and some have more upside potential than others (as compared the Wall Street price targets).

But before you go investing in any of these companies, just know that some are categorized as Master Limited Partnerships (“MLPs”) and some are not. The MLP structure can create some reporting headaches at tax time (you’ll receive a K-1 statement instead of the more typical 1099) and the K-1 info can be a pain to plug into various tax software (such as H&R Block, for example).

Another caveat with the K-1 statement is it may create problems in your non-taxable retirement accounts (such as Roth and Traditional IRAs). Specifically, MLP’s generate unrelated business taxable income (UBTI), and if it exceeds a certain threshold then you must pay taxes on it—even if its held in your IRA. In fact, some brokerages simply won’t allow you hold an MLP in an IRA.

If you can get passed the tax challenges, then MLPs (or midstream oil & gas companies, in general) can be quite attractive because of their steady fee-based income (for example, they often sign 10-year contracts with clients where payment is based on volumes NOT on oil & gas prices (this helps reduce volatility, and makes the big distributions easier to support)).

And a quick look at the data in the table shows that both Enterprise Products Partners (EPD) and Energy Transfer (ET) are two of the biggest (by market cap) and arguably the two most attractive (based on yield size, analyst rating, and upside price appreciation potential). However, they are both MLPs.

If you are looking for a non-MLP midstream, then MPLX appears attractive.

We’ve owned several of these companies in the past (although we own none at the moment). We’ll be digging into some of these names again in the upcoming weeks, and hopefully the data points in the table are helpful to you in your own research and analysis.