In this “snapshot & update” report, we share data on 75 top dividend growth stocks, and a few of them stand out in particular as attractive opportunities. If you are worried about “growth stocks” being too aggressive and “double-digit yield” securities being too risky, then you might appreciate a few of the ideas in this report which offer well-covered growing dividends and long-term capital appreciation potential.

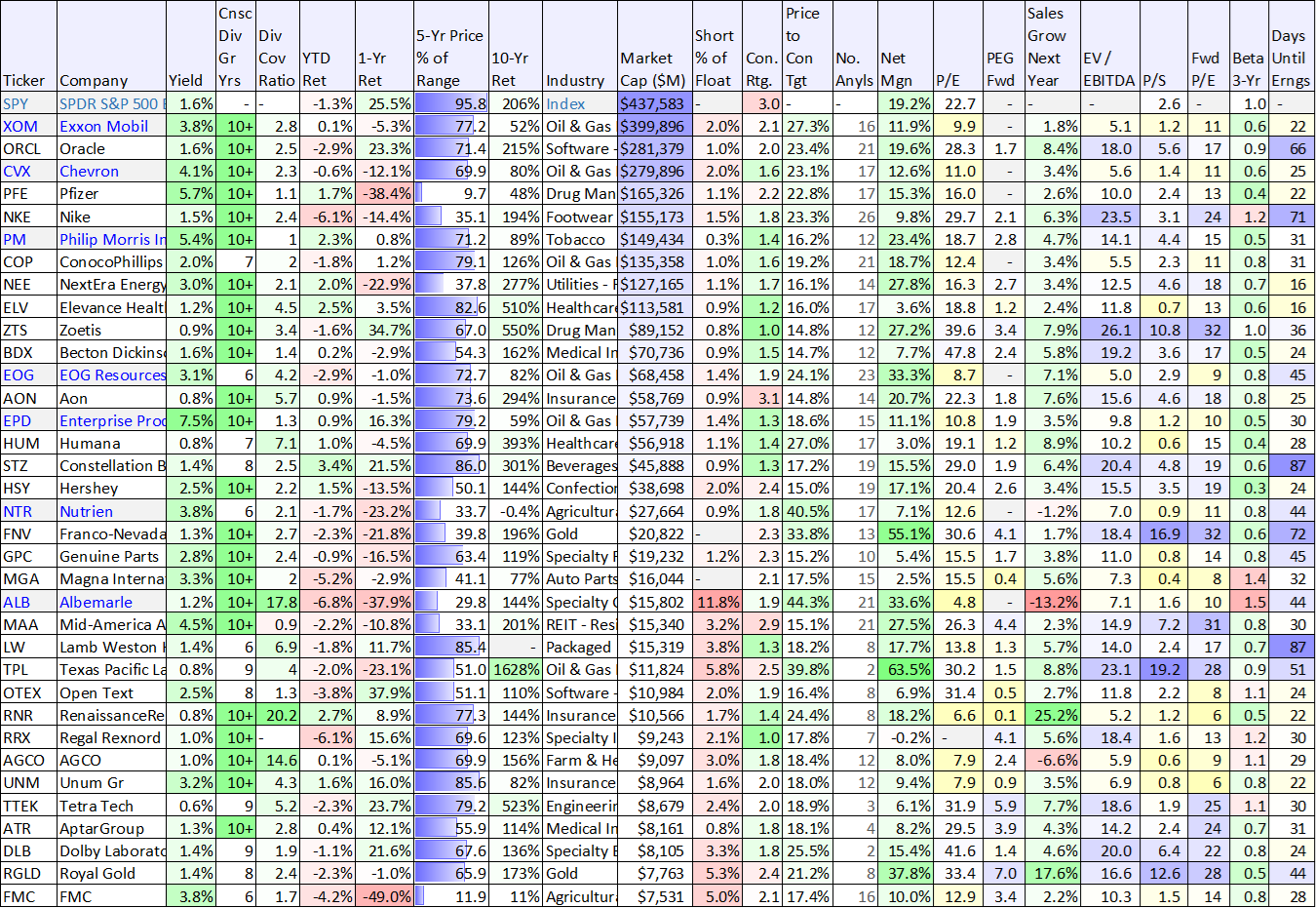

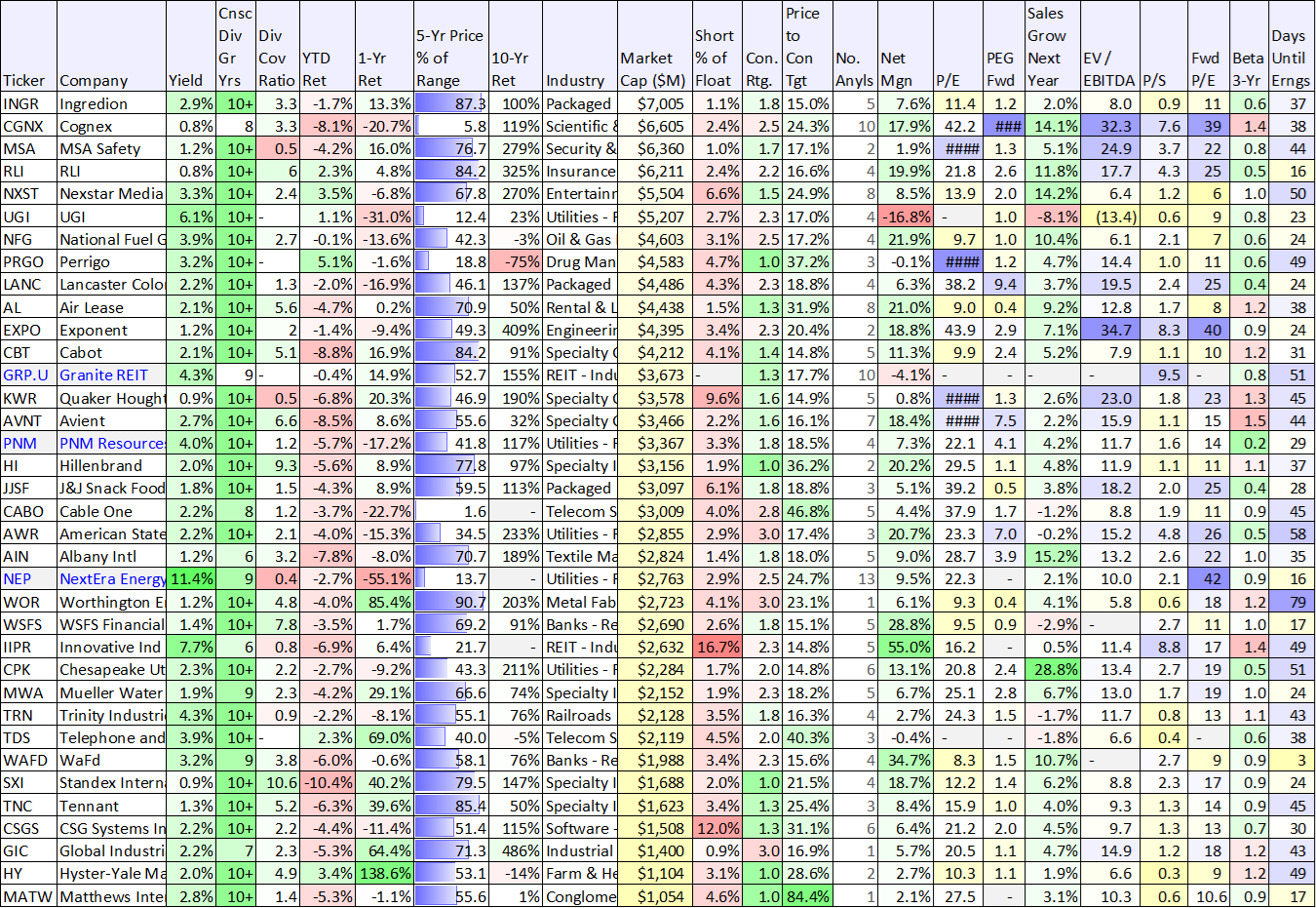

75+ Dividend Growth Stocks

To be included in this list, we required at least 6 consecutive years of dividend growth. So the table doesn’t necessarily capture the biggest dividend yields. However, it’s noteworthy that many of these stocks have outpaced the S&P 500 (in terms of total returns) over the last decade. This is a critical point because sometimes (but not always) when you chase the biggest yields, you end up with lower total returns (because the biggest yields often struggle with price returns).

As you can see in the table (sorted by market cap), there is a wide variety of data including performance, valuation metrices, dividend coverage ratios and more.

data as of Monday morning 1/8/24 (source: StockRover)

As you can see in the data, we’ve highlighted a few names in gray/bright-blue. These highlighted names standout as attractive (on these data metrices) for a range of reasons, such as big yields, compelling Wall Street Analyst rating (1.0 = “strong buy,” 5.0 = “strong sell,” and upside (versus consensus price targets).

We currently own shares of Albemarle (ALB), Exxon Mobil (XOM), and we also like Phillip Morris (PM), but prefer cigarette makers Altria (MO) and British American Tobacco (BTI) instead (we own shares of MO and BTI).

We also love Enterprise Products Partners (EPD) huge yield and attractive upside, but the MLP structure gives us some pause (as we wrote about in this report).

We also plan to look deeper into a few of the names on this list in the days ahead, such as NextEra Energy (NEP) because it offers a big yield and is VERY hated right now. And Nutrien (NTR) also looks very attractive at first glance because of its growing well-covered 3.8% yield and very compelling Wall Street Analyst ratings.

Hopefully, you’re able to find some interesting ideas in this data, and we will be following up with some reports on specific opportunities in the coming days. Stay tuned. You can view all of our current holdings here.